Lockdowns slam the brakes on business activity

After showing signs of resilience in July, the full impact of continuous lockdowns has taken its toll on Australian business activity, with dire outlooks for many businesses specifically in Sydney and Melbourne.

Key findings from August 2021:

- The CreditorWatch Business Risk Review for August 2021 highlights the difficult lockdown period most Australians are currently experiencing and masks a calm before the storm.

- The economic activity challenges Australia faces from extended lockdowns in New South Wales and Victoria are escalating.

- Data for August showed a 12.5 per cent month-on-month drop in trade receivables

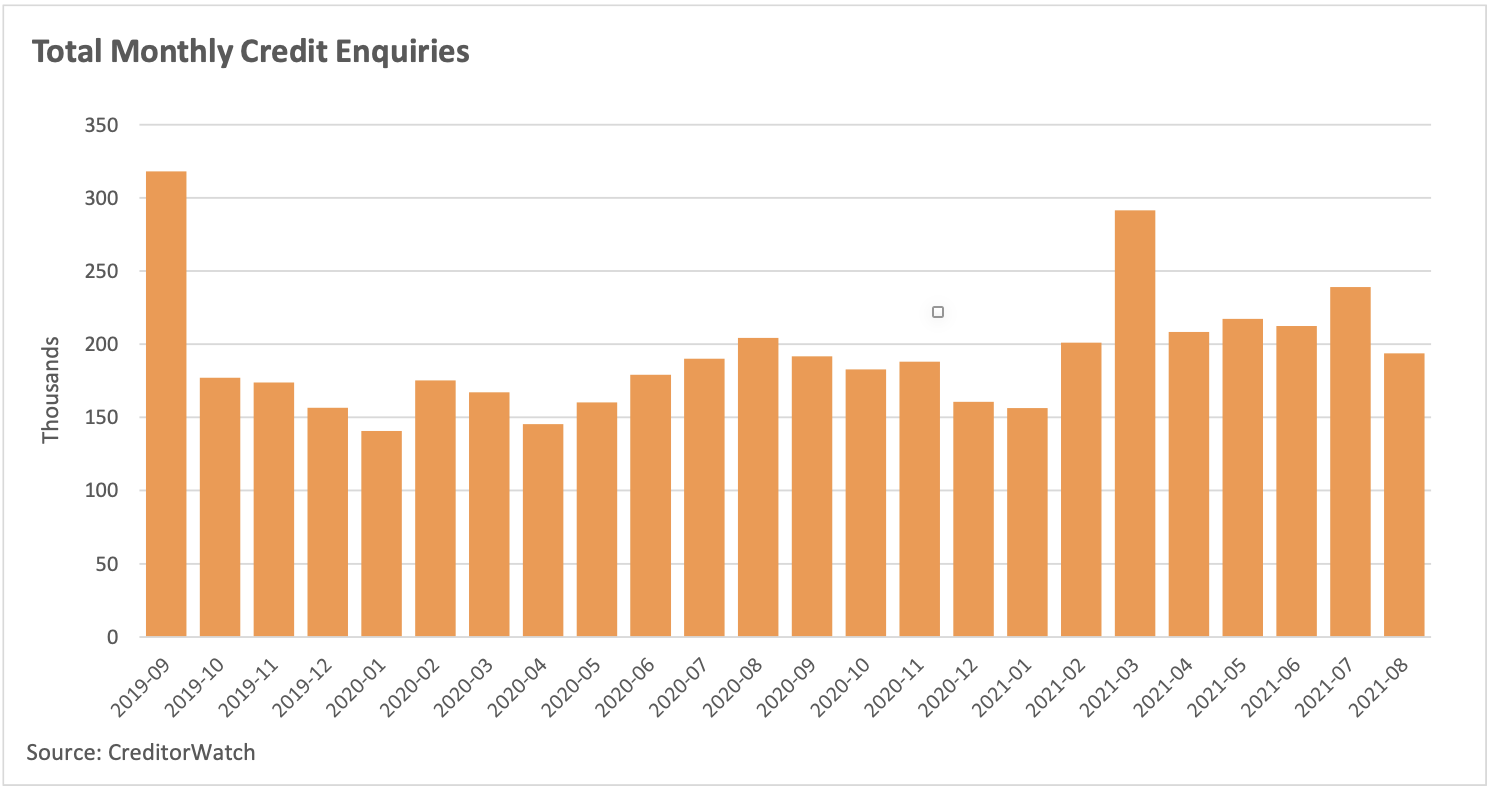

- Credit enquiries for August declined 19 per cent from last month and 5.2 per cent year-on-year, representing the first negative result since September 2020

