Transform your account receivable process and reduce outstanding invoices by up to 30%. Eliminate the stress of chasing late payments with CreditorWatch Collect solution.

Streamline your collections process so you can scale without adding headcount.

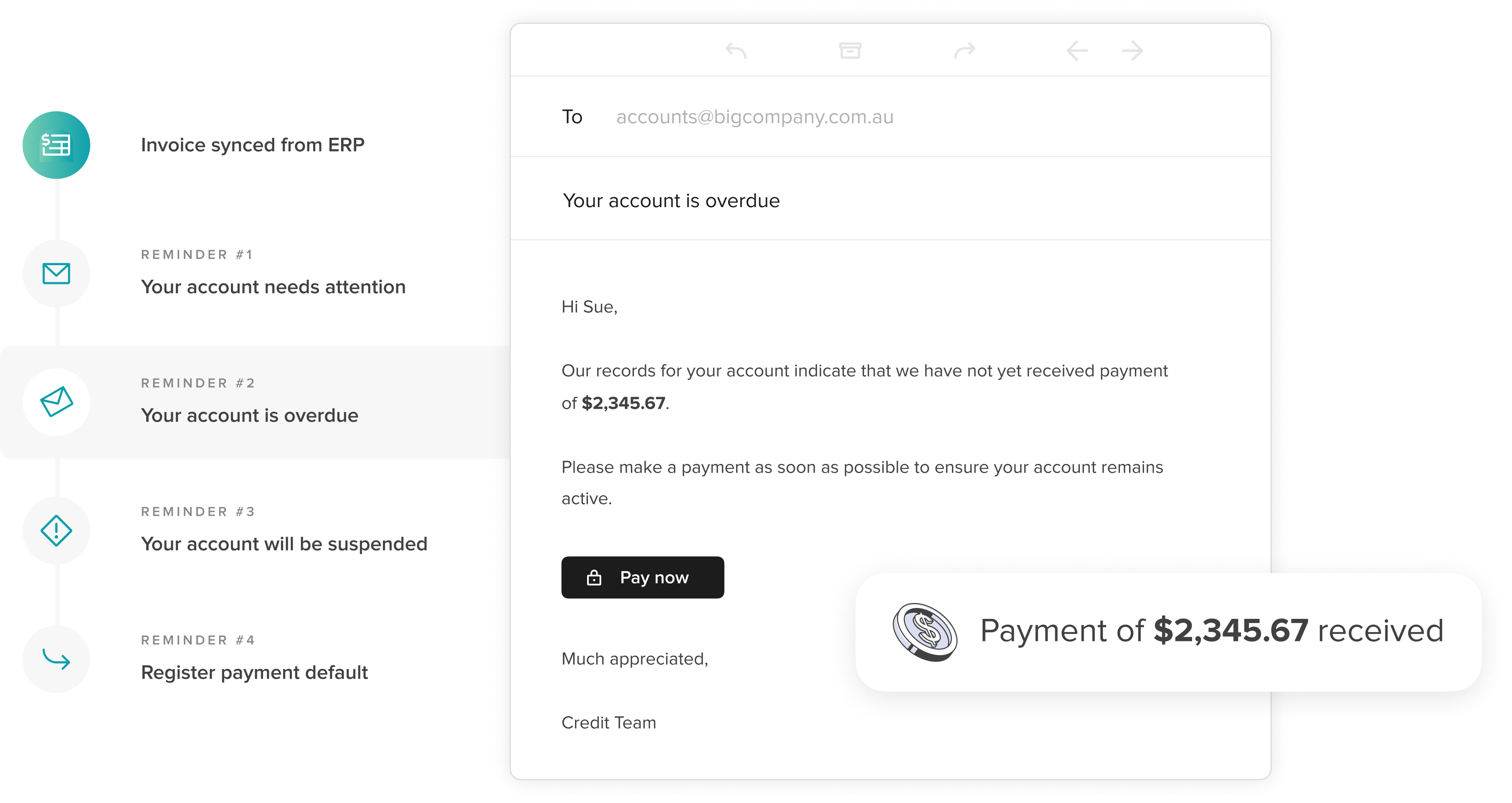

Debtors are reminded to make payments when they’re due, every time, using process automation and customisable workflows.

Empower your Accounts Receivable (AR) team to work better together with one source of truth for collections processes. Know where your receivables stand and how your AR efforts are performing.

Connect your accounting software to enable automated workflows. Start collecting proactively and streamline your collections process.

