Bottom line:

The 0.8% trimmed mean outcome probably does just enough to avoid a surprise rate rise next week, but shows only continuing very slow progress in returning inflation to target, especially with the possibility of some bias lower from the presence of the big electricity subsidies in the quarter. With the strong employment growth in recent months, it means the RBA is arguably over-achieving on full employment and at risk of under-achieving on the return of inflation to target in a reasonable timeframe. The latter is a part of the cost-of-living crisis, and will mean increased likelihood that Australian interest rates remain higher for longer. Services inflation remains elevated – especially in housing and insurance – though goods inflation has moderated. Unfortunately, no good news for those looking for an early interest rate reduction, and increased risk that the first cut comes even later.

Key Points:

Headline CPI +0.2% q/q and +2.8% y/y. Market expectations were for a +0.3% q/q increase, the low increase reflecting big subtractions from the large fall in petrol prices (-6.2% q/q) and the government’s electricity subsidies (electricity -17.3% q/q and would have increased 0.7% if the subsidies were not present);

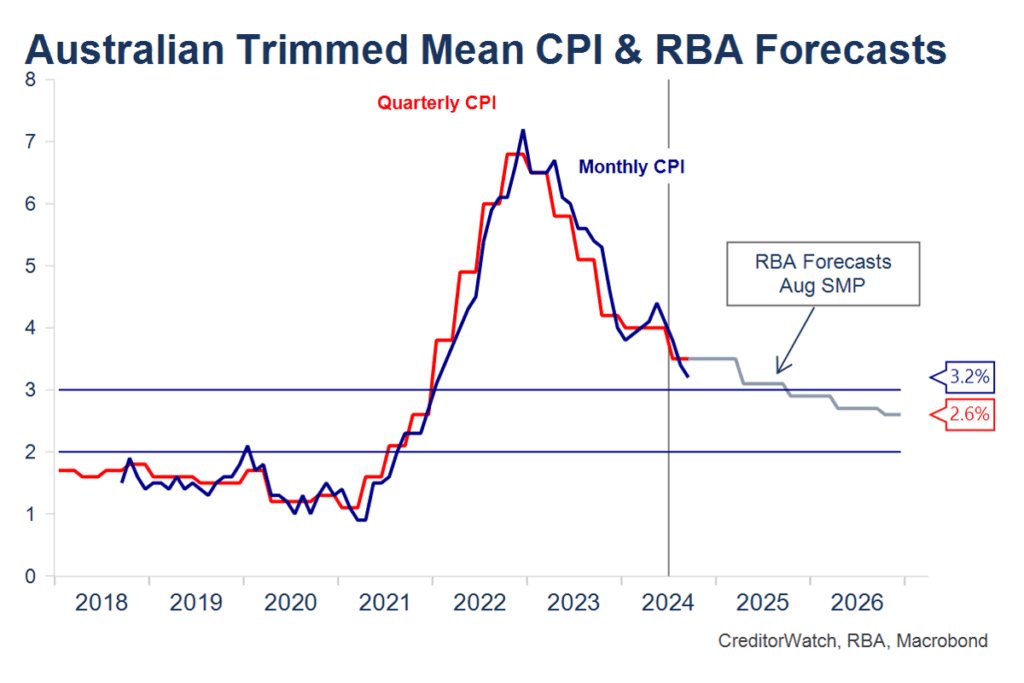

The more important trimmed mean measure of underlying inflation – more important because the RBA adjusts policy based on its forecasts for underlying inflation – which adjusts for noisy or temporary one-off large moves like the fall in petrol prices or electricity subsidies rose 0.8% q/q and 3.5% y/y. Market expectations were split between a 0.7% and 0.8% q/q outcome. The RBA August SMP forecasts incorporated a 0.8% q/q increase for this quarter.

So the TM outcome was broadly if maybe a fraction higher than expected, although my analysis suggests the presence of the big falls in petrol and electricity subsidies biases the overall trimmed mean measure maybe around 0.1 percentage points lower in the quarter. The fall in petrol prices looks like being sustained in Q4, so that is a true improvement in near-term core inflation, while the electricity subsidies may not be repeated next year, which means somewhere around 0.05-0.075 percentage points should be added back to the % quarterly trimmed mean result. This means the trimmed mean is still only making slow progress lower toward the midpoint of the RBA’s target, with services price inflation (especially rents and insurance charges very elevated). Rents rose 1.6% q/q (this would have been 1.8% without rental assistance which will be an even bigger subtraction next quarter), while insurance rose 2.8% q/q (my home and contents quote this year was up 30%, so that may well be an under-representation!.

Relative to the RBA’s dual mandate targets of at-target (2.5%) inflation and full employment (the lowest unemployment rate consistent with at-target inflation), the RBA has been overachieving on its full employment target and arguably under-achieving on its return of inflation to target by the second half of 2026, its nominated timeframe, but a timeframe which has been pushed out a number of times. I say arguably, because the full cost benefit analysis of lower inflation earlier versus higher unemployment earlier (as in NZ for example) is difficult to measure in overall economic and societal/welfare terms. The slower return to target is in my opinion part of the cost of living crisis, though higher unemployment also has its costs, though thankfully so far in most countries, somewhat higher unemployment reflects additional labour supply rather than significant job losses.

What does the result mean for the likely course of monetary policy? With employment growth having remained very strong in recent months, an early interest rate reduction in Australia remains very unlikely, with my chosen timing of February at risk from strong employment and little noticeable progress on inflation. Could the Governor raise rates next week? The 0.8% q/q trimmed mean increase probably just avoids this uncomfortable outcome, though there’s still little continuing progress in lowering inflation, so it can’t 100% be ruled out. Higher for longer in Australia seems to be the greatest likelihood bet, surprise rate hike next week next and early rate cut the outsider at present (is there a big horse race coming up?).

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.