The Australian economy ticked along steadily over the course of August. Retail trade increased very slightly, although on an inflation adjusted basis, spending continues to fall. Monthly inflation maintained its downward trajectory, with prices increasing by 4.7% over the year to July 2023, down from 5.7% over the year to June 2023.

The Intergenerational Report 2023 was released on August 24, forecasting that economic growth over the next 40 years is forecast to grow at an average rate of 2.2% a year, a slower rate than the past 40 years. Australia’s population is projected to grow more slowly over the next 40 years – at an average of 1.1% a year, compared to 1.4% over the past 40 years. The population is projected to reach 40.5 million in 2062–63, similar to projections in the 2021 IGR.

Importantly, the number of Australians aged 65 and over will more than double and the number aged 85 and over will more than triple. The number of centenarians is expected to increase six-fold. The report also identified five key long term spending pressures: health, aged care, the National Disability Insurance Scheme, defence, and debt interest payments. These are projected to rise from around one-third to around one-half of all government spending in 40 years’ time.

Inflation continues to ease

Monthly CPI data continues to show an easing of price rises in most categories in the CPI basket. The exceptions, however, are rents, which rose by 7.6% over the year to July, up from 7.3% in June. Electricity prices also rose by a substantial 15.7% over the year to July. This increase even considers the Energy Bill Relief Fund. If this had not been included, monthly the increase in electricity bills would have risen by 19.2%, instead of 6.0%.

Food and beverage prices continue to ease, thanks to better growing conditions. There was even a fall of 5.4% in the overall price of fresh food and vegetables. However, meals out and takeaway food inflation remains steady, and largely reflects the needs of business owners to pass on higher utility and rent costs on to their patrons.

Overall, inflation is moving in the right direction and is unlikely to give the RBA any reason to increase rates at the September meeting.

Unemployment remains low… for now

On a seasonally adjusted basis, the unemployment rate in Australia climbed by 0.2 percentage points, to a still very low 3.7%. The number of unemployment people in Australia climbed by almost 36,000 people, with almost all this increase being felt in two states, Queensland and NSW. The unemployment rate in Queensland rose by a substantial 0.8% on a seasonally adjusted basis, to 4.5%. While this is only one month’s worth of data, and there is no consistent trend seen yet in weakness in the labour force in these two states, CreditorWatch’s Business Risk Index data has consistently highlighted areas in Western Sydney and SE Queensland as being the most at risk of business failure. These areas have a higher-than-average proportion of workers in casual or insecure work, and businesses that have been in operation for a relatively short period of time and are therefore much more susceptible to fluctuations in demand.

Overall, Australia’s unemployment rate remains low by historic standards, but there are clear signs now that more weakness in the labour force can be expected, given the deteriorating economic conditions, led by very weak consumer demand.

Retail trade growth slows

July’s retail trade figures revealed a small increase in spending over the month, predominantly in the Goods sector. However, this follows negative growth in June 2023, and in year-on-year terms, seasonally adjusted retail trade grew by just 2.1%, versus 2.3% in June 2023. Retail turnover is now growing more slowly than in 2019, the last year for pre-COVID data, and also a time when pricing growth was very subdued.

The department store category recorded the highest monthly growth, at 3.6%. Some of the larger Discount Department Stores (DDS) such as Big W, did report in their annual earnings calls that they were noticing a trend of new consumers shopping in their stores, as they downshift to a cheaper product. Household goods spending within DDS’ is still very subdued, but health and beauty is showing resilience.

Interestingly, food retailing was flat, which may be because of some pricing moderation in the fresh food category.

Business and consumer sentiment subdued

Consumer confidence continues to bump along at near record low levels, falling by 0.4% in July 2023. Consumers are unlikely to report any improvement in confidence until inflation looks to be firmly in the rearview mirror. Unfortunately, NAB’s Business Survey for July 2023, indicated that cost pressures upon businesses remain elevated, with both price and cost growth rising sharply over the month.

Unsurprisingly, business confidence is weakest in the retail sector, at -12 index points. In trend terms, business confidence remains at below average levels, although it did rise slightly in the July 2023 figures released. The retail sector looks to be entering a period of increased business risk, and we are likely to hear more stories of insolvencies and business liquidations in the retail sector in the coming months.

