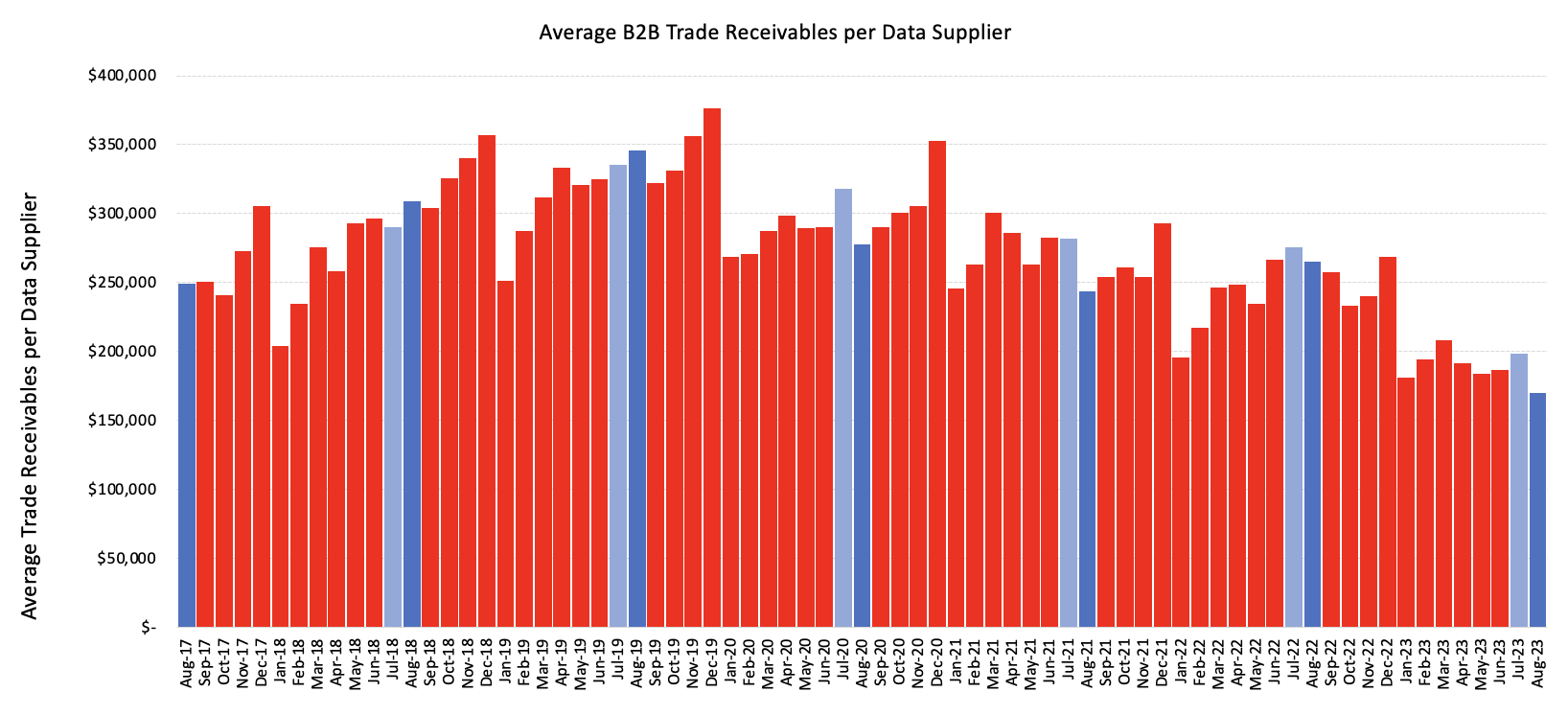

The August 2023 CreditorWatch Business Risk Index (BRI) has revealed Australian businesses activity is at near-record lows with the average value of B2B invoices now down 36% year-on-year – its lowest point since January 2017.

Australian businesses are ordering less than ever before as cost pressures bite, while consumer demand falls, which is impacting order values and revenue down the supply chain.

