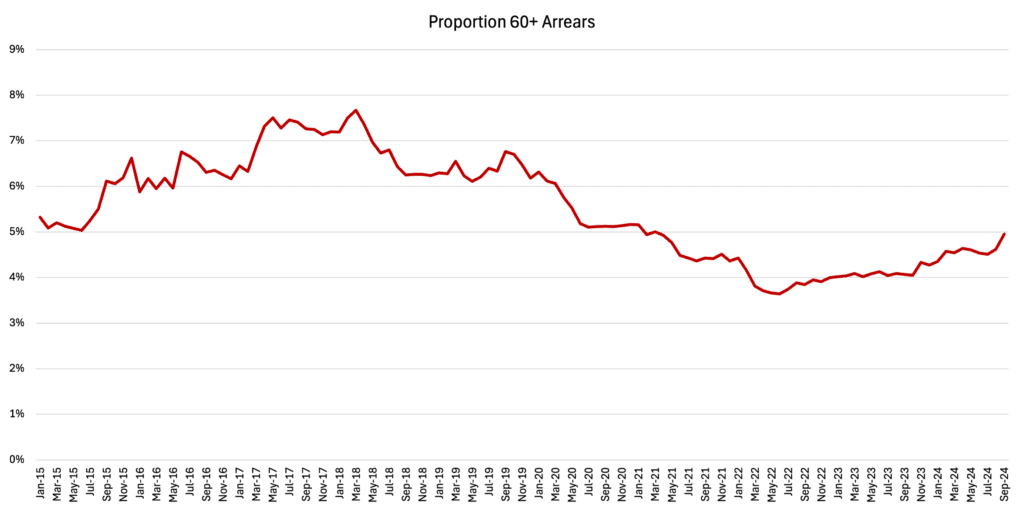

CreditorWatch, has released the September results for its Business Risk Index (BRI), revealing that late payments are at their highest rate since the end of JobKeeper in March 2021, as more businesses struggle to pay outstanding invoices.

Rising arrears reflect a combination of more challenging business conditions from impacts such as higher interest rates and higher costs of living/doing business. There have also been decreases in discretionary spending and activity and demand, especially in interest-rate sensitive sectors. This continues to be particularly noticeable in CreditorWatch and ASIC data on the Construction and Food and Beverage Services sectors.

The proportion of payments in arrears remains below that experienced in the pre-COVID period, which was a relatively soft period for economic growth in the Australian economy in the aftermath of the Banking Royal Commission, when the banks tightened lending standards.

This suggests a softer economy at the present time, but not an especially weak economy, overall, albeit with some significant variations in conditions by sector. It will be interesting to see the extent to which recent income tax cuts benefit companies in coming months.

Data Sources: CreditorWatch trade receivables data (accounting software integration)

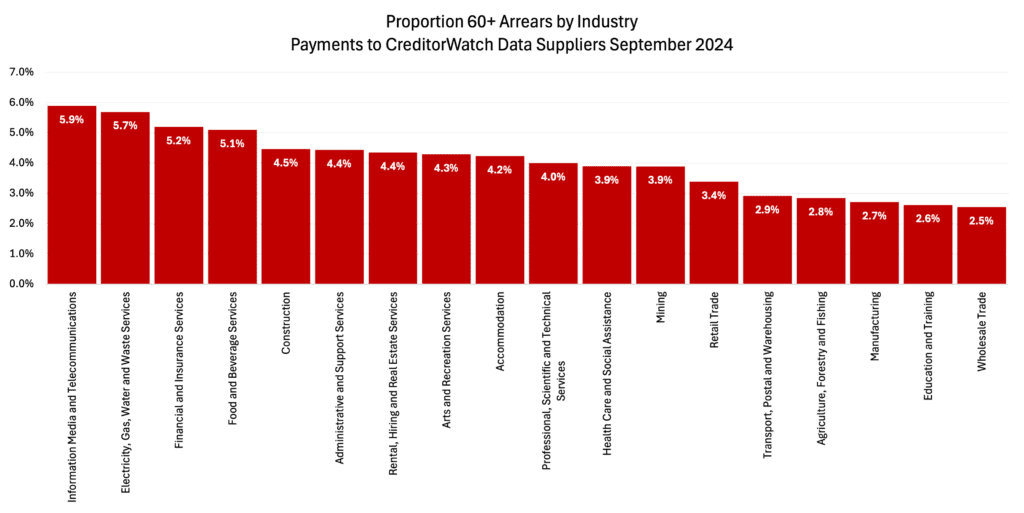

The information, media and telecommunications sector is currently experiencing the highest rate of late payment among all industries, recording a rate of 5.9 per cent for September, followed by Electricity, Gas, Water and Waste Services (5.7 per cent) and Financial and Insurance Services (5.2 per cent).

