Credit reporting bureau, CreditorWatch, has released the August results for its Business Risk Index (BRI) revealing that the rate of business failures is at its highest level since January 2021, when Australia was in the midst of the COVID-19 pandemic.

The failure rate for Australian businesses currently sits at an average of 4.95 per cent and has increased 17.3 per cent since January. CreditorWatch’s forecast is for the rate to increase to 5.20 per cent over the next 12 months.

The jump in the business failure rate has been driven by low levels of consumer spending, high inflation and interest rate increases.

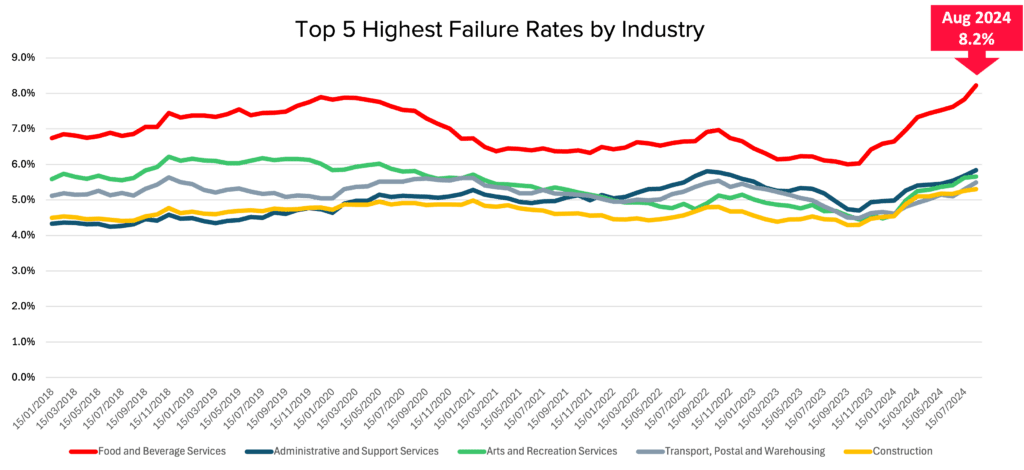

Food and Beverage Services is the industry currently experiencing the highest rate of business failures among all industries, recording a rate of 8.2 per cent for August, followed by Administrative and Support Services at 5.8 per cent. At the other end of the scale Agriculture, Forestry and Fishing recorded a rate of just 3.3 per cent.

Data source: ASIC database direct link

The Food and Beverage sector, in particular, is facing a ‘perfect storm’ of continued rising costs as demand declines. At the same time, the ATO is actively chasing tax debts, many of which sit with businesses in this sector. And in almost all instances, businesses in the Food and Beverage sector pay rent on retail space that is typically located in high foot traffic retail precincts. It is very difficult for restaurants and cafes to move premises to get a better rent deal, therefore rents and the associated increases are an added burden on this industry.

