Accurately assessing credit risk is the cornerstone of how our customers protect their businesses and CreditorWatch has been consistently at the forefront of using artificial intelligence (AI) through advanced machine learning (ML) techniques to deliver highly reliable credit scores.

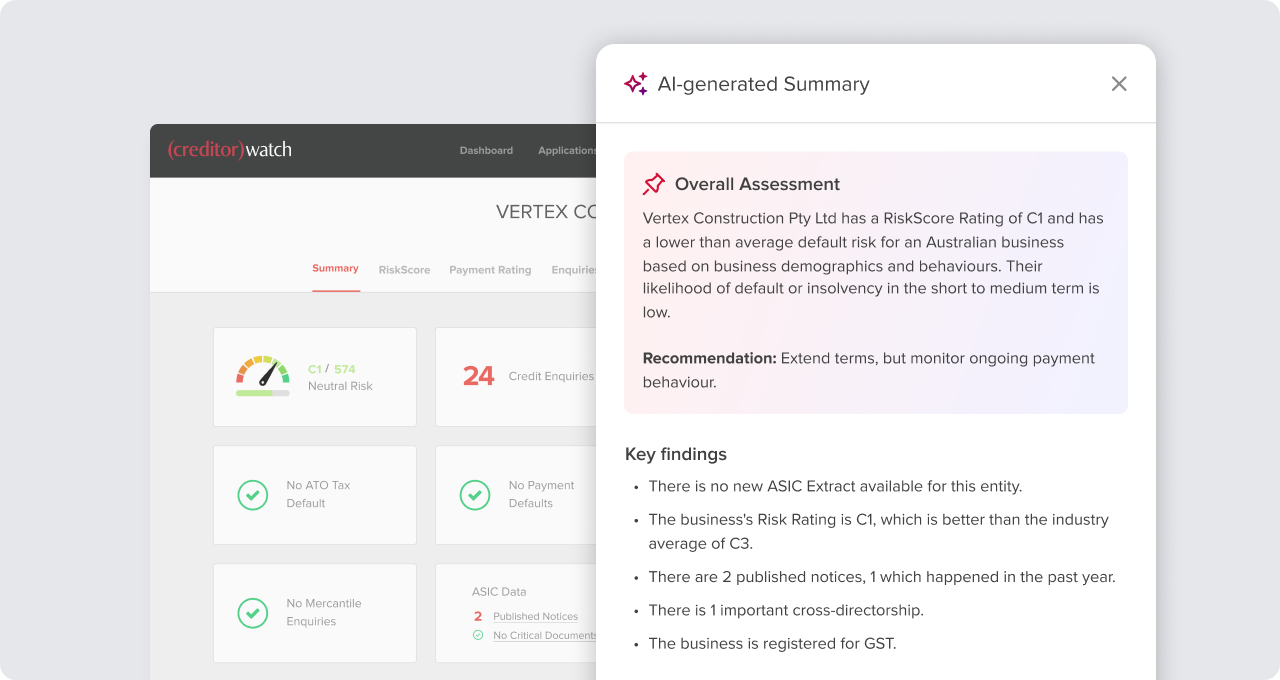

AI, particularly ML, has been transforming how we approach credit risk assessment for many years. Unlike traditional methods that rely solely on historical data, our AI-powered system analyses vast amounts of information to identify subtle patterns and correlations that human analysts might miss. This results in more nuanced and accurate credit assessments, letting businesses make informed decisions and manage their portfolios more successfully.

CreditorWatch’s market leading combination of unique data, cutting-edge technology and deep industry expertise sets us apart. We have a team of Data Scientists who play a crucial role in training and refining our AI models.

1. Domain expertise

Our team of Data Scientists forms the backbone of our AI approach. Their extensive experience provides invaluable insights that guide the development and refinement of our models. This ensures that our AI doesn’t just process data; it understands the nuances of credit risk in real-world scenarios.

2. High-quality, unique data

The old saying ‘garbage in, garbage out’ is particularly relevant to AI. That’s why we place a premium on data quality. Our AI models are trained on extensive, carefully curated datasets that capture the complexities of credit risk across various industries and economic conditions. This high-quality data, the majority of which is unique to CreditorWatch, lets our models make accurate predictions, even in challenging or unprecedented scenarios.

3. Advanced algorithms

We employ state-of-the-art ML algorithms that are specifically tailored to the unique challenges of credit risk assessment. These algorithms handle the inherent complexities of credit data, including:

- Class imbalance: the rarity of default events compared to non-default scenarios

- Historical dynamics: the changing nature of credit risk over time

- Multi-dimensional risk factors: integrating various financial and non-financial indicators.

Our algorithms are refined and updated continuously to reflect the latest advancements in AI and credit risk theory.

The goal of our AI-powered credit scoring system is to predict the likelihood of default (failure) accurately. This is a challenging task. It’s therefore important that our AI models can detect subtle indicators of potential distress long before they become apparent through traditional methods. Rather than provide a simple binary classification, our system offers a nuanced risk assessment that supports more sophisticated portfolio management. Our models learn and adapt to changing economic landscapes, so predictions remain relevant and accurate over time. We’ve also fine-tuned our models to minimise both false positives (incorrectly flagging low-risk entities) and false negatives (missing high-risk cases).

We help our clients price risk more effectively, optimise their risk appetite, and maintain healthier portfolios by delivering highly accurate default predictions.

The role of AI in credit risk assessment will only grow in importance as the financial and economic landscape continues evolving. We’re proud to be at the forefront of this revolution at CreditorWatch, delivering cutting-edge solutions that combine the best of human expertise and AI.

CreditorWatch’s commitment to innovation, coupled with our deep industry knowledge and unique data, is helping our organisation and teams to use AI to shape the future of credit risk management.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.