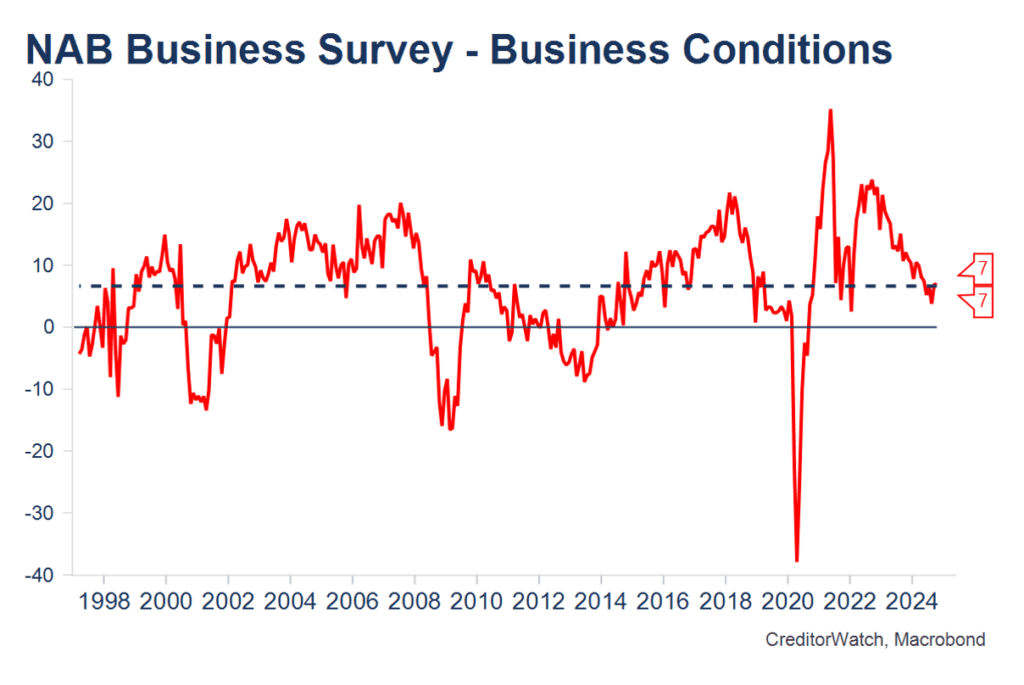

NAB Business Confidence

Bottom line:

The overall picture from the NAB Survey isn’t quite as good as that from the Westpac survey of Consumer Confidence just released, but overall, the readings for the economy are in relatively good shape. There was a welcome jump in business confidence (though that typically is not as good an indicator as business conditions), labour and input cost pressures continue to moderate though retail prices bounced back this month.

Conditions remain weakest in Manufacturing and Retail (something of a global phenomenon) and strongest in Mining and the broader services sectors. Capacity utilisation remains well above long-term averages, but is easing slowly, likely signalling an ongoing slow easing in inflationary pressures.

Overall, the survey doesn’t seem to be showing the same recent strength as consumer confidence, though the former may be leading in this cycle as consumers benefit first from the tax cuts and improved cash flow and confidence take some time to flow into business conditions.

Detail:

- Business conditions were unchanged at +7, around the long-term average for this series and not at a level consistent with a very weak economy.

- Business confidence rose sharply from -2 to +5, the highest level of confidence since early 2023. Confidence is generally not as good an indicator as it reflects businesses’ expectations (which are often wrong over the short term), while conditions reports what businesses are actually experiencing.

- Employment expectations remain positive at +3 (previously +5) – not as strong as the unemployment expectations series just published in the Westpac Consumer Confidence survey, but still consistent with employment growth.

- Forward orders remain slightly negative though have become less negative in recent months. Orders are weakest in Manufacturing, Wholesale and Retail, consistent with other indicators of the economy (and global trends).

- Capacity utilisation eased to the lowest level since Jan 2022, but still remains at a relatively high level. As the chart shows, cap use is easing only slowly, which suggests inflation pressures will also only ease slowly, as has been occurring. The trend in this series is relatively well correlated with interest rates, but the level is important too.

- Labour and input costs continue to ease, though retail prices bounced back in the month – as did the Melbourne Institute indicator of prices.