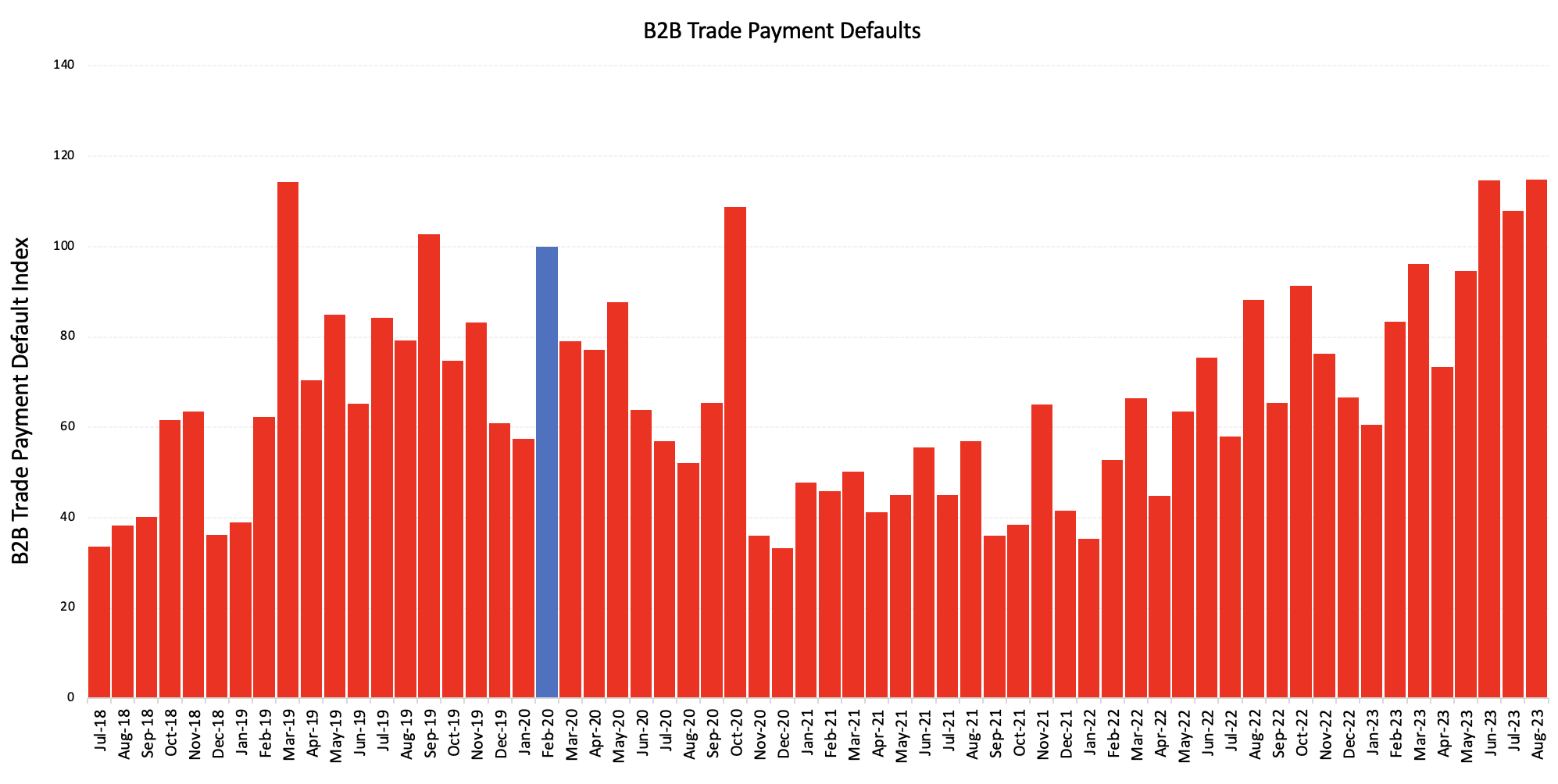

CreditorWatch’s other key business indicators, external administrations, trade payment defaults, credit enquiries and court actions, also reflect the increasing challenges confronting businesses.

