The February 2023 CreditorWatch Business Risk Index (BRI) shows that conditions have tightened as high inflation and interest rates, in combination with falling demand, put the squeeze on businesses.

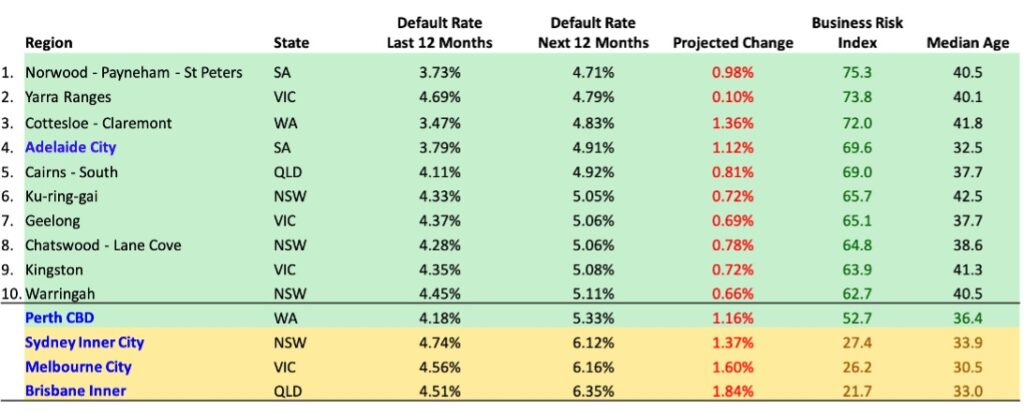

The index has also revealed that regions with a low median age have a higher default rate (current and projected) than regions with higher median ages. Nevertheless, projected default rates for the next 12 months for most regions around the country are considerably higher than their default rates over the past 12 months.

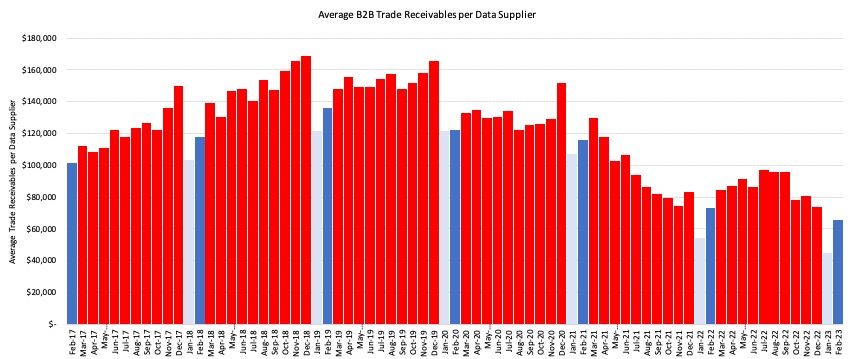

Key indicators point to challenging conditions throughout 2023 for Australian businesses, with trade receivables continuing to decline (down 10% YoY) and court actions back to pre-COVID levels – sitting at their highest point since March 2020.

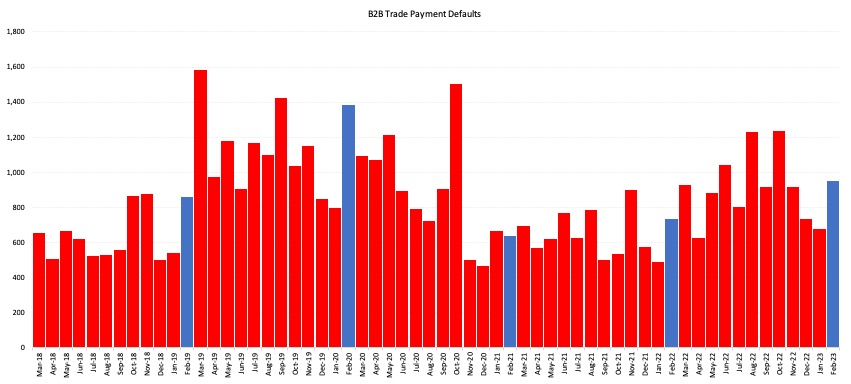

B2B trade payment defaults have risen 30% year-on-year, indicating that cash flow is becoming a problem for more businesses as trading conditions become more challenging. Credit enquiries continue to surge – up 102% YoY – as businesses tighten credit policies due to cost pressures.

Key Business Risk Index insights for February:

- B2B trade receivables are down 10% YoY as challenges confront businesses on multiple fronts.

- Trade payment defaults are up 30% year-on-year, reflecting the squeeze on business cash flow.

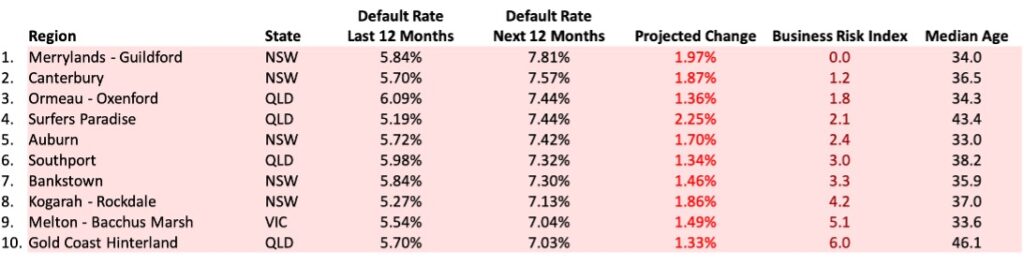

- Projected default rates for the next 12 months for most regions around the country are considerably higher than their default rates over the past 12 months.

