Use our industry-leading, AI-powered, credit risk insights to efficiently onboard your customers with speed and confidence, ensuring a smooth transition into your business.

Our solution gives you out-of-the-box expertise that empowers you to onboard customers quickly, while mitigating risk.

How? We have years of research, experience and expertise in trade credit backing us.

Approve new customers quickly with built-in credit checks, AI-powered credit decisioning and automated outcome recommendations.

Drive higher completions with an easy and intuitive application experience for customers.

Protect your business by identifying risky customers. Run thorough due diligence effortlessly.

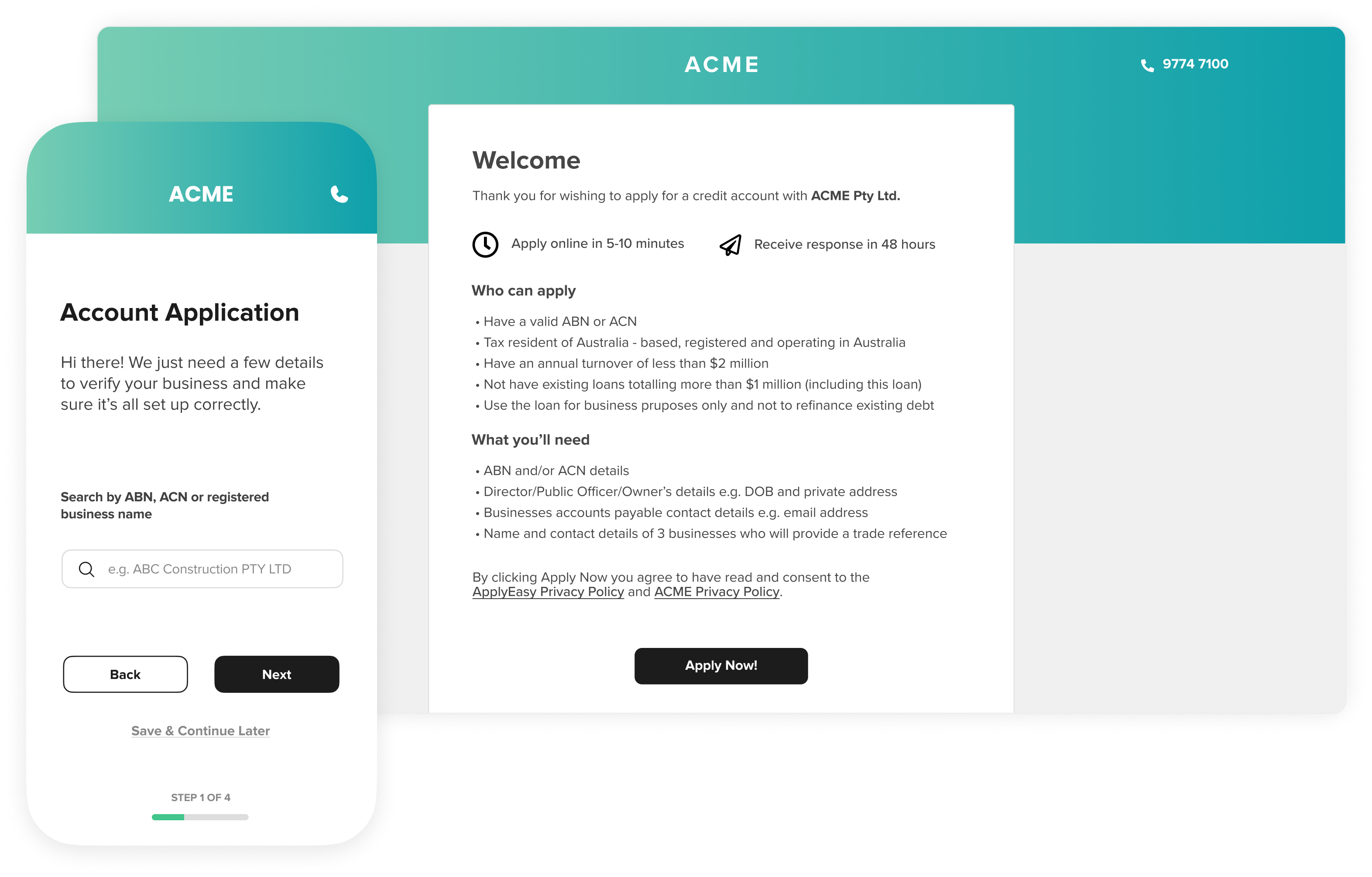

A professional, frictionless application and account opening process is non-negotiable. We make it easy for customers to do business with you.

Our secure, mobile-friendly forms allow applicants to apply and electronically sign from anywhere, 24/7.

Instantly auto-fill application fields using government databases, ensuring you receive accurate, reliable information without friction.