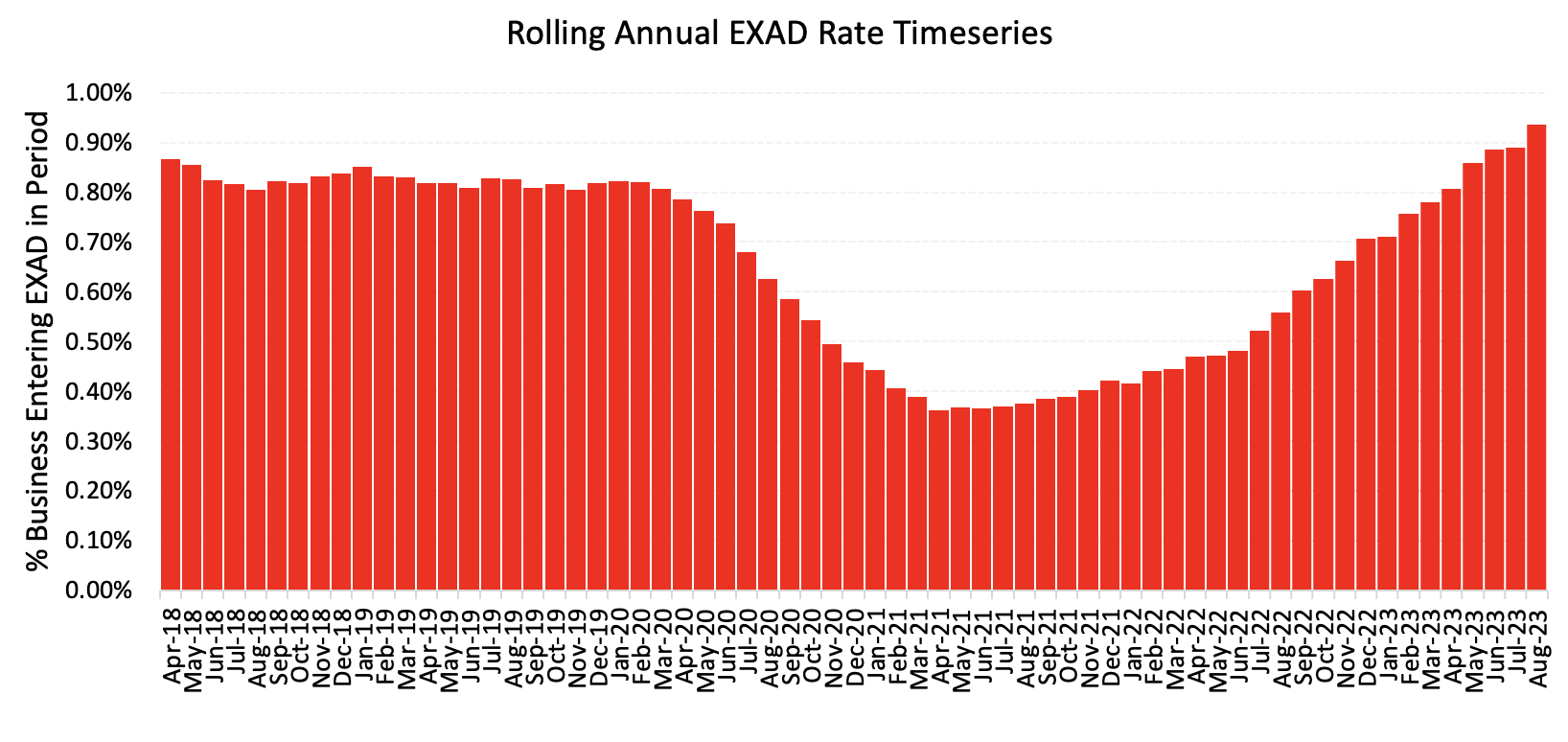

External administrations are up 28% year-on-year (their highest point since October 2015) and trade payment defaults, a leading indicator of future business failure, are up 30% YoY.

