Larger businesses are driving the adoption of new technologies across Australia, with AI the primary technology industries are adopting to enhance competitiveness, according to findings from CreditorWatch’s Business Sentiment Survey.

Thirty five per cent of businesses have implemented AI to enhance competitiveness in the past year, while other innovations like the Internet of Things (IoT) and big data analytics are also gaining traction. Despite these advancements, challenges such as limited financial resources and cybersecurity concerns are impeding full-scale digital transformation efforts across industries.

Larger businesses lead in technology adoption

In the past 12 months, 35% of businesses report implementing AI as their primary technology to boost their business’s competitiveness. Other widely adopted technologies include the Internet of Things (20%) and big data analytics (16%).

At the industry level, Business/Professional Services lead the charge with 49% of all respondents having adopted AI, followed by Financial Services and Insurance (39%) and Health and Education (34%). Business/Professional Services also spearhead the adoption of Internet of Things at 25%, followed by Financial Services and Insurance (22%) and Construction (21%) close behind. Big data analytics adoption over the past 12 months is greatest in Business/Professional Services and Health and Education at 19%, with Financial Services and Insurance and Production following at 17%.

Unsurprisingly, larger businesses are the most likely to embrace new technologies, with 89% having adopted such innovations over the past year. Medium-sized businesses follow close behind at 80%, while only 38% of small businesses report similar adoption. Notably, 47% of respondents state they have not adopted any new technologies in the past 12 months, raising questions over how competitive these businesses will be with digital transformation changing the landscape across all industries.

AI usage patterns

CreditorWatch’s Business Sentiment Survey shows AI is being utilised across a broad range of industries, with leading applications in content creation and editing (41%), idea generation (36%), customer/client service chatbots (32%), and the automation of routine tasks (29%).

| Construction | Distribution (i.e. Wholesaling, Transportation, Airlines/ airtravel, other travel services) | Health & Education | Production | Retail & hospitality | Financial & Insurance | Business/ Professional Services |

|

|---|---|---|---|---|---|---|---|

| Content creation and editing (e.g. for articles, social media posts, images and videos) | 29% | 36% | 30% | 39% | 61% | 25% | 37% |

| Idea generation | 35% | 36% | 32% | 23% | 38% | 31% | 40% |

| Customer/client service chatbot | 47% | 7% | 18% | 23% | 30% | 25% | 42% |

| Email inbox management | 47% | 21% | 30% | 32% | 30% | 19% | 26% |

| Automation of routine activities | 47% | 36% | 25% | 45% | 23% | 25% | 31% |

| Administration/ documentation | 41% | 36% | 41% | 13% | 19% | 31% | 30% |

| Sales and marketing analytics | 24% | 21% | 23% | 19% | 25% | 31% | 33% |

| Task and project management/ scheduling | 24% | 21% | 25% | 19% | 19% | 13% | 31% |

| New product or service development | 35% | 21% | 14% | 16% | 27% | 38% | 22% |

| Bookkeeping | 24% | 29% | 23% | 19% | 16% | 6% | 18% |

| Recruitment of employees (e.g. for screening job applications) | 41% | 14% | 16% | 26% | 9% | 25% | 17% |

| Inbound enquiry management | 12% | – | 20% | 10% | 9% | 13% | 20% |

Data sources: CreditorWatch 2024 Business Sentiment Survey

AI usage also varies by business size. Large businesses report using AI primarily for employee recruitment (43%) and content creation and editing (40%). Meanwhile, smaller businesses leaned heavily on AI for content creation (47%) and idea generation (40%). Medium-sized businesses most frequently applied AI to customer/client service chatbots (42%), administration/documentation (39%), and email inbox management (37%). The range of use cases vary, but businesses generally recognise the value of AI and are interested in exploring ways it can best benefit their workforce and their operations.

AI satisfaction high but barriers to digital transformation persist

Overall, 95% of businesses expressed satisfaction with the outcomes of AI adoption. Medium-sized businesses showed the highest satisfaction rates at 98%, followed by sole traders (95%) and large businesses (94%). The most enthusiastic industries were Financial Services and Insurance, where 69% reported being very satisfied, followed by Construction (59%) and Business/Professional Services (42%).

