Every day you trade on trust, your business is exposed. CreditorWatch monitors the companies you do business with and alerts you the moment their financial health changes.

Use our smart match tool to find the right fit for your business.

Submit your details and a member of our team will be in contact shortly.

Get in touch

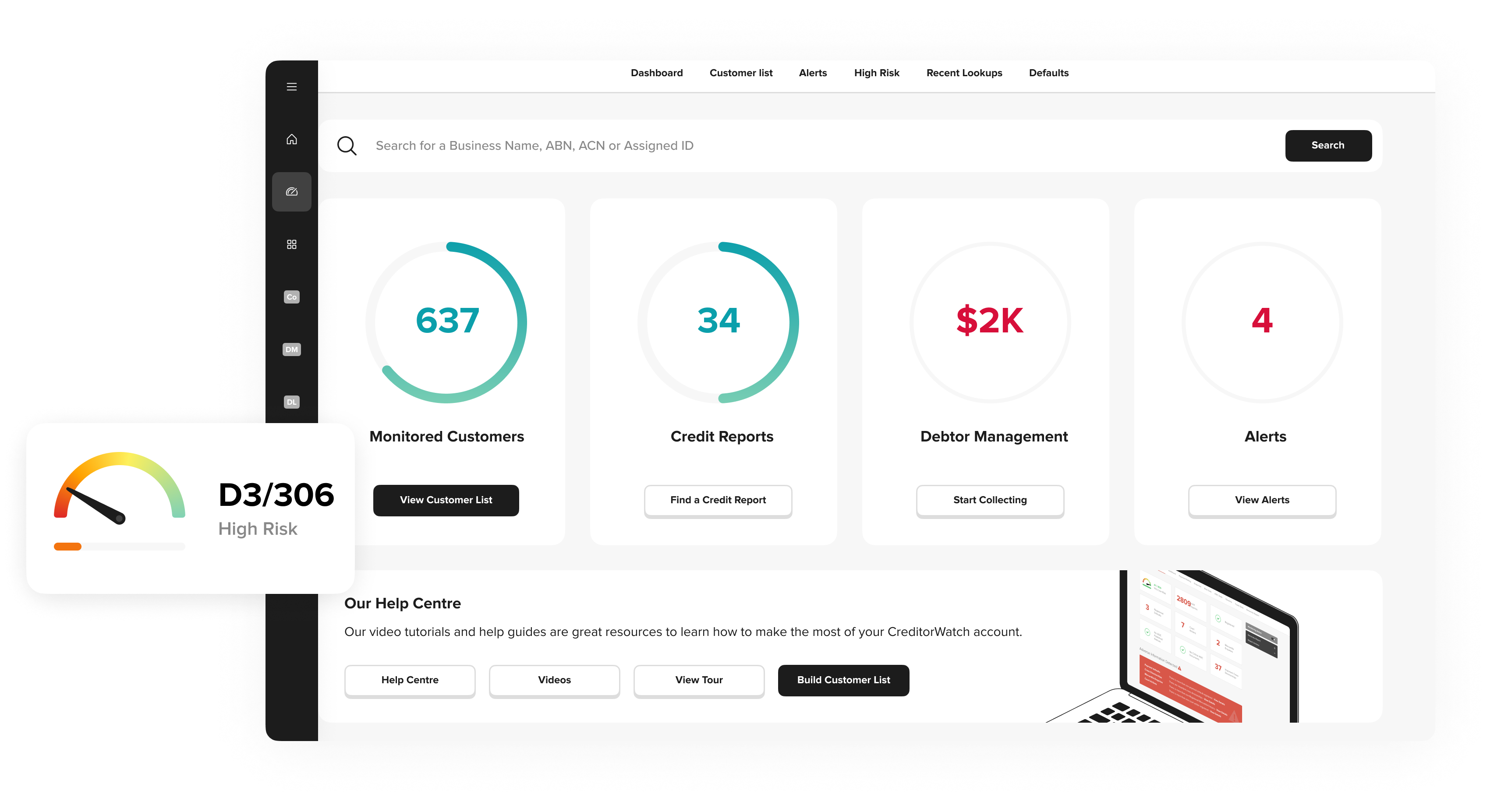

When you add customers to your watch list, CreditorWatch will monitor them 24/7 for any changes that might impact your business, such as late payments to other suppliers or going into administration. You will receive a real-time alert via email when these changes occur.

Changes can occur to any business, so monitoring customers that you regularly invoice will allow you to update your payment terms for any particular customer as their risk level changes.

A credit report is a detailed record of a business’s credit history, which includes information about their credit accounts, credit inquiries, and payment history. This report is compiled by credit reporting agencies, such as CreditorWatch, based on the data provided by lenders, credit card companies, and other creditors. Lenders and businesses extending credit use credit reports to evaluate a business or individual’s creditworthiness and determine whether to approve a loan or extend credit.

Before doing business with a new customer, you should check their credit report to help you determine their credit limit, maximum invoice amount, and whether you require payment upfront from them in order to minimise your risk and ensure you’ll be paid.

Sign up for a 14-day free trial and instantly search the businesses you work with.