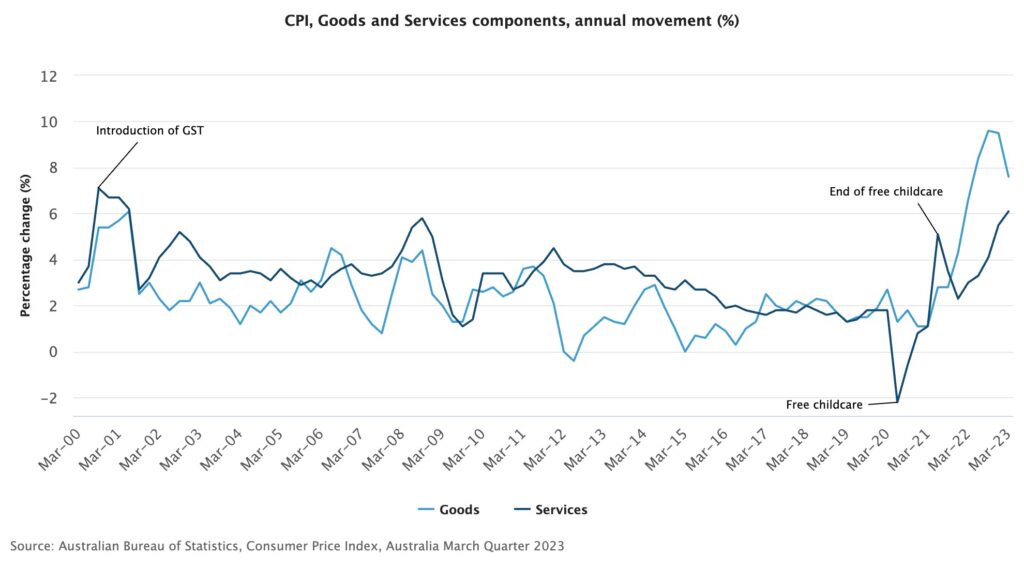

This month’s economic data was dominated by the release of quarterly CPI data. While an increase of 7.0% for the March quarter was promising in that it showed inflation is definitely reducing (down from 7.8% for December quarter), it is still high, and actually increasing in the services sector.

Still, the RBA has indicated that current monetary policy settings are in restrictive territory, and they appear to be working to decrease demand for goods, particularly discretionary goods. Services side inflation is being driven by strong migration driving up demand for and cost of rents, education and medical services, while energy costs are rising for reasons unrelated to demand or the cash rate.

From a global perspective, global banking and credit conditions remained fairly stable, and there were no major solvency issues to report. The technology sector still appears to be shedding jobs at a scale larger than any other industry, as venture capital dries up. This is particularly evident in the US, where the technology sector went on an employment ‘binge’ over the pandemic period.

Inflation

March quarter inflation was down to 7.0%, down from 7.8% in the December quarter. Consumers seem to have pulled back on discretionary items, and those items that consumers had purchased in larger than normal quantities in 2022.

Prices in the clothing and footwear, and furnishings, household equipment and services actually reduced over the quarter, by 2.6% and 0.5% respectively. Strong quarterly price rises were recorded in Education (5.3%) as overseas students returned, and Health (3.8%) as more and more doctors stop bulk billing.

Interest Rates

If we are not already at the peak of this monetary policy tightening cycle, we are very, very close. The inflation result was a mixed bag, and services inflation will likely be making the RBA board nervous. They will be aware, however, that some strong price rises in this category could not be helped by higher interest rates.

Indeed, for a category like rents, higher interest rates can actually feed inflation. So there will be a bit to consider at the May meeting. Given financial markets have factored in almost no chance of an interest rate increase in May, it is highly unlikely the board will surprise borrowers with a further increase, just as many people are still coming off fixed rate home loans.

Labour Force

The labour force remains in good shape, and is a key reason why businesses still remain relatively confident on conditions ahead. The unemployment rate remained at 3.5% this month (seasonally adjusted) while overall employment increased by 53,000. Thus far, restrictive monetary policy settings have had no impact on employment, which while positive for businesses, will slow down the return of inflation to the target band.

Retail Trade

Retail trade continues to remain subdued, helping to ease inflation in the goods sector. Trade over the month of February only increased by 0.20%, or 6.4% year on year. This was well down on mid 2022, when year-on-year retail trade in August had increased by 19%, and month on month by 0.87%.

Business and Consumer Sentiment

Consumer sentiment remains near recessionary levels, and has been this low for some time. While there was slight bounce back in confidence this month, the overall trend shows it is bumping along at very low levels by historical standards.

Business confidence, however, is still reasonably good, and businesses are still reporting good conditions. The strength of the labour force and migration is likely feeding into this result, as there is still a steady flow of additional people and income to keep businesses ticking over.

Global Conditions

Australia’s economy still sits in an enviable position compared to many other economies. Strong regulation of our banking system, strong employment and migration and solid business confidence mean that on a global comparison, Australia is a fairly low risk environment.

We won’t, however, be immune to any contagion risk should conditions overseas worsen. Stability in global credit markets is still an area of concern, and the risk of more banks – particularly smaller US banks that have large exposure to the CRE sector – going under is still very real.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.