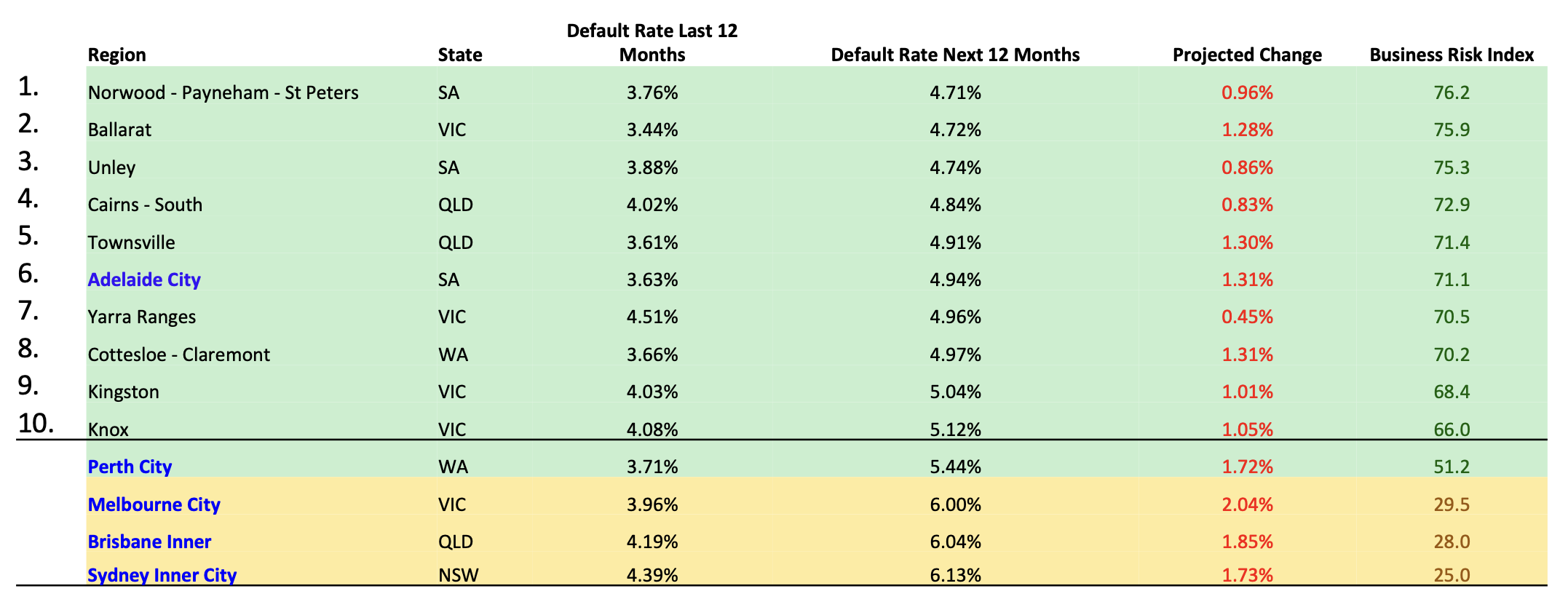

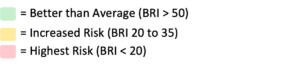

The Business Risk Index August results have also revealed that several regions in South Australia have been performing strongly, with three of the six lowest risk areas in the nation (with more than 5,000 businesses) in that state. Norwood-Payneham-St Peters, in inner Adelaide, is the lowest ranked region in Australia for business failures, with Unley coming in at number three and Adelaide City at number six.

- Average value of invoices for Australian businesses has dropped 36% over the past 12 months. This is the lowest point for this metric since January 2017.

- B2B trade payment defaults continue to trend upward, with a 30% year-on-year increase.

- External administrations have increased 28% year-on-year, an eight-year high, with most industries experiencing an increase in this measure.

- Credit enquiries are up 65% year-on-year, but have been trending down of late, reflecting the decline in overall business activity.

- Court actions continue to increase, although they are still below pre-COVID levels.

