Australian business leaders are striking an optimistic tone about the coming year, despite ongoing hurdles to accessing finance, according to new research from CreditorWatch.

CreditorWatch’s national Business Sentiment Survey of 1,017 business decision makers across all regions, industries and business sizes found strong confidence in performance, growth and working capital management. However, high interest rates and complex lending conditions are barriers to securing credit for many businesses, particularly SMEs.

Key findings include:

- 61% rated their business performance over the past year as “Good” or “Very Good” (up from 54% in 2024), with only 11% reporting poor results (down from 15% last year).

- 76% are optimistic about their growth prospects for the next 12 months (up from 72% in 2024).

- 56% reported challenges accessing finance, with high interest rates, application complexity and collateral requirements the main barriers (up from 52% in 2024).

- 80% are satisfied with their current level of working capital – a sharp rise from 69% last year.

- 60% said they had used personal funds to support working capital for their business in the past 12 months.

CreditorWatch CEO Patrick Coghlan says “The results highlight the resilience of Australian businesses and increasing confidence in the future, even with stubbornly tight financial conditions.

“Access to finance remains the critical bottleneck. Without easier pathways to funding, many businesses risk being held back from realising their full growth potential. Given the challenging conditions businesses have faced post-COVID, it is crucial that they are provided with as much support as possible.

“At CreditorWatch, we’re seeing strong demand for tools that give businesses confidence in who they trade with – whether that’s through real-time credit monitoring, debtor management or payment forecasting.”

Working capital

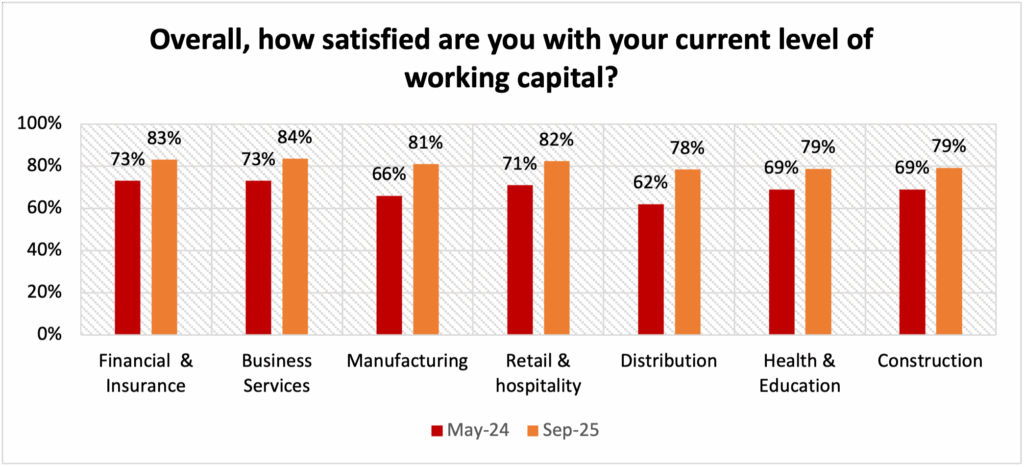

The 2025 survey results revealed a significant increase in the percent of businesses that reported being satisfied with their levels of working capital – increasing 11 percentage points from 69% in May 2024 to 80% in September 2025.

The level of satisfaction varied by business size. Small business (2-19 employees) satisfaction increased the most, rising 14% from May 2024 (63%) to September 2025 (77%). While sole traders increased 13% (58% to 71%) in the same time frame. Medium businesses (20-199 employees) and large businesses (200+ employees) saw modest gains, increasing by 6% and 3% respectively.

All industries recorded increased satisfaction with distribution and manufacturing showing the largest improvement, jumping 16% and 15% respectively. Retail & hospitality and business services both recorded 11 percentage point increases, while all other industries managed 10% increases between May 2024 and September 2025 – likely reflecting better cash flow and recovery post-pandemic.

Access to credit

Despite an increase in the percentage of business leaders saying they were satisfied with their levels of working capital, 60% said they had used personal funds to support working capital for the business in the past 12 months. 56% also said they continued to experience challenges when attempting to access credit.

Interestingly, it was large businesses (200+ employees) that reported the most difficulty accessing credit (76%) followed by medium businesses (20-199 employees) (72%), small businesses (2-19 employees) (50%) and sole traders (41%).

On an industry basis, 71% of manufacturing businesses said they had experienced challenges accessing credit, followed by finance & insurance (63%) and retail & hospitality (56%).

The biggest barriers to accessing credit were high interest rates (55%), complex application processes (45%) and high collateral requirements (37%).

South Australia, in particular, saw a large increase in businesses reporting difficulty accessing credit, up from 39% in 2024 to 56% in 2025.

Industry contrasts

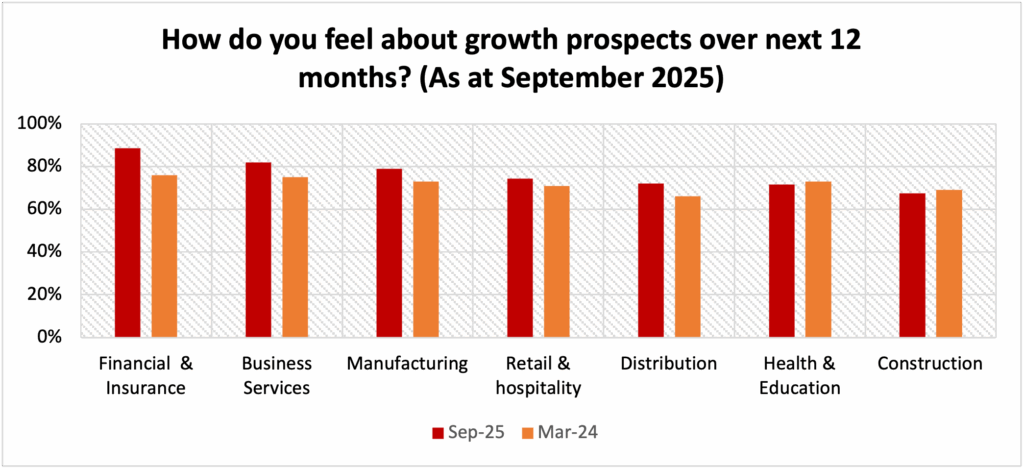

Finance and insurance businesses are the most upbeat about their prospects for the next 12 months, with 74% rating performance positively and 89% optimistic about growth. Businesses in the transport and logistics sector reported the lowest confidence, with only 43% rating their performance positively. Manufacturing businesses showed strong growth optimism (79%) but the highest reliance on personal funds and greatest difficulty accessing credit.

State-by-state sentiment

Business confidence varied significantly across states/territories with Western Australia the region with lowest satisfaction in business performance and positivity about the outlook.

Queensland and South Australia leads the nation in confidence among business leaders, with 65% viewing their performance over the the past 12 months positively. In contrast, just 49% of business leaders in Western Australia were positive about their results over the past year.

Businesses in NSW were the most optimistic about their growth prospects over the next 12 months (78%), followed by Victoria and South Australia (77%) with those in WA the least positive (69%).

Have you subscribed to the Business Risk Monitor yet? It’s free!

The Business Risk Monitor is a brand new monthly report that gives credit professionals and business owners an incredibly clear, accurate and comprehensive view of the Australian credit landscape, health of Australian businesses and the state of the economy overall.

Subscribe here. No spam!

Get started with CreditorWatch today

Take your debtor management to the next level with a 14-day free trial.