SYDNEY, Wednesday 13 April – The March 2022 CreditorWatch Business Risk Index (BRI) has revealed that Australian business activity may be finally showing some green shoots around recovery, with B2B trade activity increasing for a second month in a row – now up 55 per cent on its January low (but still down 35 percent year-on-year). This was backed up by positive data on credit enquiries, which were up 45 per cent over the last quarter.

On the downside, B2B trade payment defaults and court actions also continued to rise in March, signalling an increase in business insolvencies in the short to medium term. The Business Risk Index national default rate was up marginally to 5.8 percent, from 5.7 per cent in February, however this is forecast to continue to rise across 2022.

CreditorWatch maintains its view that the economic outlook for Australia will be bumpy due to multiple impacts including COVID-related supply chain disruptions, increasing inflation, impending interest rate rises, labour shortages, fuel price rises and the impact of the east-coast floods. Inflation and rate rises, in particular, are likely to drag on consumer confidence.

Key Business Risk Index insights for March:

- Trade receivables and credit enquiries up, indicating the economy many have reached a turning point for trade activity.

- Multiple adverse impacts will likely temper this positive data over the coming months.

- The Business Risk Index national default rate was up marginally to 5.8 percent, from 5.7 per cent in February, however CreditorWatch forecasts a continued rise across 2022.

- Credit enquiries were at 219,428 for March – the highest monthly number since July 2021 and second highest since March last year.

- Court actions were at their highest point since March 2021 indicating that enforcements and collection activities are returning to normal levels.

- Trade payment defaults are at their equal highest point since October 2020, another leading indicator of rising insolvencies.

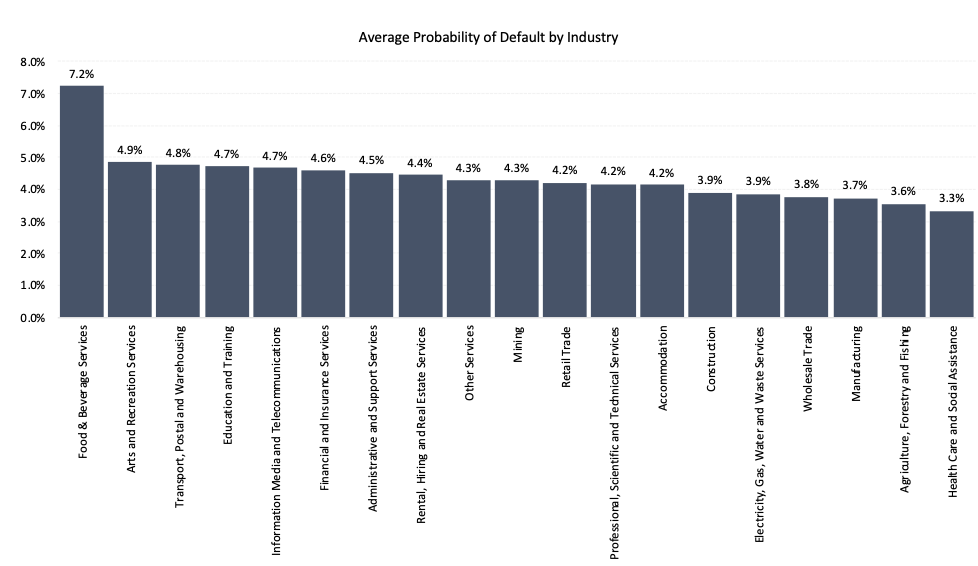

- The probability of default for the hospitality industry jumped from 6.7 per cent to 7.2 per cent from February to March. Arts and Recreation and Transport have also deteriorated.

