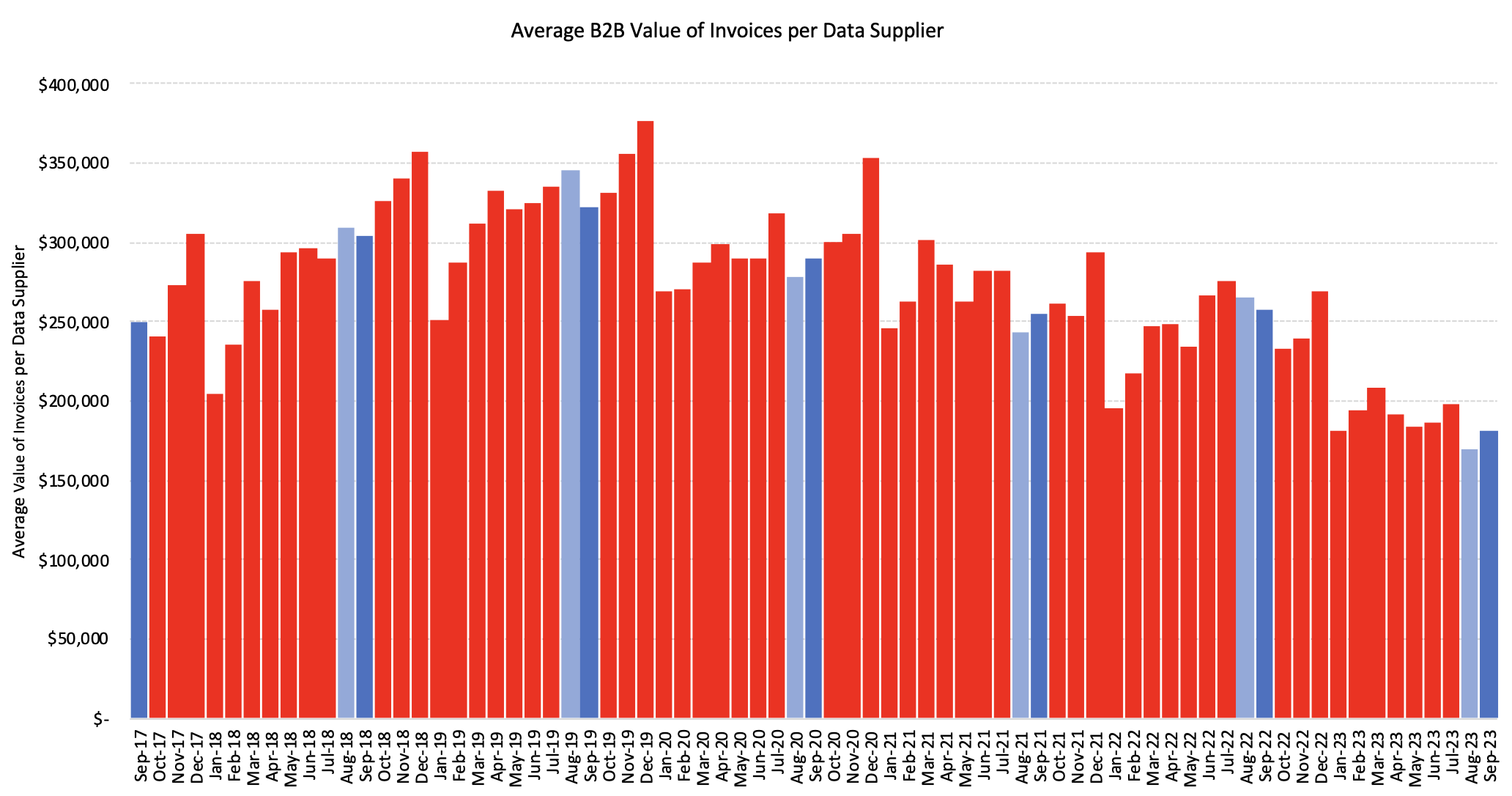

The September 2023 CreditorWatch Business Risk Index (BRI) has revealed that the contraction of Australian business activity may have eased but it remains at a low ebb, with the average value of B2B invoices down 30% year-on-year and well below pre-COVID levels.

