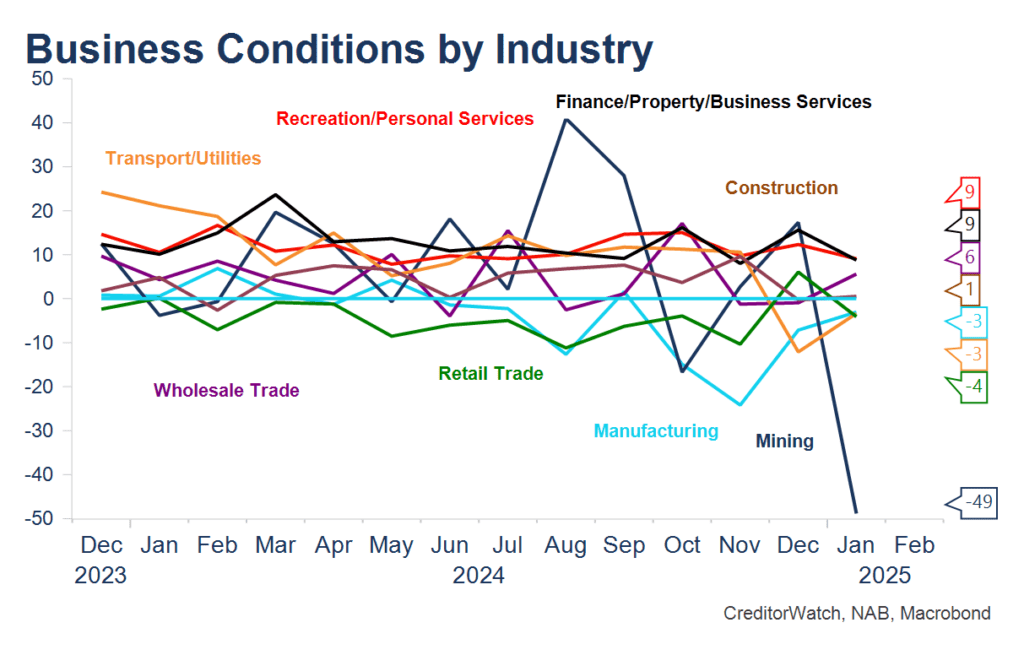

- Extreme weakness in business conditions in the mining sector drove this month’s slip in business conditions and looks to contain more noise than signal, though forward orders and profitability in mining have deteriorated so it’s not all noise.

- I’m watching the first negative reading for profitability since COVID times as, if sustained, this would be more important for economic activity and employment.

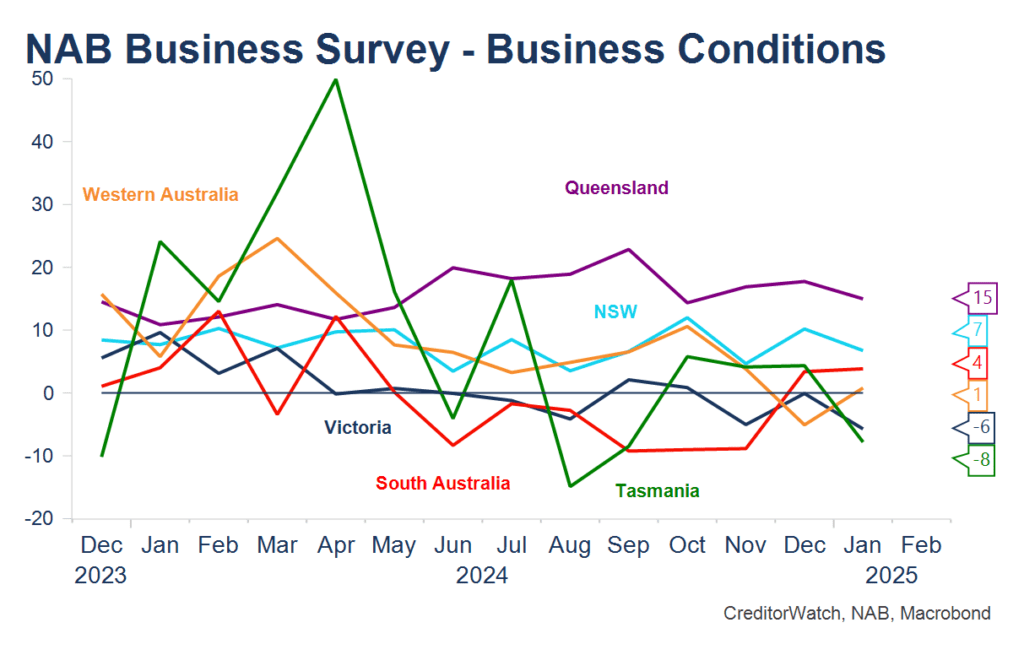

- Queensland and NSW businesses continue to report the strongest business conditions, likely reflecting population growth and relative exposure to finance and technology in NSW. Victorian businesses broadly report the weakest business conditions.