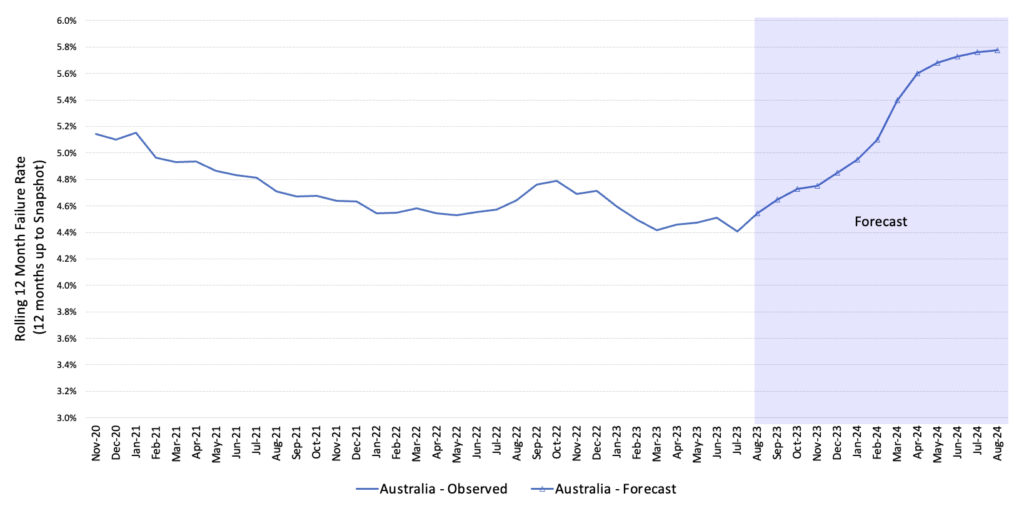

- CreditorWatch’s national business failure rate prediction for the next 12 months is for an increase from the current rate of 4.54% to 5.76%.

- Businesses in the food and beverage services sector remain the most at risk of payment defaults (7.0%) by a considerable margin. Transport, Postal and Warehousing is the next riskiest industry at 4.5%.

- External administrations in the construction industry have been consistently trending upward since May 2021 and are now above pre-COVID levels.

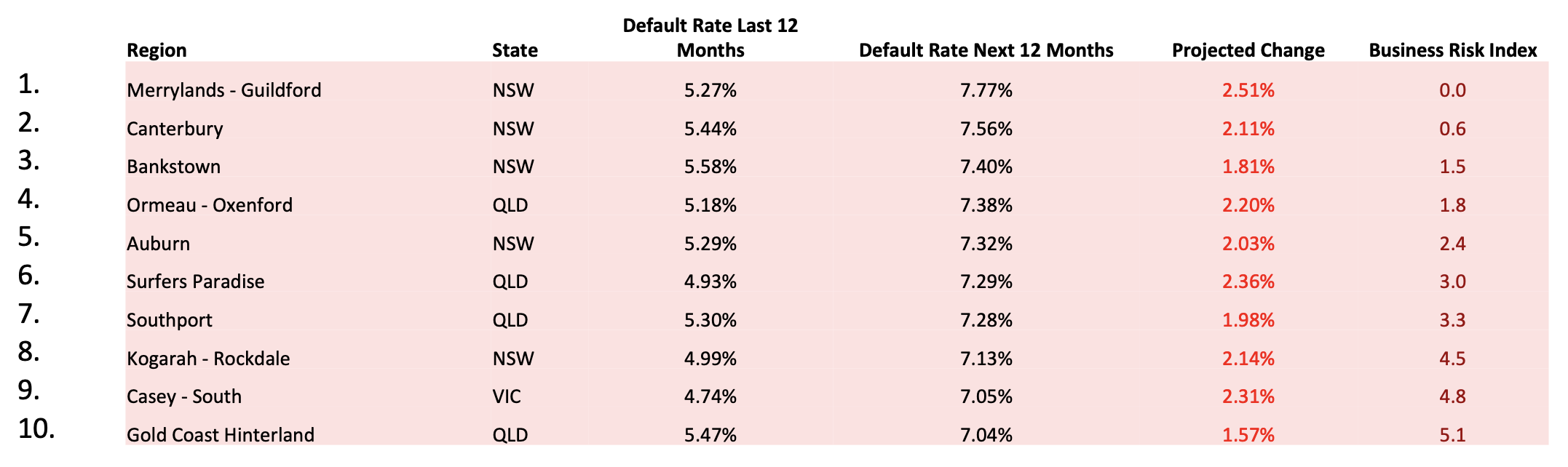

- Norwood-Payneham-St Peters in South Australia is the region with the lowest risk of business failure (across regions with more than 5,000 businesses), followed by Ballarat in Victoria and Unley in South Australia.

- The regions with the highest insolvency risk continue to cluster around Western Sydney and South-East Queensland, with Merrylands-Guildford (NSW) recording a forecast default rate of 7.77% for this time next year. This is followed by Canterbury and Bankstown, also in Western Sydney.