There was a minor lift in invoice value from August to September, in line with the lift in forward orders reported by the NAB Business Survey, but a reversal of the downward trend is a long way off, due in large part to persistently low consumer demand. Persistently low invoice values are particularly concerning in a high-inflation environment.

The average value of invoices is a critical metric on the health of Australian businesses as it impacts companies along the supply chain in multiple industries.

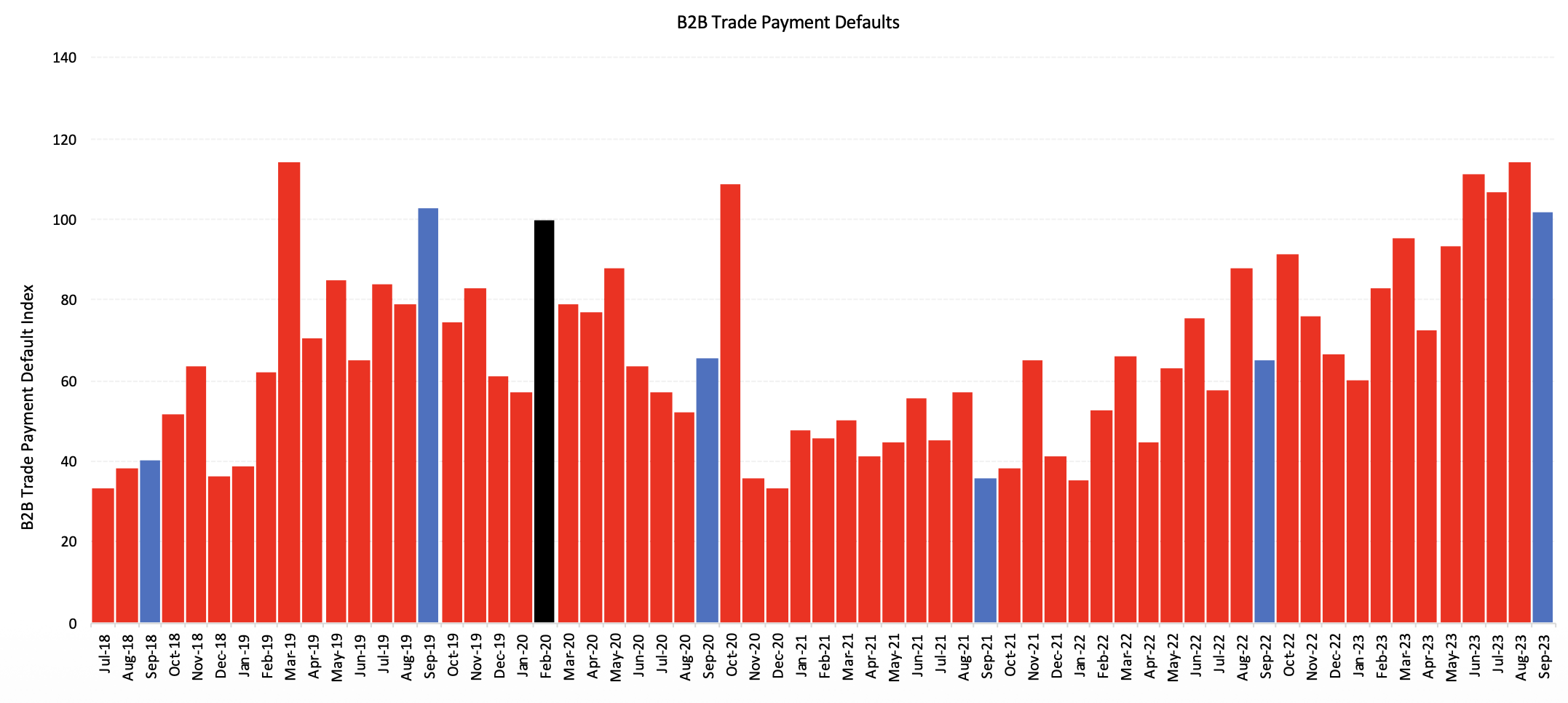

CreditorWatch’s other key business indicators, such as trade payment defaults, credit enquiries and court actions, also reflect the challenging conditions confronting businesses.

