Bottom line:

The RBA Board has recently changed its focus. It now prioritises maintaining price stability and full employment over simply returning inflation to target. As a result, the unemployment rate is more important than before. The next update is due Thursday. It follows the surprise jump to 4.3% in June.

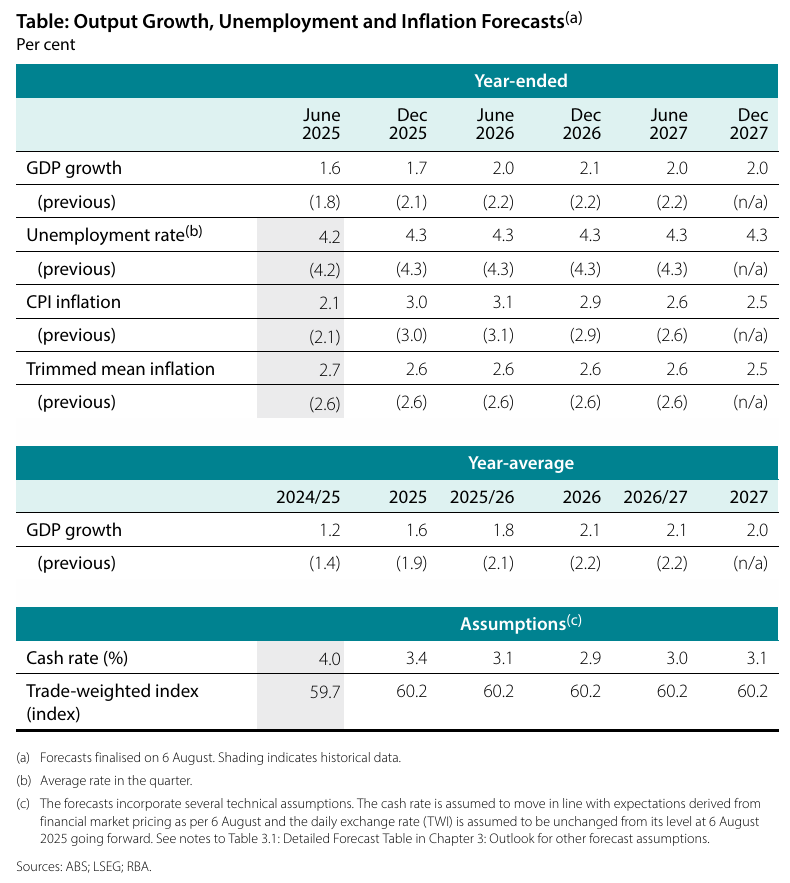

Forecasts of target inflation and stable unemployment at 4.3% (for a scarcely believable 30 months) rely on two further interest rate cuts. The Governor signalled a data-dependent approach to future board meetings. This includes assessing risks. If the data aligns with expectations, the Board will likely continue cautious and gradual easing.

Detail:

- The RBA Monetary Board voted unanimously (9-0) to cut the official cash rate by 25bps to 3.6% today.

- If the cash rate had not been cut, it would have been a far bigger surprise than last month, given the six members that voted for no cut in July signalled they were awaiting confirmation of moderating inflation from the Q2 CPI. This confirmation was duly delivered.

- Interestingly, the heading of the final paragraph of the Monetary Policy Decision changed last month (July) from “ Maintaining low and stable inflation is the priority” to “Maintaining price stability and full employment is the priority”. This was an important change as it signals the long fight to return inflation to the midpoint of the target was largely behind and that there could be greater focus on the second part of the Bank’s mandate, namely full employment. This suggests the course of the unemployment rate in coming months will be particularly important in determining the course of interest rates from here.

- The Bank’s latest forecasts for inflation and unemployment are unchanged from May, with the unemployment rate forecast to remain at 4.3% until the end of December 2027 (this is extremely unlikely) with trimmed mean inflation remaining stable at 2.6% until June 2027 before dropping to 2.5% in December 2027. Growth forecasts have been downgraded moderately, in part due to a downward revision to the productivity assumption.

- Importantly, these forecasts are predicated on a cash rate profile that anticipates the cash rate falling to 3.4% at the end of this year (one further interest rate cut) and to 3.1% in June 2026 (another interest rate cut in H1).

- In her press conference, the Governor noted the Board was now data dependant and would look at incoming unemployment and inflation data in coming months to decide whether the Board needs to continue easing gradually as suggested by the assumed cash rate forecasts noted above.

- The forecasts also assume that trade policy developments – while likely now avoiding some of the extreme outcomes that seemed possible a while ago – are still expected to have an adverse effect on global economic activity.

- The reduction in interest rates will be welcomed by both businesses and consumers with mortgages, both of whom continue to experience very elevated costs. This should help continue the levelling off in insolvencies that has been in evidence in recent months, though global growth uncertainties related to tariffs and structural change related to technology remain large uncertainties.

Chief Economist

Interest Rates

Chief Economist

Ivan joined CreditorWatch as Chief Economist in October 2024. He is a highly experienced chief economist and keynote speaker on the economy and financial markets.

Most recently, Ivan was Chief Economist, Corporate & Institutional Banking for National Australia Bank, but has also been Chief Economist for Qantas and Chief Economist (Australia) for ANZ and Deutsche Bank. Ivan has also consulted to SEEK, IATA and Virgin Australia.

Ivan holds a Bachelor of Economics with Honours from the University of Tasmania and commenced his career at the Reserve Bank of Australia.

14-Day Free Trial

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.