CreditorWatch’s October results for its Business Risk Index (BRI) show business failures are continuing to rise and are now at their highest rate since the height of the COVID-19 pandemic in October 2020.

The average failure rate for Australian businesses sits at 5.04%, having climbed from 3.97% in October last year. The previous high was 5.08% in October 2020.

The failure rate fell steadily after the initial phase of the pandemic but reversed trend in October 2023. Higher prices and interest rates have increased the cost of living for consumers and the cost of doing business for companies. The ATO also recommenced collection activities at that time to attempt to recover some of the $35 billion in outstanding debt owed to it by small businesses.

CreditorWatch Chief Economist, Ivan Colhoun says businesses are experiencing many of the same cost pressures as consumers such as higher electricity, insurance and rental costs, as well as the impacts of minimum wage increases.

“Together with some greater caution in discretionary spending and softness in interest rate sensitive sectors of the economy, this unsurprisingly has led to higher voluntary business closures and some rise in insolvencies,” he says.

“We’re yet to see the extent to which the 1 July tax cuts now flowing through the economy, will ease some of the pressures on consumers and businesses. Pleasingly the unemployment rate remains very low at 4.1%. Consumer confidence readings have risen notably from very low levels in recent months, business confidence also rose in October and business conditions are around long-term averages according to the NAB Business Survey.”

HOSPITALITY CONTINUES TO STRUGGLE UNDER LOWER HOUSEHOLD SPENDING

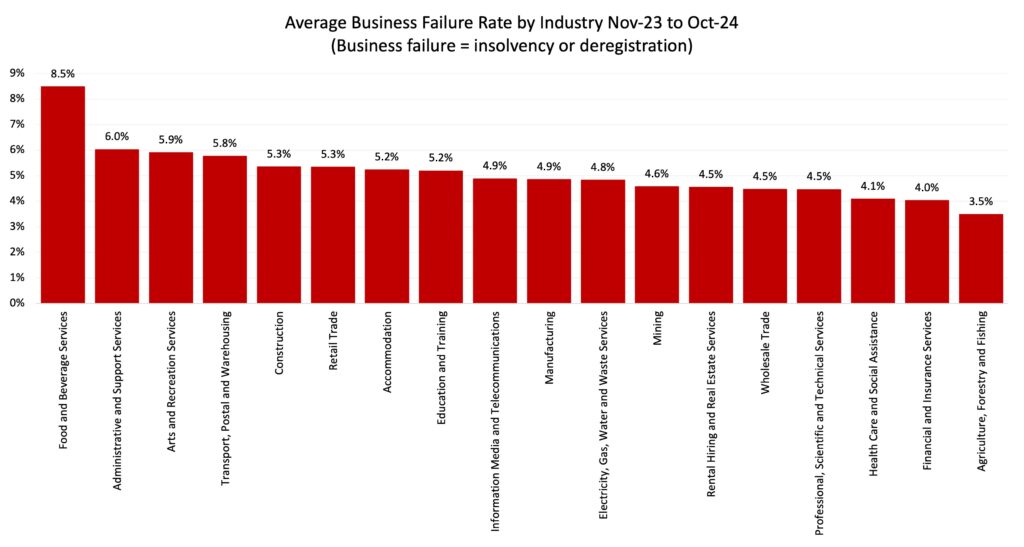

The industry breakdown clearly reflects the ongoing pressure on businesses in the Food and Beverage Services sector as consumers continue their vigilance around discretionary spending.

Food and Beverage recorded the highest failure rate of all industries in October, increasing to 8.5% on a rolling 12-month basis from 8.3% in the 12 months to September. CreditorWatch’s 12-month forecast is for the failure rate in the sector to rise further to 9.1%.

Data source: ASIC database direct link, CreditorWatch industry data; Business failure rate defined as voluntary and involuntary administrations, ASIC strikeoffs and voluntary business deregistrations.

The ABS Household Spending Indicator for September showed the number of visits to and sales in hotels, cafes and restaurants was 1.7% lower than a year ago. Sales in the Tobacco and Alcohol sector were even weaker in volume terms at -16.6% year-on-year.

Administrative and Support Services ranked second (6.0%) for the failure rate in October, followed by Arts and Recreation Services (5.9%) and Transport, Postal and Warehousing (5.8%). Interestingly, the failure rate in Construction (5.3%) may be levelling out.

Data source: ASIC database direct link, CreditorWatch industry data; Business failure rate defined as voluntary and involuntary administrations, ASIC strikeoffs and voluntary business deregistrations.

