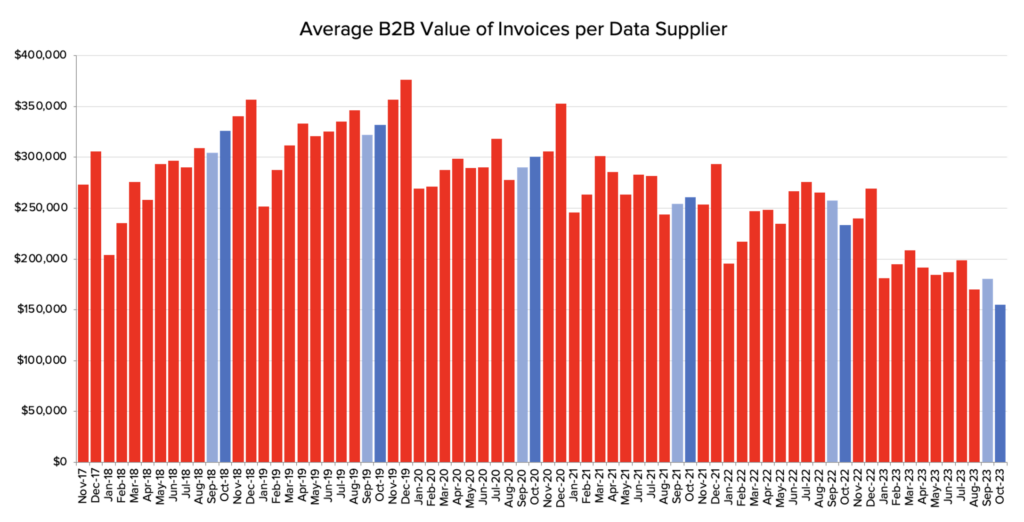

The October 2023 CreditorWatch Business Risk Index (BRI) has revealed that Australian business activity is now at disturbingly low levels with the average value of invoices at their lowest point since CreditorWatch began recording this metric in January 2015.

This 34% year-on-year decline in the average value of invoices indicates a drop in forward orders due, in large part, to consumer demand contracting, and creates a massive ripple effect down the supply chain.

