CreditorWatch Chief Economist, Ivan Colhoun notes:

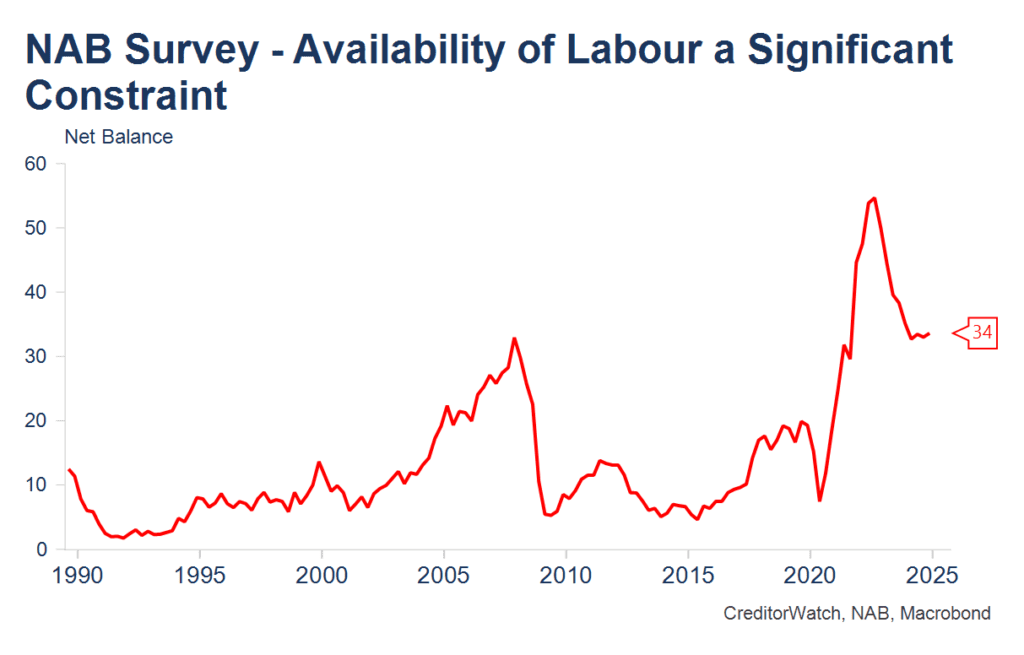

The most interesting aspect of the NAB quarterly survey is the news that the number of firms reporting the availability of labour as a significant constraint remains a very high 34% and this has not changed over 2024. This is good news for job seekers and suggests the RBA does not have to engage in either a rapid or large series of interest rate reductions.

