CreditorWatch, has released the November results for its Business Risk Index (BRI) with all key metrics pointing to an extremely challenging start to 2025 for Australian businesses, particularly small businesses.

Insolvencies, the business failure rate, B2B payment defaults and court actions are all on the rise as businesses battle a combination of cost increases, high interest rates, wage increases, skilled labour shortages, increased ATO enforcement activity and soft consumer demand.

CreditorWatch’s forecast is for insolvencies and the business failure rate to continue to increase in the first half of 2025.

CreditorWatch’s BRI data for November shows:

- Insolvencies are at record highs in number and are up 57% for the year to November.

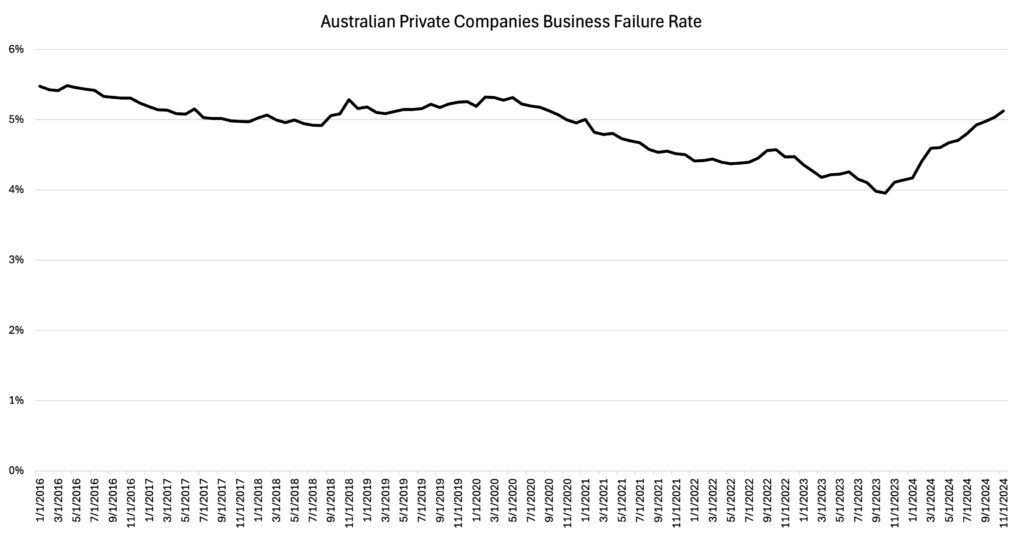

- The average business failure and closure rate for all sectors, is currently at 5.1%, the highest rate since August 2020. The failure rate is expected to be 5.6% over the next 12 months.

