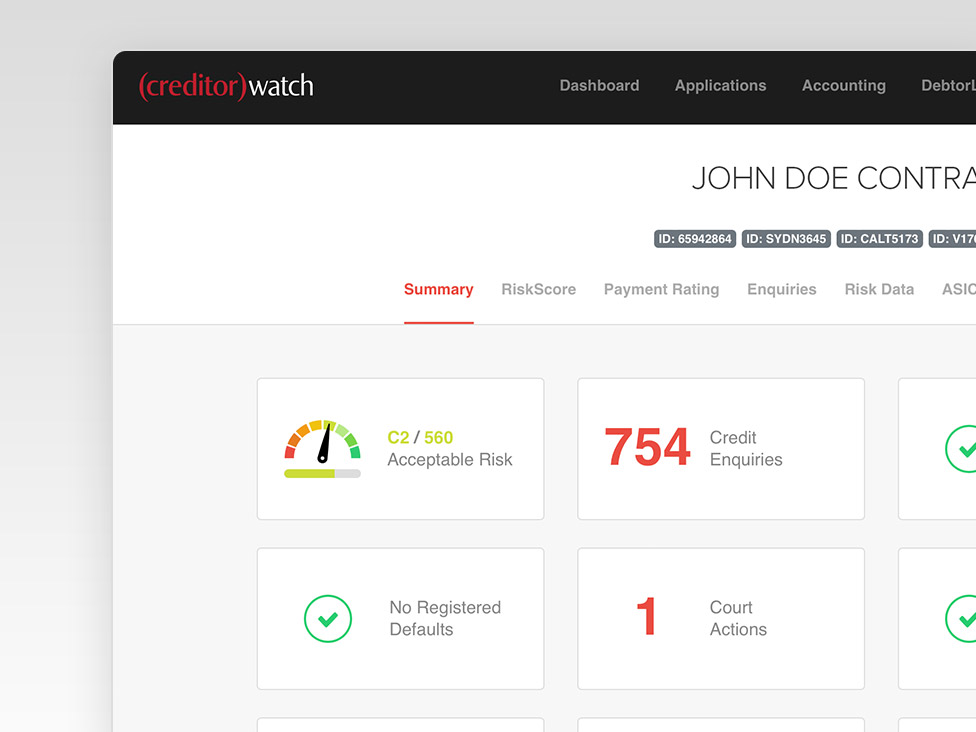

Log into your CreditorWatch account and search for any business in Australia to analyse their credit report.

Review your customer’s credit history and identify adverse information including registered defaults, court actions, insolvency notices and mercantile enquiries.

You can also purchase a company’s credit score and payment predictor information to populate the credit report with even more data. This will help you assess the company’s risk and payment behavior over a 12 month period before choosing to do business with them.