- Credit enquiries are up 102% year-on-year.

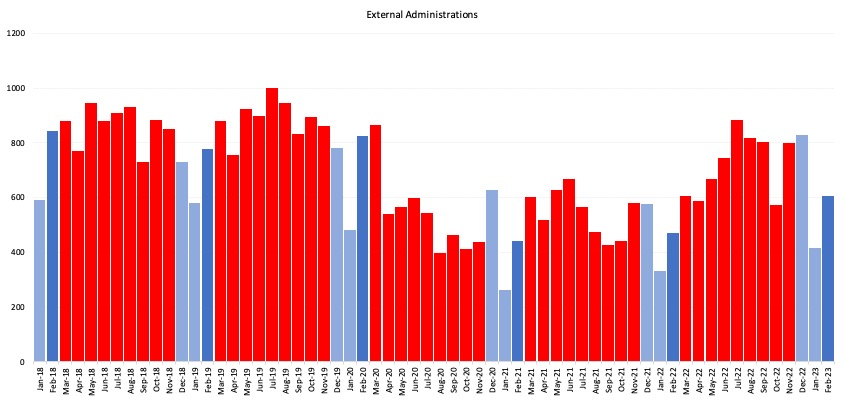

- External administrations have jumped 46% from January to February to near the 24 month average. The construction industry saw 125 external administrations in February, almost twice the number of the second ranked industry, Accommodation and Food Services.

- Court actions are back to pre-COVID levels – at their highest point since March 2020.

- Food and Beverage Services remains the industry at highest risk of default, due to its reliance on discretionary spending, which is in decline, as well as ongoing challenges such as labour shortages.

- Norwood-Payneham-St Peters in South Australia is the region with the lowest insolvency risk (across regions with more than 5,000 businesses), followed by Yarra Ranges in Victoria.

- Merrylands-Guildford and Canterbury in western Sydney are the regions at highest risk of default across Australia (for regions with more than 5,000 businesses). In fact, five of the 10 highest risk regions in Australia are in western Sydney.

- Adelaide has the best performing CBD area and Brisbane has the worst.

CreditorWatch CEO Patrick Coghlan says the February Business Risk Index results show that Australian businesses are under increasing stress.

“From inflation to interest rates, supply chain problems, labour shortages and falling consumer demand, Australian businesses are doing it tougher now than they have since the GFC back in 2009,” he says.

“The businesses that have proper credit risk management processes in place and are monitoring the health of their ledgers will weather this storm much better than those that don’t.”

CreditorWatch Chief Economist, Anneke Thompson, says we are now entering a very difficult stage for businesses to operate in.

“The economy is in the early stages of its downturn,” she says “Prices are still rising, although we appear to have the worst of the price rises behind us, interest rates are likely to need to increase further, and consumer demand is slowing, and will continue to slow.

“The immediate impact is being felt by smaller businesses that are reliant on discretionary spending, before the impact flows through to the rest of the economy, including those businesses not directly exposed to consumers.”

Data Sources: CreditorWatch trade receivables data (accounting software integration)

Data Sources: CreditorWatch trade receivables data (accounting software integration)

Data Sources: CreditorWatch trade receivables data (accounting software integration)

The trends in our data point to slowing trade among small businesses, and higher payment defaults and administrations. Our data is somewhat against the grain of what many large listed companies reported in their half yearly results, which was mostly positive reports of business activity through 2022. However, given our customer base is skewed towards smaller businesses, it shows that the downturn has already begun to work its way through the economy.

Probability of default by region

Projected default rates for the next 12 months for both best performing and worst performing regions are considerably higher than their defaults rates over the past 12 months. Regions whose residents have a higher median age typically have a lower current and projected default rate whereas the opposite is true for regions with a lower median age for residents.

Data Sources: CreditorWatch Business Risk Index and ABS

Our probability of default by region remains fairly static, with the exception of Norwood–Payneham–St Peters in SA entering the #1 position as having the lowest default rate in the country. This is because this area recently met our criteria of having at least 5,000 businesses, and not through any major change in the default rate there.

Areas dominated by younger people tend to have higher rates of default. This is because younger people are logically at the start of their debt ‘journey’, where debt is relatively high versus income. As we age, we (theoretically) pay down debt and earn higher incomes, thereby making areas with older people generally less of a risk of insolvency. This is why interest rate rises disproportionately impact the young.

Probability of default by industry

The industries with the highest probability of default over the next 12 months are:

- Food and Beverage Services: 7.19%

- Transport, Postal and Warehousing: 4.60%

- Arts and Recreation Services: 4.58%

The industries with the lowest probability of default over the next 12 months are:

- Healthcare and Social Assistance: 3.24%

- Agriculture, Forestry and Fishing: 3.47%

- Wholesale Trade: 3.56%

Source: CreditorWatch risk score credit rating average probability of default by industry

Outlook

Unfortunately for Australian businesses, trading conditions are only likely to get tougher as we move through 2023. Consumers will continue to tighten spending, and in many areas, supply chain bottlenecks are still causing problems.

The next issue for the RBA to contend with is rising unemployment. While this is a necessity to get inflation down, and employment has been at overly-tight levels for too long, there is a painful impact for individuals and families who are without employment in such a high cost environment.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.