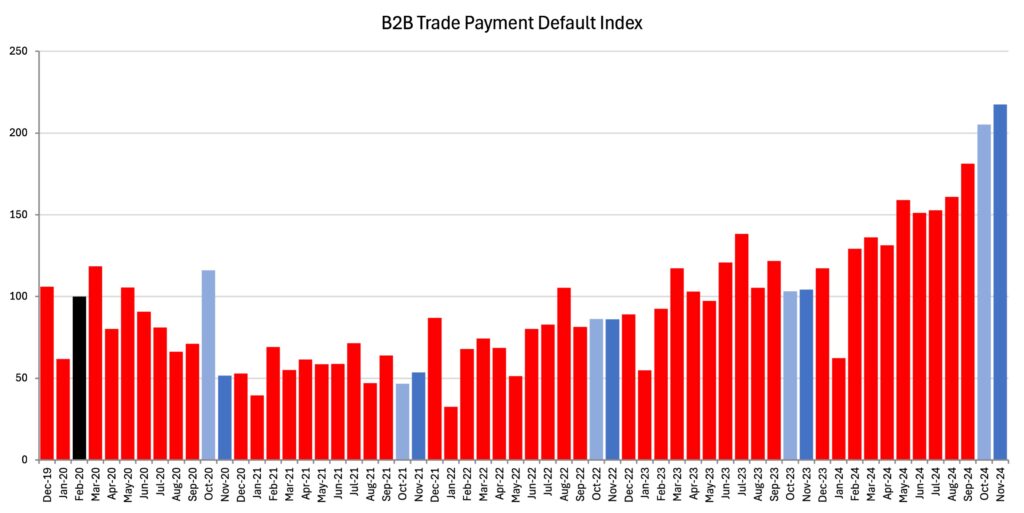

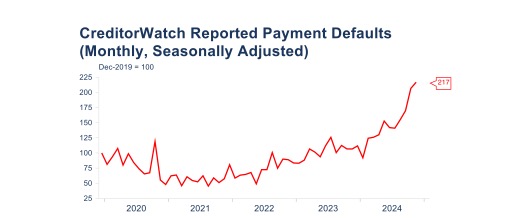

- B2B payment defaults – a leading indicator of potential insolvency – are also at record highs and have more than doubled in the past year.

- Court actions remain elevated as the ATO maintains its ramped-up debt recovery efforts.

Data source: ASIC database direct link, CreditorWatch industry data; Business failure rate defined as voluntary and involuntary administrations, ASIC strikeoffs and voluntary business deregistrations.

Data source: CreditorWatch Trade Payment default data (lodged defaults), indexed to Feb 2020 (pre-COVID)

CreditorWatch Chief Economist Ivan Colhoun notes the 2025 outlook is likely to remain challenging until the RBA delivers some interest rate relief. This was previously not expected before May 2025, but the December RBA Board Meeting has opened the door to an easing in February provided the Board gains greater confidence in its inflation forecasts from the Q1 CPI at the end of January and other data releases.

“An expected easing cycle over 2025 will be helpful for households and businesses but is only expected to be moderate in size, without a more significant slowing in the labour market, which is not currently signalled,” he says.

“Businesses and consumers will still need to adjust to the elevated cost of doing business and cost of living, as well as current interest rates, for some months.

“These fundamentals are reflected in rising B2B payment default rates and, along with increased ATO enforcement activity, will continue to lead to increased insolvencies. Lower commodity prices, changes to government policy on foreign students and immigration are also likely to lead to less favourable conditions in the Mining and Education sectors and to slower population and demand growth in general.

“President Trump’s proposed significant tariff increases add another considerable layer of uncertainty to the overall business outlook globally and in Australia, especially for the Manufacturing, Wholesale and Retail Trade and Transport and Warehousing sectors.”

HOSPITALITY INDUSTRY UNDER PRESSURE

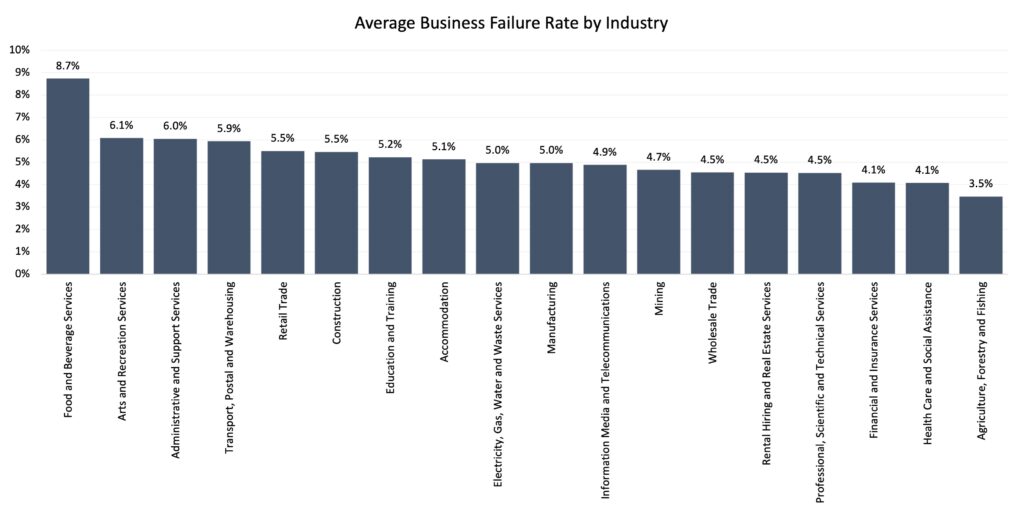

At an industry level, CreditorWatch’s data indicates the hospitality industry is under greater pressure than other industries in a number of key areas.