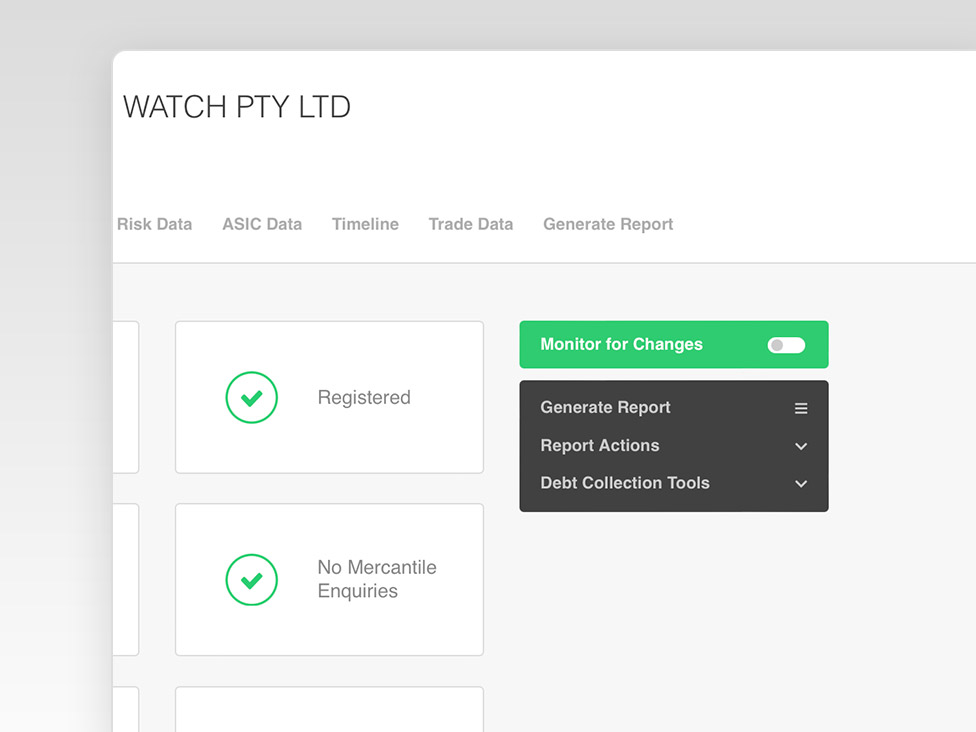

It’s best practice to monitor all of your customers, so you receive email alerts as soon as an important change occurs that could impact your customer’s financial position, and ultimately, their ability to pay you on time.

You’ll be alerted to risky behaviour, like if your customer fails to pay another supplier, incurs a payment default or is taken to court.

This helps you make better decisions to protect your business, like reduce your payment terms. Proactive credit risk management is your best defence against bad debt.

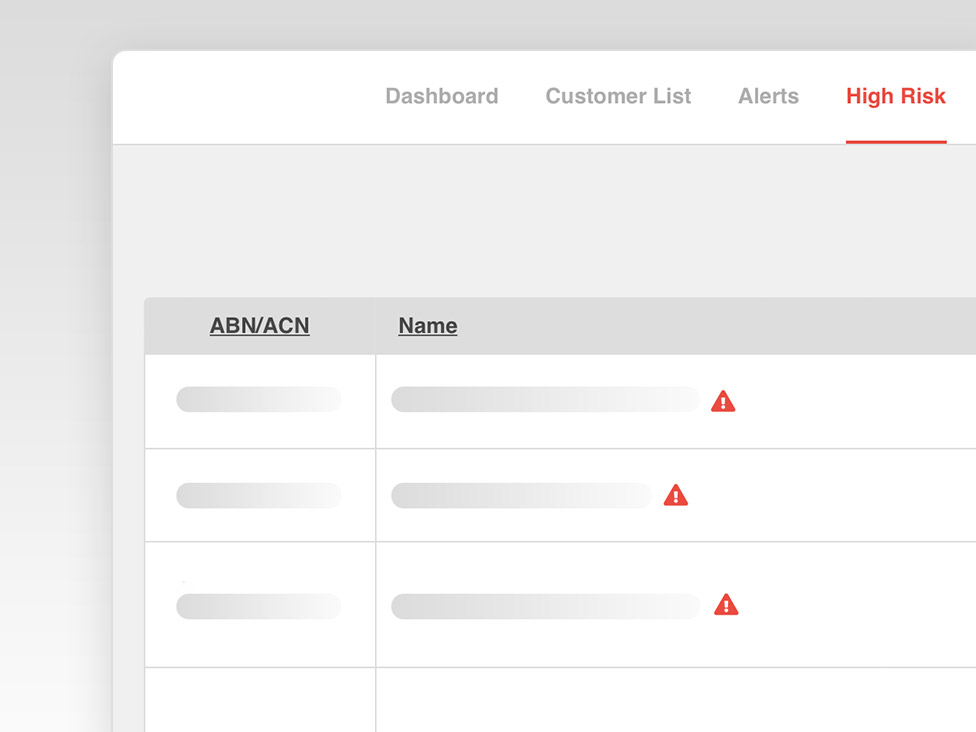

Access your High Risk List in your CreditorWatch account. This list reveals which of your monitored customers poses an immediate credit risk to your business and demands action.

