CreditorWatch, has released the January results for its Business Risk Index (BRI), revealing positive signs for Australian businesses at the end of 2024 and early 2025. However, the improvements are likely to be short lived, with the proposed tariff regime of the Trump administration expected to hinder growth, particularly for export-reliant sectors such as manufacturing and transport.

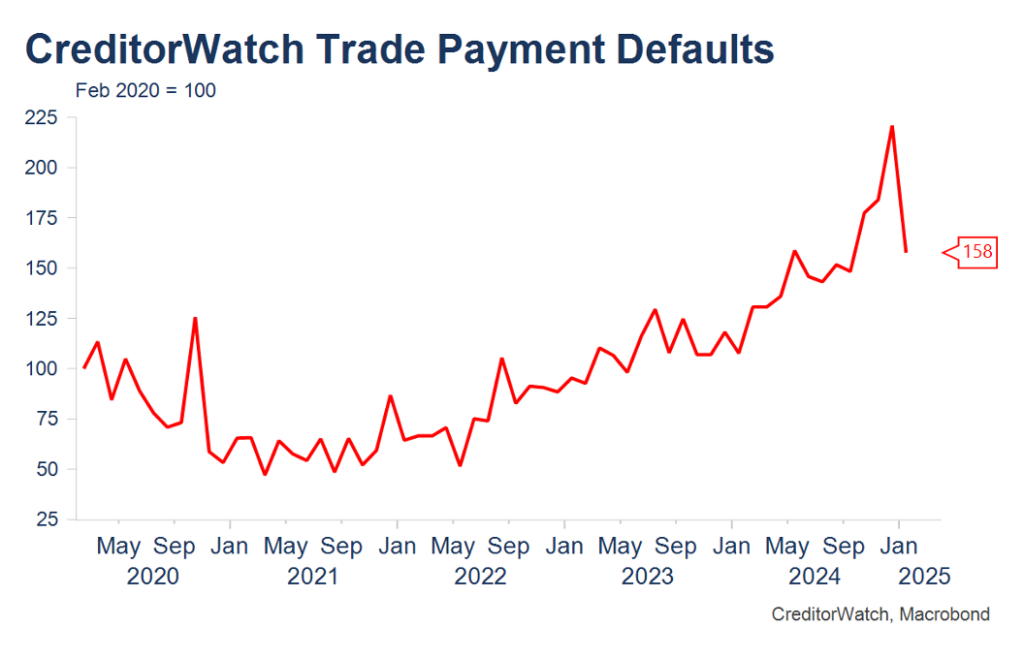

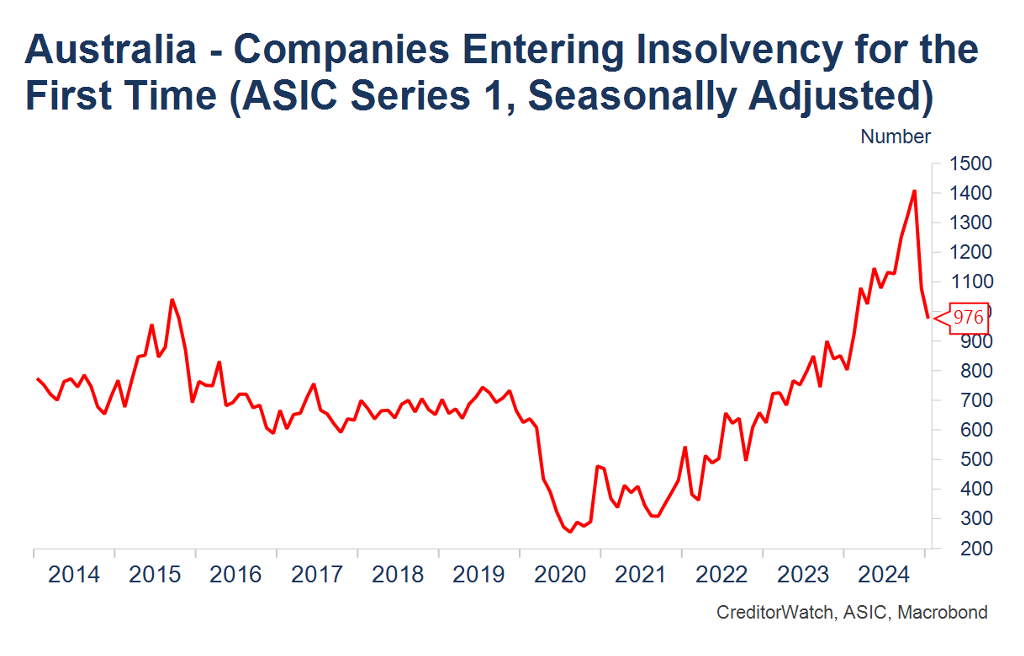

Both CreditorWatch’s proprietary trade payments defaults series (B2B reports of non- payment) and the number of first-time insolvencies reported by ASIC dropped relatively sharply in January, after adjustment for seasonality. Trade payment defaults were at the lowest level since September last year, while first-time insolvencies were the lowest since February 2024.