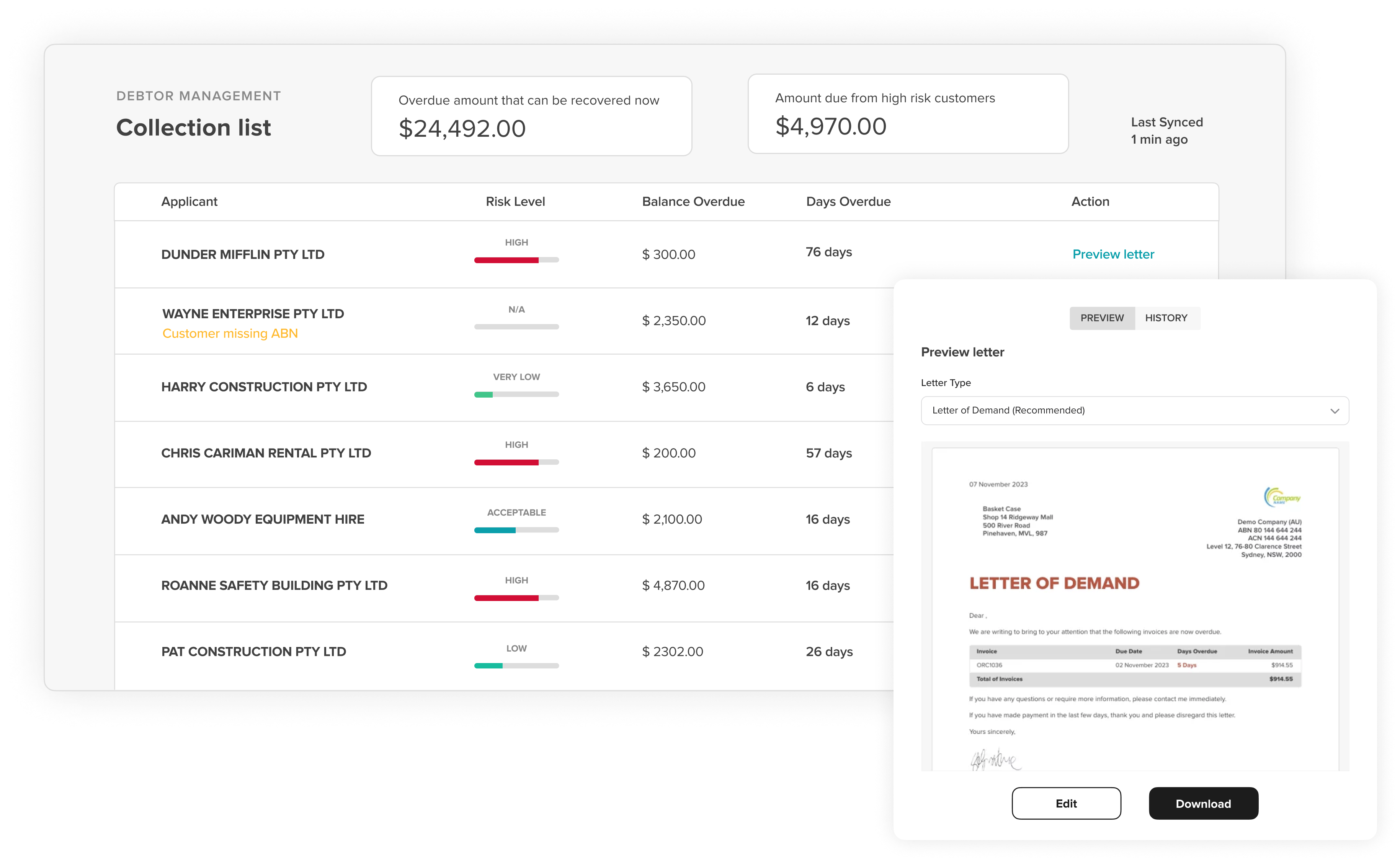

Spend less time chasing late-paying customers. Escalate with collection letters that work, created for you in just a few clicks.

Connect your accounting software to our platform to get paid faster and more efficiently. Invoice and accounts data syncs regularly to keep you up to date.

We help you decide which debtors to contact first. Sort by amount overdue, risk level, days overdue or by account name.

Just click and download. We populate the necessary information on your chosen letter template with a prominent ‘CreditorWatch member’ logo that is proven to speed up payment times.

