CreditorWatch’s latest data on Australian Tax Office (ATO) tax debt defaults has revealed thousands of Australian private businesses have collapsed over the past 12 months after failing to address significant tax debts with the ATO.

The latest findings indicate that 33.6% of private businesses with ATO tax debt defaults (1,715 out of 5,097 in total) —defined as debts exceeding $100,000 that are over 90 days overdue—have either become insolvent or voluntarily closed during the past year.

Tax debt challenges post-pandemic

During the pandemic, the ATO adopted a lenient approach to debt enforcement, leading to a surge in outstanding tax liabilities, which now total approximately $52 billion. Of this amount, around $34 billion is owed by small and medium enterprises (SMEs).

In response, the ATO has significantly intensified its debt recovery efforts in the post-pandemic period, employing measures such as disclosing business tax debts to credit reporting bureaus, issuing garnishee orders, and serving Director Penalty Notices.

CreditorWatch CEO Patrick Coghlan supports the ATO’s stricter stance, noting the importance of holding businesses accountable for their tax obligations.

“The ATO is simply trying to collect the tax that all companies are obliged to pay,” he says. “While I sympathise with businesses grappling with such large debts, it’s crucial that businesses abide by these obligations.

“A tax debt of $100,000 or more is a substantial burden, especially for SMEs, which represent the majority of businesses with tax debt defaults and can seem overwhelming. Entering into a payment plan with the ATO is an important and necessary first step in resolving these issues.”

Industry insights: Who’s struggling most?

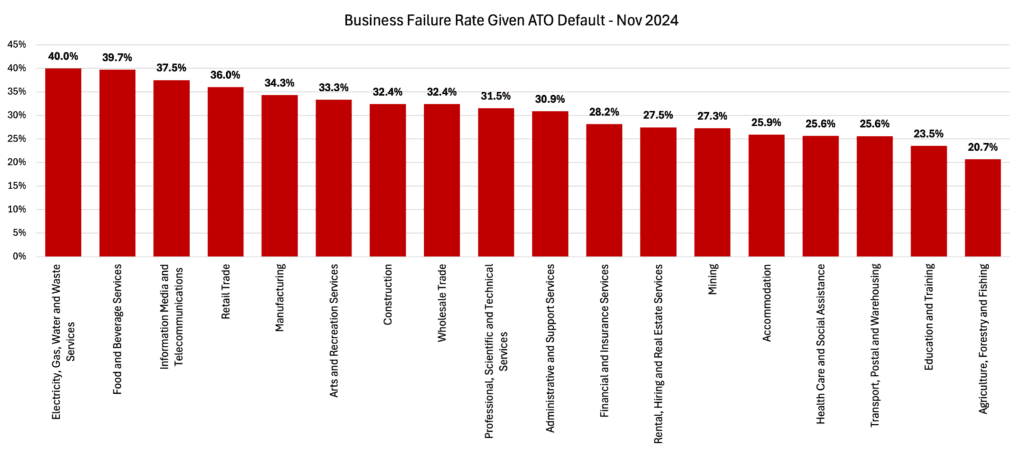

The data shows a stark disparity in the rate of business failures by industry. The Electricity, Gas, Water, and Waste Services sector has experienced the highest failure rate, with 40% of businesses defaulting on significant tax debts collapsing in the past 12 months.

Other industries experiencing high than average failure rates include:

- Food and Beverage Services: 39.7%

- Information, Media and Telecommunications: 37.5%

- Retail Trade: 36.0%

- Manufacturing: 34.3%

Data source: Australian Taxation Office Direct Link

Economic pressures amplify the risk

The combination of challenging economic conditions, rising operational costs, and declining retail trade per capita has left many businesses struggling to manage large tax debts. Even in stable economic times, repaying debts exceeding $100,000 is a formidable challenge.

The varying rates of failure among industries may also reflect how far along each sector is in its economic downturn. For instance, industries like Information, Media, and Telecommunications have been grappling with disruption for years due to the shift toward digital media. Meanwhile, the education sector, which currently has a failure rate of just 10% among businesses with tax defaults, may face mounting challenges as new caps on international students take effect next year.

