Credit reporting bureau, CreditorWatch, has released the April results for its Business Risk Index (BRI), revealing that hospitality businesses (food and beverage services) are most vulnerable to current economic conditions by a significant margin over other industries, with a 7.45 per cent chance of failure over the next 12 months.

The major challenge for businesses in the food and beverage services industry is their exposure to the discretionary spending of consumers, which has dried up as cost-of-living pressures mount.

Hospitality businesses have also struggled to manage cost pressures, such as power prices and cost of ingredients, as well as labour shortages. Food and Beverage services also tops CreditorWatch’s rankings of the rate of external administrations by industry, ATO tax debts greater than $100,000, and is ranked third for arrears (invoice payments more than 60 days late).

Small hospitality businesses bearing the brunt

The fact that so many businesses in this sector are SMEs means they are also more vulnerable to adverse economic conditions. Smaller businesses tend to have smaller cash reserves than larger businesses and are less able to take measures to cut costs such as laying off staff.

A breakdown of the business failure rate by large and small businesses confirms that it is small businesses in the food and beverage sector that are most at risk. In fact, large businesses in the sector, such as large hotel groups, have the lowest failure rate of large businesses in any sector.

CreditorWatch CEO, Patrick Coghlan, says the unfortunate fact is that conditions will get worse for businesses in the hospitality sector before they get better.

“The outlook for hospitality businesses is not likely to improve until we see a lift in consumer spending,” he says. “And that is not going to happen until the impacts of one or two rate cuts filter through to households. We don’t anticipate that being felt until at least the second half of next year.”

B2B payment defaults hit record high

B2B payment defaults are at a record high, and up 69.4 per cent year-on-year, as businesses struggle to pay their invoices.

Interest rate hikes, stubbornly high inflation, skilled labour shortages and depressed consumer demand are conspiring to squeeze margins for businesses across all industries.

CreditorWatch has also identified a strong correlation between B2B payment defaults and business failure, with a business defaulting on a payment having a 20 per cent chance of failure in the following 12 months, with the probability increasing with successive defaults. A business with four or more defaults registered against it has a 66 per cent chance of failure over the next year.

- External administrations are up 48 per cent year-on-year with the rate now well above pre-COVID levels.

- The average value of invoices, which has been consistently declining since the onset of the COVID pandemic in early 2020, actually increased in March and April and is now up six per cent year-on-year, with a seasonal component. Next month’s data will be crucial in determining if this is a reversal of the downward trend.

- Credit enquiries are relatively flat month-on-month but are down 8.1 per cent year, reflecting the decline in trading activity.

- Court actions have surged since January – now up 108 per cent year-on-year and above pre-COVID levels.

- Looking at the year-on-year change in the rate of external administrations by industry, Healthcare and Social Assistance saw a 58 per cent increase over the past 12 months, likely due to smaller NDIS providers, which proliferated during the early stages of the NDIS rollout and are now facing increasing scrutiny and competition.

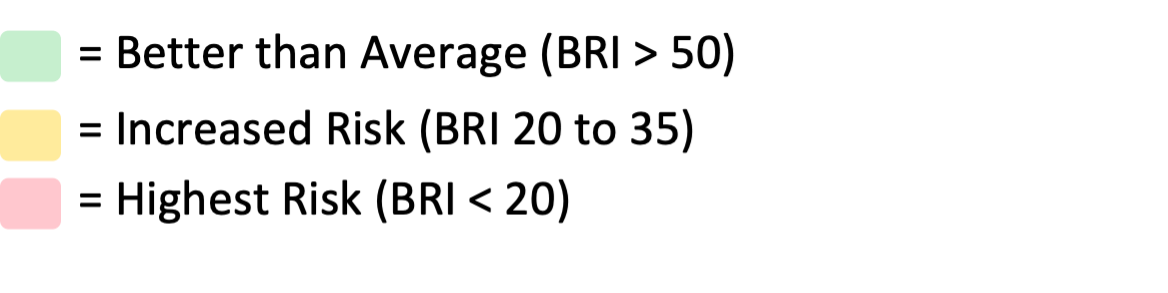

- The regions with the lowest risk of business failure remain concentrated around regional Victoria, inner-Adelaide and North Queensland. Norwood-Payneham-St Peters in South Australia, is the top-ranked region, followed by Unley, also in South Australia, and Ballarat in Victoria.

