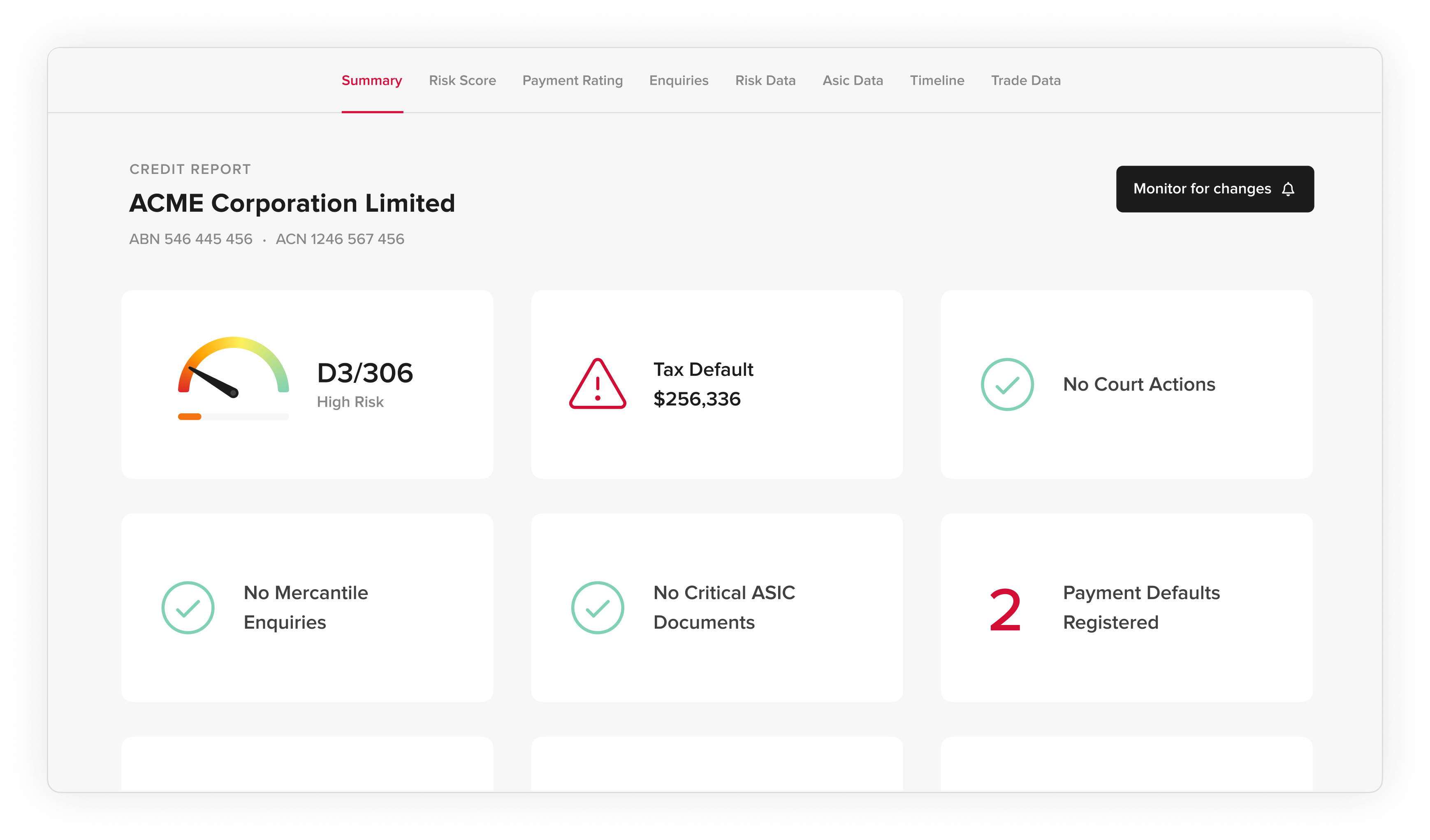

Make informed, AI-powered, credit decisions using our comprehensive reports and predictive data. Understand your level of risk and know who you’re dealing with.

Leverage our unique data and predictive insights to effectively assess the financial standing of any commercial entity and ensure that you’re partnering with reliable and profitable businesses. Our predictive insights are powered by AI to increase accuracy and help you make more informed decisions.

Identify potential issues early and check for critical information such as court actions and payment defaults. Avoid risky businesses to protect your own financial interests.

Validate business legitimacy with ASIC and ABR reports, providing essential details about directors, shareholders, and business status, ensuring transparency in your partnerships.

Leverage in-depth, AI-powered, financial analysis, including risk and payment ratings, to accurately assess creditworthiness and efficiently manage compliance obligations. Make more informed, strategic decisions, based on accurate risk assessments, that enhance your business’s stability.

Stay informed and get notified whenever critical changes relating to your customers and suppliers occur.