CreditorWatch Chief Economist, Ivan Colhoun says, “after tough conditions during much of 2024, during which insolvencies, late payment times and trade payment defaults all rose, the data suggests Australian businesses had a slightly better end to the year”.

“Positive developments in recent months include a strengthening in retail sales and consumer confidence, likely reflecting the continuing flow-through of the 1 July 2024 tax cuts to the economy, cost of living support and an ongoing strong labour market.”

This week’s 25 basis point rate cut to 4.1%, the first in five years, will also benefit both consumers and businesses. Despite these positive developments, and a moderation in the rate of inflation, the cost of living for consumers, and of trading for businesses, has not dropped. This will therefore continue to be a pressure for many and is expected to keep insolvencies near recent highs in the near term.

This, of course, is all before the impacts of President Trump’s tariff policies are felt by Australian businesses – and businesses across the globe.

CreditorWatch CEO, Patrick Coghlan says the business community is in desperate need of relief from interest rates and cost increases.

“The signs are good that we have seen a levelling off of insolvencies and B2B payment defaults,” he says. “Australian businesses have been doing it tough for a long time now, so we hope that the impacts of this week’s rate cut and the easing in inflation will quickly flow through to them. The big unknown, of course, is the impact of the Trump administration’s tariff regime.”

IMPACTS OF US TARIFFS

Tariffs – to the extent they are implemented on any country’s goods – act to raise prices for the levying country’s consumers and businesses (initially in a one-off way) and reduce demand for the foreign producer’s goods in favour of boosting domestic production. The currency of the country levying the tariff tends to increase and the foreign country’s currency tends to fall.

President Trump’s proposed tariff regime is extremely broad, with very high tariff rates. If large and broad-based tariffs are enacted for an extended period (still to be seen), the impact will be higher prices in the US, a stronger US dollar and some switch to domestic production. Other countries will see a reduction in demand for their goods from the US and face weaker currencies.

It is hoped that Australia will avoid much of the direct tariff imposition given we have a trade deficit with the US and are a strong ally in the Pacific region. This, however, doesn’t mean that we won’t see the goods of other tariffed countries ending up in our markets, potentially at lower prices, and of course the Australian dollar would remain generally weaker in this scenario.

Supply chains and trade flows may also reroute significantly over time, potentially adding to shipping costs. All of this has the potential to create additional pressure on manufacturing, wholesale and transport businesses, not to mention the inconvenience for business owners.

It’s too early to be definitive on the scale of the impact because the policies are still being rolled out, however they are generally expected to add to uncertainty and costs at the expense of weaker growth.