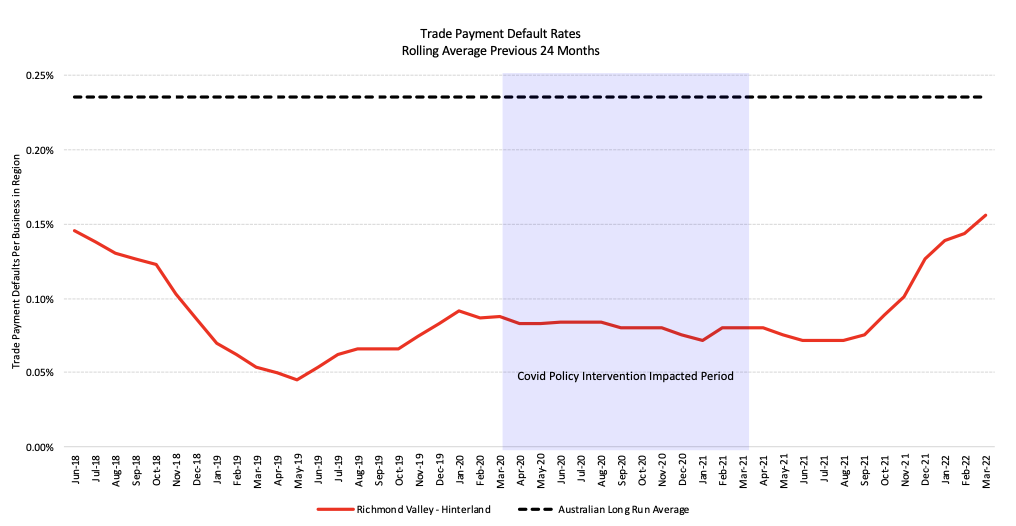

- Trade payment default rates in the Lismore region have increased from February to March but remain well below the national average.

- The net result of the CreditorWatch Business Risk Index and our broader credit indicators is that the economic outlook is bumpy, with multiple negative impacts conspiring to drag on growth.

CreditorWatch CEO Patrick Coghlan says that while the increase in trade receivables and credit enquiries are very encouraging signs, the rises in trade payment defaults and court actions were of concern.

“It’s great to see some signs of recovery, and like the rest of the business community, I truly hope this can be sustained. However, I remain cautious about the timeframe for trade activity to return to pre-COVID levels. There is still so much uncertainty out there, and with inflation on the rise and interest rate increases looming, consumers may be reluctant to open their wallets too much.”

According to CreditorWatch Chief Economist Anneke Thompson, inflation is the key threat to Australia’s economic outlook.

“Notably, inflation is rising because of supply side issues – supply chain bottlenecks, high fuel prices, New South Wales/Queensland floods and staffing shortages – rather than particularly high demand,” she says.

“This is important as future cash rate rises, while looking increasingly necessary to keep inflation within the target band, are more effective at targeting the demand side, by cooling consumers and investors’ appetite for borrowing. Indeed, the RBA will be very wary of cash rate rises further fuelling supply side price rises, if businesses on thin margins choose to pass on higher borrowing costs to consumers.

She adds that given the market is already pricing in cash rate rises, consumers have responded.

“The Westpac Consumer Sentiment Index has been in decline since November 2021. While the index is not low by historic measures, the decline certainly gives us reason to believe that consumers and businesses are already factoring in cost rises and future interest rate rises in their purchasing decisions.”

Defaults surge in hospitality industry

The probability of default in the Hospitality industry leapt from 6.7 per cent to 7.2 per cent from February to March due to a perfect storm of self-imposed lockdowns among consumers, ongoing staff shortages due to COVID and rises in the cost of inputs due to supply chain shortages and fuel price increases.

Given that hospitality spend is viewed as discretionary spending, it is expected to suffer further when rising inflation and interest rates prompt consumers to tighten their belts. Interest rate increases may also force some smaller landlords to raise commercial rents, bringing further pressure to bear on hospitality businesses.

The Arts and Recreation and Transport industries both saw their probability of default increase by 0.3 per cent, moving into second and third highest risk industry rankings respectively.

Source: CreditorWatch RiskScore Credit Rating Average Probability of Default by Industry

Default rates rise in flood-affected Lismore region

The March Business Risk Index data shows, not surprisingly, that trade payment default rates in the flood-affected Lismore region are on the rise. However, the rate remains well below the national average.

CreditorWatch expects that the true picture around defaults will be clouded by the banks and ATO, quite rightly, taking a ‘hands off’ approach to payment collections to assist businesses to recover. However, we expect defaults to rise considerably once collections resume, non-insured businesses are forced to close, and others are unable to bounce back after being deprived of income for so long.