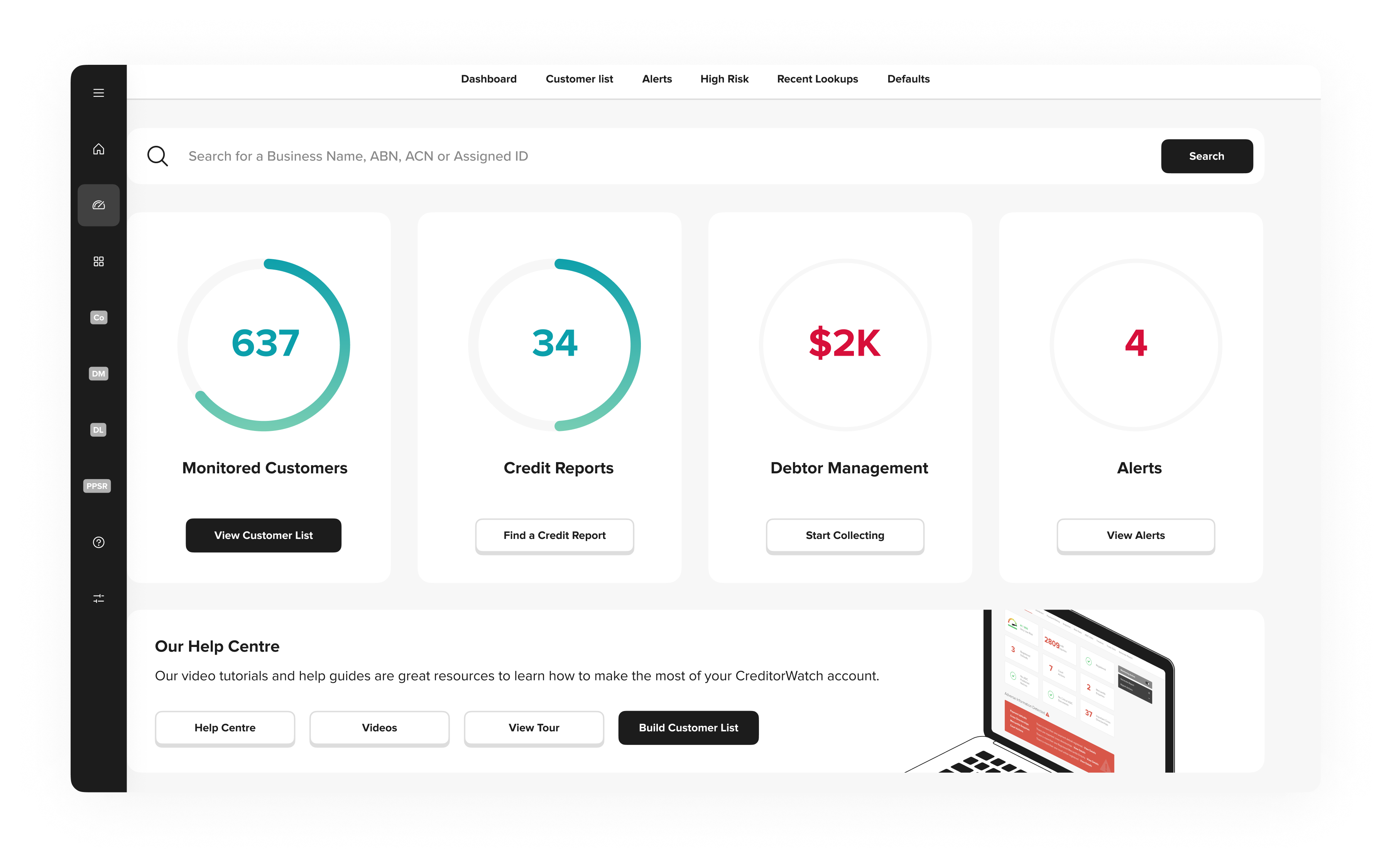

Ongoing credit monitoring enables you to be vigilant about your trading partners and make better business decisions. CreditorWatch empowers businesses with the latest credit information and risk insights.

We constantly watch over your customer base and alert you to critical issues like court actions or payment defaults.

Track ASIC/ABR changes, notable events and risk rating fluctuations.

Keep your customer information up to date and ensure you have the latest risk insights to inform better decisions.

