The silly season is upon us and chances are your calendar is already beginning to fill up with end of year catchups and Christmas parties. Then there are the many meetings to discuss projects that must be completed before we all head off for a bit of respite and sun.

What should be on your list, but often isn’t, is your cash flow protection plan for the holiday period. If your accounts receivables aren’t managed properly over this time, you can return to a dire cash flow problem in the new year that can take months to recover from.

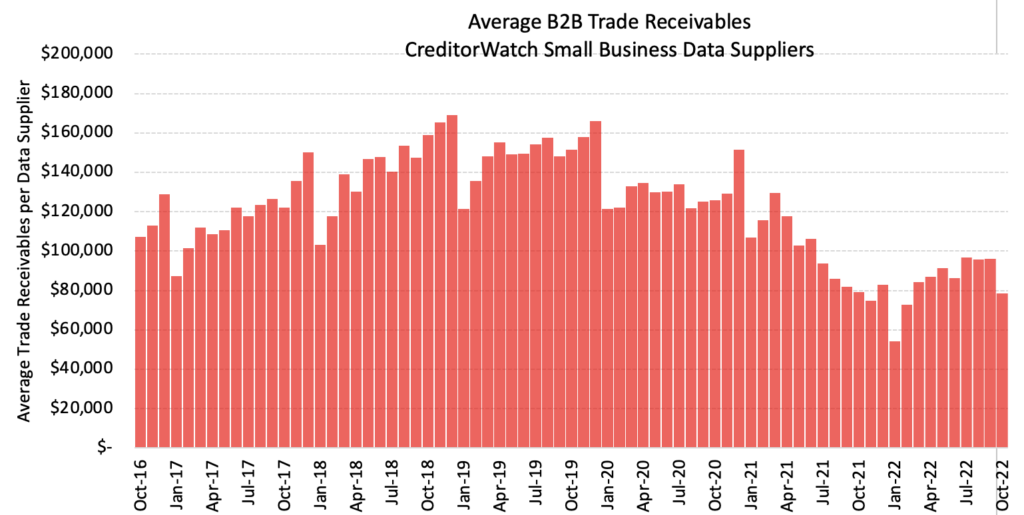

CreditorWatch’s Business Risk Index data on trade receivables, shows that Australian businesses typically experience a seasonal decline in revenue of around 20 per cent over January/February.

WHAT’S THE WORST THAT CAN HAPPEN?

When you’ve got a long list of tasks to tick off before you head to the beach, debtor management doesn’t often make it to the top of the list. For businesses that don’t manage debtors well over this time though, the consequences can be great. They include:

- A lack of cash flow

- Late payment to suppliersand inability to take advantage of early payment discounts

- A negative impact on your credit rating

- Lost productivity due to hours spent chasing overdue accounts

At the best of times no one wants to deal with these issues. Certainly not when you’ve just come back from a relaxing holiday. With a bit of planning however and the right tools, you can have your holiday and come back to strong cash flow too.

KEY ACTIONS FOR CASH FLOW PROTECTION THESE HOLIDAYS

With a few simple steps you can have your holiday, confident that your credit control is in good shape. We’ve outlined key actions you can take to protect your cash flow over the holiday period, broken down into pre, during and after your holiday.

PRIOR TO YOUR HOLIDAY CLOSE-DOWN:

1. MINIMISE OVERDUES

If you’re looking for a relaxing holiday, then heading into December with a mountain of overdue invoices is not setting you up for success. As we roll toward the end of the year, set time aside for you or your team to assess your current accounts receivables situation. Pick up the phone and chat to customers whose invoices are overdue. Be persistent. You want as little outstanding as possible when you close for the holidays.

2. SEND PRE-REMINDERS

Make sure you contact all debtors in advance (and try not to make it in those last couple of days before offices close). Ensure they have everything they need to pay your invoice. Remind them of payment terms. Encourage advance payment if they will be away on the due date and can’t set the payment up now. If you don’t get a response via email, then pick up the phone to confirm this. This is especially important for customers who tend to pay late. Remember, this should be done for every account that will be due, not just the high value invoices.

3. HAVE A HIT LIST

This can be a handy way to ensure you’re keeping cash flowing even if all your invoices aren’t paid on time during the holiday period. Identify any large invoices that will be due just prior to, during or just after the holiday period. Getting these paid could make a crucial difference in your ability to pay suppliers and employees. Once you’ve got that hit list sorted, get your best people on the phones. Check in with these customers. As with pre-reminders you want to ensure that there are no barriers to them paying the invoice on time (nothing disputed, PO# is available if needed, invoice is correct, they know how to pay).

Once you’ve established all is good to go, get confirmation from them on the date that you can expect payment to be paid. Again, if the due date falls during the holiday period, remind them that the invoice still needs to be paid and encourage them to pay early if they are not able to set up a payment for that date in advance.

To take your hit list to the next level and minimise your credit risk further, sign up to CreditorWatch’s RiskScore tool.

DURING YOUR CLOSE-DOWN PERIOD

1. KEEP SENDING REMINDERS

Time doesn’t stop ticking while you’re on the beach. Just as you’ll continue to have supplier invoices due or employees to be paid, your invoices will also be up for payment. Make sure you’ve got a process for reminders to be sent out over this time. Reminders should be sent for all invoices due, not just the large ones. If you’re worried about maintaining relationships over this time, remember reminders can be friendly. Just ensure the key points a clear, and easily seen on the invoice – the total amount due, due date, options for payment, and any fees incurred for overdue payment.

BACK IN THE OFFICE

1. REVIEW YOUR HIT LIST

With these measures in place, when you do return to the office you shouldn’t be overwhelmed with overdue invoices. But if your accounts receivables isn’t quite where you want it on your return then go back and review your hit list. Anyone on this list who still hasn’t paid their invoice should be prioritised and a phone call made to them as soon as possible.

2. YEAR-ROUND CASH FLOW PROECTION

If cash flow is an issue for you this holiday season, then chances are you haven’t automated your credit control. If you’re serious about cash flow protection then automating your credit control before closing for the summer break is one of the smartest and most cost-effective actions you can take. Automated credit control helps you collect more, faster, with less resources. It also means that you can approach the new year on the front foot with an advantage over your competitors rather than recovering from a period of low cash flow.

CreditorWatch Collect takes your repetitive credit control tasks and puts them into a best practice, automated workflow. It is fast to set up, integrates in just a few clicks with most popular accounting systems (Xero, MYOB, QuickBooks) and delivers results almost immediately.

Start automating your credit control now and breathe easy this holiday season. Get in touch with our expert team to get started today.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.