The June 2023 CreditorWatch Business Risk Index (BRI) has revealed that B2B trade payment defaults have surged to a record high, indicating that businesses are experiencing increasing stress, and rates of insolvencies will rise over the months ahead.

Businesses with a payment default lodged against them by a single trading partner have a 26% chance of insolvency in the next 12 months, according to CreditorWatch’s payment defaults data. This rises to 45% for businesses with payment defaults lodged against them by two trading partners and to 65% for defaults lodged by three or more trading partners.

CreditorWatch’s other leading business indicators: credit enquiries, court actions and external administrations are also reflecting a deterioration in business conditions.

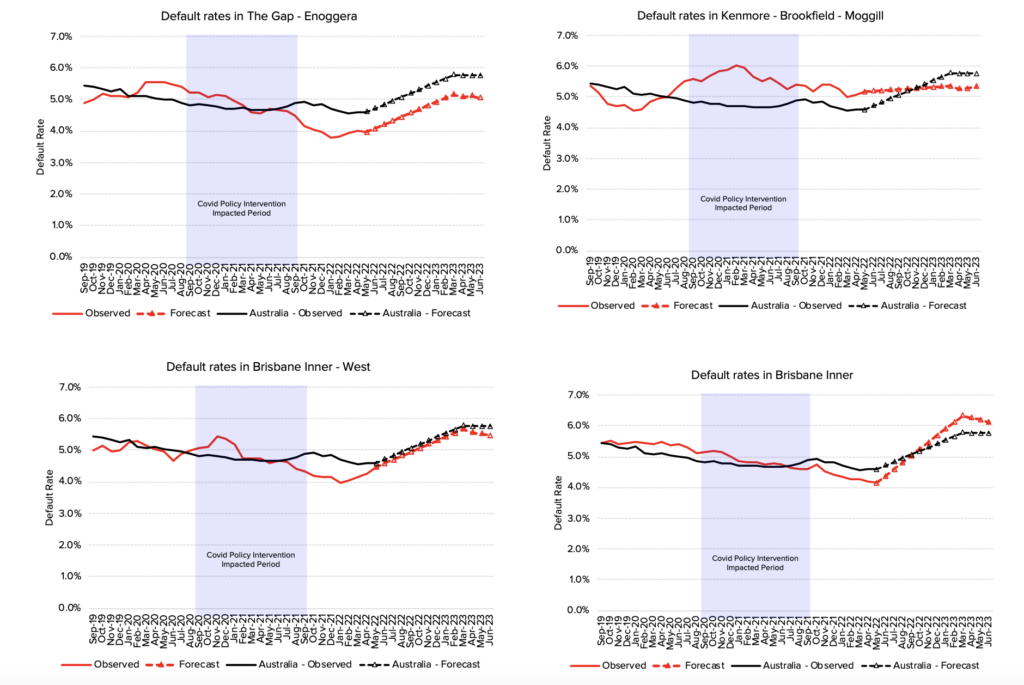

On the positive side, Business Risk Index data for the past 12 months shows that three of the four biggest improving regions are all adjoining, in Western Brisbane: The Gap-Enoggera, Brisbane Inner-West and Kenmore-Brookfield-Moggill. These regions all feature below-average rental and property costs and well above-average incomes, low personal insolvency rates and score highly on the ABS indexes of social advantage and economic opportunity.

Key Business Risk Index insights for June:

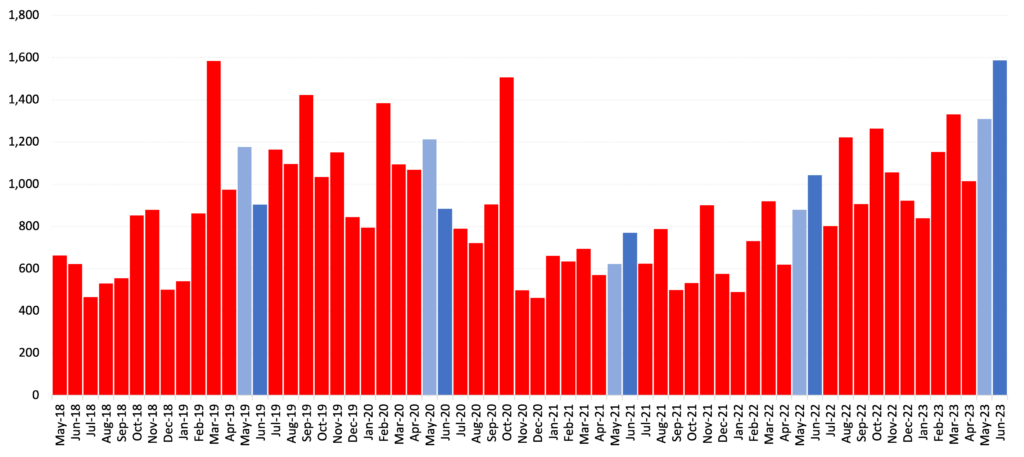

- B2B trade payment defaults were at a record high of 1,586 in June – a 52% YoY increase. The previous high was in March 2019.