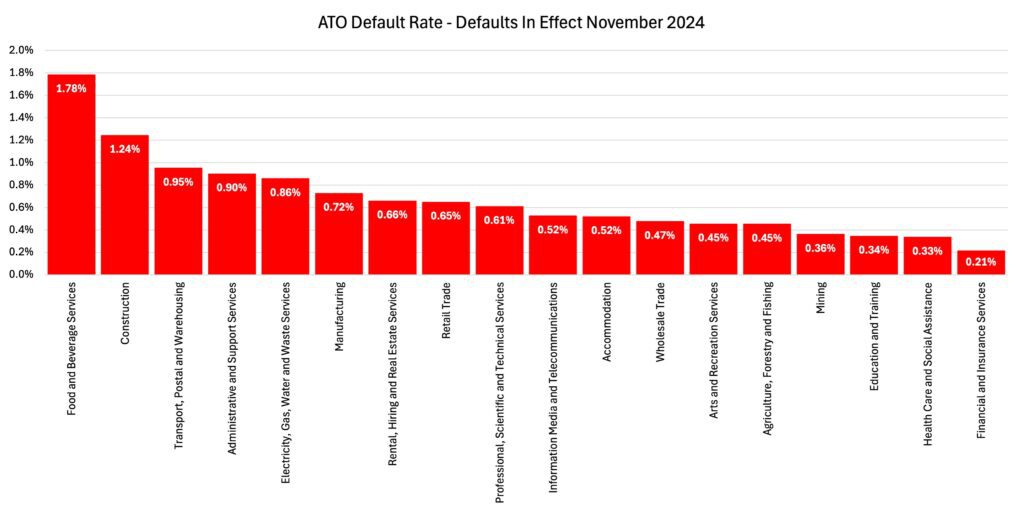

Food and Beverage Services leads the industry rankings for the business failure rate, late payments, ATO tax debt defaults over $100,000 and is ranked second for payment defaults.

The ABS retail trade data for cafes, restaurants and takeaway food services shows that spending at these outlets has been largely flat since the beginning of 2023. CreditorWatch expects spending to remain relatively subdued over the current Christmas/New Year period, meaning that these businesses will, begin the new year without the full seasonal cash injection that they have traditionally relied upon.

Businesses in the sector have been struggling to maintain profitability under ongoing cost pressures, higher interest rates, wage increases, labour shortages and softer consumer demand. Cost-of-living pressures have pushed some households to tighten purse strings and cutback on discretionary spending, which the hospitality industry is heavily reliant on.

Interest rate relief to potentially counterbalance some of these negative fundamentals may begin in February, adding to the recent significant improvement in consumer confidence as the 1 July income tax cuts and government cost of living relief payments benefit consumers’ take-home pay.

These positive developments will still take some time to show up in reduced payment defaults and arrest current insolvency trends.

Business Failure Rate

CreditorWatch defines a business failure as voluntary and involuntary administrations, voluntary business deregistrations (closures) and ASIC strikeoffs. There are clear rising trends for both involuntary administrations and ASIC strikeoffs, with the involuntary administration rate for private companies now considerably above pre-COVID levels.

As with other metrics, the business failure rate (the chance of a business being wound up or closing voluntarily) is particularly high in the Food and Beverage sector.

Data source: ASIC database direct link, CreditorWatch industry data; Business failure rate defined as voluntary and involuntary administrations, ASIC strikeoffs and voluntary business deregistrations.