External administrations came off the boil on September, after surging to above pre-COVID levels since March this year, although it remains to be seen if the peak is passed.

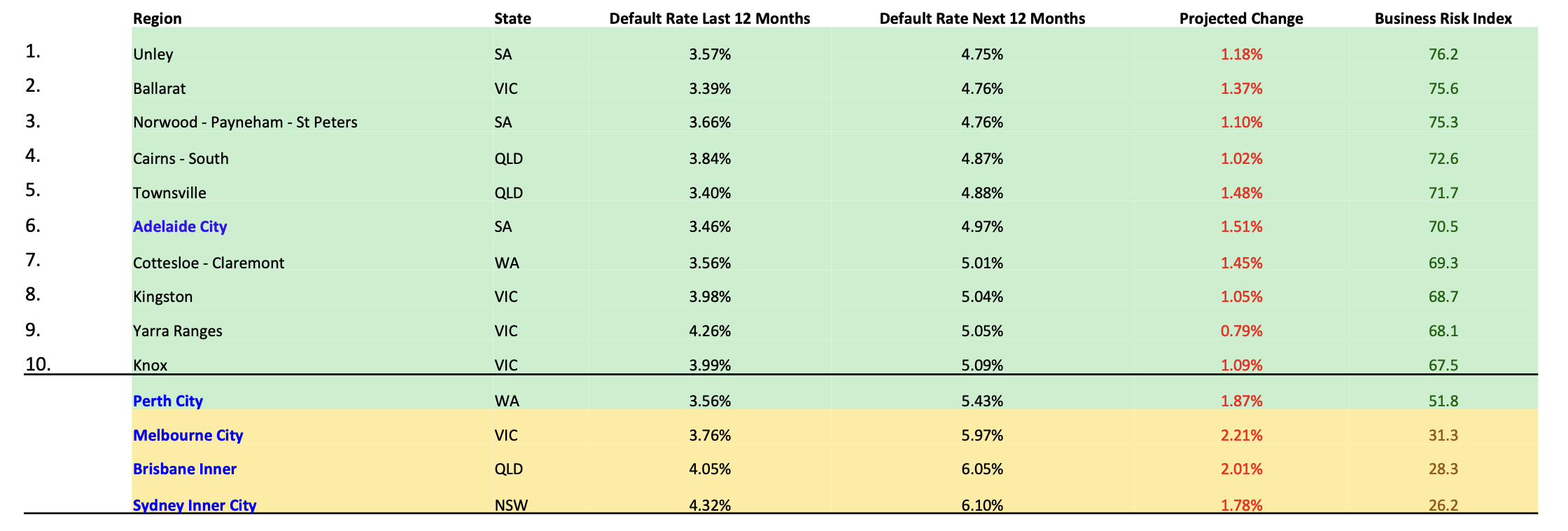

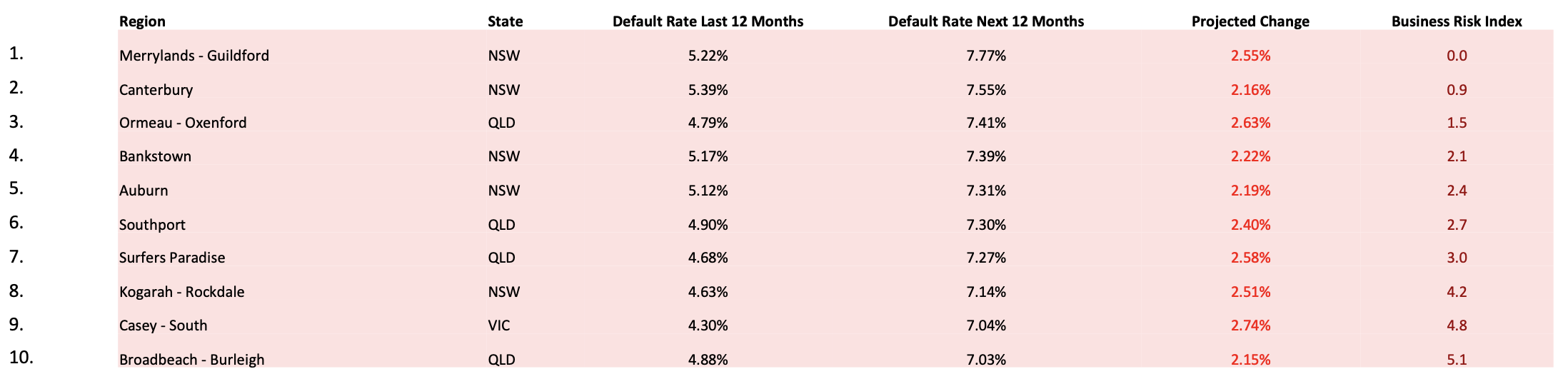

In terms of regional risk, Western Sydney is an unfortunate outperformer by a large margin. It has eight of the top 20 regions in Australia most at risk of business failure. At a state level, 16 of the 20 worst performing regions in NSW are also in Western Sydney.

This region is very sensitive to interest rate changes, given the relatively high levels of debt among both businesses and households, and lower than average incomes. Consumers in Western Sydney are far more likely than the average consumer to be reducing their discretionary spending, and this has flow on effects for businesses.