- Credit enquiries continue to surge – up 161% YoY – as businesses tighten their due diligence processes and credit policies.

- External administrations dipped from May to June but are up 13% YoY and continue to trend upwards overall.

- Court actions continue their upward trend although they are not yet back to pre-COVID levels.

- CreditorWatch’s national default rate prediction for the next 12 months is for an increase from the current rate of 4.71% to 5.76%.

- Food and Beverage Services remains the industry at highest risk of default, due to its reliance on discretionary spending, which is in decline, as well as ongoing challenges such as labour shortages. It is followed by Transport, Postal and Warehousing.

- The rate of external administrations in the construction industry continue to trend upward – sitting at a their highest point since April 2020.

- Business Risk Index data for the past 12 months has revealed that three of the four biggest improving regions are all in Western Brisbane: The Gap-Enoggera, Brisbane Inner-West and Kenmore-Brookfield-Moggill.

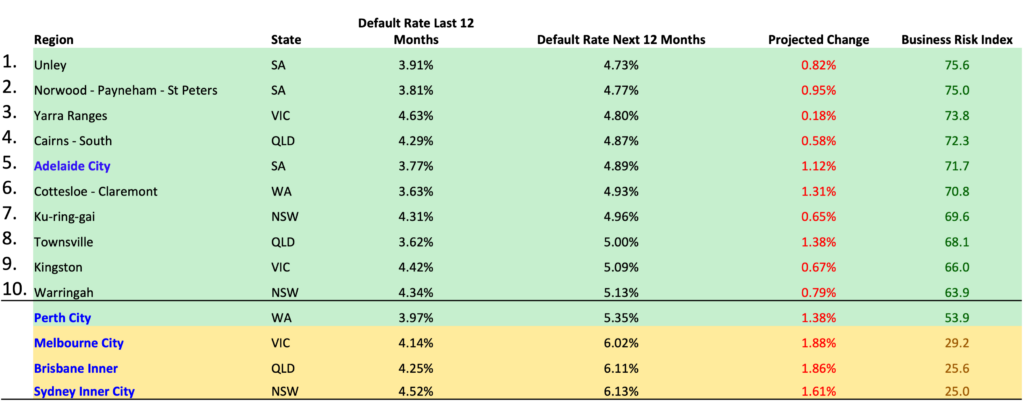

- Unley in South Australia is the region with the lowest insolvency risk (across regions with more than 5,000 businesses), followed by Norwood-Payneham-St Peters (SA) and Yarra Ranges (VIC).

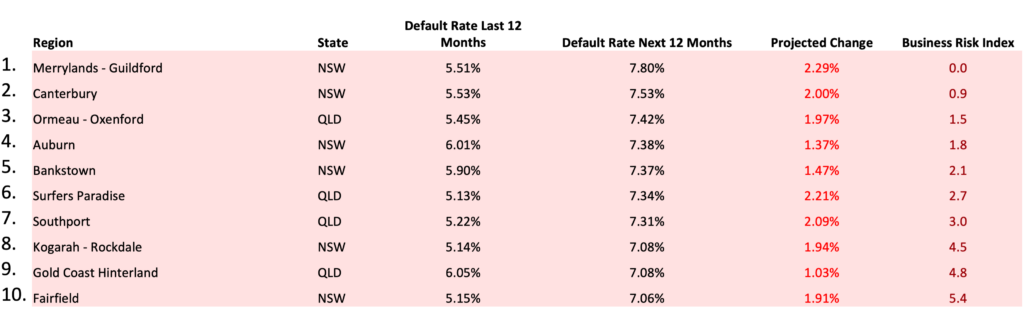

- The regions with the highest insolvency risk continue to cluster around Western Sydney and South-East Queensland, with Merrylands-Guildford (NSW) recording a forecast default rate of 7.80% for this time next year.

CreditorWatch CEO, Patrick Coghlan, says the RBA’s 12 consecutive interest rate rises to a current 4.10% are beginning to squeeze small businesses and consumers alike.

“The impact of the rate rises, as well as high inflation, is increasingly being felt by businesses as consumers tighten their belts. Forward orders are going down as demand falls away, and both business and consumer sentiment is in rapid decline.

“Thankfully, many businesses emerged leaner and more efficient in the wake of the pandemic after trimming fat and investing in technology, which bodes well for the tough conditions now and in the months ahead.”

CreditorWatch Chief Economist, Anneke Thompson, says the pause in monetary policy tightening, while welcome for business owners, is only expected to be temporary.

“Inflation is still too high, evidence from overseas also tells us that core inflation is proving ‘sticky’, and labour markets are still too tight,” she says. “The RBA has succeeded in slowing consumer spending for goods and reducing inflation in this area, however, consumers alone can’t bring down inflation.

“A slowdown in business investment and hiring is now needed to further drive inflation down. For this reason, the RBA will be closely monitoring job vacancy and labour force data for signs that their policy intervention is flowing through to the business side. Our June BRI data strongly suggests that businesses are absolutely tightening their belts.”