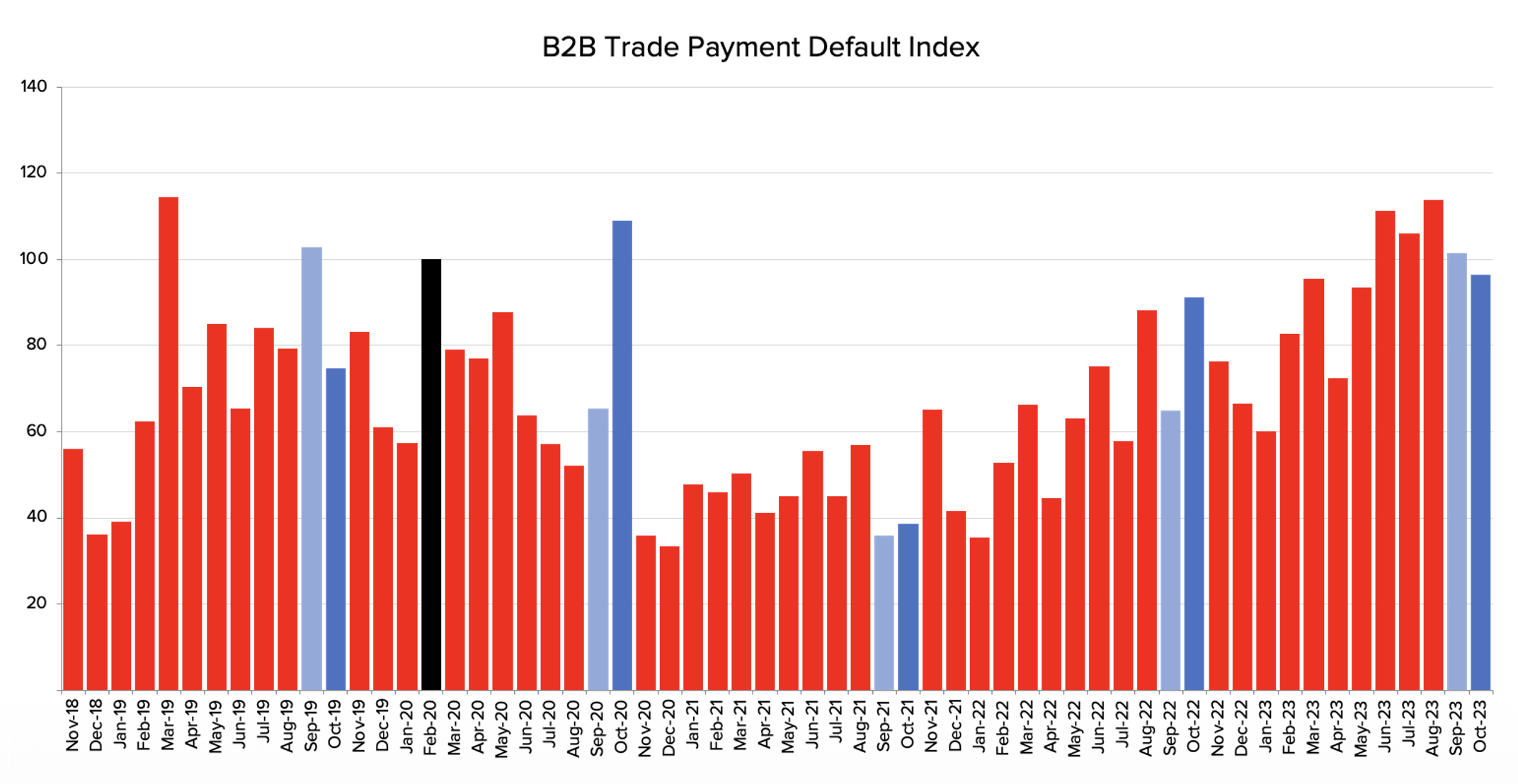

Another of CreditorWatch’s key indicators of business activity, B2B trade payment defaults, is trending up and, while it retracted slightly from September to October, is now consistently sitting above pre-COVID levels. Payment defaults are a leading indicator of the likelihood of business failure.

External administrations are also now above pre-COVID levels with an 81% year-on-year increase to October. Credit enquiries (look ups of credit reports on the CreditorWatch platform) have declined since May, which reflects the drop in business activity and decline in commercial loan applications.

