SYDNEY, Wednesday 17 July 2024 – Credit reporting bureau, CreditorWatch, has released the June results for its Business Risk Index (BRI) which reveal a dramatic and concerning drop in the value of invoices held by Australian businesses as declining consumer demand forces cuts to inventory.

CreditorWatch has increased its 12-month forecast for hospitality failures to 9.1 per cent – one in 11 businesses – as conditions for consumers and businesses continue to deteriorate.

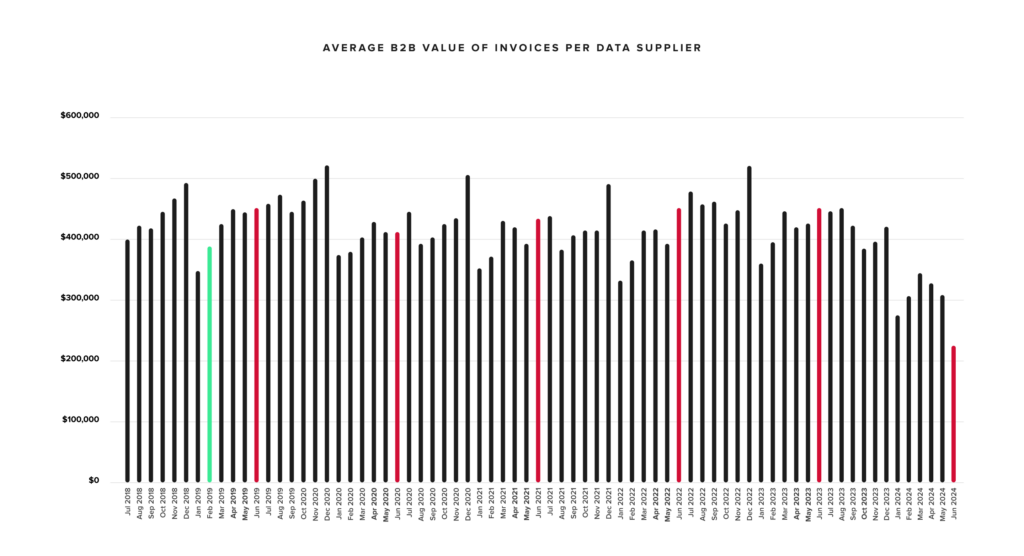

Business orders values at record low – down 49.9% YoY

The average value of invoices held by businesses has fallen 49.9 per cent over the year to June 2024 reflecting a drop in order values as businesses are forced to wind back inventory due to higher prices and declining demand in the economy.

Compounding this problem is rising invoice payment defaults, which have been trending up since mid-2021. This indicates that businesses are finding it increasingly difficult to pay their suppliers despite lower order values.

Another of CreditorWatch’s key metrics, the business failure rate, is also deteriorating with an 8.8 per cent increase across all industries over the past 12 months.

Data sources: CreditorWatch trade receivables data (accounting software integration)

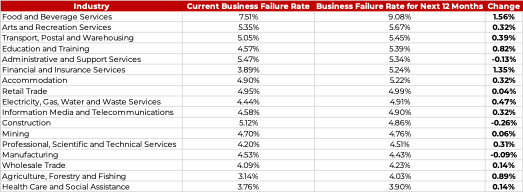

One in 11 hospitality businesses to fail over next year

The outlook has worsened for businesses in the hospitality industry with CreditorWatch now forecasting the failure to increase from 7.5 per cent to 9.1 per cent – that’s one in 11 businesses.

This is well above the forecast for Arts and Recreation Services and Transport, Postal and Warehousing which are ranked second and third with forecast failure rates of 5.7 per cent and 5.5 per cent respectively. The average forecast for all industries in 5.1 per cent.

Hospitality has a significantly higher failure rate forecast than other industries primarily because of its heavy reliance on discretionary spending, which has dried up as consumers tighten their belts to cover increases in mortgage payments, rents, power bills and other essentials.