First impressions matter. A professional, custom-branded experience builds trust and credibility to convert prospects to customers.

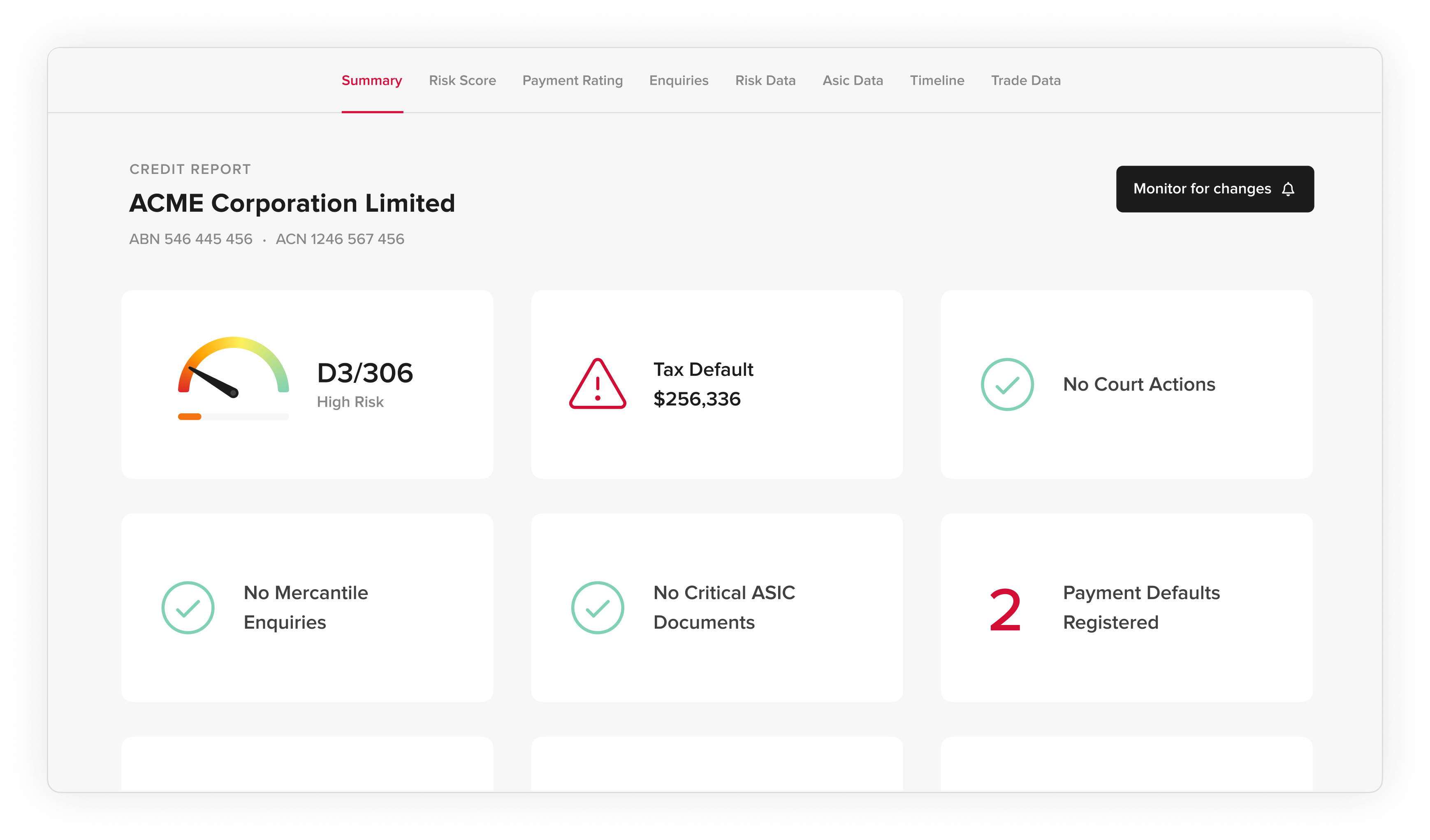

Leverage industry leading credit risk insights and government data to make informed decisions and prevent future losses.

Use the power of AI for more accurate risk assessments and powerful insights. Assess credit risk, identify bankrupt directors, uncover fraudulent attempts, check for active licences and more to speed up decisions.

Register on the PPSR in under two minutes so you can trade confidently knowing your goods and/or assets are protected.

We’ll keep you up to date with important changes to your customers. Simply choose what you’d like alerts for, and we’ll deliver. These alerts are often an early indicator that a business is under stress. For example, our data shows that businesses that have lost two or more directors in the past 12 months are seven times more likely to go insolvent in the next 12 months.