However, despite widespread technology adoption, challenges persist. Across all businesses, limited financial resources emerged as the leading obstacle to more successful digital transformation (32%), followed by concerns around cybersecurity (27%) and a lack of time or capacity (25%).

Large businesses cited a ‘lack of skilled employees with appropriate skills and capabilities’ (31%) as another key obstacle, while medium-sized businesses highlighted ‘lack of a clear/well defined strategy’ (28%) and ‘not knowing which platforms are most appropriate’ (26%).

CreditorWatch’s CEO, Patrick Coghlan, says the results demonstrate both the potential and the challenges of digital transformation across industries.

“It’s encouraging to see so many businesses adopting AI and other advanced technologies,” he says.

“However, the fact that nearly half of businesses haven’t implemented any of these technologies highlights the ongoing barriers, such as limited financial resources and concerns on cybersecurity, which are holding many back from realising the benefits that can be achieved through digital transformation.

“In today’s economic climate, where businesses are under pressure from a range of external factors, digitally transforming and optimising operations with the support of futuristic technologies can help deliver cost savings and competitive advantage.”

FIND OUT MORE

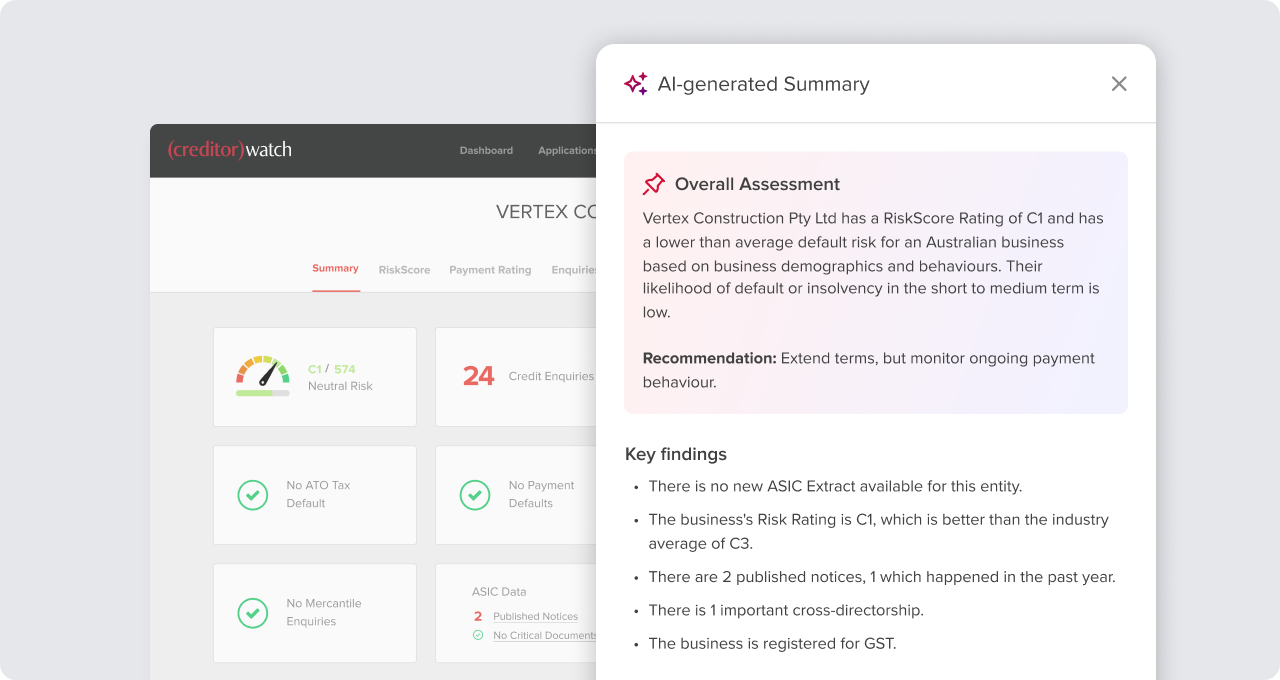

You can find more information on how CreditorWatch incorporates AI into its credit scoring system, RiskScore, here.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.