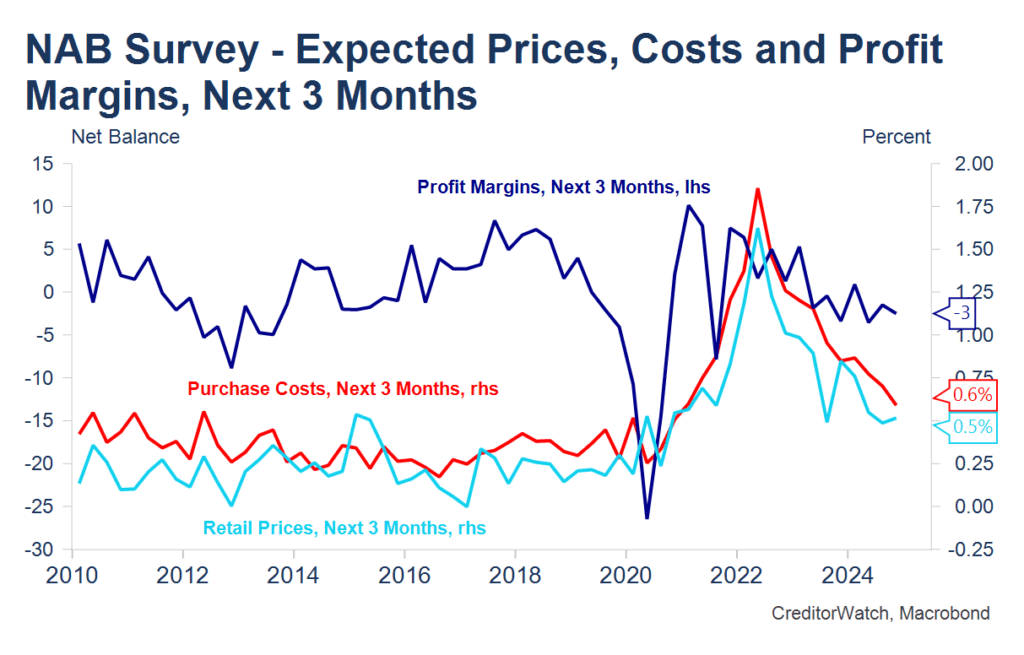

News on the inflation front was favourable with cost increases and expected retail price rises over the next three months back to levels broadly consistent with the RBA’s inflation target. That should allow the RBA to reduce interest rates by 25bps at its mid-February Board Meeting in just under two weeks’ time.

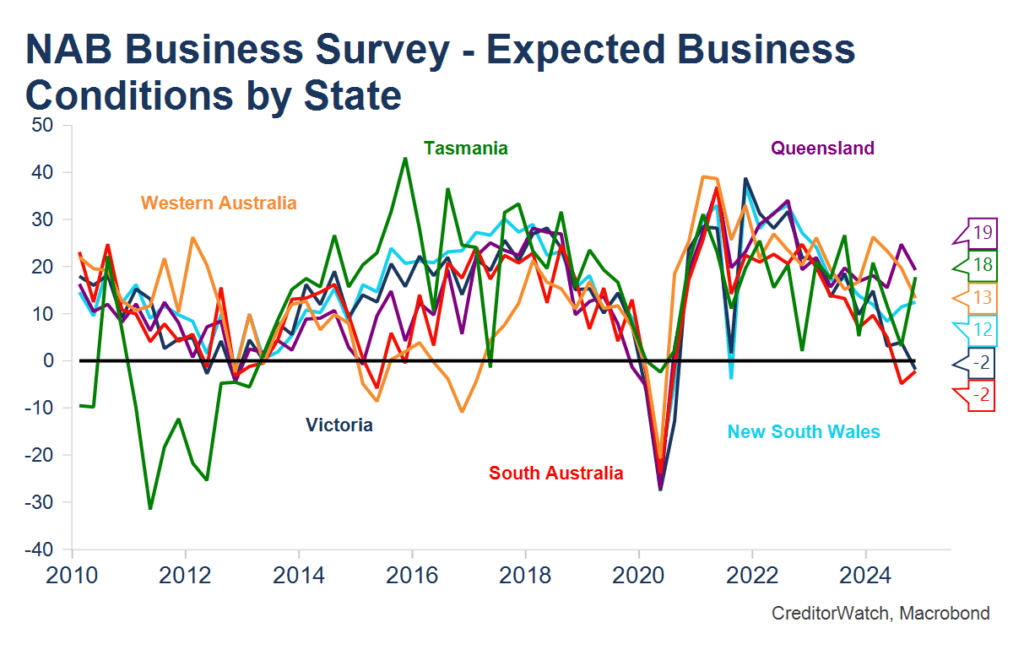

Other news from the survey is broadly similar to that from the monthly survey: Queensland and NSW businesses report the strongest business conditions, with SA and Victorian firms reporting weaker, but not very weak business conditions. By industry, Retail is weakest, while conditions in Mining and Manufacturing have been steadily deteriorating through 2024. Conditions are strongest in Recreation and Personal Services, Transport and Banking, Finance and Business Services.

It’s far too soon for this survey to have reflected any expectations let alone impacts of recent US tariff news and moves. The first indication might be in the upcoming January monthly NAB survey, more likely in coming months.