SQUEEZE CONTINUES FOR HOSPITALITY BUSINESSES

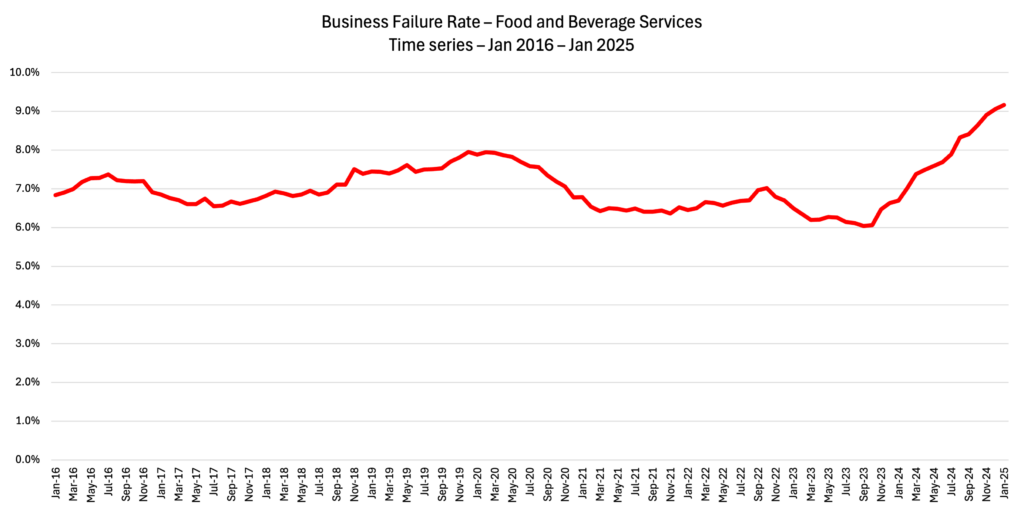

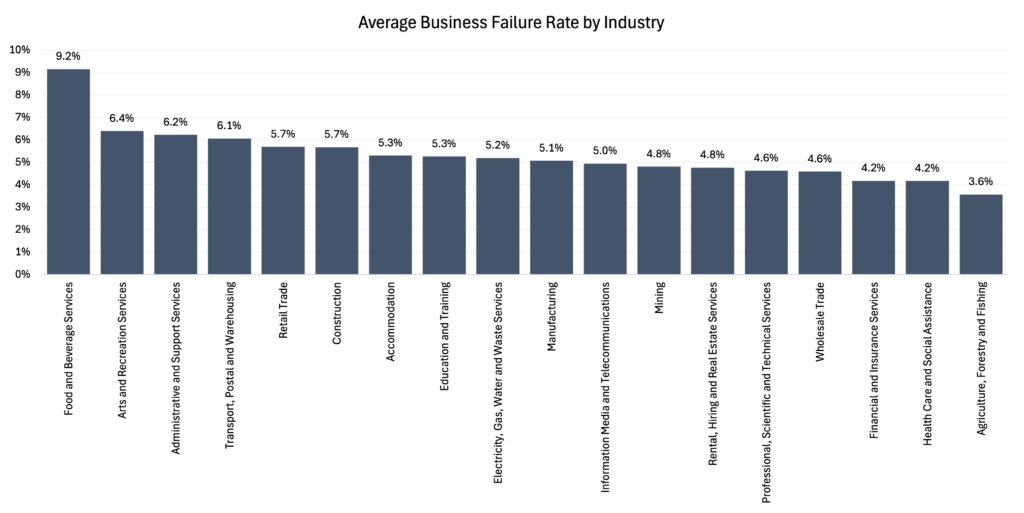

At the industry level, CreditorWatch’s data shows the Food and Beverage Services sector is most significantly bearing the brunt of cost-of-living pressures with 9.2% of businesses becoming insolvent, closing voluntarily or being struck off by ASIC in the 12 months to 31 January – a record high.

Many businesses in the sector likely have low levels of cash reserves and have been squeezed both by higher running costs (rents, wages, insurance, interest rates and food prices) at the same time as their customers have reduced discretionary expenditure due to cost-of-living pressures. Some in city centres have also experienced reductions in trade due to increased working from home.

Lower interest rates could benefit both these businesses directly and some of their customers, though a large interest rate reduction cycle is not expected. Lower inflation would be the most important development for a more positive outlook for this sector.

Data sources: CreditorWatch, ASIC database direct link

Data sources: CreditorWatch, ASIC database direct link

Note: Business failure defined as insolvency, voluntary closure or ASIC strike off.

Food and Beverage Services, unsurprisingly also leads the industry rankings for late payments and ATO tax debt defaults over $100,000.

REGIONAL PERFORMANCE

- The highest risk regions are predominantly in Western Sydney and South-East Queensland. These tend to be exposed to construction and/or are regions with generally relatively lower income levels. Businesses in Bringelly-Green Valley in Western Sydney have a forecast average business failure rate of 7.8% over the next 12 months.

Data source: CreditorWatch Business Risk Index

- The lowest risk region in Australia is Norwood-Payneham-St Peters in inner-city Adelaide. Businesses in that area have a forecast average failure rate of 4.55% over the next 12 months. As well as inner-Adelaide, the lowest risk regions remain concentrated around regional Victoria.

- Adelaide has the lowest forecast failure rate among the capital city CBDs (5.01%), followed by Perth (5.21%), Brisbane (5.80%), Melbourne (5.93%) and Sydney (6.07%).

THE OUTLOOK

The RBA and economists are forecasting a near perfect soft landing for the economy this year. Inflation should moderate sufficiently to allow interest rates to be reduced moderately, which in turn should see growth pick up modestly and ensures the unemployment rate remains very low by historical standards.

Slower population growth, as a result of the government’s policies on foreign students and migration, is likely to act as a drag on growth against the positives of lower interest rates and continuing flow through of the July 2024 tax cuts into the economy.

As noted earlier, the largest uncertainty for businesses and the economic outlook is the effects of Mr Trump’s policies, especially his proposed major imposition of tariffs very broadly. These have the potential to slow growth globally and raise prices in the US, preventing or delaying further interest rate cuts there. They could even reverse previous cuts if inflation re-accelerates in a sustained way.

Supply chains and shipping costs could be significantly impacted, while other major countries might divert some goods subject to US tariffs to other markets including Australia at discount prices for a time. Overall, added uncertainty and, potentially, cost increases are the likely outcomes if the proposed widescale tariff policy is enacted. That will add additional pressures on some businesses especially in the manufacturing sector.

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.