B2B trade payment defaults

The record rate of B2B trade defaults points to businesses seriously tightening up their cash flow processes. The end of the financial year is a time when all business owners sit down and evaluate their cash flow processes, forward orders, revenue, cost projections and their existing customer payment patterns. The environment of high interest rates and inflation means that in FY2024, business owners will, by necessity, have very little patience for late payments and, for this reason, we expect trade payment defaults to remain elevated.

Data Sources: CreditorWatch Trade Payment default data (lodged defaults)

CreditorWatch default rate prediction

Given that B2B trade defaults are such a strong indicator of future insolvencies, our default rate predictions are continuing to increase. We now appear to be at the point of the cycle where consumer pain is being felt by businesses. The construction sector is still dealing with high input costs that are, in many cases, wiping out any profit margin on projects, and it now has the added challenge of very low dwelling approvals, resulting in a depressed demand outlook. For retailers and the food and beverage sector, the outlook for discretionary spending appears very depressed, particularly as more home loans move off fixed rates.

Data Source: CreditorWatch Business Risk Index – Business default defined as entering external administration or strike-off

Best and worst regions and capital cities (5,000+ businesses)

Once again, areas with an older median age present the lowest risk of business insolvency as these businesses are likely to have lower debt levels and more established income streams. Areas with the highest risk of insolvency not only tend to have younger populations, but also business profiles that are more strongly weighted to construction, tourism and retail trade.

Worst regions (5,000+ businesses)

Sources: CreditorWatch Business Risk Index and ABS

The areas that have seen the biggest improvement in their risk profiles over the past 12 months are those where incomes sit well above the median. Business owners in these areas are are more likely to have bigger cash reserves in place to help them absorb higher costs and interest payments.

Why have businesses in Western Brisbane improved so much?

The fortunes of businesses in Western Brisbane have improved more than for those in any other region in Australia over the past 12 months. This is a function of factors such as very low rental and property costs, low personal insolvency rates, very high median income and high positions on the ABS indexes of Relative Social Advantage and Economic Opportunity. This improvement in business conditions has not occurred across all of Greater Brisbane, however, with Inner Brisbane (CBD) showing higher default rates than the national average.

While trading conditions across most industries are getting tighter, businesses in areas with higher average incomes are better placed to withstand the coming downturn. Likewise, white collar workers are better able to increase workloads/hours at relatively low cost, whereas for construction, retail, food and beverage businesses, longer hours or a bigger workload won’t increase profit at the same rate, as the cost of doing business in these sectors is currently so high.

Source: CreditorWatch Business Risk Index June 2023

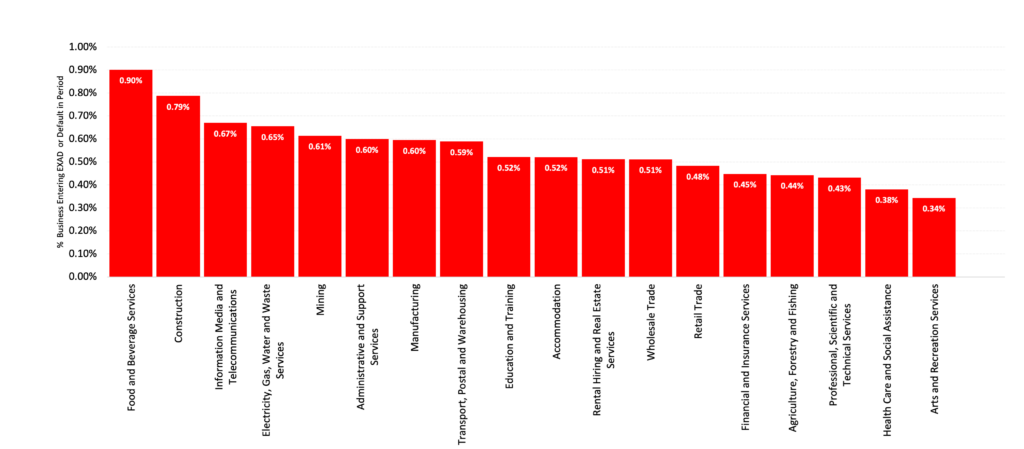

Probability of default by industry

The industries with the highest probability of default over the next 12 months are:

- Food and Beverage Services: 7.06%

- Transport, Postal and Warehousing: 4.57%

- Arts and Recreation Services: 4.55%

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.24%

- Agriculture, Forestry and Fishing: 3.49%

- Wholesale Trade: 3.56%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

Industry insolvency rates

The food and beverage sector is coming off a period of very strong demand, although this has unfortunately been countered by rising food, electricity, debt and labour costs. Demand is likely to fall in the coming months, while input costs are still rising, presenting very challenging conditions for café and restaurant owners.

Interestingly, the arts and education sector is one of the lowest risk sectors, as Australians continue to spend on concerts and events that they were unable to attend during lockdowns. The sector is also being supported by big name overseas acts coming to Australian shores, with demand for these tickets still very strong given the unique nature of these performances.

Outlook

The beginning of the new financial year is likely to bring increasing pessimism among Australian business owners, particularly those reliant on discretionary spending. While labour force data is still very strong, it is likely we will start to see a slow rise In the unemployment rate, as businesses prepare for weaker conditions over the next 12 months.

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.