- QLD remains the strongest state, with WA and NSW next at around long-term averages. VIC is recording weak business conditions, but the weakest conditions are currently being reported by firms in TAS and SA. Readings in these two states are often quite volatile, but these trends have been in place for a few months now. They may reflect some easing in population growth, particularly in TAS as catch-up interstate migration occurs and as prior boosted levels of domestic tourism subside.

- The weakest sectors for business conditions remain Retail and Manufacturing, while Mining and the services sectors (in trend terms) are relatively stronger. Construction has now been recording positive business conditions for a few months, perhaps suggesting the worst is over for this sector.

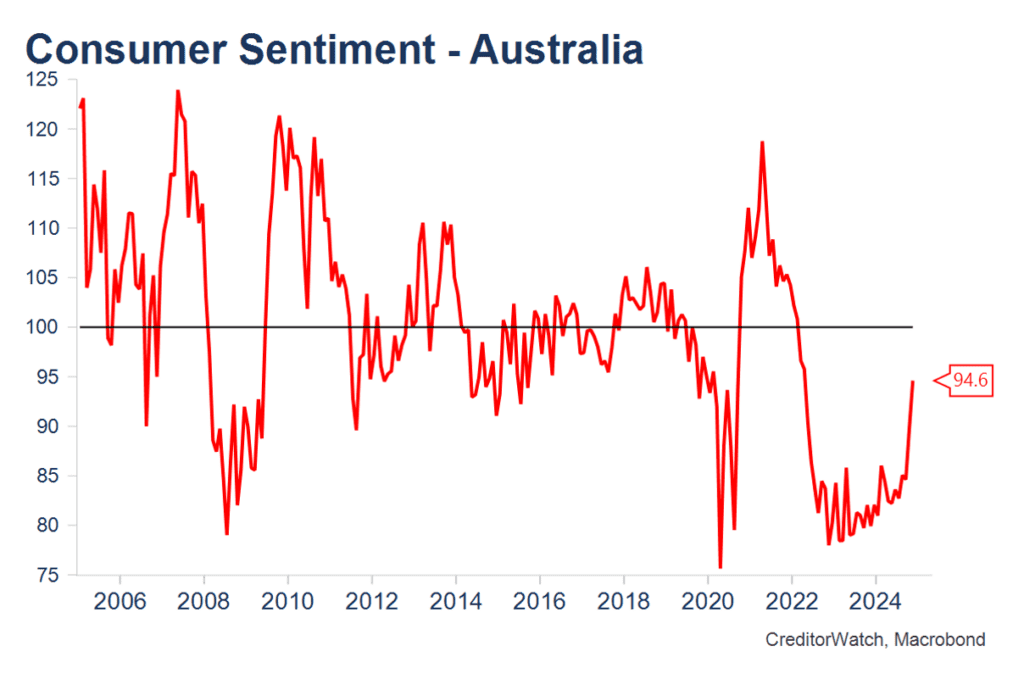

Westpac Consumer Sentiment

Bottom line:

It’s a wow! Pretty much all parts of the monthly Westpac Melbourne Institute survey of consumer confidence recorded further strong improvement in November and have risen even more strongly from low points in either June or July this year.

This is likely to reflect the beneficial impacts of the government’s 1 July income tax cuts together perhaps with expectations that interest rates will not rise further. It will be interesting to see if similar improvement is in evidence in the NAB Business Survey.

There was also a spectacular fall in the unemployment expectations series, which has a good lead on unemployment trends and which, at face value, suggests the unemployment rate may decline rather than rise in the months ahead. Low unemployment has been an important positive preventing more significant pressures on consumer spending and bad debts.

Detail:

- Consumer confidence rose 5.3% in November to a two and a half year high and is now 13.2% above the early June reading.

- There was strong improvement in expectations about family finances compared to a year ago (+6.8% in the month and +24.1% off the low for this series in July), which strongly suggests a beneficial impact from the 1 July income tax cuts. Consumer expectations about whether it’s a good time to buy a house or a major household item have also improved in recent months.

- There has been nothing short of a spectacular plunge in the unemployment expectations series over the past two months. That series tends to lead the unemployment rate by 3-4 months and at face value suggests the unemployment rate will fall rather than rise further in the months ahead. SEEK job ads have also stabilised in recent months. The series bears close watching.

- There’s not a lot in this data to support the RBA cutting interest rates any time soon.

GET IN TOUCH

For more information on how you can safeguard your business from challenging trading conditions, contact our team today.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.