- Average value of invoices for Australian businesses has dropped 30% over the past 12 months.

- B2B trade payment defaults continue to trend upward, with a 57% year-on-year increase. Payment defaults are a key predictor of future business failures.

- External administrations dropped 24% from August to September and remain flat year-on-year. It remains to be seen if they have passed their peak.

- Credit enquiries were down 6% MoM but remain up 58% year-on-year.

- Court actions are up 6% over the last quarter but remain flat YoY.

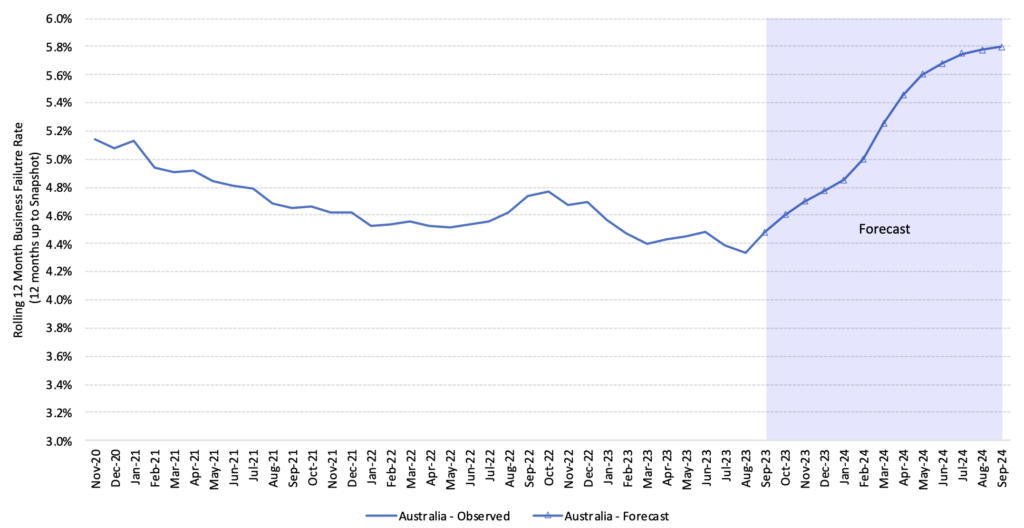

- CreditorWatch’s national business failure rate prediction for the next 12 months is for an increase from the current rate of 4.54% to 5.76%.

