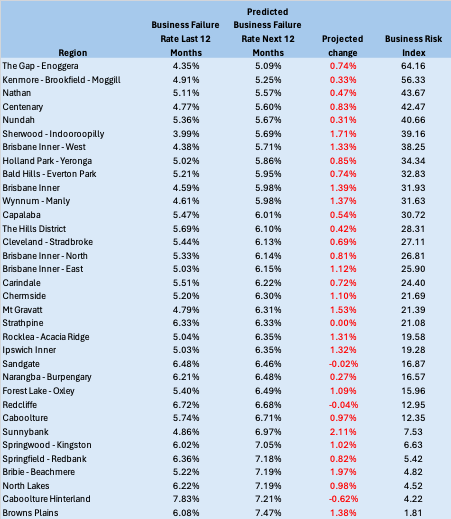

CreditorWatch’s Business Risk Index (BRI) data for May 2024 indicates that 88 per cent of regions in Greater Brisbane will record higher business failure rates over the next 12 months.

All but two Greater Brisbane regions (The Gap-Enoggera and Kenmore-Brookfield-Moggill) are ranked in the lower 50 per cent of regions on the index.

The areas of Sunnybank, Sherwood-Indooroopilly and Mt Gravatt, all south-west of the Brisbane CBD, are forecast to record some of the biggest increases in business failure rates in Brisbane.

Sunnybank’s business failure rate is expected to increase by 2.11 per cent, to 6.97 per cent by May 2025, which would be the largest deterioration the Brisbane. Second on the list of rising business failure rates is Bribie – Beachmere in Brisbane’s far north, where the business failure rate is forecast to increase by 1.97 per cent to 7.19 per cent.

At a business failure rate of this magnitude, this would rank Bribie – Beachmere amongst the regions with the highest failure rate, alongside Browns Plains (7.47 per cent), Caboolture Hinterland (7.21 per cent) and North Lakes (7.19 per cent).

Whilst Brisbane and Queensland as a whole are experiencing very strong migration rates, this is not necessarily providing protection or relief against the very challenging economic conditions. New migrants often correlate with new businesses that need start up financing, and many of these smaller, newer businesses will be severely exposed to high interest rates and cost increases.

The domestic tourism industry is also a big economic driver in South-East Queensland, and conditions in this sector are deteriorating as Australians tighten their belts.

It is likely conditions will remain very challenged until we get some interest rate relief. At this stage, we don’t expect a cut to the cash rate until Q2 2025.

Data sources: CreditorWatch Business Risk Index

A business failure is defined as an insolvency (external or voluntary administration), ASIC strike-off, company deregistration or closure of a solvent business.

Regions are defined by the ABS SA3 categorisation

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.