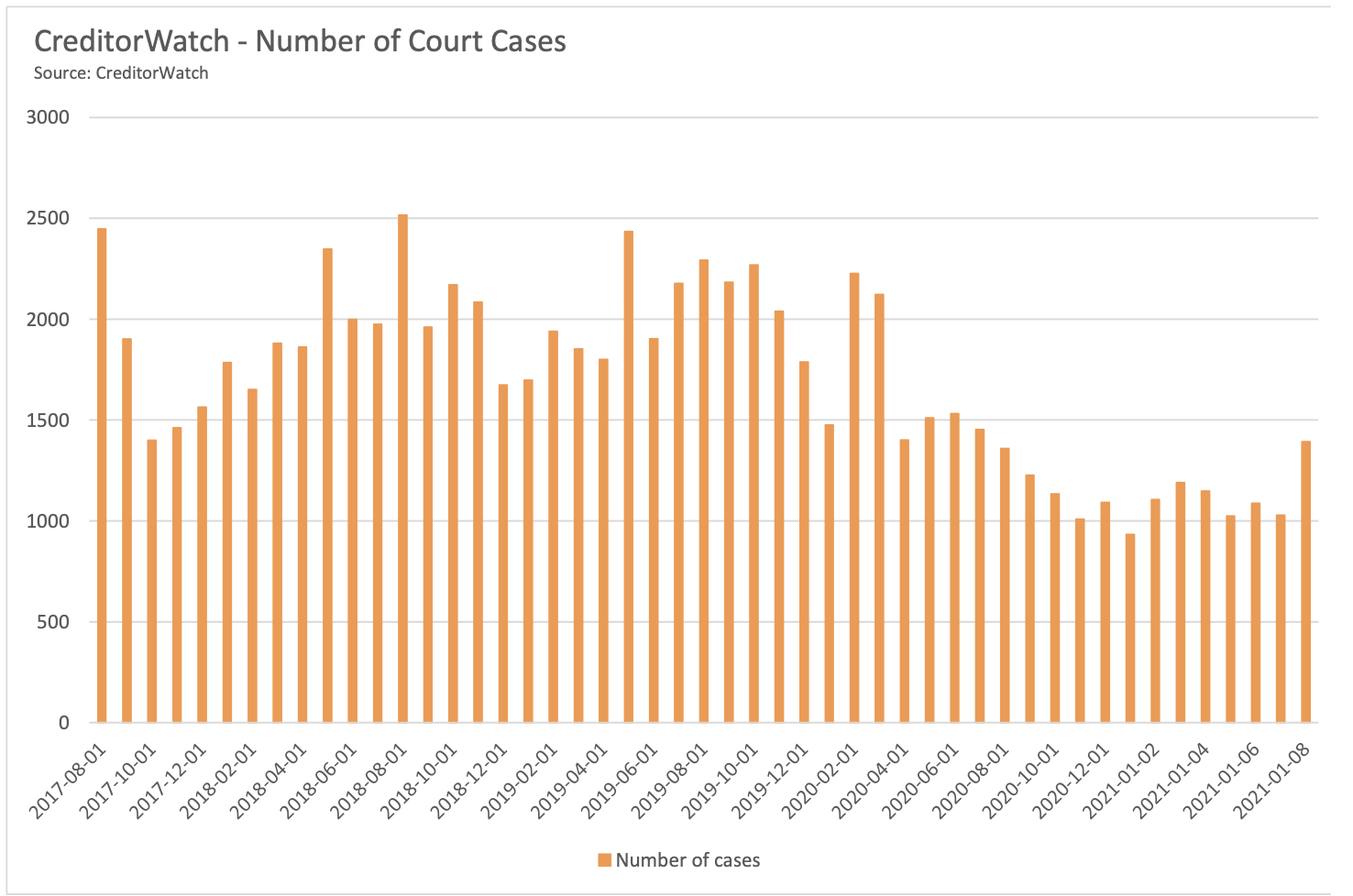

- The number of court cases jumped by 35 per cent in August, on an annual basis, there was a three per cent rise – the first rise since March 2020