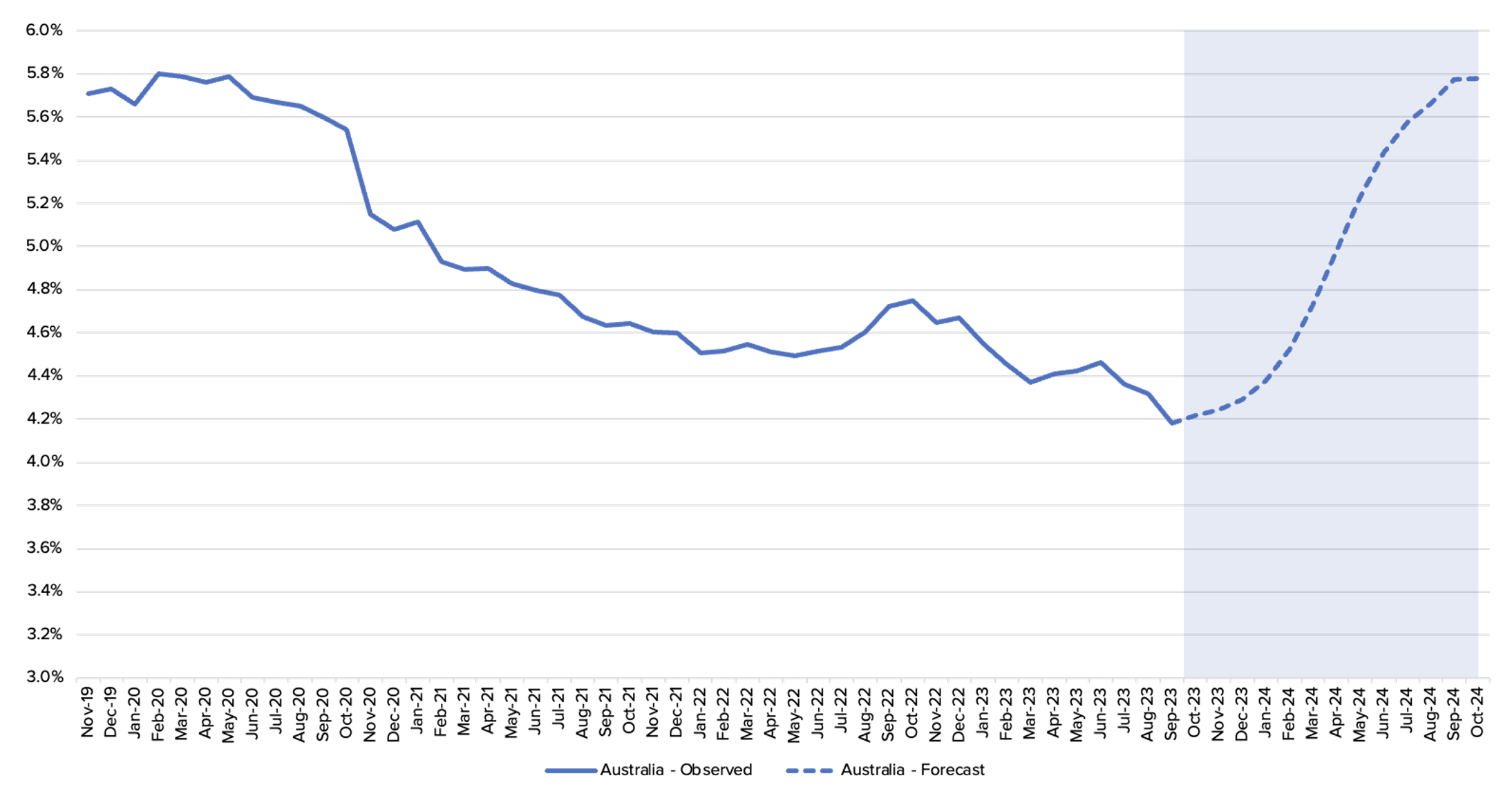

CreditorWatch forecasts the business failure rate to increase to 5.78% over the next 12 months from the current 4.21%.

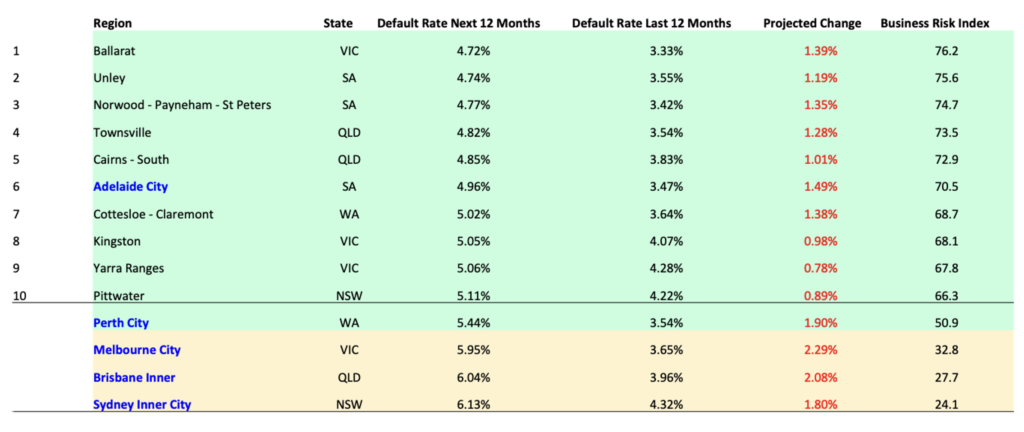

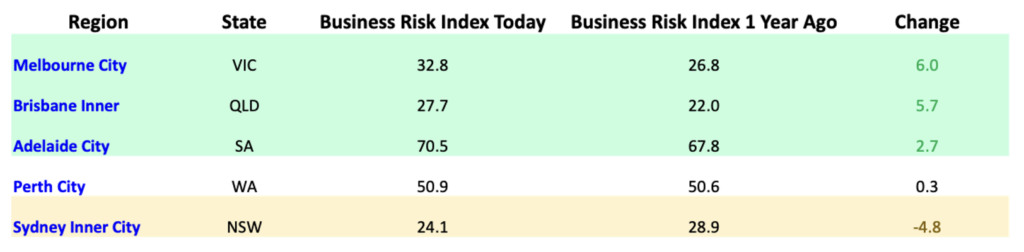

A year-on-year comparison of capital city CBDs has revealed that Melbourne City is the most improved CBD area over the past 12 months, with a six-point move up the business risk index to 32.8. Meanwhile, Sydney Inner City is the least improved CBD area with a slide of 4.8 points down the index to be the worst performing capital at 24.1.

The Central Melbourne area is benefiting from an improvement in foot traffic in non-working hours – namely weekends and nighttime. Sundays are now busier in Melbourne than Mondays, and the influx of international students and the return of sporting events to the MCG/Melbourne Park precinct has ensured nighttime activity remains robust. Melbourne has always had a relatively diverse CBD, and is now benefiting from non-office activities rebounding strongly since lockdowns have ended.

