CreditorWatch, has released the March results for its Business Risk Index (BRI), revealing that ongoing cost-of-living and cost of doing business pressures continue to drive elevated payment defaults between Australian businesses across a number of key sectors.

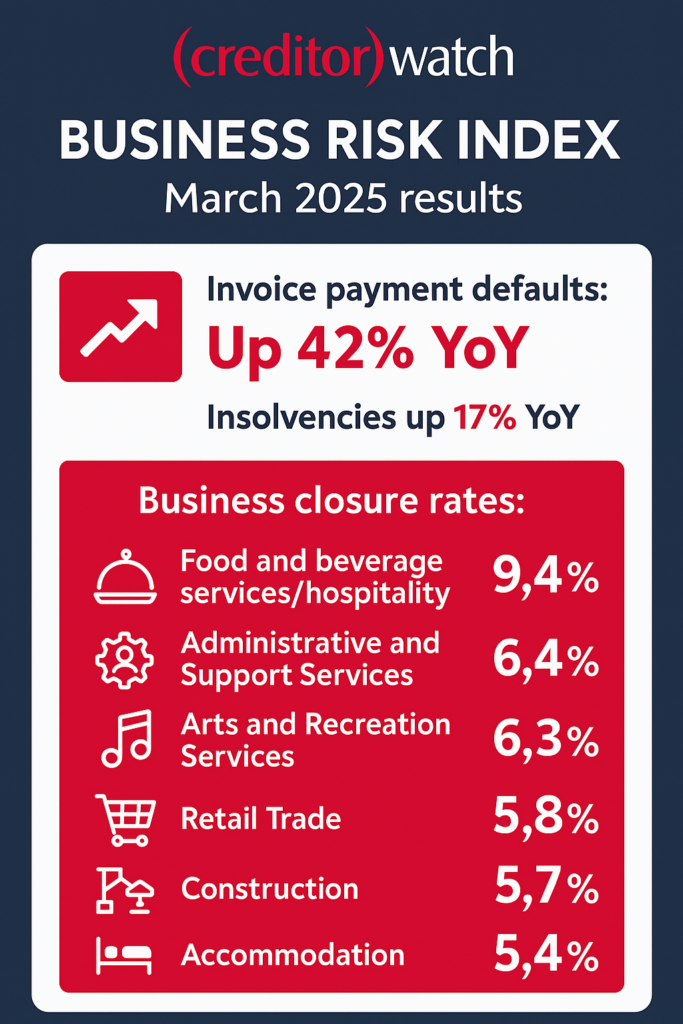

Invoice payment defaults were 42% higher than in March 2024. And, after an end-of-year drop, insolvencies bounced back in February, up around 17% year-on-year in March. Payment defaults are a key forward indicator of insolvencies.

Key themes remain in place. Previous price and cost rises are a double whammy for many discretionary businesses, with consumer demand constrained on the one side due to high interest rates, rent increases, prior price increases and slowing wages growth. At the same time, business costs have risen sharply (rents, labour, interest rates and insurance), and for the construction sector, building materials prices have recorded very large increases.

Invoice payment defaults

Monthly, seasonally adjusted, Feb 2020 = 100

Data sources: CreditorWatch Trade Payment default data (lodged defaults)

LOWER DISCRETIONARY CONSUMER SPENDING HEAVILY IMPACTING BUSINESSES

CreditorWatch’s latest data shows that six of the top seven ranked industries for business closures in the 12 months to March 2025 are dependent on the discretionary spending choices of Australian households. These industries and their current closure rates (against the industry average of 5.3%) are:

- Food and beverage services/hospitality (9.4%)

- Administrative and Support Services (6.4%)

- Arts and Recreation Services (6.3%)

- Retail Trade (5.8%)

- Construction (5.7%)

- Accommodation (5.4%)

The closure rates for all these sectors are now at or above pre-COVID levels. The hospitality sector continues to struggle in the face of increased cost pressures and lower demand. A record high 9.4% of businesses in the sector closed their doors in the 12 months to March 2025.

Business closure rate by industry – time series

1/1/20 – 1/3/25

Data Sources: CreditorWatch, ASIC database direct link; closure rate includes insolvencies, ASIC strike offs and voluntary business deregistrations.

Business closure rate by industry – time series

1/1/20 – 1/3/25

Data Sources: CreditorWatch, ASIC database direct link

CreditorWatch CEO, Patrick Coghlan says the data on business closures shows how desperately Australian households need cost-of-living relief.