CreditorWatch CEO, Patrick Coghlan, says the impact of contractionary monetary policy and inflation on consumers, is clearly being felt by businesses.

“Twelve rate rises in just over a year was always going to have a major effect on consumer sentiment and force people to tighten their belts, having a particularly big impact on those businesses exposed to discretionary spending,” he says. “I’m very sorry to say that we’re far from the peak of business failures.”

CreditorWatch Chief Economist, Anneke Thompson, says the good news is that monetary policy tightening has worked to slow consumer and business spending.

“This, in turn, is driving inflation down,” she says. “The unfortunate reality is that this will also result in business failures, particularly for those businesses that were already only marginally profitable when interest rate settings were low.”

Despite challenging lockdown conditions imposed Australians, consumers were spending far more on a per capita basis over the 2020 and early 2021 period. A huge amount of new construction and renovation activity resulted in high average invoice values over this time. However, as the construction and retail sectors see workflow slow dramatically, the average size of invoices is also falling. This is a further indication that unemployment is only going to rise from this point on, as many businesses have a reduced need for additional labour.

CreditorWatch’s Trade Payments Default Index shows that businesses continue to lodge defaults against their debtors at record rates, notes Anneke Thompson.

“As the average size of invoices falls, it stands to reason that cash flow is also reducing among a growing cohort of businesses, and this is resulting in more late payment of invoices,” she says.“Unfortunately, this has a snowball effect, as businesses that are being paid late are also at risk of becoming late payers themselves. The past few months’ worth of data tells us that this is already happening.”

As more businesses fall further behind in payments, and consumer and business activity also declines, CreditorWatch expects the rate of business failures to increase quite dramatically over the next year. The Australian Tax Office (ATO) has also become tougher on calling in GST payments that are overdue, which has compounded the pressure on business cash flow.

South Australia has some of the lowest-leveraged households in the country, as house prices have not risen there to the same extent as in the east-coast states over the past three years. This means that South Australian regions feature relatively prominently in CreditorWatch’s list of areas that have the lowest risk of businesses failure.

Census data gives us some insight into just how different the impact of higher interest rates is on households in Adelaide versus Sydney. As at the 2021 Census, households in Adelaide earned 34% less than their Sydney counterparts. However, monthly mortgage repayments were 55% lower in Adelaide, and weekly rents 47% lower. This means that soaring mortgage and rent repayments are having an outsized impact on Sydney households compared to Adelaide households, and businesses in Sydney are likely to be feeling a more extreme drop in demand. This is one of the reasons why businesses in Western Sydney feature so prominently in our riskiest regions in the country.

Looking more closely at some of the best performing regions in South Australia (for areas with more than 5,000 businesses), another clear correlation is very low personal insolvency rates in these areas, as well as ranking very highly on the ABS Index of Economic Opportunity. Rents are generally lower than or equal to the Australian median in these areas as well. Median incomes are also far above the median in Norwood-Payneham-St Peters and Unley. In Adelaide City, incomes are slightly lower than the national median, although this would be impacted by the many international students living in the Adelaide CBD, who often finance their living costs through overseas income/savings.