Analysis

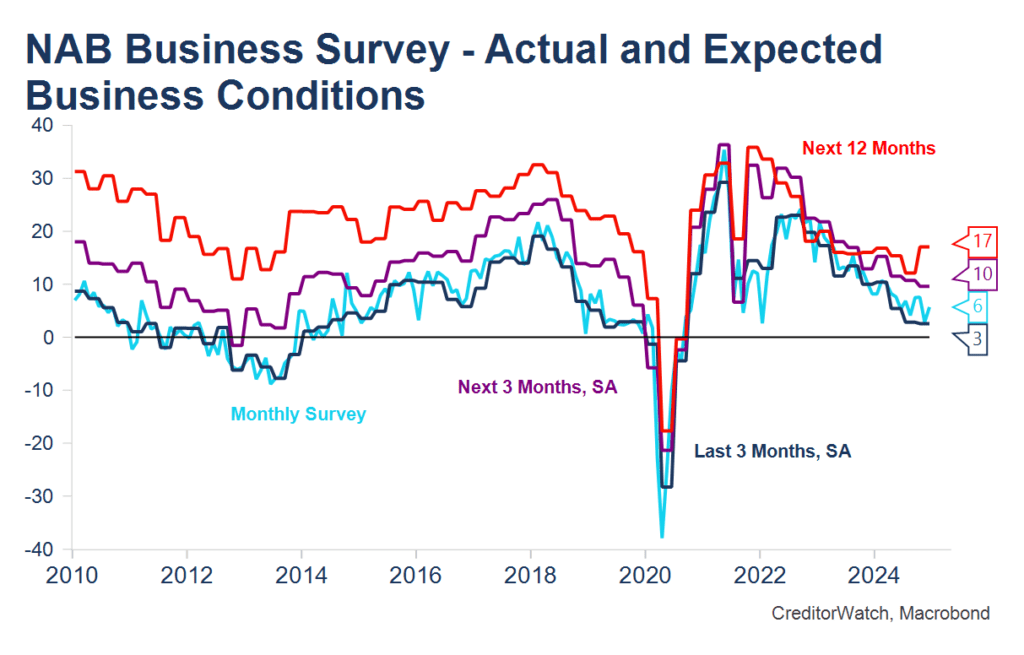

The quarterly business survey doesn’t get as much focus as the more regular monthly release, but it does have some extra information, particularly forward looking aspects about what business conditions firms expect over the next three and 12 months. The survey also has broader coverage, with around twice the number of firms captured in the quarterly survey.

The overall level of business conditions experienced over the past three months hasn’t changed much in recent quarters, but remains considerably weaker than the mostly very favourable conditions experienced by many but not all firms over the COVID period. The level is quite low, but not very low. Interestingly, while current and near-term expected conditions have been easing, firms’ expectations about the next twelve months have remained pretty solid and improved this quarter.

I’d expect that it is too early for this survey which was taken between mid-November and early December to reflect much in the way of expectations let alone actuality from recent Trump tariff announcements.

I like to focus on the changes in how different industries are seeing conditions over the next three months. As in the monthly survey, the most optimistic sectors are Recreation & Personal Services, Finance, Property & Business Services and Transport. Construction and Wholesale are middle of the road. Retail firms have the most pessimistic expectations about business conditions, but most interesting has been the significant deterioration in expected business conditions for both Mining and Manufacturing, which has been in place over the whole of 2024.

The survey provides some additional information on both inflationary pressures and the availability of labour. The message on the latter, has not changed. While the labour market has eased, it hasn’t eased that much and remains far tighter than in pre-COVID times. Thirty four per cent of firms report the availability of suitable labour remains a significant constraint on output and that figure hasn’t changed during 2024.

This suggests the labour market will remain broadly favourable for job seekers and that the RBA does not need a rapid or large series of interest rate cuts. There is also favourable news on the actual and expected inflation front, with expected retail price and cost increases back to quarterly rates of change that could be considered broadly consistent with the RBA’s 2-3% inflation target.

Get in touch

For more information on how you can safeguard your business from challenging trading conditions, contact our team today.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.