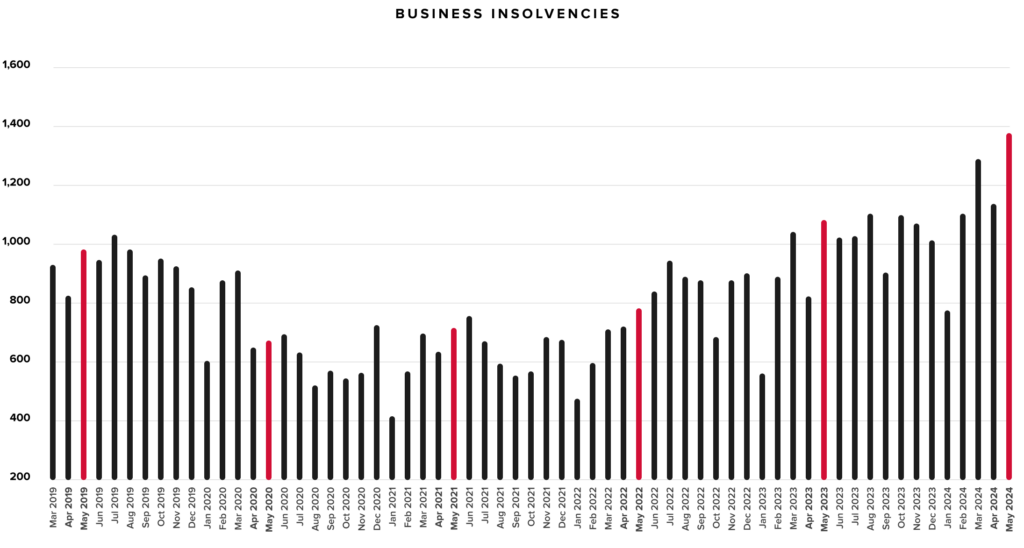

Credit reporting bureau, CreditorWatch, has released the May results for its Business Risk Index (BRI), revealing that insolvencies for Australian businesses are now at a record high as the impacts of stubbornly high inflation, interest rate increases and declining consumer demand squeeze margins.

CreditorWatch’s data shows an average increase in the rate of insolvencies of 38 per cent over the year to May 2024 across all industries. The total number of insolvencies is up 34 per cent year-on-year and 41 per cent above its pre-COVID maximum.

Data sources: ASIC database direct link

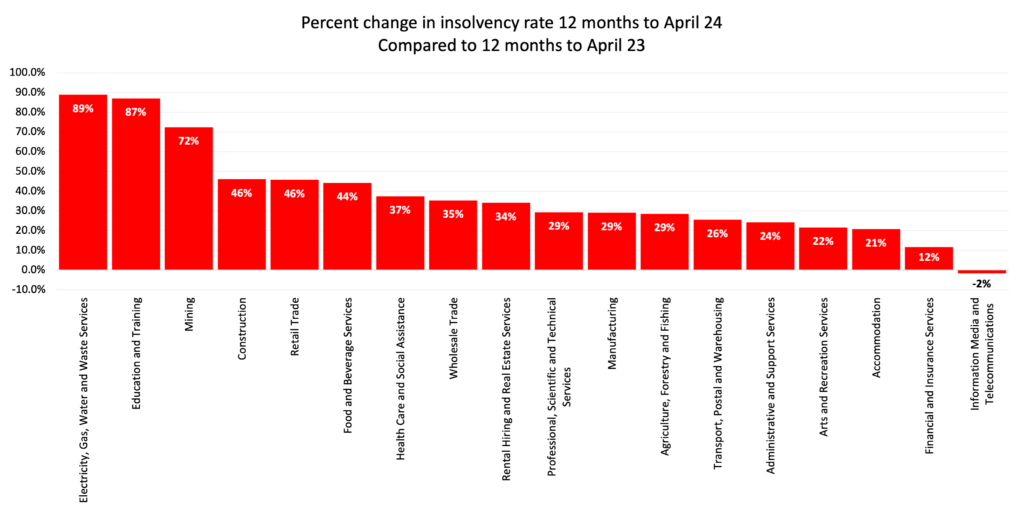

Insolvency rate up 38% on average for all industries

Electricity, Gas, Water and Waste Services tops the list of industries by rate of increase in insolvencies, with an 89 per cent increase year-on-year, followed by Education and Training (87 per cent) and Mining (72 per cent). Information, Media and Telecommunications was the only industry to see an improvement in the rate of insolvencies, with a drop of two per cent.

The rise in insolvencies in the Electricity, Gas and Waste Services is driven mostly by increases in insolvencies in small businesses in this sector, which are entering external administration at a rate of 1.16 per cent as at May 2024, compared to only 0.51 per cent in May 2023.