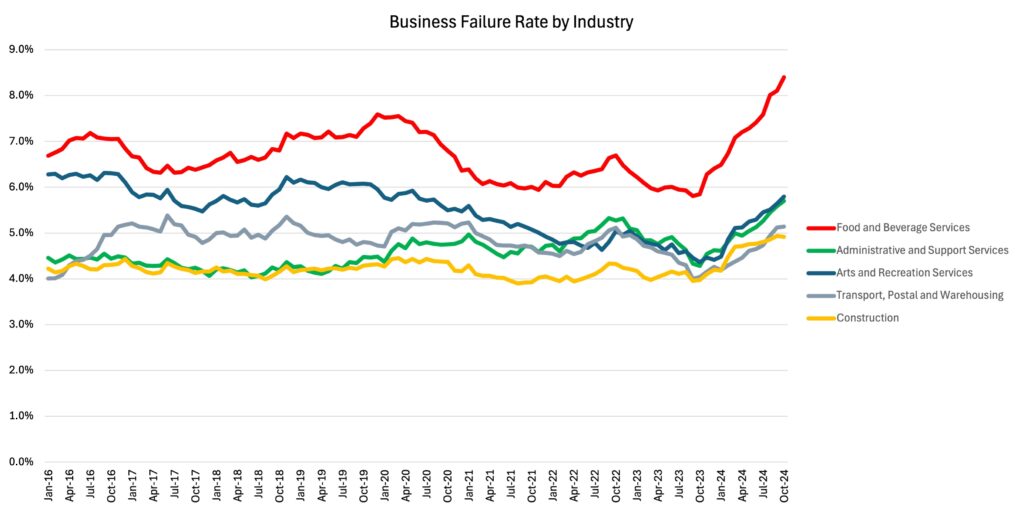

All sectors have seen a pickup in business failures since the step-up in ATO collections activity beginning in October 2023. Prior levels were therefore unrepresentatively low, while current rates may be a little overstated to the extent they reflect some bunching of failures that probably would have occurred at an earlier date.

However, we can see that failures are higher than pre-COVID levels for Construction, Administrative and Support Services and Food and Beverage Services. The challenges of the Food and Beverage Services and Construction sectors are relatively well known and have been present for some time.

These sectors along with Arts and Recreation Services and Transport, Postal and Warehousing will tend to have a high proportion of wages linked to relatively high National Wage Case wage increases. Post-COVID slowdowns or substitutions in spending (e.g. to overseas travel) and/or a reduction in CBD visitation due to continuing working from home, are also likely to be impacting.

CreditorWatch CEO, Patrick Coghlan, says that while inflation increases appear to have peaked, businesses are eagerly awaiting interest rate relief.

“A slowdown in the inflation rate will certainly help businesses but we must remember this just means that price rises have slowed down, so the cost pressures remain. In most cases, you won’t see the cost of goods and services coming down,” he says.

“Businesses desperately need interest rates to come down so households have some relief in cost-of-living pressures and start spending more.”

OTHER BUSINESS RISK INDEX INSIGHTS FOR OCTOBER:

- Business insolvencies and loan arrears are still increasing. Annualised insolvency rates have more than doubled over the last 18 months and have shot past pre-COVID levels by about 25%.

