CreditorWatch, has released the July results for its Business Risk Index (BRI) which show 87.2 per cent of regions around Australia will experience an increase in business failure rates over the next 12 months.

Queensland is forecast to see the highest rate of business failures while Western Australia is predicted to see the biggest increase in the failure rate. The analysis covers 329 regions around the nation.

Region by region

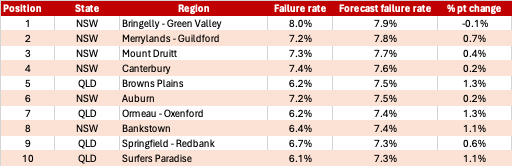

Regions in Western Sydney and South-East Queensland are expected to see the highest rates of business failure over the coming year.

Many businesses in these regions continue to struggle in the high interest rate environment. Households in suburbs surrounding these areas tend to be highly indebted, and on lower-than-average incomes, which means they are spending less in their local communities.

Commercial property prices and rents in Sydney and South-East Queensland are also relatively high, with Queensland having the added burden of high, and still increasing, construction costs, meaning it is very difficult to add new supply of commercial space which would relieve pressure on rents.

Source: Business Risk Index; regions with at least 1,000 businesses

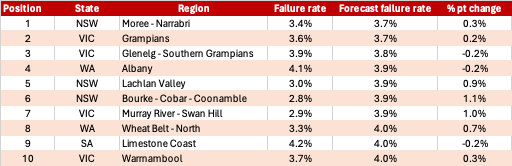

At the other end of the scale, the regions expected to experience the lowest business failure rates over the next 12 months are typically in regional areas across the country.

Regional areas continue to benefit from lower commercial rents, low competition among businesses, older populations and stronger local economies – particularly those areas where agriculture dominates. The agricultural sector is less impacted by high interest rates, as the goods produced are largely non-discretionary and demand for them increases broadly in line with population growth, which has been very strong.

Some areas may also have experienced a small uptick in domestic tourism, as budget conscious Australians look for cheaper and better value holiday options than the traditional locations of the Gold Coast, Sunshine Coast and overseas destinations like Bali and Fiji.

Source: Business Risk Index; regions with at least 1,000 businesses

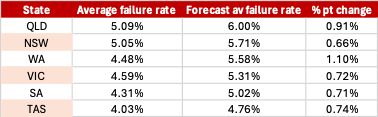

State by state

On a state-by-state comparison, all states are forecast to experience an increase in the average failure rate. Queensland is expected to see the highest average rate of business failure over the next 12 months of 6.00 per cent, with Western Australia predicted to experience the largest average increase in business failures. Meanwhile, Tasmania has the lowest forecast average failure rate of 4.76 per cent.

Queensland and Western Australian businesses are being hampered by lingering price increases, particularly in the construction sector. This is despite their respective state governments being in a strong fiscal position. In some ways, this strong fiscal position makes the task of getting inflation under control harder, as state-government spending fuels price increases, particularly in the construction and healthcare sectors.

Source: Business Risk Index; regions with at least 1,000 businesses

Sources: CreditorWatch Business Risk Index and ABS

CreditorWatch CEO, Patrick Coghlan, says the data shows how tough businesses around the Australia are doing right now.

“The fact that almost 90 per cent of regions will see an increase in the rate of business failures indicates that the current pressures from interest rates, cost increases and declining consumer demand are being acutely felt right around the country – particularly those areas with younger populations and a higher proportion of businesses in high-risk sectors,” he says.

“Our hope is that the Stage 3 tax cuts will continue to boost consumer confidence to some extent, but we don’t expect a significant improvement in conditions for businesses until the impacts of one or two rate cuts are felt by households.”

CreditorWatch Chief Economist, Anneke Thompson, says consumer confidence is unlikely to trend upward for some time yet.

“Consumer confidence is still incredibly low, even though consumers reported to Westpac in its August survey that confidence was slightly up,” she says.

“While consumers are now less fearful of an increase in interest rates, and also report a small positive sentiment increase from tax cuts, the increase in confidence is not nearly enough to suggest that household consumption will recover any time soon.

“As long as households are spending less, and we know from retail trade data that spending per head of population has decreased for eight straight quarters, businesses will continue to battle high interest rates and continuing high input costs with falling demand.”

Business orders remain flat – down 51.5% YoY

The average value of invoices held by businesses has dropped 51.5 per cent over the year to July 2024, indicating that businesses are ordering significantly less from suppliers as consumer demand falls away.

We expect that invoice values will continue to stay low, by historic standards, while consumer sentiment and retail trade are so flat. Very low housing starts will also be contributing to falling invoice values in the construction sector.

Source: CreditorWatch Business Risk Index July 2024

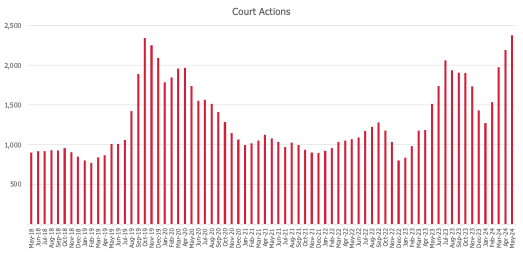

Court actions

Court actions have surged to above pre-COVID levels as creditors ramp up actions to collect outstanding debt. Actions dropped dramatically during the pandemic but have now jumped as more businesses come under pressure and debts owed to large creditors such as the ATO and financial institutions increase.

Data source: Courts database direct link

Other Business Risk Index insights for July:

- B2B payment defaults dipped in June but surged in July and are now up 42 per cent year-on-year.

- Credit enquiries are largely flat across 2024, reflecting the subdued trading conditions in the Australian economy.

- Food and Beverage Services is the top ranked industry by business failure rate by a considerable margin. It currently sits at 8.3 per cent, followed by Arts & Recreation Services (5.8 per cent) and Administrative Support Services (5.6 per cent).

- Food and Beverage Services is also the leading industry for outstanding ATO tax debts above $100,000, with a rate of 1.67 per cent. Construction and Transport, Postal and Warehousing are next at 1.19 per cent and 0.88 per cent respectively.

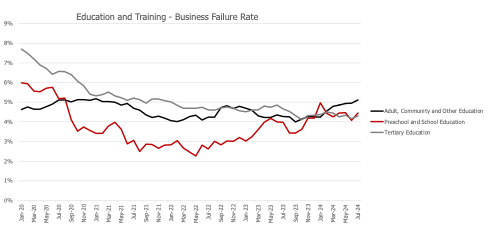

- Insolvencies in the Education and Training Sector increased 88 per cent in the year to July 2024. This sector has been rocked in recent years by huge decreases in demand at the onset of COVID-19, followed by a huge increase once borders re-opened and international students came back into the country. The recent announcements by the Federal Government on caps to international student visa numbers further complicate things. This has made the operating environment very hard to predict for businesses in this sector.

Data Sources: ASIC database direct link

Outlook

We maintain that the operating environment for businesses in Australia will remain very challenging until at least the first quarter of 2025, at which point the RBA is likely to have cut the cash rate or will be very close to cutting it.

As our data suggests, the pain felt by businesses will not be spread evenly across the country, as high interest rates have an outsized impact on areas with younger populations and a high proportion of businesses in the construction or discretionary retail spend sectors.

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.