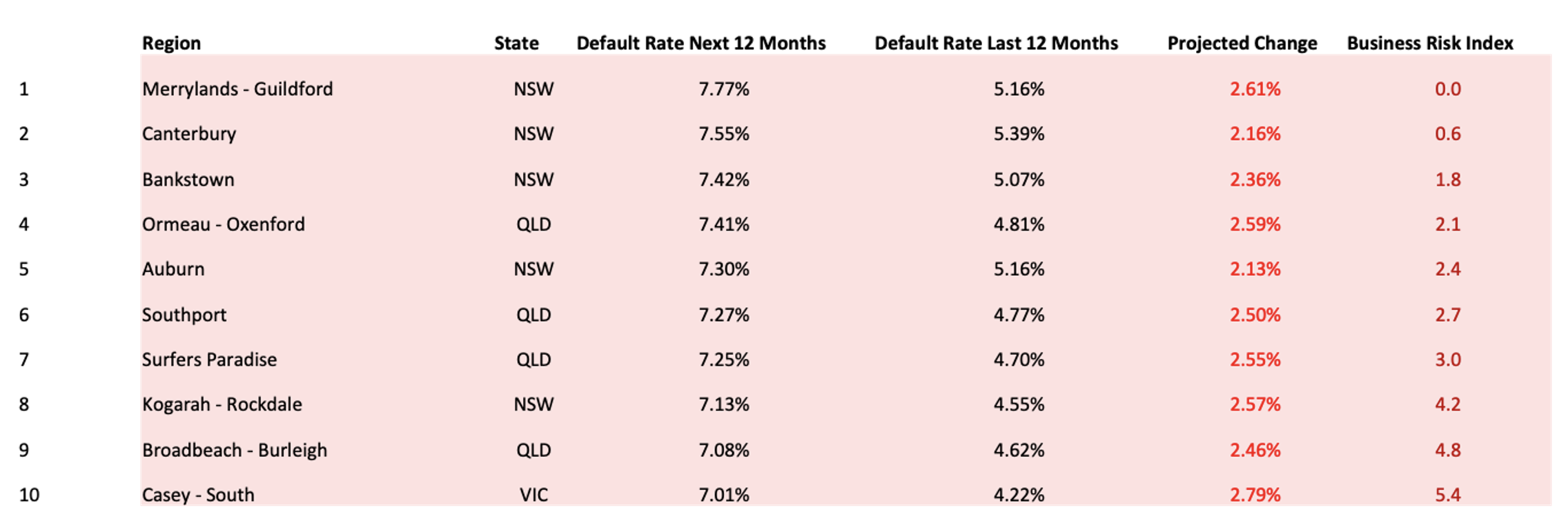

In terms of regional risk, Western Sydney and South-East Queensland dominate the list of highest risk regions. These regions are particularly sensitive to interest rate changes, given the relatively high levels of debt among both businesses and households, and lower than average incomes.

The list of best performing regions is more of a mixed bag, with areas in regional Victoria, inner-city Adelaide and North Queensland making up most of the top 10. These areas are typified by below-average property and rent prices and above-average incomes.

- Average value of invoices for Australian businesses has dropped 34% over the past 12 months.

- B2B trade payment defaults continue to trend upward, with a 60% increase since January.

- External administrations continue to rise, with an 81% year-on-year increase.

- Credit enquiries are trending down as business activity and credit/loan applications decline.

- Court actions remain flat year-on-year and are well below pre-COVID numbers.

- CreditorWatch’s national business failure rate prediction for the next 12 months is for an increase from the current rate of 4.21% to 5.78%.

- Businesses in the food and beverage services sector remain the most at risk of payment defaults (6.8%) by a considerable margin. Transport, Postal and Warehousing is the next riskiest industry at 4.4%, followed by Financial and Insurance Services (4.3%)

- Ballarat in Victoria is the region with the lowest risk of business failure (across regions with more than 5,000 businesses), followed by Unley and Norwood-Payneham-St Peters in South Australia.

- On a yearly basis, the most improved region is Melville in Perth, which has moved 15 points up the Business Risk Index, followed by Brunswick-Coburg in inner-city Melbourne.

- The regions with the highest risk of business failure are around Western Sydney and South-East Queensland, with Merrylands-Guildford (NSW) the top ranked region, followed by Canterbury (NSW) and Bankstown (NSW).

- The worst performing region in Australia on a yearly basis is Gosford in NSW, which has slide almost 22 points down the index.

CreditorWatch CEO, Patrick Coghlan, says the RBA’s attempts to curb inflation with interest rate increases is hitting businesses hard as consumers curtail spending.

