Patrick Coghlan, CEO of CreditorWatch, shares why embracing AI, predictive analytics and automation is critical for credit managers, CFOs and risk leaders in 2026.

Credit risk management has always been about judgement. In 2026, that judgement is increasingly being shaped by predictive data insights, automation and artificial intelligence.

Australian finance leaders are operating in an environment where risk is less visible, change is faster and tolerance for error is shrinking. The old model of periodic reviews, static reports and manual workflows cannot keep pace with modern commercial reality. The organisations that will outperform over the next decade are those that embed intelligent, responsible AI into the heart of their credit decision-making.

This is not a future concept. It is already happening.

CreditorWatch data shows that 41.5% of Australian businesses implemented AI in the past year, up from 34.8% the year before, with adoption highest among larger enterprises but accelerating quickly across the mid-market.

More importantly, almost 95% of those businesses report positive outcomes. The message is clear: AI is no longer experimental. It is becoming mission-critical.

From reactive risk management to early warning systems

The most profound shift underway is the move from reactive credit risk management to early intervention. Traditionally, warning signs emerged only once payments were missed or financials deteriorated. By then, options were limited.

AI changes that equation. By analysing patterns in payment behaviour, defaults, court actions and broader economic signals, predictive models can surface risk months earlier than traditional approaches. Our own data consistently shows that subtle changes in payment timeliness often precede more serious distress well before a formal insolvency event occurs.

For credit managers and CFOs, this means the focus in 2026 must be on continuous monitoring, not periodic assessment. Real-time alerts and predictive indicators give businesses time to engage customers earlier, adjust exposure and protect cash flow while relationships are still salvageable.

Democratising expert judgement through AI

One of the less discussed benefits of AI is its ability to close the capability gap between large organisations and smaller teams. Large enterprises have historically enjoyed access to specialist analysts, bespoke models and deeper data resources that SMEs have not.

