CreditorWatch has long been at the forefront of using AI to enhance credit risk assessment. Our machine learning (ML) models are the cornerstone of RiskScore, our credit scoring system, providing businesses with accurate and reliable credit reports to better manage credit risk exposure.

However, as leaders in the field, we recognised that the potential of artificial intelligence (AI) extends far beyond just generating credit scores. We saw an opportunity to leverage the latest advancements in AI, particularly generative AI (Gen AI), to enrich our service delivery and provide even greater value to our clients.

Our journey into the world of Gen AI began with a simple yet crucial observation: while our credit scores were highly accurate and valuable, explaining the intricacies behind these scores often posed a challenge.

This realisation set us on a path to explore how we could harness the power of GenAI and large language models (LLMs) to bridge this communication gap and further solidify our position as innovators in the credit risk industry.

Matching solutions to challenges

Our AI strategy team conducted in-depth interviews led by experienced data scientists and business analysts with key stakeholders across different departments. We wanted to identify pain points where AI could not just incrementally improve processes but fundamentally transform them. While increasing productivity is an obvious and easy win, we were looking for a process that is specific to our business.

We identified several potential use cases for AI across our organisation through this thorough analysis. However, one stood out as having the potential for immediate and significant impact: using GenAI to help explain our credit scores. This use case aligned perfectly with our core business offering and addressed a clear pain point for both our sales team and our clients.

Our credit scoring system is powered by sophisticated ML algorithms and considers an extensive range of factors to produce a comprehensive risk assessment. While this complexity is what makes our scores so accurate and valuable, it also makes them challenging to explain in simple terms. This situation hindered our customer service process, requiring our sales team to consult with our product team when clients asked for explanations about their scores or those of their business partners.

The product team would also need to reach out to our credit risk specialists for a detailed breakdown of the score components in more complex cases. This multi-step process was time-consuming and resource-intensive, potentially impacting our ability to provide timely responses to our clients.

This use case had the potential to create value across multiple levels of our organisation. Implementing a Gen AI solution to explain credit scores let us address the needs of our sales team, enhance our client experience, reduce the workload on our product team, and free up our credit risk specialists to focus on higher-value tasks.

Getting on the Gen AI journey

With the use case identified, we began developing a solution to leverage the power of LLMs to generate clear, concise, and accurate explanations of our credit scores. However, we were acutely aware that simply applying an off-the-shelf LLM wouldn’t be enough. Our credit scores are based on complex, proprietary models, and any explanation system would need to be deeply integrated with our existing infrastructure.