“Consumer demand is one of the key drivers of the economy and that is coming to a grinding halt as cost-of-living pressures bite,” he says. “Costs of rents, electricity and fuel are all still very high despite the RBA’s best attempts to drive down inflation. Mortgage holders are suffering from increased loan repayments as well.

“Two of our leading indicators, average value of invoices and B2B payment defaults, paint a very clear picture of what businesses are going through at the moment: order values are dropping, therefore so are revenues, and margins are also being squeezed through inflation.

“That is causing an increase in the number of businesses that are unable to pay their invoices to suppliers – and that is a real worry because those defaults greatly increase the chance that a business will not survive into the future. All the data is pointing to another challenging Christmas trading period so it is prudent for businesses to follow up on outstanding debts before then.”

CreditorWatch Chief Economist, Anneke Thompson, says CreditorWatch’s data is consistent with the tightening of monetary policy tightening as higher interest rates will always impact smaller businesses first.

“SMEs are more susceptible to changes in demand than bigger businesses and, on the personal side, many owners will have rising home-loan repayments to service, which may involve them having to remove more money from their businesses and reduce orders from suppliers where possible as a result,” she says.

Trade default numbers remain elevated and have been rising on a trend basis since the cash rate began its climb upwards in April 2022. Businesses are now forced to direct more of their cash towards loan repayments, and at the same time continue to grapple with unavoidable running costs that continue to rise, such as electricity, gas, fuel and insurance.

In some cases, this is resulting in insufficient cash to pay all suppliers each month. It tends to be the smaller, non-essential suppliers who are reporting trade payment defaults.

CreditorWatch’s business failure rate prediction is for a significant increase in the current rate of business closures. This is in part because we are coming off a period where there has been an unusually low rate of business failures, but also the steep decline in consumer spending on discretionary items, which will impact many marginal smaller businesses.

The ATO is also pursuing unpaid tax with more vigour, and there are many businesses that still owe significant amounts of GST following the end of COVID payment ‘holidays’.

There is still a wide variance in the make up of the regions included in our Top 10 best-performing regions for business failure rates. Most of these regions have residential populations with a higher median age, and it is older, retired people with little to no debt that are least impacted by increases to the cash rate. In fact, many of these retirees with savings in the bank will have more to spend due to higher interest payments on their savings.

The worst performing regions all have relatively young resident populations, and the spending power of this group is being disproportionately impacted by rising interest rates. This is impacting the businesses in these areas, particularly retail and food and beverage businesses.

The Sydney Inner City area is the only CBD area to fall down the rankings on the Business Risk Index by. This is due to rental costs in the Sydney CBD and inner areas, which are much higher than in other capital city CBD areas.

The Sydney CBD also has less nighttime activity than many other Australian capital city CBDs, although this is slowly improving, making CBD businesses much more reliant on office workers for business trade.

In addition, many office workers continue to work from home at least for part of the week, which is impacting turnover of many retail and food related businesses.

The industries with the highest probability of business failure over the next 12 months are:

- Food and Beverage Services: 6.75%

- Transport, Postal and Warehousing: 4.44%

- Financial and Insurance Services: 4.34%

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.15%

- Wholesale Trade: 3.34%

- Agriculture, Forestry and Fishing: 3.42%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

The finance and insurance industry has moved up in to the top three industries ranked by probability of failure over the next 12 months. This is likely due to less demand for home loans, which impacts mortgage and insurance brokers, who rely on consistent turnover in the housing market for continued business.

The transport, postal and warehousing sector is being impacted by slower demand for goods purchased online, as well as higher fuel costs and soaring industrial rents – particularly in Sydney.

The food and beverage services sector continues to have the highest proportion of external administrations by far, with 1 in 100 businesses being put into administration each year. This highlights the risky nature of this sector, with restaurants and cafes being very sensitive to changes in demand, pricing and new competitors opening up.

The construction sector is also still recording high rates of external administration, with many businesses still struggling to balance high supply costs with lower demand for new housing and renovation work.

CreditorWatch expects the 2023 Christmas period to be a particularly challenging one for the retail sector. Many corporates have reduced their discretionary spending, and this will impact the hospitality industry over the Christmas period.

While consumers will still spend on Christmas gifts, many are likely to be far more modest and selective with their purchasing. A number of retailers are predicting that the Black Friday sales at the end of November will see record turnover, as consumers hunt for bargains and plan their Christmas purchasing well in advance so as not to be forced to pay higher prices nearer to Christmas.

Domestic travel, however, may be the beneficiary of these challenging economic conditions, as holiday makers may revert to a preference for domestic holiday travel, as they did during the COVID pandemic, to avoid the higher costs of international travel.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.