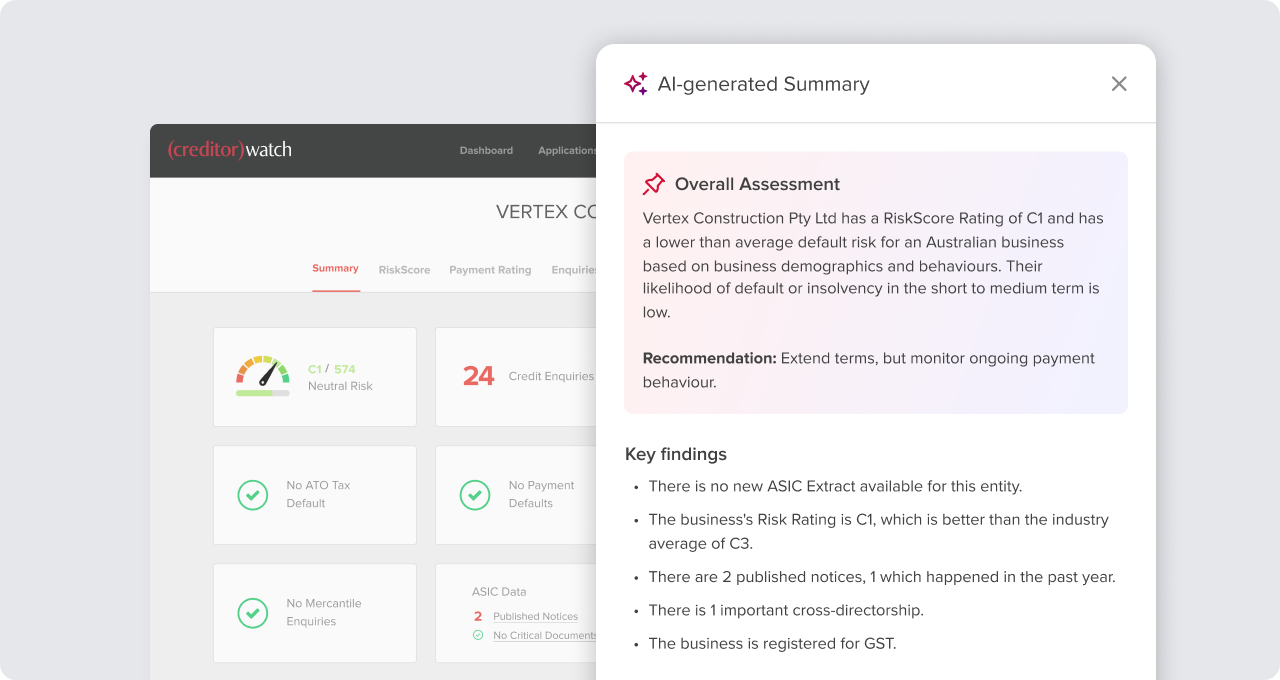

AI is changing that balance. Natural language models can now synthesise complex credit data into clear, plain-English risk summaries and recommended actions in seconds. At CreditorWatch, we see these tools effectively providing an on-demand credit analyst, enabling less-experienced staff to make more confident, consistent decisions.

This democratisation of insight is critical in a market where credit talent is scarce and teams are under pressure to do more with less.

Automation as a foundation, not a threat

There is understandable concern that automation and AI will replace human judgement. In practice, the opposite is true when implemented correctly.

The most advanced credit teams in 2026 are automating routine processes – data collection, report generation, limit reviews and exception flagging – so their people can focus on strategy, negotiation and complex decision-making. Automation improves consistency, reduces error and strengthens governance, but final accountability remains firmly with humans.

From a board and regulatory perspective, this matters. Automated workflows create clearer audit trails, enforce policy discipline and support defensible decision-making at scale.

Responsible AI and governance are non-negotiable

As AI becomes embedded in credit processes, expectations around governance, transparency and accountability are rising. Finance leaders must be confident they can explain how risk assessments are generated and demonstrate appropriate oversight.

This means moving beyond ‘black box’ solutions. Responsible AI augments existing risk models rather than replacing them, uses high-quality and secure data, and keeps humans in control of critical decisions. Data sovereignty, privacy and model explainability are now table stakes, not optional extras.

In our own product development, AI is used to enhance insight, not override judgement, ensuring credit decisions remain aligned with commercial reality and regulatory expectations.

Bridging the digital divide

Despite rapid adoption, a digital divide remains. While around 69% of large organisations now use AI, only a third of smaller businesses have done so, often due to concerns about cost, complexity and expertise.

The opportunity for 2026 is to remove those barriers. AI tools must be intuitive, embedded within existing workflows and deliver clear, measurable value from day one. When implemented well, they do not require data science teams or major transformation projects. They simply make better credit management accessible to more businesses.

What best practice looks like in 2026

For credit managers, CFOs, risk managers and financial controllers, best practice in 2026 is defined by five principles:

- Continuous, real-time monitoring rather than periodic reviews

- Predictive insight that surfaces risk early, not after damage is done

- Intelligent automation that improves efficiency and consistency

- Enterprise-wide visibility of credit risk for executives and boards

- Responsible AI governance that enhances judgement and accountability

Organisations that adopt this framework are not just reducing risk; they are strengthening resilience and creating competitive advantage.

The road ahead

AI will not remove uncertainty from the Australian economy, but it will change how well businesses can navigate it. The combination of real-time data, predictive analytics and automation gives finance leaders something they have rarely had before: time to act.

The next generation of credit risk management is proactive, data-driven and human-centred. In 2026, leadership in this space will not be defined by who adopts AI first, but by who adopts it responsibly, strategically and at scale.

Those who do will be better positioned to protect cash flow, support sustainable growth and lead with confidence in an increasingly complex risk environment.

Want to know more?

To learn more about how we can help you improve your cash flow management process, get in touch with our friendly team at CreditorWatch today.

Get started with CreditorWatch today

Take your debtor management to the next level with a 14-day free trial.