“As the cost-of-living crisis drags on we are seeing a bigger and bigger impact on all businesses, but particularly those that rely on the discretionary spending of consumers. Households don’t have many levers they can pull to save extra money, but they can certainly reduce costs in areas such as entertainment spending, retail purchases, services such as cleaners and gardeners and, on a larger scale, put off building a new house.

“We particularly feel for small businesses that typically have smaller cash buffers than larger businesses and are less able to take measures to cut costs such as laying off staff or closing locations.”

INSOLVENCIES REBOUND AFTER LATE 2024 DROP

Insolvencies remained elevated in March, broadly unchanged on February levels, but 17% higher than in March 2024. As a share of total company registrations – to account for the rise in the number of companies – insolvencies are well above pre-COVID rates.

At the same time, the share of insolvencies remains at the lower end of the range that was typical over the 2002-2012 period. The impact of cost-of-living and cost-of-doing business increases, along with accumulated taxes owed to the Australian Taxation Office, appear to be the dominant drivers of elevated insolvencies at the current time.

ASIC first-time insolvencies, monthly, seasonally adjusted

Data Sources: CreditorWatch, ASIC database direct link, Macrobond

CreditorWatch Chief Economist Ivan Colhoun says, “President Trump’s tariff changes are already having significant effects on financial markets, with significant volatility in share prices and the Australian dollar.

“All of the above are immediately damaging to consumer and business confidence and to the extent these uncertainties cause either consumers or businesses to delay purchases, hiring or investment decisions, the impact is a slowdown in economic activity, which will pressure weaker businesses.

“Along with pressures from previous cost increases, this is likely to keep payment defaults and insolvencies elevated in the months ahead. One helpful aspect is that the RBA is more likely to reduce interest rates at its mid-May Board meeting.”

ATO TAX DEBT DEFAULT

CreditorWatch’s March data shows around 30,000 businesses have a tax debt default with the ATO of over $100,000. Having a tax debt of this size has been a significant cause of insolvency in the past 12 to 18 months as the ATO resumed normal collections activities after the COVID pandemic.

The share of businesses with tax defaults is highest in Construction and Food and Beverage Services, the two sectors with the highest insolvencies in recent times.

Since October 2024 there has been a considerable decline in the number of businesses that are paying off their tax debts or entering into a payment plan with the ATO. This could be an indicator of a pick-up in insolvencies in coming months.

ATO tax debt defaults – inflow, outflow and total in effect

Data Sources: Australian Taxation Office Direct Link – Currently Active ATO Defaults and Inflow and Outflow

Insolvency given ATO default

12 months to March 2025

Data Sources: ASIC, Australian Taxation Office Direct Link – Currently Active ATO Defaults and inflow and outflow

ANALYSIS OF HIGHEST AND LOWEST RISK REGIONS

The March results for the Business Risk Index show that businesses in Western Sydney are showing the highest levels of risk in Australia. Six of the highest risk regions in the country are in Sydney’s west.

These regions have high levels of personal insolvency, lower than average income levels and higher than average commercial rents and property prices. Businesses in Bringelly-Green Valley in Western Sydney have a forecast average business closure rate of 7.9% over the next 12 months.

The lowest risk region in Australia is Norwood-Payneham-St Peters in inner-city Adelaide. Businesses in that area have a forecast average closure rate of 4.5% over the next 12 months. As well as inner-Adelaide, the lowest risk regions remain concentrated around regional Victoria and North Queensland.

Adelaide has the lowest forecast failure rate among the capital city CBDs (5.2%), followed by Perth (5.3%), Melbourne (5.8%) Brisbane (5.8%) and Sydney (6.3%).

CREDITORWATCH’S OUTLOOK

CreditorWatch Chief Economist Ivan Colhoun says it’s a very uncertain time for businesses and consumers by virtue of the significant and ongoing changes to US tariff and trade policies and the resultant large flow-on effects to financial markets.

“The tariff changes remain very fluid, which makes it very hard for businesses to react to and plan for.

“Recent data on trade payment defaults and insolvencies has levelled out, albeit at elevated levels, likely benefiting from the mid-2024 income tax cuts and in time, the RBA’s February interest rate reduction will have some positive impact as well.

“The negative effects of US tariff announcements likely trump (pun intended) those positives. Many businesses, especially small businesses, will likely have to ride out the waves. There may be opportunities for some businesses to gain access to cheaper imported tariffed products, but this will also pressure Australian producers of these products.

“As always, conditions such as these highlight the importance of having a diversified customer base, financial reserves in case of shocks or economic downturns, and to monitor the productivity of your business processes and workforce.”

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.