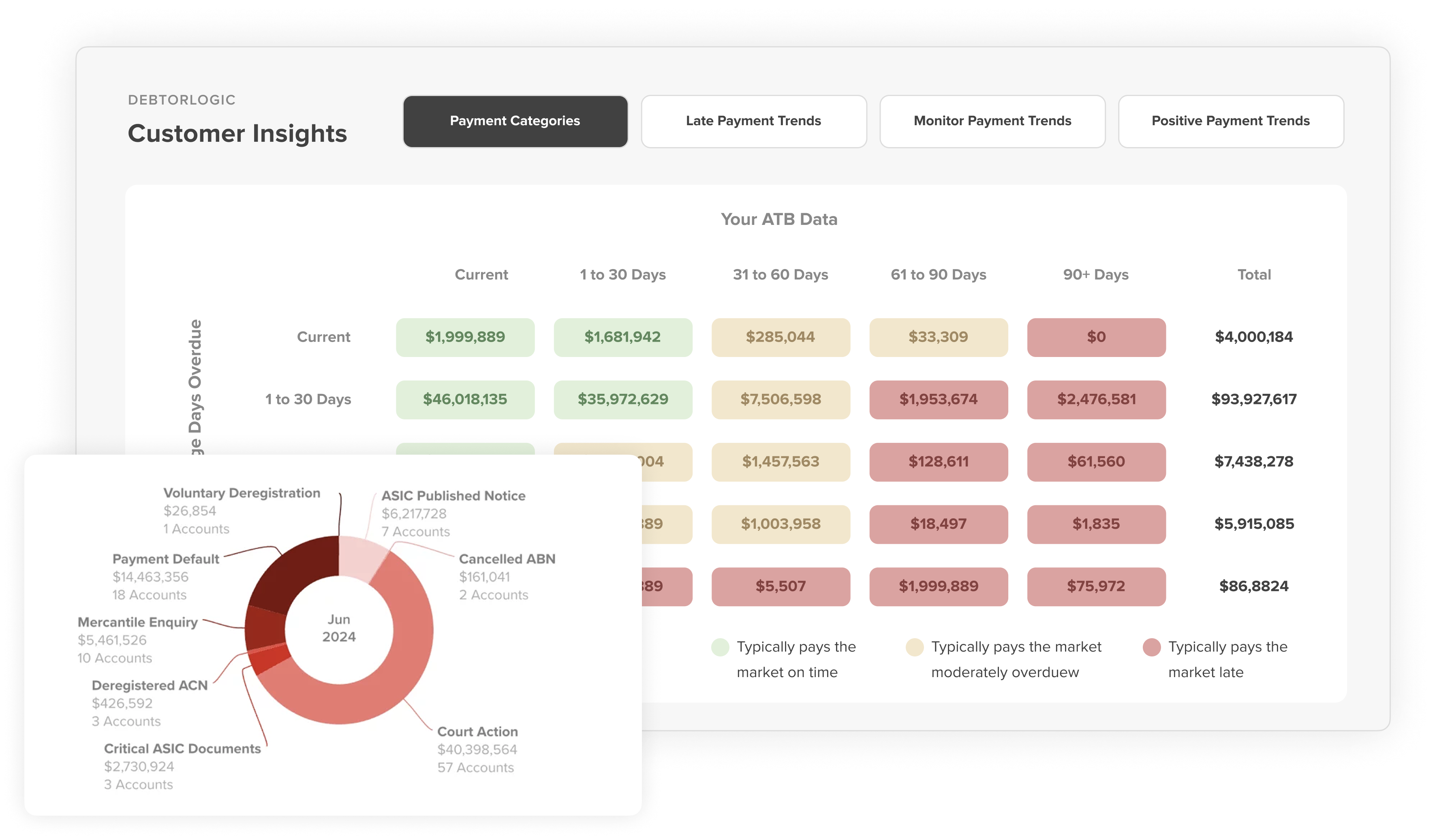

Understand risks and behavioural trends across your customer base so you can make informed, strategic risk decisions.

Reveal adverse information about trading partners. View payment and risk scores to gain deeper insights about your debtors.

Discover how you’re being paid in comparison to the market and which customers are deliberately withholding payments.

Know which customers pay on time and are low risk so you can expand your trading relationship with them or approve more favourable terms.

CreditorWatch integrates with all major accounting softwares including:

Yes! You can connect your accounting platform/ERP via API if we do not have an out-of-the-box connector.

Data from your accounting software is imported automatically every 24 hours. You also have the option to manually trigger a sync.

CreditorWatch generated collection letters are proven effective to increase the rate of collections. These formal letters can be automatically created for you through Debtor Management once you’ve connected your accounting platform and chosen which accounts and invoices to include.

CreditorWatch Collect has robust workflow and reporting tools dedicated to managing your collections tasks. Reminder SMS and emails are only one part of the solution.

No, Automated Collections minimises manual work by automating repeatable tasks. You’ll still need to make escalation calls and decide how to manage your relationship with debtors.

We do have a team of experienced Accounts Receivables professionals whose services you could engage as an extension of your own team to complete Accounts Receivables tasks.

Ask questions, get help with pricing and plans, explore use-cases for your team, and more.