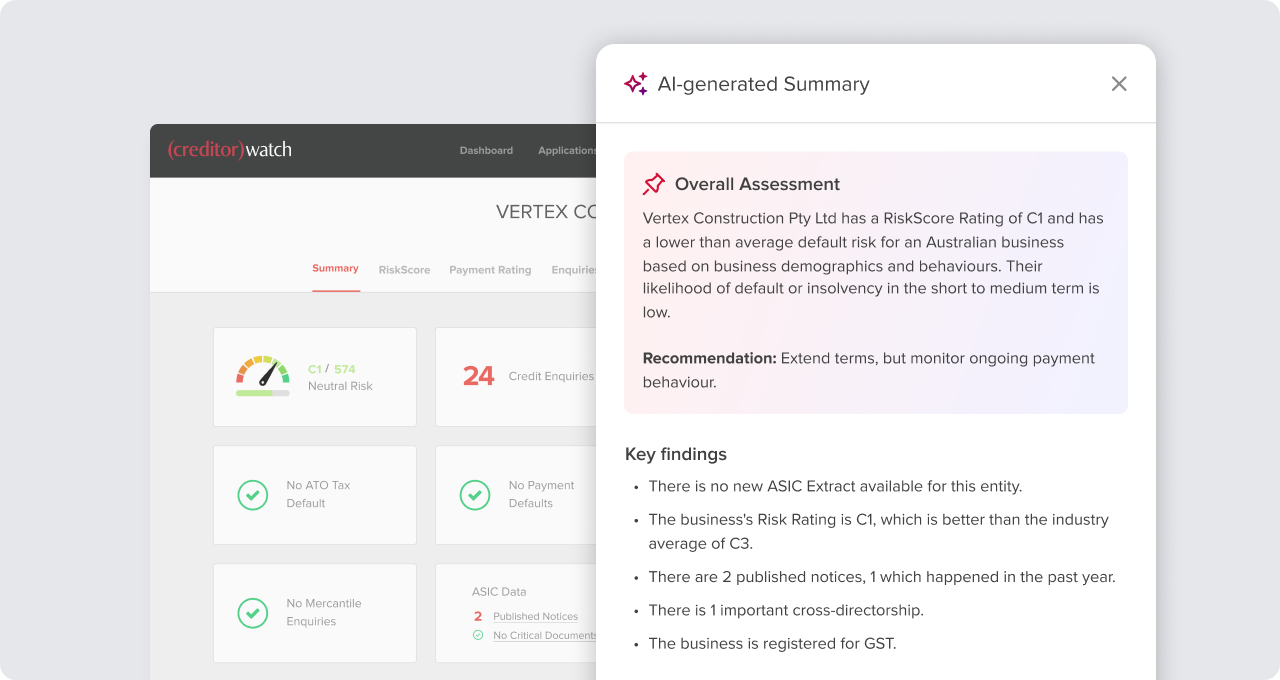

The system we are developing and testing will translate the output from our ML credit scoring model into natural language explanations. It doesn’t just regurgitate numbers and statistics; instead, it provides context, highlights the most significant factors influencing the score, and explains how these factors interrelate.

The system also adapts its explanations based on the user’s level of financial sophistication, providing more detailed technical explanations for financial professionals and simpler, more accessible explanations for those less versed in credit-risk terminology.

Leveraging human-in-the-loop credit risk augmentation

This Gen AI system will benefit multiple levels of our organisation. It provides an invaluable tool for the sales team to quickly and confidently answer client queries about credit scores. Once the system is proven and embedded in our processes, they will no longer need to defer complex questions or wait for responses from other departments. This makes them more efficient and delivers more value to our clients.

The benefits are equally significant for our clients. They will receive faster, more comprehensive explanations of credit scores, enhancing their understanding of the risk landscape and empowering them to make more informed decisions. Querying the system using natural language also makes our credit scores more accessible, potentially opening new market segments for our services.

We’re also freeing up significant time for our product team by automating the explanation of credit scores. Now, instead of fielding queries from the sales team, our product specialists can focus on higher-value tasks, such as refining our credit scoring models and developing new product offerings.

Perhaps most importantly, this Gen AI system lets our credit risk specialists (the true experts behind our scoring models) to have a broader organisational impact. Their expertise is encoded into the AI system and can now be accessed instantly by anyone who needs it. This makes better use of their valuable time and applies their insights across all our client interactions consistently.

We’re acutely aware of the need for thorough testing and validation as we prepare to roll out this novel system. We’re in the process of internal testing, ensuring that the system’s outputs are accurate, consistent, and aligned with our high standards for financial advice. We’re also developing monitoring systems to track overall performance and make continuous improvements.

We see this Gen AI system as just the beginning of a new era in credit risk assessment. We’ll gain invaluable insights into the aspects of credit risk that businesses find most challenging or interesting as the system interacts with more users and handles more queries. This feedback loop will both help us refine the AI system and inform the evolution of our core credit scoring models.

At CreditorWatch, we’ve always believed that the true power of AI lies not in replacing human expertise, but in amplifying it. This Gen AI system embodies that philosophy, combining the analytical power of our ML models with the contextual understanding of our human experts, all delivered through the natural language capabilities of advanced AI.

Book a demo

If you’d like to learn more about how to leverage CreditorWatch’s credit reports to comprehensively assess the risk of your customer base, book a demo with our team today.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.