RECORD HIGH B2B PAYMENT DEFAULTS IN AUGUST

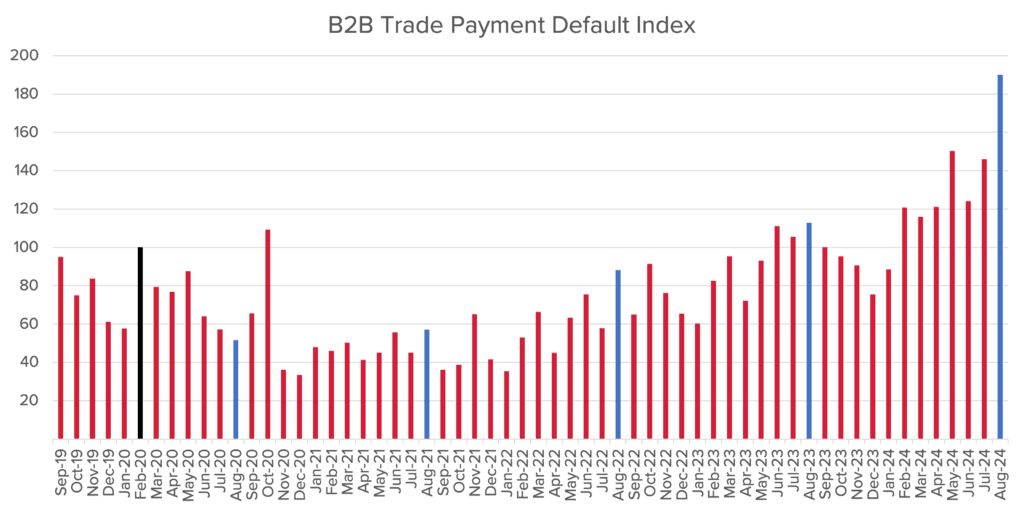

The increase in the business failure rate is also reflected in CreditorWatch’s data on business payment defaults, which have leapt 68.1 per cent in the past year and are now at record levels, indicating that an increasing number of businesses are unable to pay their invoices from suppliers.

More businesses than ever are finding it difficult to pay their invoices on time, which points to increasing stress in the business sector, both on those businesses unable to pay their bills on time and the businesses waiting to receive payment.

CreditorWatch has identified a strong correlation between B2B payment defaults and business failures in the following 12 months. A business with one default has a 28 per cent chance of closing in the next 12 months, rising to 74 per cent for four or more payment defaults.

Data sources: CreditorWatch Trade Payment default data (lodged defaults)

CreditorWatch CEO, Patrick Coghlan, says the rising business failure rate shows how urgently businesses need interest rate relief.

“One of the biggest contributing factors to this increase in our business failure rate is the lack of consumer demand”, he says. “This is reflected in the ABS household spending and Westpac Consumer Sentiment numbers.

“Consumers won’t be inclined to open their wallets in any significant way until they get a reduction in their mortgage payments. A couple of rate cuts would also mean that credit becomes more affordable for businesses, and they are able to get back on the growth track as well.”

OTHER BUSINESS RISK INDEX INSIGHTS FOR AUGUST:

- Court actions are now well above pre-COVID levels as large creditors such as the banks and the ATO resume collections activity. Actions were up 15.4 per cent year-on-year in August.

- Credit enquiries are largely flat across 2024, reflecting the subdued trading conditions in the Australian economy. Fewer businesses are applying for commercial loans and trade credit.

- Food and Beverage Services is also the leading industry for outstanding ATO tax debts above $100,000, with a rate of 1.73 per cent. Construction and Transport, Postal and Warehousing are next at 1.20 per cent and 0.89 per cent respectively.

- The lowest risk region in Australia is Norwood-Payneham-St Peters in inner-city Adelaide. Businesses in that area had an average failure rate of 3.4 per cent over the past 12 months. As well as inner-Adelaide, the lowest risk regions were concentrated around regional Victoria, North Queensland and the northern suburbs of Sydney.

- The highest risk regions were in Western Sydney and South-East Queensland. Businesses in Bringelly-Green Valley in Western Sydney had a failure rate of 8.2 per cent over the past 12 months.

- Perth had the lowest rate of business failures among the capital city CBDs (4.08 per cent), followed by Adelaide (4.14 per cent), Melbourne (4.57 per cent), Brisbane (4.72 per cent) and Sydney (5.23 per cent).

OUTLOOK

CreditorWatch Chief Economist, Anneke Thompson says tomorrow’s (Thursday 19 September) ABS Labour Force data will be very illuminating on what the next few months holds for the Australian economy.

“Our data, consistently and for some time now, indicates that Australian businesses are operating under extremely challenging conditions – particularly those in the Food and Beverage, Arts and Recreation, Retail Trade and Construction sectors”, she says.

“Under these circumstances, it is almost certain that unemployment will continue to rise – the question is by how much? So far, very strong public sector employment, especially in the NDIS sector, has masked weakening underlying job creation in the private sector.

“We don’t expect businesses to feel more confident until there have been at least two or three cuts to the cash rate. Unfortunately, this means it is likely things will get worse before they get better.”

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.