SYDNEY, Wednesday 13 July – The June 2022 CreditorWatch Business Risk Index (BRI) has revealed that business confidence is teetering, with key indicators such as trade receivables and credit enquiries down, while trade payment defaults continue to register at pre-COVID levels.

In fact, average trade receivables for June were down 18 per cent year-on-year. Another key indicator, trade payment defaults, is up 18 per cent year-on-year, reflecting the recent slight decline in the NAB Business Confidence Index.

Court actions are at their highest rate since March 2020 (pre-COVID), indicating that lenders have resumed their regular collections activity.

Key Business Risk Index insights for June:

- Trade receivables and credit enquiries are down month-on-month, indicating that business confidence is at a turning point.

- Credit enquiries dipped marginally from May to June but are still up eight per cent year-on-year.

- Court actions are at their highest rate since March 2020, indicating that lenders have resumed their regular collections activity.

- Multiple adverse impacts will continue to batter the economy over the coming months.

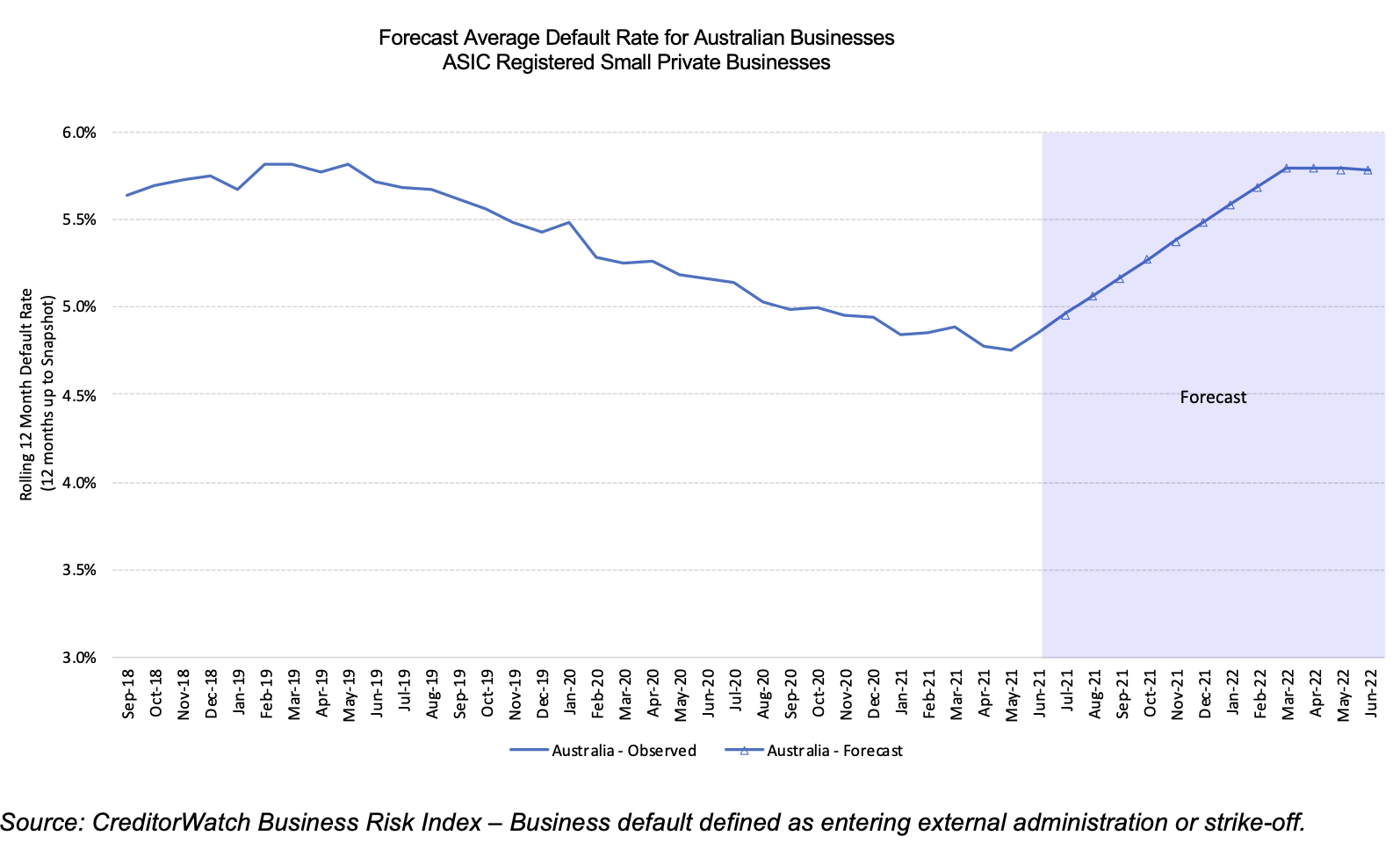

- The Business Risk Index national default rate remained flat at 5.8 per cent in June. We note that it is far more likely than not that our forecast default rates will climb, given the deteriorating economic outlook.