Data Sources: CreditorWatch Business Risk Index

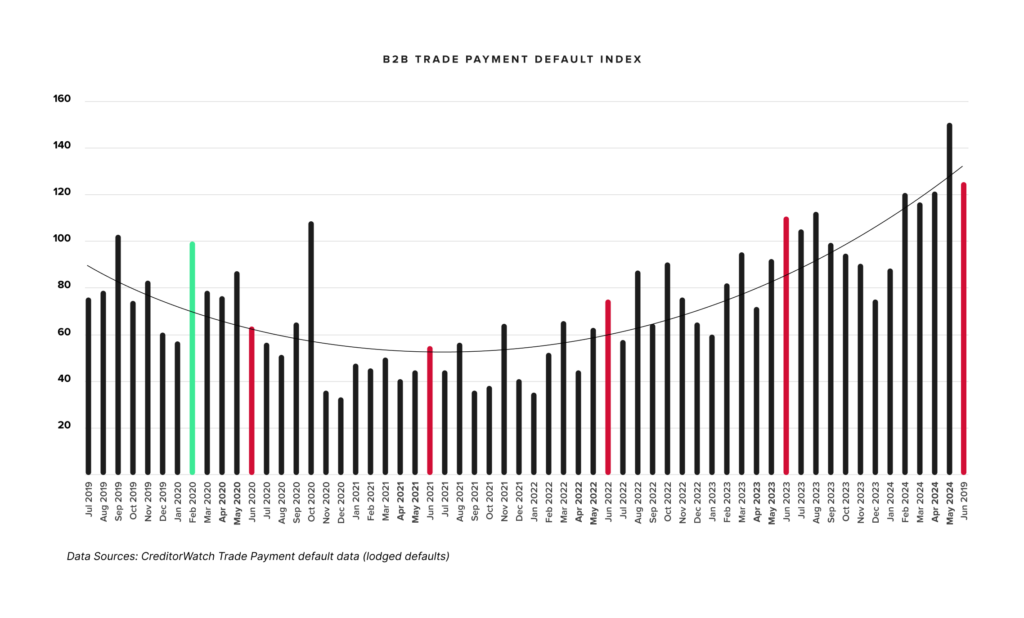

More businesses unable to pay invoices

Business payment invoice defaults dipped from May to June but have been trending up since the middle of 2021 and are well above pre-COVID levels. Rising costs and declining demand have conspired to squeeze businesses, making it more difficult to pay suppliers.

CreditorWatch has identified a strong correlation between a B2B payment default and the chance of a business failing over the following months.

Data Sources: CreditorWatch Trade Payment default data (lodged defaults)

Other Key Business Risk Index insights for June:

- Court actions are trending strongly upward with a 37 per cent increase for the year to June 2024. They are now sitting well above pre-COVID levels.

- Credit enquiries dropped from May to June and remain flat across 2024, reflecting the subdued trading conditions in the Australian economy.

- Food and Beverage Services is the top ranked industry for outstanding ATO tax debts above $100,000, with a rate of 1.65 per cent. Construction and Electricity, Gas, Water and Waste Services are next at 1.18 per cent and 0.94 per cent respectively.

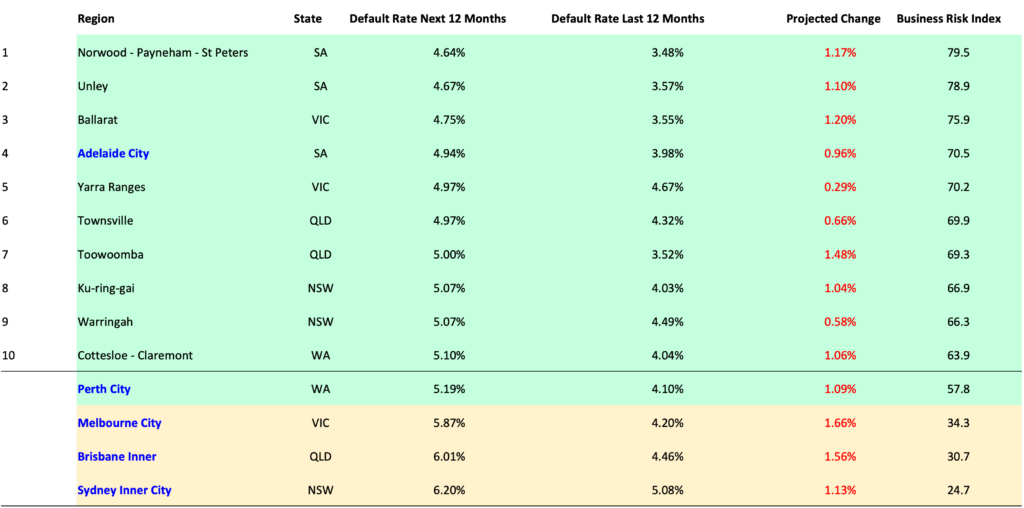

- Adelaide has the best performing capital city CBD by a considerable margin. It is followed by Perth, Melbourne, Brisbane and Sydney.