- The regions with the highest risk of business failure are around Western Sydney (six of the top 10) and South-East Queensland, with Bringelly-Green Valley (NSW) the top-ranked region, followed by Merrylands-Guildford and Canterbury, all in Western Sydney.

CreditorWatch Chief Economist, Anneke Thompson, says very weak consumer spending is noticeably hurting customer facing businesses, particularly those that are classified as smaller businesses.

“While Australia is far from being in a technical recession, and Treasury is still forecasting positive, albeit weak, GDP growth over the three-year outlook, business conditions will feel recessionary to most businesses that rely on consumer spending, particularly those businesses located in ‘mortgage belt’ areas of our capital cities,” she says.

Without even feeling the impact of the Federal Government’s recently announced reduction in international student visa numbers, the education and training sector has recorded a dramatic 104 per cent increase in the rate of external administrations.

There is no doubt that the rate of external administrations in this sector will increase over the next year, as smaller colleges offering vocational courses are significantly impacted by slowing demand. The good news is that this slowing in demand may help reduce inflation in the education sector, which is one part of the CPI basket, where inflation has proved ‘sticky’. We expect consolidation in this sector as education providers fold or restructure in order to cope with a significant reduction in international student numbers over the next few years.

The Healthcare and Social Assistance sector is typically considered quite a safe industry, as it is a non-discretionary service and has a high degree of government support. Indeed, inflation in the ‘health’ category of CPI is running at 4.1 per cent, as at March 2024. However, smaller healthcare and social assistance businesses are at increasing risk of insolvency, according to our latest BRI data.

Insolvencies in this category have increased 46 per cent year on year. While there will be varied reasons as to why businesses in this category are becoming insolvent at increasing rates, one likely cause is the large increase in NDIS providers in recent years.

Many of these businesses are small, sole proprietor businesses, which we know are more vulnerable to tough economic conditions. Running costs of aged and childcare facilities have also been increasing at high rates, and this is also making trading conditions tough even in an environment of strong demand.

The best performing regions continue to be those with a higher proportion of older businesses, and older residents. Adelaide City continues to rank as the safest CBD in terms of insolvency risk. This CBD benefits from relatively low rents, and large numbers of both workers and international students.

The industries with the highest probability of business failure over the next 12 months are:

- Food and Beverage Services: 7.45%

- Arts and Recreation Services: 5.53%

- Accommodation: 5.07%

The industries with the lowest probability of default over the next 12 months are:

- Agriculture, Forestry and Fishing: 3.28%

- Health Care and Social Assistance: 3.71%

- Financial and Insurance Services: 3.83%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

In addition to Food and Beverage Services sector, the Arts and Entertainment and Accommodation sectors have the highest business failure rate. This data includes ASIC strike offs which, in most cases, is businesses closing voluntarily.

Anecdotally, accommodation providers in high tourism areas are experiencing weaker demand, as more and more Australian households put travel plans on hold. It appears that even shorter, cheaper local holidays are now being reconsidered by cash-strapped households.

Weaker demand will also be felt more acutely by Australian hotels, motels and resorts given most of them experienced very strong demand in the two years post COVID and invested and put on staff in large numbers as a result.

The outlook is for continued tough business operating conditions, at least until mid 2025, when lower interest rates should finally provide some relief for cash strapped Australian households. It is highly unlikely that the $300 energy rebate for each household that was announced in the Federal Budget will be enough to persuade consumers to open their wallets to any great degree.

Lower income tax rates from July 1 may provide some small benefit to consumers, however, given continued high mortgage repayments, rents, food and transport costs, this is unlikely to alleviate the financial pressure enough in most Australian households to warrant an improvement in the outlook over 2024. For that reason, we unfortunately expect insolvency rates to rise through to the middle of 2025.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.