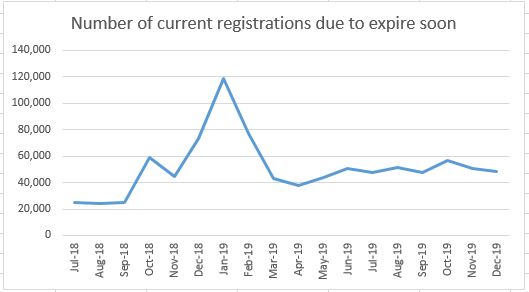

A huge volume of PPS registrations are due to automatically expire over the next 18 months – is your business ready?

AFSA (being the government department responsible for the #PPSR) has recently released a set of statistics showing the number of registrations that will automatically lapse, if you don’t take positive steps to renew your registrations.

I have modelled these statistics for you in the following graph:

Why the auto lapse?

When the PPSA came into effect, many registrations were given a 7-year life limit. January 2019, will mark the end of that 7-year period for 120,000+ registrations.

What should you do about it:

1. Review your registrations and map out which ones are automatically going to lapse soon

2. Sign up to PPSR Logic for free, and you will be able to view all of your existing registrations and those due to expire soon! Renew with one click!

3. Update your customer details

4. Utilise a credit bureau provider like CreditorWatch, to help you manage the large volume of renewals you will likely need to process and receive renewal alerts; and

5. Get expert help!

Are you ready?

More articles like this: PMSI’s and trust companies, to ABN or ACN?

About the author