- CreditorWatch continues to forecast a rise in business insolvencies across 2022.

- Cottesloe-Claremont in WA is the lowest insolvency risk region with greater than5,000 businesses.

- The Western Sydney region of Merrylands – Guildford is the highest risk region in the country.

CreditorWatch CEO Patrick Coghlan says the June Business Risk Index data indicates that businesses could be in for a softer second half of 2022.

“We continue to see a disturbing rise in trade payment defaults, our leading indicator for future business insolvencies,” he says. “Court actions are also back to pre-COVID levels, reflecting that the banks are back to their regular collection activity after the ‘loan holidays’ that they provided during the peak of the pandemic. We will be closely watching the data to see if these figures indicate an inflection point in business confidence as economic conditions worsen.”

CreditorWatch Chief Economist Anneke Thompson says while Australian businesses have been operating at record capacity levels and business conditions are still slightly better than the long-term average, our June data is pointing to the start of a deterioration in conditions.

“Businesses will be increasingly wary of their credit customers and their ability to pay going forward, even if no problems have arisen to this point,” she says. “Businesses in the growth phase, who require equity or debt for growth, may now see these lines of funding get increasingly more difficult to source.”

Small business default forecast

Business default rates are rising on average in Australia, and we expect to them peak at around 5.8 per cent over the next 12 months. We note that there is upside risk to this forecast, as we won’t see the full impact of interest rate rises, plus higher labour costs, until around October/November.

Probability of default by region

Likely best performers – The five regions at least risk of default over the next 12 months (5,000 businesses or more) are:

- Cottesloe-Claremont (WA): 4.91 per cent

- Adelaide City (SA): 4.96 per cent

- Yarra Ranges (VIC): 5.01 per cent

- Ku-ring-gai (NSW): 5.02 per cent

- Chatswood-Lane Cove (NSW): 5.10 per cent

Likely worst performers – The five regions most at risk of default over the next 12 months are:

- Merrylands-Guildford (NSW) 7.78 per cent

- Canterbury (NSW) 7.55 per cent

- Surfers Paradise (QLD) 7.49 per cent

- Auburn (NSW) 7.40 per cent

- Ormeau – Oxenford (QLD) 7.32 per cent

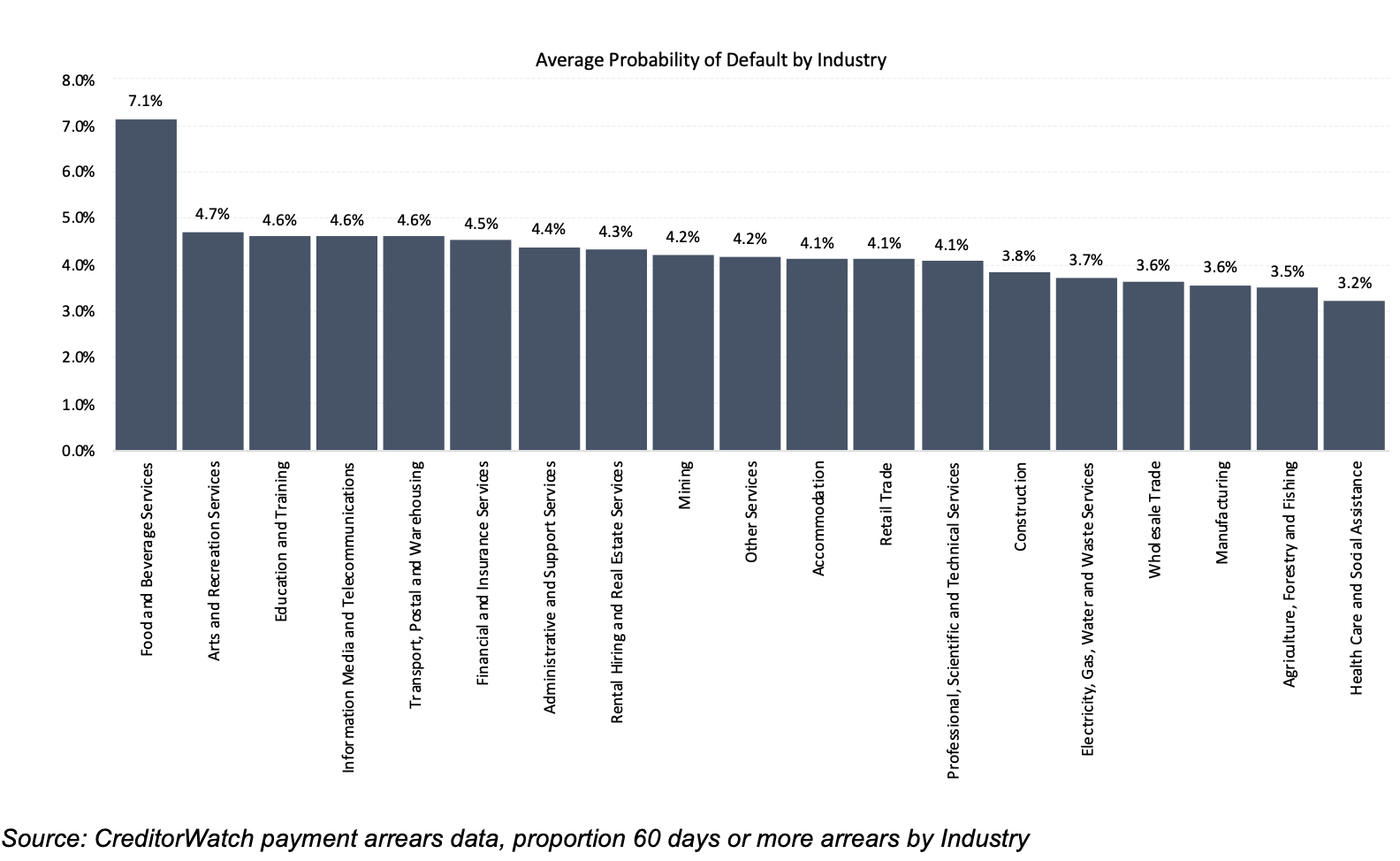

Probability of default by industry

The industries with the highest probability of default over the next 12 months are: –

- Food & Beverage Services: 7.1 per cent

- Arts and Recreation Services: 4.7 per cent

- Education and Training: 4.6 per cent

Interestingly, discretionary spending still appears to be holding up when reading ABS retail trade data. More current data provided by the big four banks suggests that retail trade is starting to slow down, albeit modestly.

This means that people are still eating out at restaurants, entertaining, buying clothes etc. An area where we expect to see more immediate impact is the finance and insurance sector, as mortgage brokers and credit providers will see less work as a result of the immediate slowdown in the Australian Housing Market.

Eventually, the performance of housing flows through to the rest of the economy, and we will see more of this impact towards the end of 2022 when the big Christmas shopping season is upon us.

The industries with the lowest probability of default over the next 12 months are: –

- Health Care and Social Assistance: 3.2 per cent

- Agriculture, Forestry and Fishing: 3.5 per cent

- Manufacturing: 3.6 per cent

Once again, health care and agriculture are unsurprisingly the least risky industries in Australia, as they provide essential services that are not interrupted by economic conditions. Manufacturing is benefitting from slow supply chains around the world, although we note that very high energy prices will negatively impact this sector going forward.

Outlook

Overall, the June Business Risk Index data suggests that businesses are beginning to trade more cautiously. We already know that consumer confidence is very low, but that actual trade figures take a while to reflect that mentality. The same is true of the business sector.

One serious implication of this will be to the labour market. Right now, the jobs market is as tight as it’s ever been. But this could start to change soon if businesses take a more cautious approach to investment and growth. Especially if they are linked to retail, housing, construction or finance, and they know that by the end of the year their pace of growth will have slowed considerably.

Contacts

Michael Pollack

Head of Content michael.pollack@creditorwatch.com.au 0422 513 258

Hayley Schubert

Senior Account Manager hayleyschubert@slingstone.com 0431 651 418

ABOUT THE BUSINESS RISK INDEX

The Business Risk Index is a predictive economic indicator to help guide businesses when making future growth plans and inform public policy. It is a new credit rating that ranks more than 300 Australian geographies by relative insolvency risk, providing unique insights into the health of Australian businesses by region.

Each region is ranked from best to worst in terms of the potential for businesses in it to become insolvent. The index can also measure the potential for insolvency risk at a national, state and individual business level.

Regions are ranked on a scale from zero to 100, where 100 represents the best credit quality regions, that is, the lowest risk of insolvency, and zero represents the weakest credit quality regions, that is, the highest insolvency risk.

The index is calibrated by data from approximately 1.1 million ASIC-registered, credit-active businesses. It combines these insights with CreditorWatch’s proprietary data, previously published as the monthly Business Risk Review.

Subscribe to the Business Risk Index to be the first to receive our monthly updates.