The High Risk List automatically populates itself by ordering your customers by their severity of risk.

These are the customers in your ledger to watch out for.

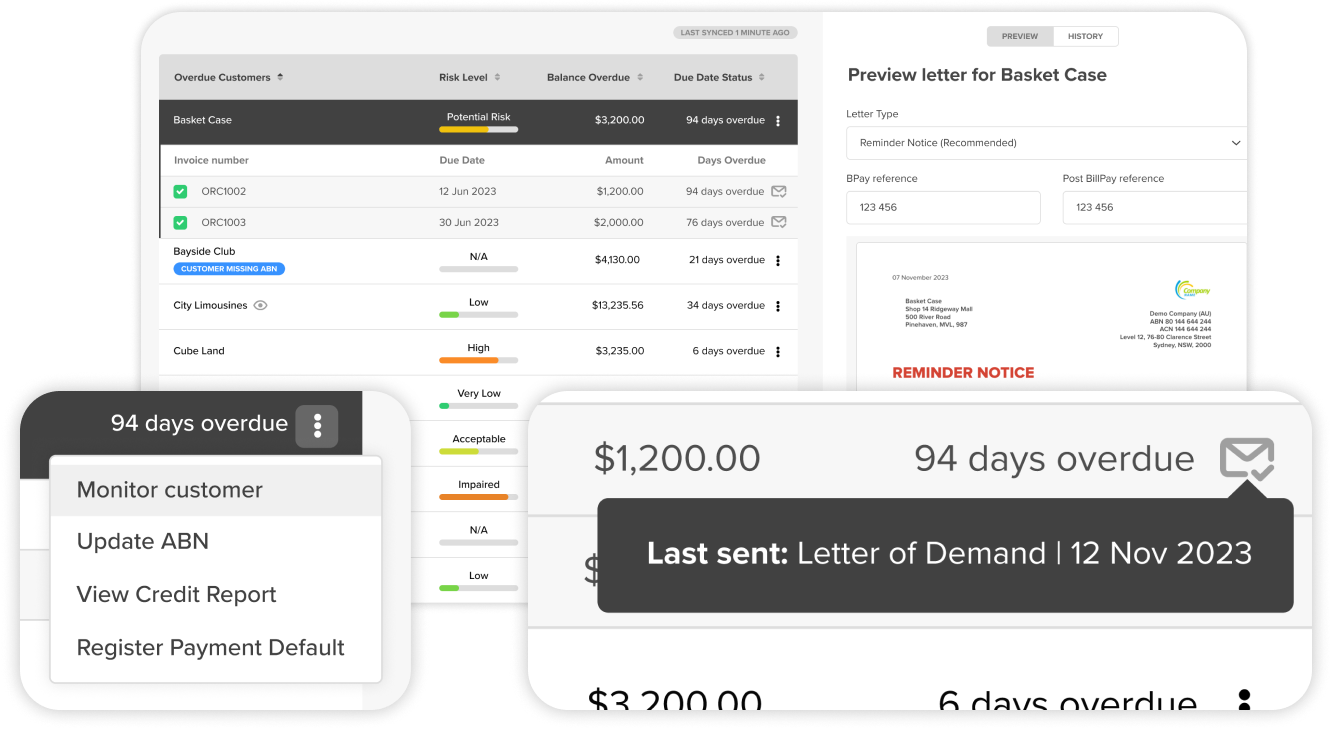

When your invoices are ignored, Debtor Management helps you escalate with proven collection letters created in just a few clicks.

We automatically generate the most suitable letters based on overdue invoices and offer CreditorWatch member-branded templates that can boost recovery rates by up to 53%.

All overdue accounts are displayed on a single page, highlighting which debtors require action. Use insights like payment risk, overdue amount, and days overdue to prioritise your collections efficiently.

Take your credit management to the next level with a 14-day free trial.