The continued price pressures coupled with anaemic consumer confidence are weighing heavily on profitability, particularly in the household goods and department store sectors. Both sectors are selling less product than they did the previous quarter, despite very strong population growth. For furniture, electrical and appliance retailers as well as residential construction wholesalers, conditions are very challenged, as consumers can quite easily tighten spending in these areas, and also did a lot of their household good spending during the lockdown periods. Low residential sales volumes and new dwelling completions also weigh heavily on these sectors.

Interest rates

There does appear to be acknowledgment from the RBA that unlike goods (especially discretionary goods) price rises in rents, electricity, insurance and education cannot be brought under control by further monetary policy tightening. Nevertheless, higher services inflation will slow the downward trajectory of overall inflation, and this is likely to mean that interest rates need to be maintained at their current contractionary level at least until mid 2024.

Global conditions

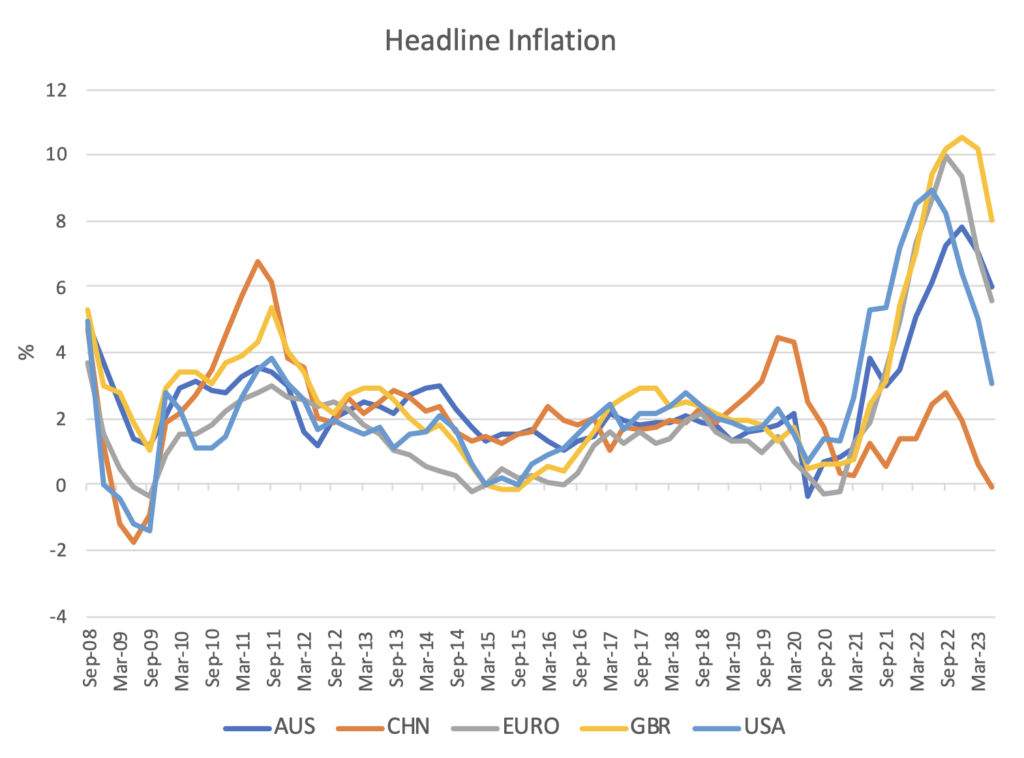

The behaviour of inflation in most developed countries is behaving in a very similar manner to inflation in Australia. Headline inflation in the USA is falling sharply and peaked earlier than in most major economies. Given the still very strong labour force data coming out the USA, there is increasing hope that they can engineer a ‘soft landing’ while getting inflation under control.

The Chinese economy, however, is now dealing with deflation, in extreme contrast to most of the rest of the world. Chinese consumers are very sceptical about spending, dwelling sales have slowed significantly, affecting their massive property market which relies on new sales to pay for construction of previously sold dwellings. Youth unemployment is now so high in China, they have simply stopped reporting statistics. It appears that the huge GDP growth numbers that we have become accustomed to coming out of China won’t be repeated, and if major brave economic decisions aren’t taken, their economy has no hope of overtaking the size of the US economy.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.