Transparency in tax debt reporting

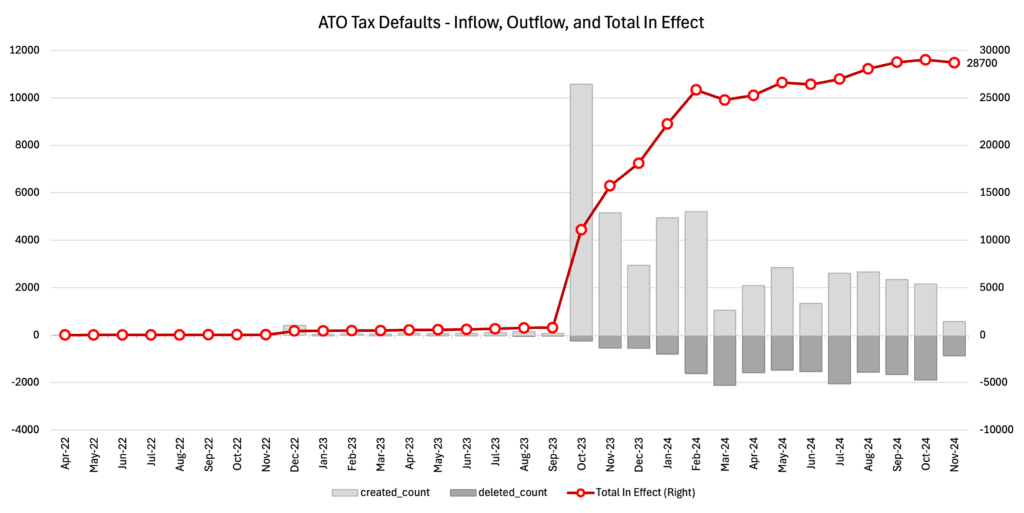

Since April 2022, the ATO has disclosed business tax debts to credit reporting bureaus under specific conditions:

- The debt exceeds $100,000 and is over 90 days overdue.

- The business has not responded to two outreach attempts or a notice of disclosure from the ATO.

Credit reporting bureaus, including CreditorWatch, must remove records of tax debts once the business engages with the ATO, either by paying the outstanding debt or entering into a payment plan.

As of November 30, 2024, CreditorWatch maintains records on 28,700 ATO tax debt defaults, 18,319 of which are from private companies.

Data source: Australian Taxation Office Direct Link

Industry rankings for tax debt defaults

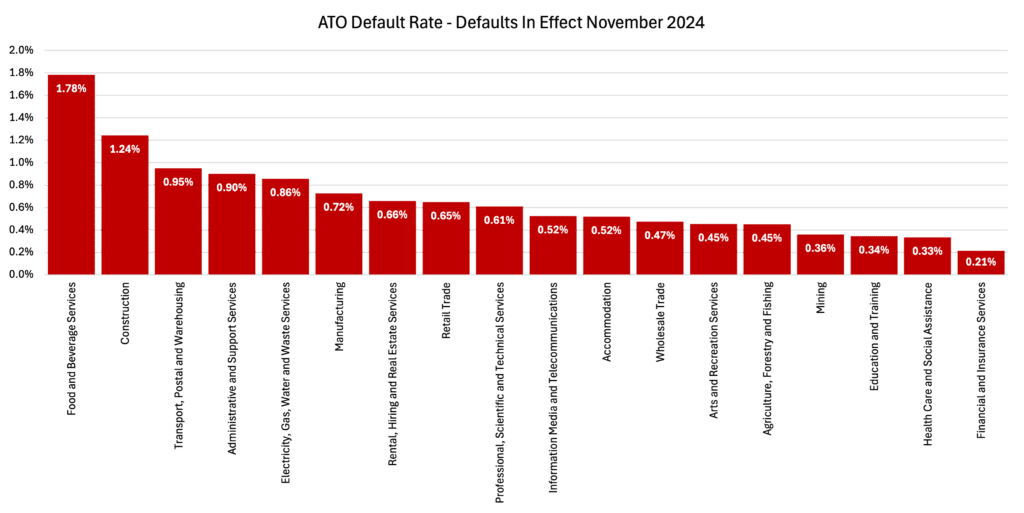

The Food and Beverage Services sector leads in tax debt default rates, followed by Construction and Transport, Postal, and Warehousing industries.

CreditorWatch’s latest data underscores the mounting pressures on Australian businesses and highlights the need for strategic financial management to navigate economic challenges.

Data source: Australian Taxation Office Direct Link

Get in touch for a demo

Empower your business with CreditorWatch and trade with more confidence using fewer resources. Book a demo with our team today.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.