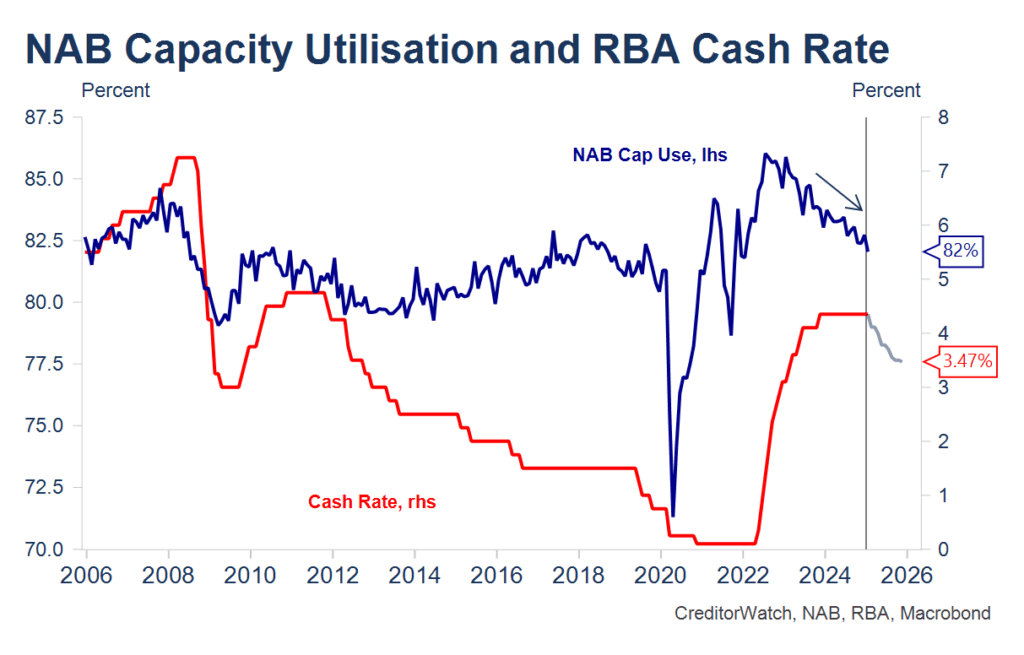

- While labour costs and retail prices rose in the month, capacity utilisation eased to the lowest point since the economy was coming out of COVID. This suggests a broader easing in inflationary pressures, even though labour costs and retail prices rose this month. Together this will allow the RBA to ease interest rates only modestly in coming months, but likely beginning with a 25bps reduction at 2.30PM next Tuesday.

Detail:

At face value, generally less favourable news from the NAB survey this month after the across-the-board improvement recorded in December. However, a massive decline in reported business conditions in the volatile mining sector drove most of the result, so I’d be inclined to consider this as noise rather than interpret it fully as a signal. Other sectors didn’t change much but manufacturing – a very weak sector recently – improved.

For the record, business conditions overall dropped back to +3 from +6, below the long-term average, but not it’s fair to say, a huge way below! Interestingly, profitability was -2, again not super low, but the first negative reading for profitability since COVID times and if sustained a concern for employment trends and the broader economy.

By industry, conditions remain weakest in trend terms in manufacturing, mining and wholesale and strongest in finance, business and property and recreation and personal services. The volatility in mining makes it hard to trust the degree of the signal this month.

By state, QLD and NSW businesses continue to report the strongest business conditions (population growth, relative exposure in NSW to technology and banking and finance), while Victoria, Tasmania and South Australian businesses report weaker business conditions (greater exposure to manufacturing?).

WA businesses have reported weaker business conditions in recent times, perhaps partially reflecting the signal from mining business respondents, but the degrees of the signal does not triangulate.

Capacity utilisation eased again, to the lowest level for some time. This holds out hope of weaker inflationary pressures. As the chart below shows, cap use and the RBA cash rate are directionally correlated, though the current level of cap use remains somewhat elevated (perhaps reflecting the tight labour market) and is therefore not currently signalling a large easing cycle is commencing.

Other price and wage indications were not as favourable this month as in recent months with labour costs having reaccelerated (consistent with a relatively tight labour market) and retail prices running at 0.9% at a quarterly rate, which would be around a 3.5% inflation rate if sustained.

To be fair, the previous two months have run at 0.7% at a quarterly rate, which would be close to consistent with the RBA’s 2-3% target.

Get in Touch

For more information on how you can safeguard your business from challenging trading conditions, contact our team today.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.