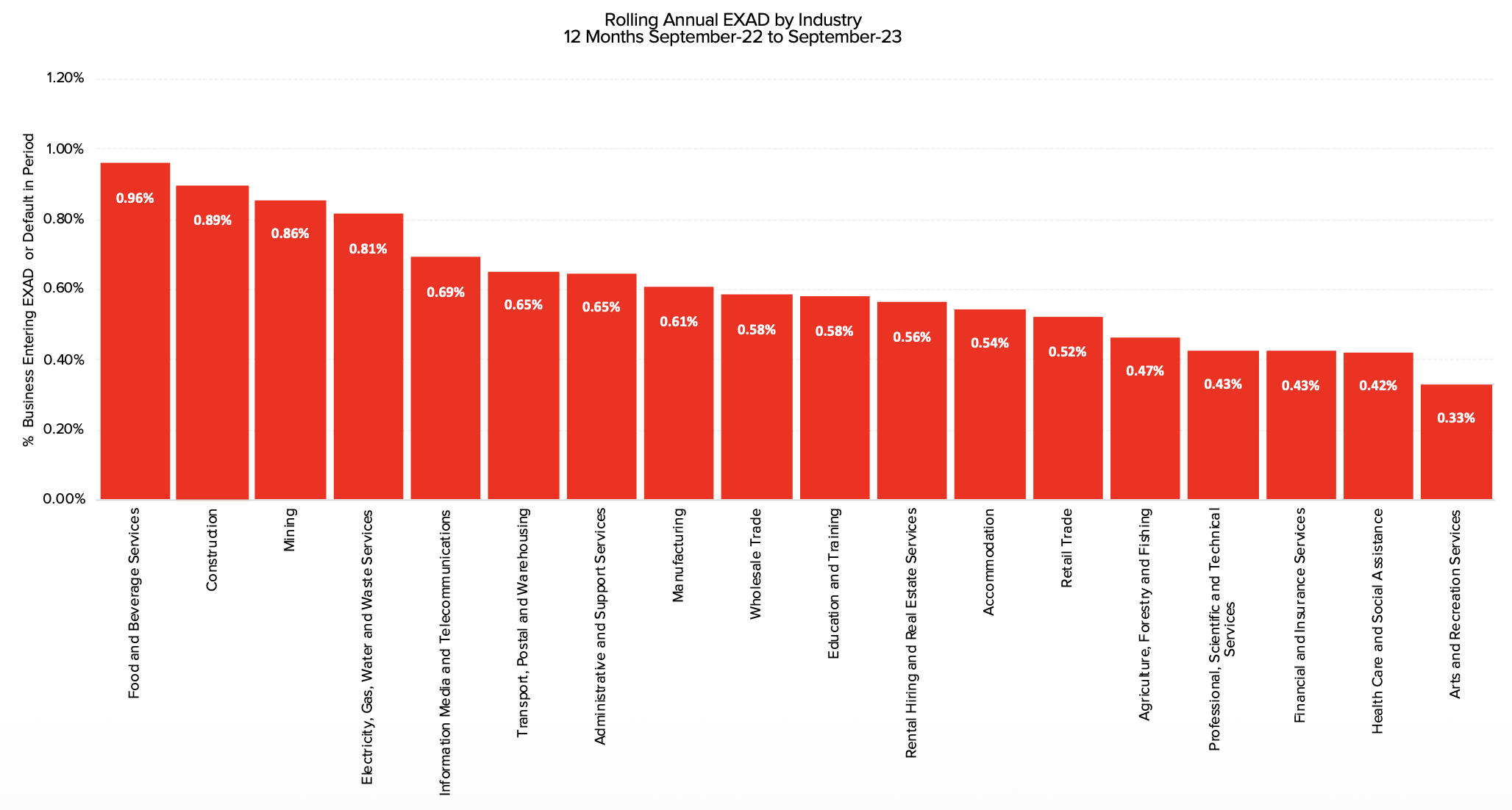

- Businesses in the food and beverage services sector remain the most at risk of payment defaults (6.8%) by a considerable margin. Transport, Postal and Warehousing is the next riskiest industry at 4.5%.

- Unley in South Australia is the region with the lowest risk of business failure (across regions with more than 5,000 businesses), followed by Ballarat in Victoria and Norwood-Payneham-St Peters in South Australia.

- The regions with the highest insolvency risk continue to cluster around Western Sydney and South-East Queensland, with Merrylands-Guildford (NSW) recording a forecast default rate of 7.77% for this time next year. This is followed by Canterbury (NSW) and Ormeau-Oxford (QLD).