In the mining sector, insolvency rates have risen steeply for both small and large businesses, mostly in the mining services sector. The Education and Training sector has a very wide variance of insolvency rates between small and large businesses, with almost all insolvencies in the small business sector. Conditions in this sector are likely to get far more challenging as international student numbers fall.

Data Sources: CreditorWatch RiskScore Credit Rating average Business Failure Rate by Industry

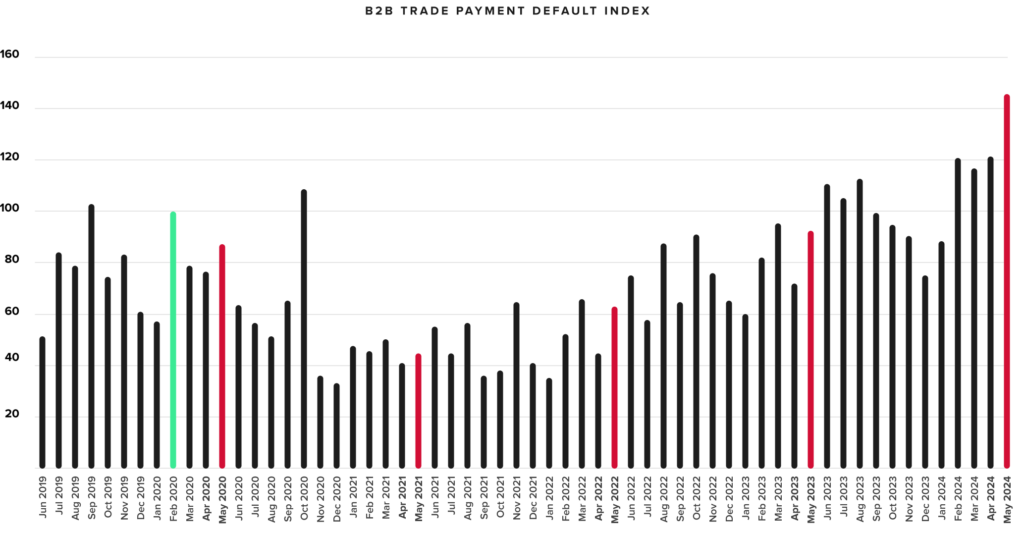

Business payment defaults smash previous record

B2B payment defaults also hit a new record in May, up 21 per cent on April’s record and a 58 per cent year-on-year increase.

CreditorWatch has identified a strong correlation between payment defaults and business failure, with a business having a 20 per cent chance of failure in the following 12 months if it has a default registered against it. This rises to 42 per cent for two defaults and 62 per cent for three.

Data Sources: CreditorWatch Trade Payment default data (lodged defaults)

Court actions jump

Court actions continue to rise and are now sitting above pre-COVID levels, indicating that creditors have resumed their regular collections activity. CreditorWatch’s May data shows that they are up 63 per cent year-on-year.

CreditorWatch CEO, Patrick Coghlan, says this combination of deteriorations in CreditorWatch’s key measures of business health reflects the increasing impact of cost-of-living pressures on consumers.

“Multiple interest rate hikes and stubbornly high inflation have forced consumers at all income levels to cut back on spending,” he says.

“We don’t expect a meaningful turnaround in consumer confidence until the impact of at least two rate cuts has been felt, which won’t be until well into 2025.

“The only bright-spot for households is next-month’s tax cuts, although we don’t see much of this going to discretionary spending.”

Other Key Business Risk Index insights for May:

- Food and Beverage Services is the most at-risk industry, with a 7.54 per cent failure rate. It is followed by Administrative and Support Services (5.43 per cent) and Arts and Recreation Services (5.40 per cent).

- The Mining sector saw a massive 41 per cent year-on-year increase in the failure rate, followed by Food and Beverage Services (20 per cent) and Construction (15 per cent).

- It is also the top-ranked industry for the rate of annual insolvencies (1.74 percent)

- Construction is experiencing the highest proportion of late payments with 10.46 per cent of businesses having payments 60-plus days late. This is followed by Food and Beverage Services (8.75 per cent) and Financial and Insurance Services (8.74 per cent).

- Food and Beverage Services is the top ranked industry for outstanding ATO tax debts above $100,000, with a rate of 1.70 per cent. Construction and Transport, Postal and Warehousing are next at 1.21 per cent and 0.91 per cent respectively.

