The February 2024 CreditorWatch Business Risk Index (BRI) has revealed that payment defaults from business-to-business transactions are at record highs. This comes as a direct result of the increasing cost pressures that Australian businesses are confronting from factors such as higher interest rates, inflation, wages and labour shortages, coupled with lower consumer demand as households struggle to manage cost-of-living pressures.

CreditorWatch research shows a strong correlation between payment defaults and business failures. Businesses with one default have a 24 per cent chance of going insolvent in the next 12 months. This rises to 42 per cent for two defaults against two businesses and 62 per cent for three defaults against three businesses.

Last month CreditorWatch reported that the average value of invoices was at a record low. This was also reflected in last week’s ABS Business Indicators for the December quarter, which showed businesses were running down their inventories in anticipation of further declines in consumer demand.

While the February BRI data recorded a seasonal increase in the average value of invoices from January to February (up 10.4%) values continue to trend downward and sit at their lowest point since September.

CreditorWatch CEO, Patrick Coghlan, says the rise in B2B payment defaults and falling invoice values is a very concerning combination.

“Trade payment defaults going up while invoice values decline is a real worry,” he says. “This indicates that cash reserves are being depleted and margins are being squeezed. An increasing number of businesses have less cash coming in, which means they are then finding it more difficult to pay their own suppliers and as such we are seeing a steep increase in payment defaults being registered on the CreditorWatch database. They are also cutting the size of their orders and running down inventories.

“This payment defaults data provides our members with critically important intelligence about the trading behaviour of other businesses, some of whom they could have extended credit to.”

- B2B trade payment defaults are now consistently above pre-COVID levels, recording a record high in February and a 47.9 per cent year-on-year increase.

- The average value of invoices for Australian businesses had a small uptick in January but is still trending down and sits 16 per cent below the February 2023 level.

- External administrations are now sitting consistently above pre-COVID levels (up 24.6 per cent year-on-year).

- Credit enquiries had a seasonal jump in February but are still trending down as trade activity declines.

- Court actions are returning to pre-COVID levels. For our latest observed month, December 2023, they are up 52.0 per cent against December 2022.

- Businesses in the food and beverage services sector remain the most at risk of business failure (7.08 per cent) by a considerable margin. Public Administration and Safety is the next riskiest industry at 5.39%, followed by Accommodation (5.09%).

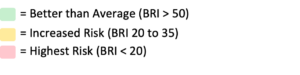

- The regions with the lowest risk of business failure remain concentrated around regional Victoria, inner-Adelaide and North Queensland. Ballarat, in regional Victoria, is the top-ranked region, followed by Norwood-Payneham-St Peters in South Australia and Townsville in Queensland.

- The regions with the highest risk of business failure are around Western Sydney and South-East Queensland, with Merrylands-Guildford (NSW) the top-ranked region, followed by Bringelly-Green Valley and Canterbury, all in Western Sydney.

- On a quarterly basis, the best performing region is Nundah, in inner-Brisbane, which moved 22.0 points up the index, while Stonnington-East in inner-Melbourne recorded the biggest slide down the index – also 22.0 points.

CreditorWatch Chief Economist, Anneke Thompson, notes that the BRI data has been pointing towards a rapidly slowing economy for some time now, and this has now been reflected in the December quarter Australian National Accounts.

“Gross Domestic Product (GDP) grew by a very slow 0.2 per cent over the December quarter, taking the annual growth rate to 1.5 per cent,” she says. “However, in per capita terms, GDP has been negative for three straight quarters, which means Australia is in a ‘per capita’ recession. The sustained fall in the average value of invoices over 2023 was a very good leading indicator of the overall slowing of the economy.”

The rate of external administrations is now well above pre-COVID levels. Unfortunately, given the decline in the average value of trade invoices and the record level of trade payment defaults recorded in February, we expect that the rate of external administrations will continue to increase over 2024.

The public administration and safety; mining and electricity, gas, water and waste services industries have all recorded the largest increase in external administrations against this time last year. There are numerous sub-sectors within these industry categories, such as security companies and waste management services that are facing very challenging conditions and a slowdown in demand.

The food and beverage services sector still has the highest rate of external administrations, and this sector is expected to remain to maintain its unenviable position at the top of this table as Australians pull back their spending at restaurants and on takeaway in the face of cost-of-living pressures.

While we recorded a slight rise in the average value of invoices over February 2024, this is a normal seasonal adjustment after January, when typically, many Australians are on holiday. The overall trend is very concerning and tells us that the slowdown in consumer spending over 2023 has well and truly created a trickle-down effect into all sectors of the economy.

The best performing regions continue to be areas with older-than-average populations, and more businesses that are out of start-up mode, and have lower levels of debt. The default rate in the worst performing region – Merrylands-Guildford in Western Sydney – is projected to be almost 65 per cent higher than the best performing region – Ballarat in regional Victoria, over the next 12 months.

The industries with the highest probability of business failure over the next 12 months are:

- Food and Beverage Services: 7.08%

- Public Administration and Safety: 5.39%

- Administrative and Support Services: 5.16%

The industries with the lowest probability of default over the next 12 months are:

- Agriculture, Forestry and Fishing: 3.28%

- Health Care and Social Assistance: 3.53%

- Financial and Insurance Services: 3.67%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

Business failures consider external administrations as well as ASIC strike offs – so the closure of a business for various reasons. Over the next 12 months we expect just over seven per cent of all food and beverage services business to shut their doors. The agriculture, forestry and fishing industry is much more stable, with only 3.28 per cent of businesses in this sector expected to close.

Based on BRI data coming through and models projecting external administrations and business failures, we expect the next six months, at least, to be very challenging for Australian businesses. All businesses will need to watch their cash flow very closely, even when the cash rate begins to decline, which at this stage looks to be sometime in Q3 2024.

It will take three or four cuts to the cash rate before Australian consumers start to feel more comfortable making purchases of discretionary items, which is unlikely to be until early 2025.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.