CreditorWatch, has released the February results for its Business Risk Index (BRI), which reveal Australian businesses remain under pressure across key metrics.

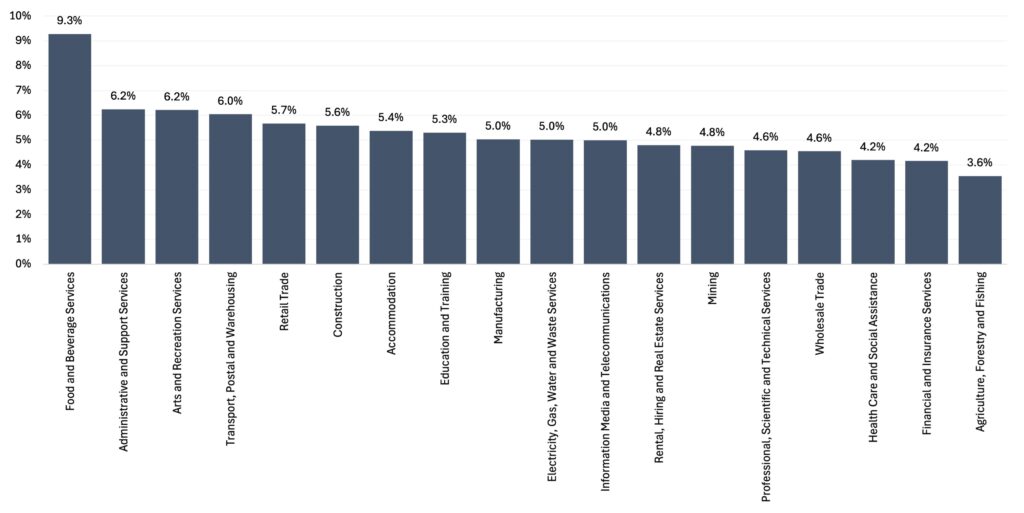

Cost increases and household cost-of-living pressures continue to impact the hospitality sector, with closures hitting a record high of 9.3% (one in 11 businesses) in the 12 months to February 2025, up from 7.1% in the 12 months to February 2024.

The business closures rate comprises voluntary and involuntary administrations, ASIC strike offs, deregistrations of solvent businesses and voluntary closures.

The food and beverage services sector has struggled under cost pressures from food price increases, energy and insurance price rises, wage increases and higher rents. Businesses in CBDs have also experienced a drop in trade as more people work from home. At the same time, their customers have experienced cost-of-living pressures and reduced discretionary spending.

Rolling Annual Business Closure Rate by Industry

12 Months – February 2024 to February 2025

Data sources: CreditorWatch, ASIC database direct link

B2B INVOICE PAYMENT DEFAULTS UP 47% YEAR-ON-YEAR

CreditorWatch’s data on invoice payment defaults, a key measure of business stress, shows a 47% increase for the 12 months to February 2025 as higher costs of inputs and softer demand over much of last year meant more businesses struggled to pay their trading partners.

Trade payment defaults have a strong correlation with a business becoming insolvent or closing voluntarily in the following 12 months. The risk of insolvency rises from 0.70% to 7.9% when a business defaults on an invoice payment.

B2B trade payment defaults

Monthly, seasonally adjusted, Feb 2020 = 100

Data sources: CreditorWatch, Macrobond

CreditorWatch CEO, Patrick Coghlan says it is a precarious time for businesses as many were already doing it tough, while the shadow of US tariffs now looms.

“The expected slowdown in economic growth from the widespread US tariff regime will, unfortunately but inevitably, result in higher insolvencies. After a tough couple of years managing higher inflation, interest rate increases and lower demand, I certainly hope Australia businesses are spared the worst of it.

“We encourage businesses to take steps now to manage that risk, whether it is reviewing credit policies, running a portfolio health check or monitoring customers more closely.”

INSOLVENCIES RESUME AFTER A CHRISTMAS BREAK

Insolvencies rose in February after having dipped in December and January to below the November high. They continue to trend strongly upward.

CreditorWatch Chief Economist, Ivan Colhoun says “given the economic and cost pressures and continuing high levels of accumulated ATO tax debt, it’s too early to expect the level of insolvencies to reduce much in the period immediately ahead”.

Insolvencies

Monthly, seasonally adjusted to Feb 2025

Data sources: CreditorWatch, Macrobond

SOME SUPRISES IN INSOLVENCY ‘STATE OF ORIGIN’

There are a few surprises in the insolvency ‘state of origin’. The ACT and NSW recorded higher rates of insolvency in February than Victoria. The ACT is often considered quite recession proof, while economic data and reported business conditions in the NAB Business Confidence Survey for Victoria have clearly been weaker for Victoria than for NSW.

It’s possible that weakness in Victoria has shown up in some insolvencies in NSW headquartered businesses. In the ACT, increased working-from-home may be part of the story for some business failures – a story that has been evident in other cities where workforce foot traffic has reduced.

There’s no surprise that WA has recorded the lowest insolvency rate over the past year. WA has the lowest unemployment rate in the country and, until recently, business conditions in the important mining sector had been very strong.

Insolvency Rate by State

12 Months – February 2024 to February 2025

Data sources: CreditorWatch

The highest risk regions remain predominantly in Western Sydney and South-East Queensland. These tend to be exposed to construction and/or are regions with generally relatively lower income levels. Businesses in Bringelly-Green Valley in Western Sydney have a forecast average business failure rate of 7.9% over the next 12 months.

The lowest risk region in Australia is Norwood-Payneham-St Peters in inner-city Adelaide. Businesses in that area have a forecast average failure rate of 4.5% over the next 12 months. As well as inner-Adelaide, the lowest risk regions remain concentrated around regional Victoria.

Adelaide has the lowest forecast failure rate among the capital city CBDs (5.1%), followed by Perth (5.2%), Melbourne (5.8%) Brisbane (5.8%) and Sydney (6.2%).

CREDITORWATCH’S OUTLOOK

The outlook for the Australian economy had brightened in recent months as the mid-2024 income tax cuts flowed through. The RBA’s first interest-rate reduction in February would have reinforced this in coming months.

Cost pressures and accumulated tax debts remain persistent negative pressures on many businesses. At the same time, tariff storm clouds offshore threaten a bumpier landing, given likely impacts on business confidence, share prices, and employment.

President Trump’s proposed tariff regime is a potential source of significant economic and business disruption. Australia is not a large exporter to the US, which means the direct impact on the Australian economy is likely to be limited. It’s the indirect linkages that are important, via lower share prices, weaker US and global growth and higher unemployment if tariffs are implemented as broadly and at such high rates as the US is proposing.

The outlook, unfortunately, is now hostage to these somewhat unpredictable policies of the Trump administration. If the breadth and high rates of tariffs being discussed are implemented globally, with reciprocal actions from other countries for an extended period this raises the risk of a significant slowdown in global growth or even a recession.

What’s hard to manage is the equally possible prospect that at some point, President Trump could reverse his proposed policies. For now, businesses should prepare for the former and hope for the latter.

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.