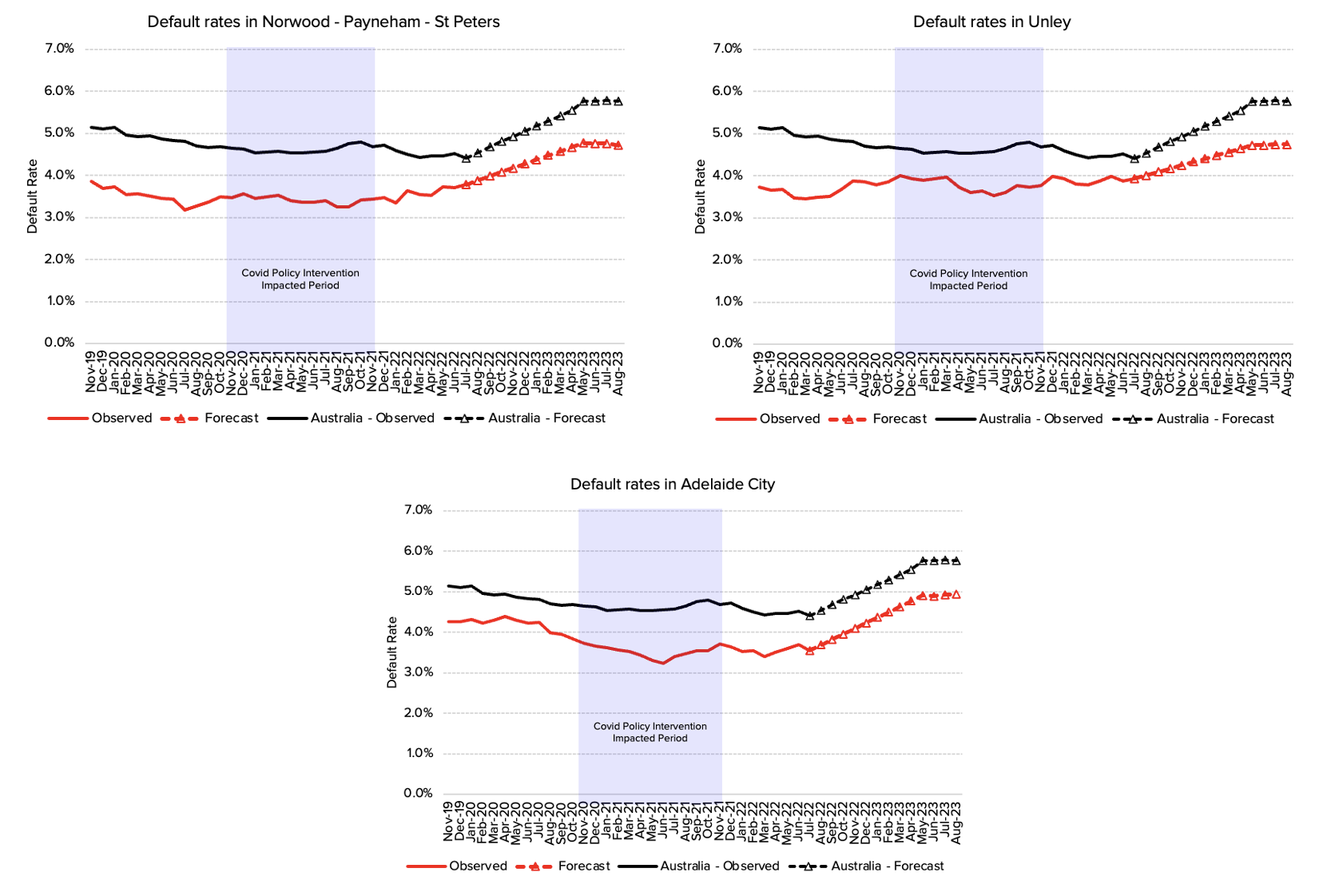

The industries with the highest probability of business failure over the next 12 months are:

- Food and Beverage Services: 6.96%

- Transport, Postal and Warehousing: 4.48%

- Arts and Recreation Services: 4.43%

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.21%

- Wholesale Trade: 3.40%

- Agriculture, Forestry and Fishing: 3.46%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

The food and beverage services sector will continue to record business failures at a much higher rate than other industries, due to the high-cost nature of running these businesses, as well as slowing demand as discretionary spending declines. The transport, postal and warehousing sector is being impacted by a slowdown in online shopping growth. During the ‘lockdown years’ of 2020 and 2021, there was an explosion in courier services opening, as demand for goods delivered to homes soared. A number of these services will now be competing for fewer deliveries, and we are seeing the impact on business failures.

Rates of external administration in the construction sector are now higher than where they were pre-COVID. While businesses in the food and services sector fail at a higher rate, the rates of failure are lower than pre-COVID levels, indicating that there is still much pain to be felt in this sector as interest rates stay higher for longer. There are also more food and beverage businesses that are choosing to voluntarily close, rather than getting to the point of external administration.

Based on current data, and the rate that inflation is slowing, it is highly likely that interest rates will stay at current settings until at least mid 2024. This means that consumers are going to continue slowing spending as they are forced to allocate a larger proportion of their income to interest payments and rent. For this reason, the business failure rate is only going to get higher, particularly in those areas with heavily leveraged households or those that pay high rents relative to their incomes.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.