Source: CreditorWatch Business Risk Index

Probability of default by region

The five regions at least risk of default over the next 12 months are:

| 1. Wheat Belt – South (WA): 3.48 per cent |

| 2. Glenelg – Southern Grampians (SA): 3.56 per cent |

| 3. Mid North (SA): 3.67 per cent |

| 4. Murray River – Swan Hill (VIC): 3.70 per cent |

| 5. Esperance (WA): 3.71 per cent |

The five regions most at risk of default over the next 12 months are:

| 1. Bringelly – Green Valley (NSW): 7.83 per cent |

| 2. Merrylands – Guildford (NSW): 7.80 per cent |

| 3. Gold Coast – North (QLD): 7.67 per cent |

| 4. Canterbury (NSW): 7.57 per cent |

| 5. Surfers Paradise (QLD): 7.47 per cent |

Probability of default by industry

The industries with the highest probability of default over the next 12 months are: –

- Food & Beverage Services: 7.2 per cent

- Arts and Recreation Services: 4.9 per cent

- Transport, Postal and Warehousing: 4.8 per cent

The Business Risk Index highlights that those industries exposed to discretionary spending and fuel costs have seen their risk of default increase quite significantly. Any sector where consumers can substitute their purchasing choice – e.g., eating meals at home instead of eating out, watching movies at home instead of going to the cinema – is at increased risk in this inflationary environment.

The transport sector is obviously exposed to rising fuel prices, and those businesses that can’t immediately pass on cost rises will have seen their margins deteriorate significantly in the past few months.

The industries with the lowest probability of default over the next 12 months are: –

- Health Care and Social Assistance: 3.3 per cent

- Agriculture, Forestry and Fishing: 3.6 per cent

- Manufacturing: 3.7 per cent

In an inflationary environment, there are sectors that are relatively immune to strong drops in demand. While supply side cost rises impact all industries in the country, the ones at lowest probability of default have virtually no substitutes. People still need health care, farms still need to produce food etc.

Manufacturing is one of the sectors in the early stages of what might be significant structural change in Australia. After two years of dealing with COVID and border closures, as well as a significant deterioration in the global geopolitical environment, onshore manufacturing has made a recovery. While manufacturing locally is often more expensive than alternative markets like China and Vietnam, the risk of moving product globally is such that the benefit of lower offshore cost has almost been wiped out in some parts of the manufacturing sector, hence why the Business Risk Index is showing more confidence in manufacturers.

Outlook

The overall outlook for Australian businesses is looking quite challenging. Businesses will need to be focused on cost pressures and maintaining margins, while also ensuring that they can induce demand for their products and services as consumers tighten their belts. It won’t be easy.

More open borders may help to alleviate staffing pressures, but an impending decision by the Fair Work Commission on the minimum wage from July 1, 2022, will partly set the scene on what wage pressures businesses will be under going forward.

Add to this cash rate increases – likely around mid-year – and we have conditions set to see continued inflation. For many Australians, this will be their first experience of dealing with inflation and rising home loan rates, so the threat to consumer and business confidence could be quite dramatic.

Contacts

Mitchy Koper

GM Communications and Marketing, CreditorWatch

mitchy.koper@creditorwatch.com.au

0417 771 778

Michael Pollack

Head of Content, CreditorWatch

michael.pollack@creditorwatch.com.au

0422 513 258

ABOUT THE BUSINESS RISK INDEX

The Business Risk Index is a predictive economic indicator to help guide businesses when making future growth plans and inform public policy. It is a new credit rating that ranks more than 300 Australian geographies by relative insolvency risk, providing unique insights into the health of Australian businesses by region.

Each region is ranked from best to worst in terms of the potential for businesses in it to become insolvent. The index can also measure the potential for insolvency risk at a national, state and individual business level.

Regions are ranked on a scale from zero to 100, where 100 represents the best credit quality regions, that is, the lowest risk of insolvency, and zero represents the weakest credit quality regions, that is, the highest insolvency risk.

The index is calibrated by data from approximately 1.1 million ASIC-registered, credit-active businesses. It combines these insights with CreditorWatch’s proprietary data, previously published as the monthly Business Risk Review.

Subscribe to the Business Risk Index to be the first to receive our monthly updates.