Data Sources: CreditorWatch trade receivables data (accounting software integration)

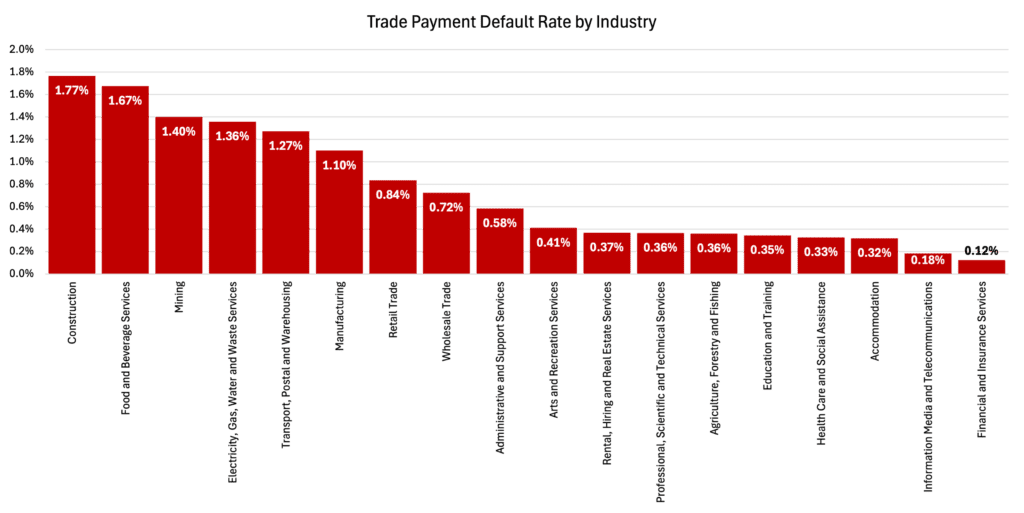

CONSTRUCTION AND HOSPITALITY REGISTER HIGHEST PAYMENT DEFAULT RATES

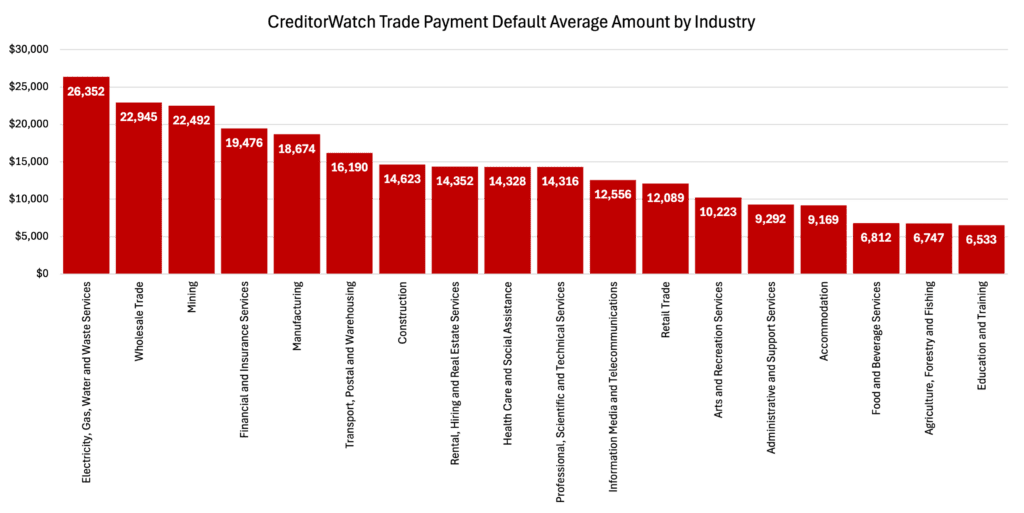

The construction and hospitality sectors currently have the highest rates of payment defaults, at 1.77 per cent and 1.67 per cent respectively.