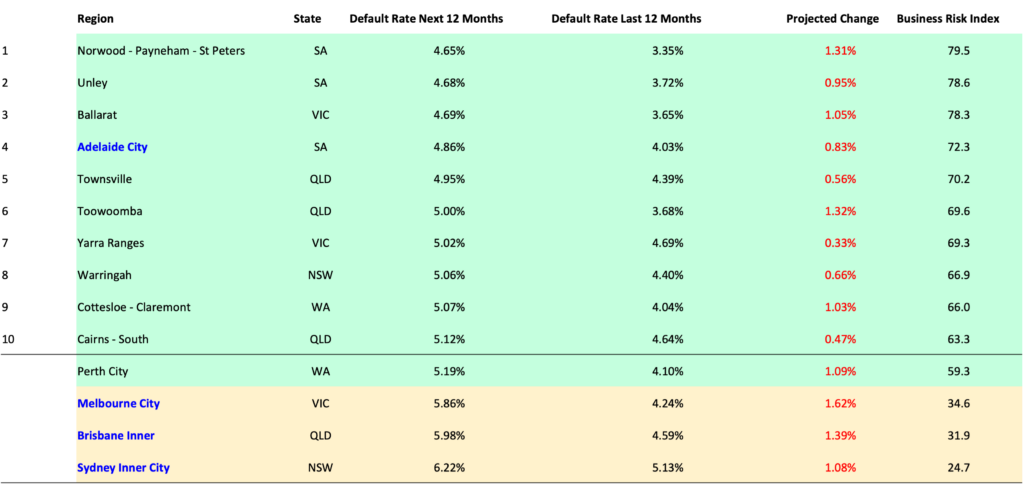

- The regions with the lowest risk of business failure are concentrated around regional Victoria, inner-Adelaide and North Queensland. Norwood-Payneham-St Peters in South Australia, is the top-ranked region (3.35 per cent chance of default), followed by Unley, also in South Australia, and Ballarat in Victoria.

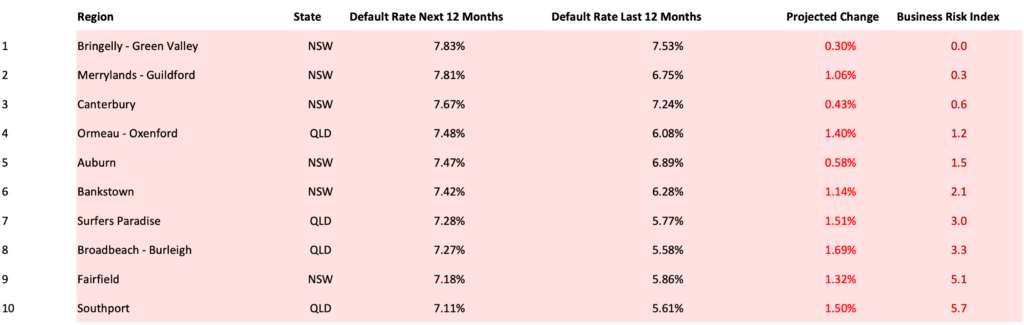

- The regions with the highest risk of business failure are around Western Sydney (six of the top 10) and South-East Queensland, with Bringelly-Green Valley (NSW) the top-ranked region (7.53 per cent chance of default), followed by Merrylands-Guildford and Canterbury, all in Western Sydney.

CreditorWatch Chief Economist, Anneke Thompson, says record high trade payment defaults point to increasing cash flow problems within the Australian business sector.

“We have known for some time now that consumers have pulled back on spending quite dramatically as high interest rates and inflation smashed household budgets,” she says.

“This trend took some time to flow through to businesses but is now showing up in the data in the form of increasing late payment rates and rising court actions, as well as increased business failures and insolvencies.

Despite income tax cuts taking effect in July 2024, it is likely that the remainder of 2024 will be extremely challenging for businesses, as interest rates are unlikely to fall before the end of the year, and money flowing through the economy is focused on non-discretionary goods and services.

Business failure rate by industry

The industries with the highest business failure rates:

- Food and Beverage Services: 7.54%

- Administrative and Support Services: 5.43%

- Arts and Recreation Services: 5.40%

The industries with the lowest business failure rates:

- Agriculture, Forestry and Fishing: 3.27%

- Health Care and Social Assistance: 3.74%

- Financial and Insurance Services: 3.93%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration.

Best performing regions and CBDs (5,000+ businesses)

The best performing regions continue to be those with a higher proportion of older businesses, and older residents. Adelaide City continues to rank as the safest CBD in terms of insolvency risk. This CBD benefits from relatively low rents, and large numbers of both workers and international students.

Data Sources: CreditorWatch Business Risk Index

The Australian economy has shown remarkable resilience in the face of rising interest rates and high inflation. The labour market has been very strong, with businesses still hiring new staff in good numbers.

However, record high migration may have been disguising underlying stress in the economy. Now that migration is moderating, and both consumers and businesses are recognising that interest rates will stay high for some time, confidence is now falling, and businesses are showing clear signs of financial stress.

We expect that business trading conditions for the remainder of 2024 will be some of the hardest in recent memory, and that insolvency rates – already sitting higher than their pre-COVID peaks – will rise further from here and not begin to moderate until the RBA provides some interest rate relief.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.