- The regions with the lowest risk of business failure are concentrated around regional Victoria, inner-Adelaide and North Queensland. Norwood-Payneham-St Peters in South Australia, is the top-ranked region (3.48 per cent chance of default), followed by Unley, also in South Australia, and Ballarat in Victoria.

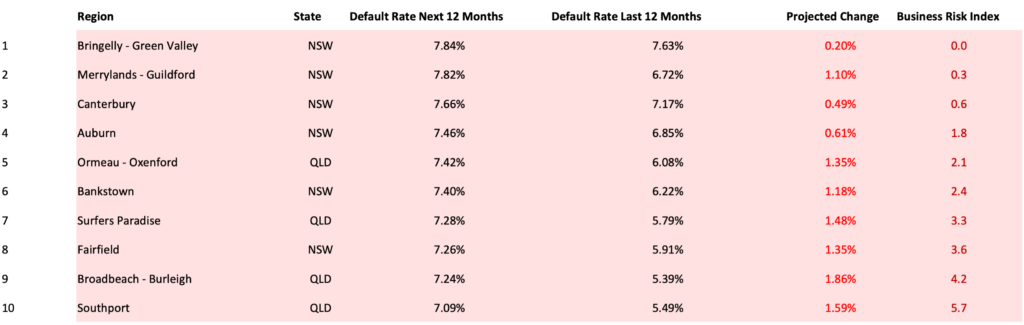

- The regions with the highest risk of business failure are around Western Sydney (six of the top 10) and South-East Queensland, with Bringelly-Green Valley (NSW) the top-ranked region (7.63 per cent chance of default), followed by Merrylands-Guildford and Canterbury, all in Western Sydney.

CreditorWatch CEO, Patrick Coghlan, says conditions are becoming truly dire for Australian businesses.

“The combination of declining order values and increasing payment defaults is a major concern as it indicates more businesses are experiencing both cost and demand pressures,” he says.

“With another rate increase becoming increasingly likely, we expect both metrics to deteriorate even further.

“It is small businesses that are hurting the most as they are more vulnerable to adverse economic conditions than larger businesses. They operate on tighter margins and are less able to take measures to cut costs.”

CreditorWatch Chief Economist, Anneke Thompson, says that we are now well and truly in the toughest phase of the monetary policy cycle.

“The high cost of debt is compounding the problems wrought by inflation, that is still too high in some areas,” she says.

“Monetary policy decisions usually lag what is happening in the broader economy, as data takes time to filter through to the RBA, and the RBA also wants to see a few months’ worth of data to be more certain that their decisions taken at board meetings are the correct ones.

“While this approach is sound theoretically, in practice it means businesses have to endure high interest rates long after consumer demand has plummeted, and discretionary spending has significantly weakened.”

Best performing regions and CBDs (5,000+ businesses)

The best performing regions continue to be those with a higher proportion of older businesses, and older residents, who typically have lower rates of personal insolvency than younger people. Adelaide City continues to rank as the safest CBD in terms of insolvency risk. This CBD benefits from relatively low rents, and large numbers of both workers and international students.

Data Sources: CreditorWatch Business Risk Index

CreditorWatch’s Business Risk Index June 2024 data indicates that monetary policy settings, combined with continued rising prices in the services, utilities and insurance sector and record low consumer confidence are having severe negative impacts on Australian small businesses.

The impact is not spread evenly through the economy – areas with younger populations and businesses in the hospitality sector have been hardest hit. This trend will continue well in to 2025, which is the earliest realistic time we can expect the RBA to have cut the cash rate a few times.

As a result, businesses will fail at an alarmingly high rate, and it is inevitable that unemployment will rise, albeit off a low base. Low unemployment and good job security has been one of the few positives that Australian households have benefitted from over the past few years and, sadly, it looks like even these positive measures will soon come to an end.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.