CreditorWatch CEO, Patrick Coghlan, says easing inflation is a positive sign for business activity going into 2024 but conditions remain challenging.

“Rents, energy prices and the cost of services are keeping the heat in inflation but it’s encouraging to see some of the other drivers normalising. However, our forecast is still for the business failure rate to increase over the next 12 months.”

CreditorWatch Chief Economist, Anneke Thompson, says business conditions, particularly among small businesses which are more sensitive to drops in consumer spending, are likely to remain subdued until at least mid 2024, when cuts to the cash rate are forecast.

The average value of invoices has increased slightly, although there has been a noticeable downward trend since late 2019. Given that, in an inflationary environment, we would expect this indicator to be going up, it is somewhat concerning for the health of the economy that it is moving in the opposite direction.

Trade payment defaults continue to be elevated, although there was a slight reduction in the number of defaults lodged in September. We would hope that a stabilisation of the cash rate means better certainty of future cash flow for businesses, and more businesses are able to pay their invoices on time.

The challenging operating environment means that we are forecasting a sharp rise in the business failure rate over the next 12 months. While high interest rates and reduced consumer spending are playing a large part in this, tax debts are also an important factor. Many businesses took the opportunity during the pandemic to defer tax bills. Many of these are now due, and the ATO is taking a more hard-line approach to collecting these debts.

The Adelaide CBD continues to be the only CBD to feature in the Top 10 best performing regions in the country. Retail spending has held up better in Adelaide as households have less debt on average than their eastern seaboard counterparts. Rents are also cheaper in the Adelaide CBD than Sydney, Melbourne and Brisbane, and therefore businesses are better able to withstand any drop in demand. Another two regions in inner Adelaide, Unley and Norwood-Payneham-St Peters, feature in our Top 10 areas with the least risk of business failure.

In contrast to some areas of Adelaide, the highly indebted areas of Western Sydney and South-East Queensland feature heavily in the Top 10 riskiest regions in the country. These areas have a higher proportion of businesses that are in more risky industries, such as transport postal and warehousing. Given the general younger age of the population, the businesses in this area tend to be younger as well, and thus more likely to have higher levels of debt and lower levels of cash reserves than average.

Consumers in these areas are also pulling back on discretionary spending harder than in other areas of the country, given the relatively low ranking on the Index of Relative Social Advantage.

The industries with the highest probability of business failure over the next 12 months are:

- Food and Beverage Services: 6.83%

- Transport, Postal and Warehousing: 4.47%

- Arts and Recreation Services: 4.36%

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.15%

- Wholesale Trade: 3.35%

- Agriculture, Forestry and Fishing: 3.43%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

Food and beverage services continues to have a much higher failure rate than any other industry as these businesses tend to pay high rents and have input costs that can increase quickly and frequently.

Cafes and restaurants need to order food daily, and therefore price rises can be passed on to them very quickly. The transport, postal and warehousing sector is also proving riskier, as the surge of online shopping over lockdown periods has eased dramatically. Newer businesses that were opened in response to this surge in logistics demand will be finding operating conditions now much more challenging.

At the other end of the spectrum, while labour shortages and costs are still a problem in the healthcare sector, demand is such that businesses are more able to pass these on. Many healthcare costs are also borne by government, which is obviously a very safe creditor.

The food and beverage and construction industries still top the list of industries where external administrators are appointed. While construction cost rises have eased, there are still far fewer housing starts than completions, which means that forward work orders are diminishing.

Given that many construction businesses pay current jobs with future work, this is a serious challenge for the industry. Another challenge is rising insurance costs, particularly for small construction businesses. Most construction type businesses cannot operate without insurance, so there is no choice but to pay these higher premiums. For some businesses that were already only marginally profitable, insurance premium increases could be the thing that tips them into insolvency.

While Australia stands out among OECD countries as one of the better performers economically, the business operating environment will still be challenging for at least the next year. By mid 2024, we should have some reasons to believe that the cash rate will soon fall, and this will give many businesses (and consumers) more confidence to spend and invest.

However, until then, large tax bills, rising insurance premiums, depressed consumer spending and high debt repayments are all issues that will be very confronting for some businesses and, in some cases, insurmountable.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.