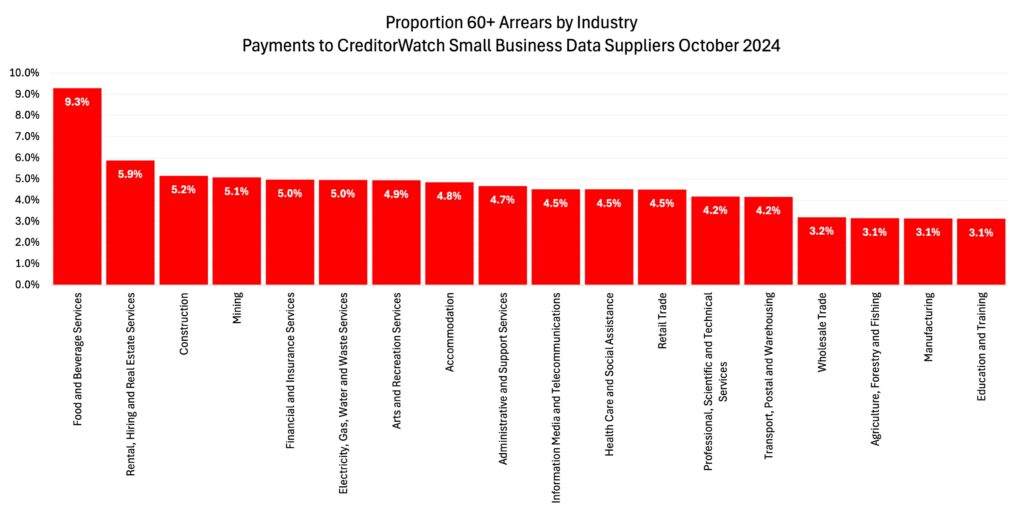

Late Payments

Unsurprisingly late payments and arrears are trending higher and have risen relatively sharply in recent months. This likely reflects the cumulative effects of higher costs of doing business and cost of living and the lagged effect of monetary policy, which always has its peak impact on the economy some 12 to 18 months later. Reflecting this, Average Days Past Due – the time businesses wait until their debtors pay invoices has lengthened over the past year. Food and Beverage Services and Construction occupy two of the top three positions for payment arrears.

Data sources: CreditorWatch trade receivables data (accounting software integration)

ATO Tax Debt Defaults (above $100k)

Food and beverage services also has the highest proportion of businesses carrying an outstanding ATO tax debt greater than $100,000. This is particularly concerning given that most entities in the sector are small businesses.

Late payments and insolvencies have both risen more sharply since the ATO stepped up its collections’ activity in October 2023. While there has likely been a degree of catch up overstating the underlying situation in the economy in recent months, the consequences of the ATO’s actions affect the business in question and potentially other business relationships.

With court actions remaining elevated in recent months – but falling in November – the likelihood is that collections activity will remain a source of pressure for businesses for some months to come on top of underlying challenging macro fundamentals.

Data source: Australian Taxation Office Direct Link; ATO tax debt defaults greater than $100,000

B2B payment defaults

B2B or trade payment defaults continued to rise in November, albeit less markedly than in recent months. Elevated trade payment defaults are an important lead indicator of business failures and insolvency, especially where multiple payment defaults are lodged against a single business.

Trade payment defaults remain especially elevated in the Construction and Food and Beverage Services sectors but have risen across most industry sectors in recent months, suggesting increased pressure on businesses.

Data sources: CreditorWatch, Macrobond

CreditorWatch CEO, Patrick Coghlan, says this Christmas will be another challenging one for Australian businesses, particularly those in consumer facing sectors.

“Our data, on multiple levels, shows businesses are under increasing stress,” he says. “Despite these headwinds, Australian businesses remain resilient.

“We expect those exposed to discretionary spending such as Hospitality, Retail and Arts and Recreation will continue to find it particularly difficult, at least until consumers receive interest rate relief and increase spending again.

“The incidence of bad debts is going to increase in line with this, which makes it critically important for business operators to monitor the payment behaviour of their customers and change payment terms where necessary.”

THE REGIONAL OUTLOOK

- The highest risk regions are in Western Sydney and South-East Queensland. Businesses in Bringelly-Green Valley in Western Sydney have a forecast average business failure rate of 7.9% over the next 12 months.

- The lowest risk region in Australia is Norwood-Payneham-St Peters in inner-city Adelaide. Businesses in that area have a forecast average failure rate of 4.56% over the next 12 months. As well as inner-Adelaide, the lowest risk regions remain concentrated around regional Victoria and North Queensland.

- Adelaide has the lowest forecast failure rate among the capital city CBDs (5.06%), followed by Perth (5.12%), Melbourne (5.76%), Brisbane (5.87%) and Sydney (6.24%).

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.