- The number of defaults rose by 0.6 per cent in August 2021 compared to the same month last year. Although the increase was small, it represented the first rise in defaults since May 2020

COVID-19 pandemic lockdowns are hitting Australian businesses increasingly hard and putting the brakes on trading activity, according to CreditorWatch’s August Business Risk Review data.

The August results reveals that many businesses are either unable to trade or are preferring to sit in a holding pattern until economic conditions improve and become more certain, reflected in CreditorWatch’s data for August which showed a 12.5 per cent month-on-month drop in trade receivables.

“Despite state government support packages, it is obvious that continuing uncertainty about the path out of lockdown restrictions has impacted business confidence,” said Patrick Coghlan, CreditorWatch CEO.

“Many businesses are struggling to trade through lockdowns or are unable to trade at all,” he said. “At this point, cash reserves are dwindling and yet credit enquiries have slumped.

“It is small businesses that will bear the brunt of this as they have the smallest cash reserves. Unfortunately, some businesses are in a position where they simply won’t be able to re-open at all. This is a very concerning scenario for the Australian economy.”

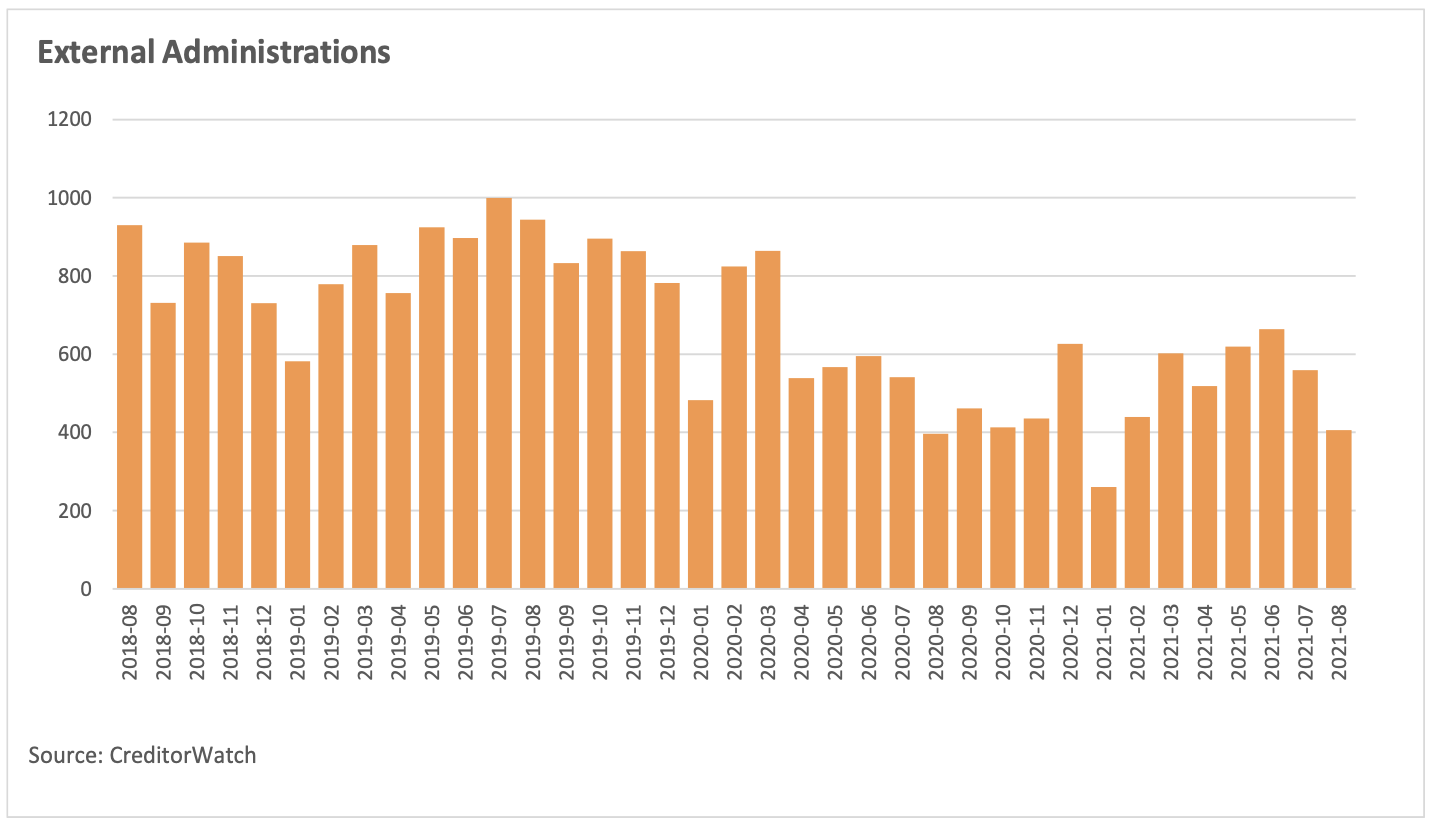

CreditorWatch Chief Economist, Harley Dale, noted that while credit defaults were steady over 2021 and external administrations fell heavily over July and August, this was likely to reverse once lockdowns are over.

“We’re really in an artificial economy due to the lockdowns; it’s not a normal trading environment. For example, there is a dichotomy of activity between those businesses that are able to utilise technologies like click-and-collect and those that can’t. So, it’s important to view this month’s Business Risk Review in that context,” he said.

“It’s likely the full impact of the lockdowns will play out in CreditorWatch data later in the year. We will see key industries adversely affected through the rest of the year, including construction, wholesale trade, retail, accommodation and food services, healthcare and social assistance,” he added.

Default numbers stable

