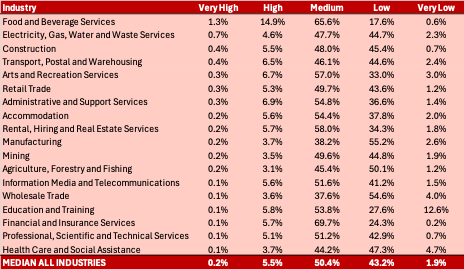

CreditorWatch, has released its latest industry risk ratings, revealing businesses in the hospitality sector are currently exhibiting an extremely high level of risk compared to other sectors.

CreditorWatch currently rates 16.2 per cent of businesses in the food and beverage services sector as ‘high’ or ‘very high’ risk, significantly higher than second ranked Administrative and Support Services at 7.2 per cent and Arts and Recreation Services at 7.0 per cent.

Businesses in the food and beverage services are currently struggling under the higher interest rate regime, increased input costs, energy price rises, reduced visitation in CBD locations, and lower consumer demand due to cost of living pressures.

Data source: CreditorWatch RiskScore

At the other end of the scale, it is the Wholesale Trade sector that has the highest proportion of businesses rated at ‘low’ and ‘very low’ risk (58.6 per cent), followed by Manufacturing (57.8 per cent) and Agriculture, Forestry and Fishing (51.3 per cent). Just 18.2 per cent of Food and Beverage businesses are rated low and very low risk. In fact, just 0.6 per cent are rated very low risk.

CreditorWatch Chief Economist, Ivan Colhoun says there are some common characteristics among sectors rated low risk.

“On the lower risk ratings side, unsurprisingly, there is a predominance of government or effectively government-funded business categories,” he says. “It will be interesting to see to what extent there is movement in risk ratings in the Education and Training sector over the next year, given the well-publicised changes to federal government policy in respect of higher education and immigration caps.”

CreditorWatch CEO, Patrick Coghlan says businesses in sectors such as hospitality and the arts are unlikely to see an improvement in business conditions until the RBA begins cutting interest rates.

“These industries that are heavily reliant on discretionary spending will, unfortunately, continue to find it tough until consumers feel a reduction in cost-of-living pressures, which won’t happen until we see a couple of rate cuts,” he says.

“Discretionary spending is one of the few ways that consumers can actively cuts costs, whether that’s eating out less, buying fewer coffees at cafes or not seeing so many concerts or theatre shows.”

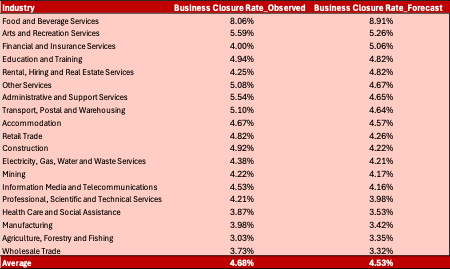

HOSPITALITY AND ARTS FORECAST TO SEE HIGHEST BUSINESS CLOSURE RATES

CreditorWatch forecasts the Food and Beverage Services and Arts and Recreation Services sectors to have the highest closure rates over the next 12 months, followed by Financial and Insurance Services.

CreditorWatch defines the business closure rate as voluntary and involuntary administrations, ASIC strike-offs and closures of solvent businesses.

Data sources: CreditorWatch and ASIC

CreditorWatch’s models are predicting increased business failures in four industry sectors: Food and Beverage Services; Financial and Insurance Services; Rental, Hiring and Real Estate Services; and Agriculture, Forestry and Fishing.

Three of the four sectors forecast to show deterioration likely reflect the lagged impact of tighter monetary policy on what are relatively interest sensitive and/or discretionary spending sectors of the economy.

Food and Beverage Services is also likely being impacted by reduced CBD visitation in many cities, with failure rates and arrears rates across most states higher for businesses in cities than for firms in non-metropolitan regions.

Financial and Insurance Services and Rental, Hiring and Real Estate Services are also predicted to experience increased business closure. Neither sector is currently showing a significant rise in companies in the ‘very high’ or ‘high’ risk categories of CreditorWatch’s Risk Ratings, however, it’s not unreasonable to expect some increased pressure in these areas given the current restrictive setting of monetary policy and the likelihood that interest rates will not be reduced before early 2025 in light of slow progress reducing inflation and continuing strength in the labour market.

The models forecast a modest increase in failure rates for companies in Agriculture, Forestry and Fishing. While higher interest rates are likely to be part of the story, lower commodity prices, especially for beef, in the face of escalated costs, are a more likely driver. Again, from a macro perspective, it would also not be surprising to see some increase in Education and Training business closures as a result of changes to federal government policies on foreign students and immigration.

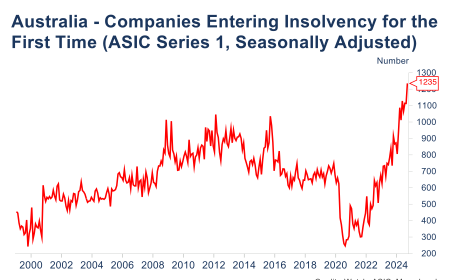

COMPANY INSOLVENCIES AT RECORD HIGHS

ASIC reports that 1225 companies entered insolvency for the first time in September 2024. In seasonally adjusted terms, the number was slightly higher but not significantly so. At face value, this data leads to the headline “company insolvencies at record highs” as the number of insolvencies is indeed higher than the previous peaks during and after the Global Financial Crisis and in the slow period for economic growth that followed the end of the mining boom.

Data sources: CreditorWatch, ASIC and Macrobond

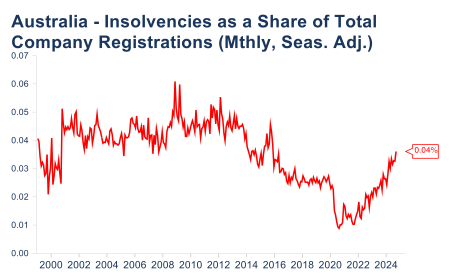

However, the number of registered companies has risen substantially between 2008 and today – indeed at 3.4m, there were twice as many registered companies in September 2024 as there were at the start of 2009. Scaling the number of monthly insolvencies to the number of companies registered presents a somewhat different perspective of the record high number of insolvencies.

While it’s true that insolvencies are rising, the overall proportion is not as high as during either of the previous periods. There’s also some uncertainty about the extent to which the resumption of ATO collections activity may be creating some bunching or catch-up in insolvencies after the significant reduction in enforcement over the COVID period thereby potentially overstating the underlying trend somewhat.

Data sources: CreditorWatch, ASIC and Macrobond

OUTLOOK

Ivan Colhoun says that, overall, restrictive monetary policy and several COVID after-effects (ATO enforcement actions, migration and foreign student policy changes) are combining to increase the risk of business failure, with interest sensitive/consumer discretionary sectors most at risk.

The rate of insolvencies is not yet especially high and the enforcement actions of the ATO are currently obscuring the underlying trend. CreditorWatch modelling expects a further lift in insolvency rates, though expected interest rate cuts in the first half of 2025 and the beneficial aspects of recent tax cuts should prove a support.

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.