The well-known challenges of the construction sector continue to be evident in the payments arrears data, also likely reflecting the recommencement last year of enforcement actions by the ATO. Food and Beverage Service businesses have likely been impacted by more cautious discretionary spending. The rise in Mining payment default rates likely reflects generally lower commodity prices (with the notable exception of gold) and somewhat reduced export and activity levels.

Data Sources: Unique CreditorWatch Trade Payment Defaults Data

Looking at other interesting aspects of the breakdown of payment defaults by industry, it’s clear that businesses with a high degree of government support or funding continue to experience lower rates of default, as do many services, including financial and insurance services.

Forthcoming caps on foreign students, however, can be expected to produce less favourable conditions for Education and Training providers.

The rural sector also has been doing well after three favourable seasons in a row, but lower commodity prices, especially for beef, could be expected to see increased pressures in coming months.

Data Sources: Unique CreditorWatch Trade Payment Defaults Data

CreditorWatch CEO, Patrick Coghlan, says deteriorating B2B payment times and the upward trend in payment defaults indicate that many businesses are still under considerable cash flow pressure.

“Ongoing economic impacts such as weaker consumer demand are clearly bringing more pressure to bear on Australian businesses,” he says.

“The fact that the construction and hospitality sectors have the highest rates of payment defaults and construction has the highest rates of arrears, mirrors the latest ABS data showing declining building approvals and flat spending in cafes and restaurants across much of 2024.”

OTHER BUSINESS RISK INDEX INSIGHTS FOR SEPTEMBER:

- Food and Beverage Services tops the rankings for business closure rates at 8.3 per cent over the past 12 months, followed by Administrative and Support Services (5.9 per cent) and Arts and Recreation Services (5.8 per cent). Our forecast is for the rate of closures in the Food and Beverage Services industry to hit 9.1 per cent over the next 12 months.

- Court actions are now well above pre-COVID levels as large creditors such as the banks and the ATO resume collections activity. Actions were up 13.7 per cent from July 2023 to July 2024.

- Credit enquiries are largely flat across 2024, reflecting subdued trading conditions in the Australian economy. Fewer businesses are applying for trade credit as a result.

- Food and Beverage Services is also the leading industry for outstanding ATO tax debts above $100,000, with a rate of 1.95 per cent. Construction and Transport, Postal and Warehousing is next at 1.29 per cent and 1.00 per cent, respectively.

- The lowest risk region in Australia is Norwood-Payneham-St Peters in inner-city Adelaide. Businesses in that area had an average failure rate of just 3.5 per cent over the past 12 months. As well as inner-Adelaide, the lowest risk regions remain concentrated around regional Victoria, North Queensland and the northern suburbs of Sydney.

- The highest risk regions were in Western Sydney and South-East Queensland. Businesses in Bringelly-Green Valley in Western Sydney had a failure rate of 8.2 per cent over the past 12 months.

- Perth had the lowest rate of business failures among the capital city CBDs (4.04 per cent), followed by Adelaide (4.13 per cent), Melbourne (4.64 per cent), Brisbane (4.76 per cent) and Sydney (5.22 per cent).

OUTLOOK

The broad economic outlook is likely to be most influenced by:

- The combination of current high interest-rate settings and the ongoing impact of the high cost of living

- Low unemployment

- Some continuing influences from the pandemic including catch-up immigration and overseas travel, and WFH-related effects on CBD visitation and office vacancies

- The recent income tax cuts

- A variety of longer-term global megatrends including: AI & Technology; the Ageing Population; Climate Change and the Energy Transition; Geopolitics and The Rise of Inequality.

In the short term, there are some tentative signs of support flowing through the economy from the 1 July tax cuts, with improved Consumer Confidence in early October, stronger Retail Sales in August and businesses reporting slightly stronger business conditions in the NAB Business Survey in September.

Latest RBA communications reinforce the message that further progress lowering inflation will be required before Australian interest rates can be reduced. Those conditions are expected to be in place in early 2025. Recent interest rate reductions by overseas central banks and a significant Chinese economic stimulus package increase the chances of global economic growth experiencing a soft landing, where inflation moderates, unemployment does not rise significantly, and most economies experience slower growth but not recession.

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.