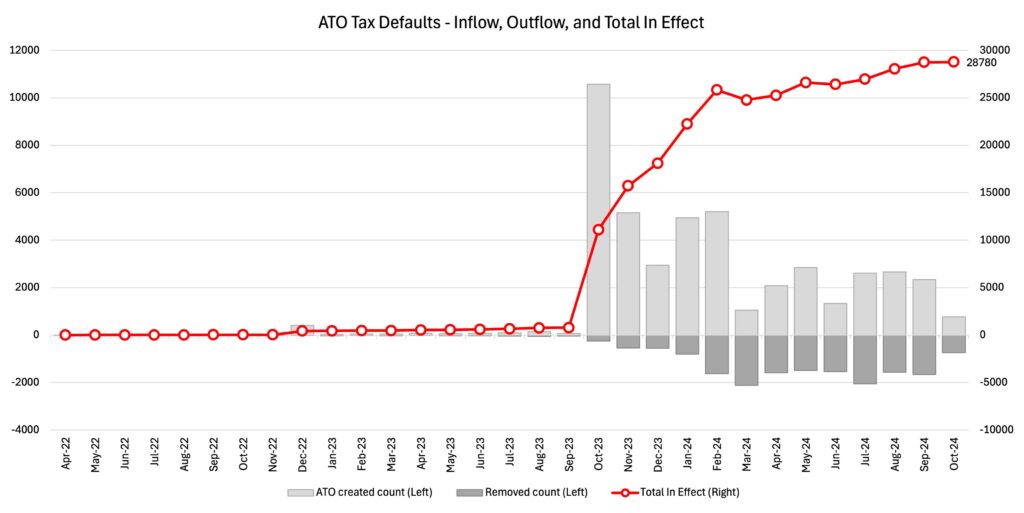

- The ATO is in collection mode, and this will be a source of added stress and insolvencies for the foreseeable future. Food and Beverage Services is the leading industry for outstanding ATO tax debts, with 1.84% of companies in this sector having outstanding debts of more than $100,000. Construction and Transport, Postal and Warehousing is next at 1.28% and 0.97% of businesses, respectively. CreditorWatch now has 28,780 records of businesses with overdue tax debts of more than $100,000, with sole traders comprising 14,216 (49.4%) of these.

Data sources: Australian Taxation Office Direct Link

- The rate of inflation has clearly peaked, though this does not mean that prices or costs of doing business are falling – they are just rising more slowly from a much higher level. Interest rates have also likely peaked, though any early reduction in interest rates seems very unlikely. Longer-term borrowing rates have risen in recent weeks as markets have become concerned about possible inflationary policies of the new Trump administration. High prices and interest rates have a lagged effect on credit losses, so the impacts are likely yet to be fully realised in insolvency statistics.

- Court actions are now well above pre-COVID levels as large creditors such as the banks and the ATO resume collections activity. Actions were up 13% from August 2023 to August 2024.

- Credit enquiries remain flat across 2024, reflecting generally subdued trading conditions in the Australian economy. Fewer businesses are applying for trade credit as a result.

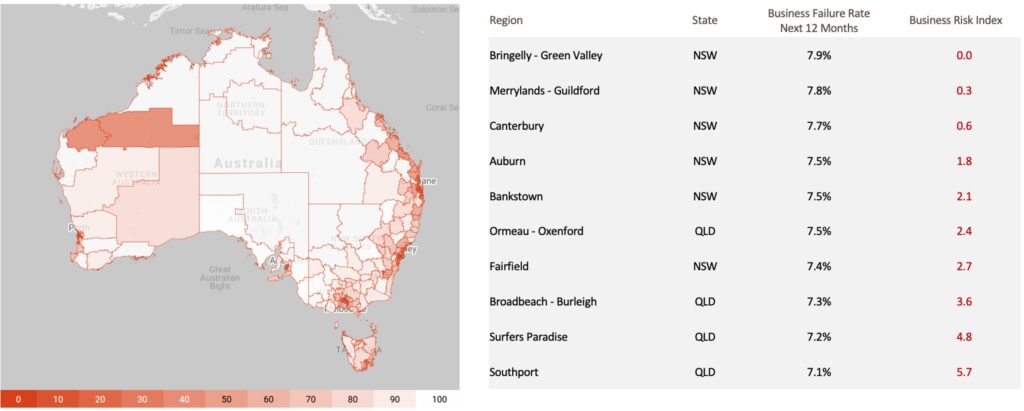

- The highest risk regions were in Western Sydney and South-East Queensland. Businesses in Bringelly-Green Valley in Western Sydney have a forecast average business failure rate of 7.9% over the next 12 months.

Data sources: CreditorWatch Business Risk Index

- The lowest risk region in Australia is Norwood-Payneham-St Peters in inner-city Adelaide. Businesses in that area have a forecast average failure rate of 4.57% over the next 12 months. As well as inner-Adelaide, the lowest risk regions remain concentrated around regional Victoria, North Queensland and the northern suburbs of Sydney.

- Adelaide has the lowest forecast failure rate among the capital city CBDs (5.10%), followed by Perth (5.19%), Melbourne (5.77%), Brisbane (5.91%) and Sydney (6.24%).

OUTLOOK

Measures of consumer confidence and business confidence improved in October, perhaps as income tax cuts started flowing more broadly through the economy, share prices continued rising and as employment growth remained strong and unemployment very low and stable at 4.1%. These are favourable developments in what remains an uncertain time for businesses, impacted by many cross currents including Geopolitics, Technology and post-pandemic effects to name a few of the major forces on top of high inflation and high interest rates.

The return of President Trump will likely add some further uncertainty to the outlook, with policy promises of significant tariffs on China and other trading partners – if enacted – likely to pressure US inflation. A cut in the company tax rate from 21% to 15% has also been proposed. Ahead of these policy changes, central banks still appear to be well positioned to guide economies to soft landings, with inflation generally moderating, while unemployment remains generally very low.

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.