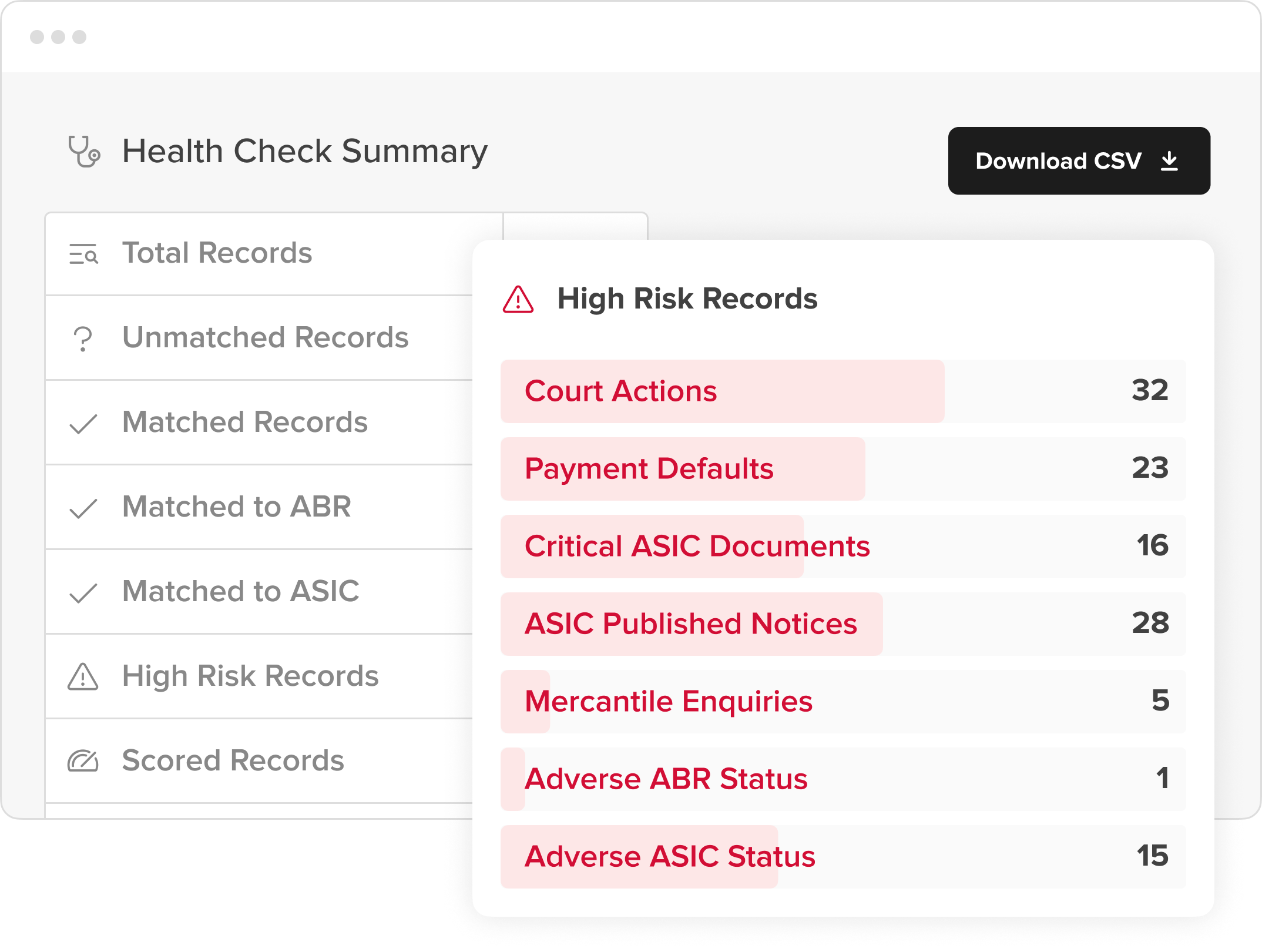

Our data matching and validation process adds context to your existing records, capturing vital financial information from ASIC, the ATO, ABR, AFSA, Australian courts, mercantile agents and CreditorWatch.

Your Portfolio Health Check is provided in a CSV file with the original information alongside it. Easily cross-reference both files or simply upload your new file straight into your accounting or ERP software.

Remove old and incorrect information, and keep up with current risk. Use extra details from our many data sources to gain insights and make better, more accurate business decisions.

A credit report is a detailed record of a business or individual’s credit history, which includes information about their credit accounts, credit inquiries, and payment history. This report is compiled by credit reporting agencies, such as CreditorWatch, based on the data provided by lenders, credit card companies, and other creditors.

Before doing business with a new customer, you should check their credit report to help you determine their credit limit, maximum invoice amount, and whether you require payment upfront from them in order to minimise your risk and ensure you’ll be paid.

When you add customers to your watch list, CreditorWatch will monitor the financial health of those customers 24/7 for any changes that might impact your business, such as late payments to other suppliers or going into administration. You will receive a real-time alert via email when these changes occur.

Changes can occur to any business, so monitoring customers that you regularly invoice will allow you to update your payment terms for any particular customer as their risk level changes.

CreditorWatch’s Portfolio Health Check provides a comprehensive review of your customers so you can validate their data, remove old and incorrect information, and identify high-risk businesses. Use extra details from our many data sources to gain insights and make better decisions – even when your database is thousands strong.

Our data matching, validation, reconstruction and standardisation process adds context to your existing records, capturing vital financial information from ASIC, ABR, AFSA, Australian courts, mercantile agents and CreditorWatch.

Ask questions, get help with pricing and plans, explore use-cases for your team, and more.