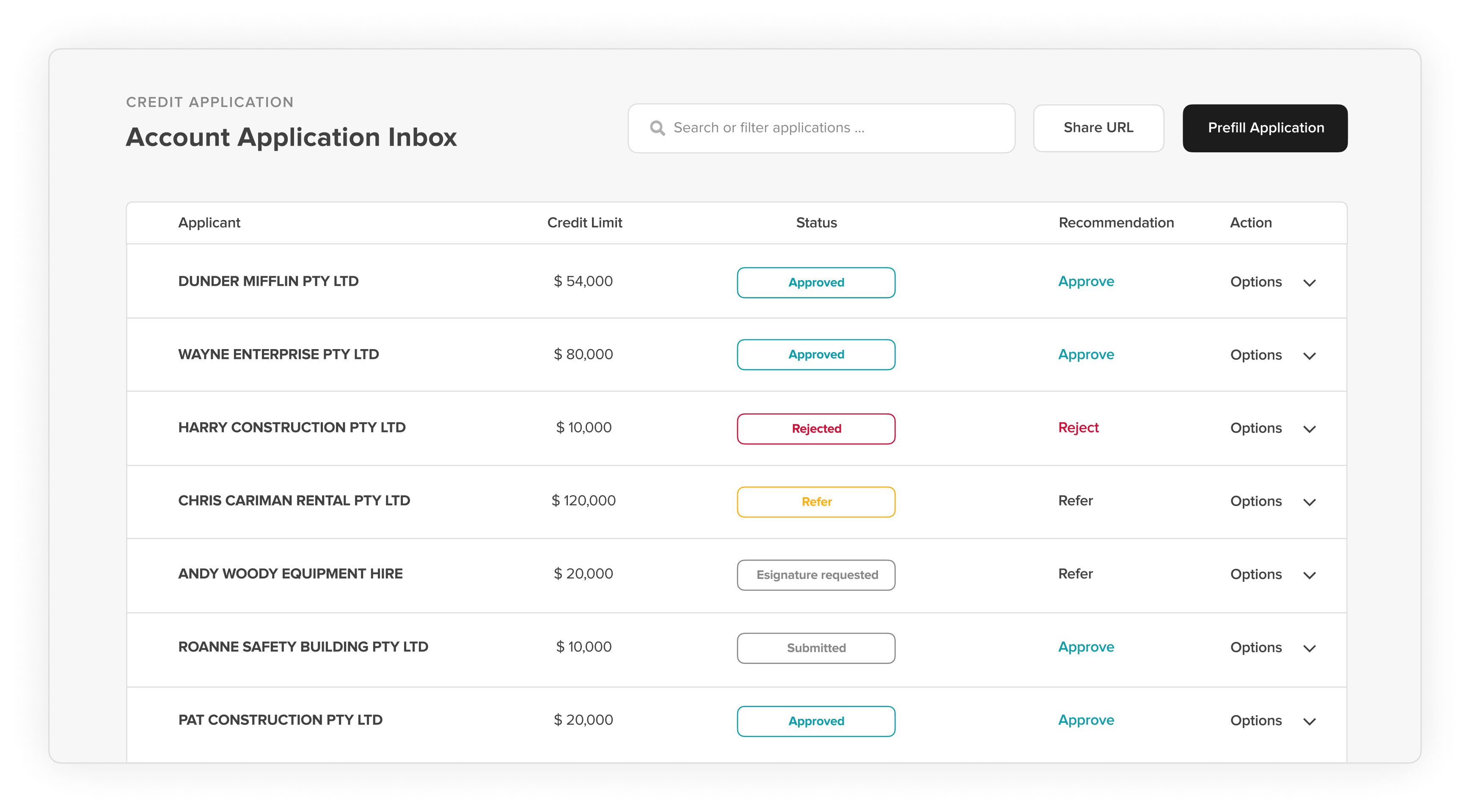

An organised workflow and application management system alongside automated processes is critical to approving applications quickly.

Track progress and simplify application management with your secure inbox. Effortlessly search, sort and filter customer applications.

Minimise manual assessments and approve, reject or refer applications instantly based on your predefined rules.

Set application status, trigger automated emails and tasks to ensure you never miss a step.

Yes, electronic signatures are legally valid in Australia and are governed by federal and state legislation.

We use industry-leading encryption to protect your data. Digital is often more secure than paper-based systems.

The Personal Properties Securities Register (PPSR) is an official Australian government register. For businesses, the PPSR is the only way to enforce their retention of title clauses against customers in the event of insolvency. If a customer becomes insolvent recouping losses will be extremely difficult or impossible if you haven’t registered your interests on the PPSR.

Yes, you have the option to add your own form fields.

Yes, we offer API integrations to easily connect your customer data to your CRM/ERP.

Ask questions, get help with pricing and plans, explore use-cases for your team, and more.