The number of business defaults is a leading indicator of commercial risk, and the monthly CreditorWatch Business Risk Review provides revealing insights. The number of defaults rose by 0.6 per cent in August 2021 compared to the same month last year. Although the increase was small, it represented the first rise in defaults since May 2020.

Flat default numbers seem counterintuitive given lockdowns, new restrictions and stay-at-home orders, however, there are a number of explanations for this. Trade receivables are down given many businesses were are unable to trade, which helps to lower defaults.

Many creditors, especially those trading with businesses in hot spot LGAs, are working with their debtors to help them through this time, which also has an impact on default numbers. Additionally, the ATO and banks are taking a benign approach to businesses whose turnover has suffered due to lockdowns, except for those businesses that are gaming the current system, which the ATO is keeping a close eye on.

However, as extended lockdowns persist, defaults will inevitably rise.

Credit enquiries slide

While credit enquires are up by 12 per cent over the three months to August this year compared to the same period in 2020, they fell by 19 per cent in August 2021, on a non-seasonally adjusted basis. On an annual basis the number of enquiries fell by 5.2 per cent, the first negative result since September last year.

Court cases spike

The number of court cases jumped by 35 per cent in August, on a non-seasonally adjusted basis, with a three per cent rise in court cases on an annual basis, the first rise since March 2020. The number of court cases is four per cent higher over the three months to August 2021.

External administrations

The number of external administrations has fallen heavily over July and August 2021, although these numbers are not seasonally adjusted. Administrations fell by six per cent over the three months to August compared to the three months to May.

Outlook

For many businesses, the trading environment is difficult at best. State government support packages are vital lifelines for affected firms during this period. The business community is crying out for definitive guidance from state and federal governments about the re-opening schedule and state and international borders reopening.

CreditorWatch is urging federal and state governments to give businesses more certainly about when the economy will re-open in full and the stages and milestones required to achieve this.