This month’s results from both CreditorWatch and other important industry data show a clear downward shift in business confidence and more treacherous conditions for businesses ahead. While any deterioration in business conditions can instinctively seem like a negative for the economy, unfortunately high inflation periods can only be ‘cured’ through broad economic slowdowns. For this reason, the news that businesses are less confident and forward orders are slowing (NAB Business Conditions Oct 2022) is exactly what the Reserve Bank of Australia (RBA) wants to see happen as a result of their monetary policy tightening.

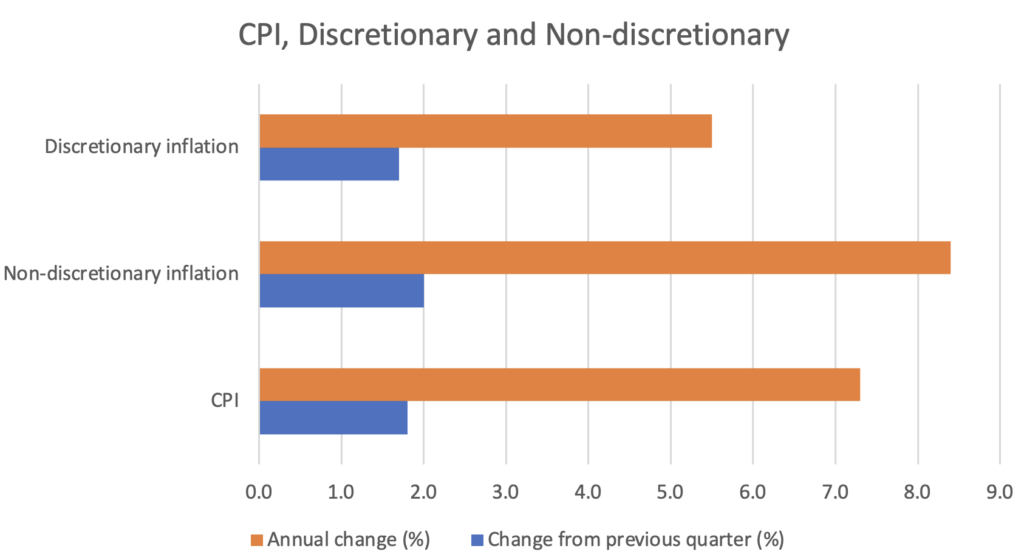

September quarter inflation data this month revealed a clear split between discretionary and non-discretionary price increases. Unfortunately, non-discretionary inflation (that is, the cost of ‘essentials’) is growing much faster than discretionary inflation, at 8.4 per cent and 5.5 per cent year-on-year respectively. Interest rate rises tend to have a greater impact on discretionary items, as these are the goods that consumers can choose to go without if needs be, so the RBA would be concerned about the high rate of non-discretionary inflation as this is largely driven by exogenous factors.

Source: ABS September-quarter CPI data

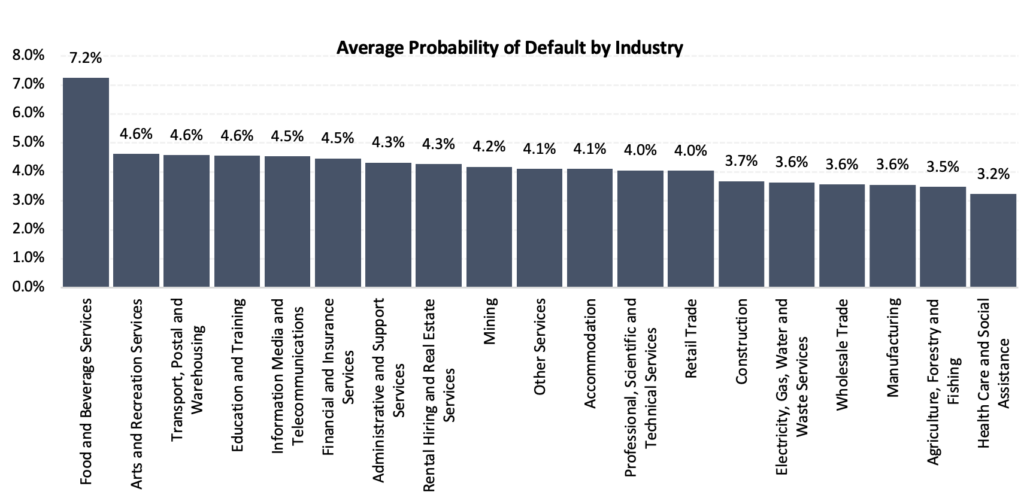

It is not a coincidence that industries that rely on non-discretionary spending are at the highest risk of default, according to our October BRI data. These industries, such as Food & Beverage Services and Arts & Recreation Services, have not changed for some months. Whilst we have been highlighting the risk to these industries for some time, it is the next few months that will be the most critical, as we seem to be at an inflection point where more and more consumers need to start making choices as to where they spend their money. Westpac’s Consumer Confidence Index also took another nosedive, probably partly in relation to the Treasurer’s fairly bleak assessment of economic growth in 2023 and continuing growth in energy prices. This may have been the point when many Australians started to acknowledge that the time to start watching their budget closely had come.

The upcoming Christmas retail spending period will be a fascinating one to watch, but it is almost certain that consumers will have less to spend than they did last year. Christmas 2021 came at a time when many consumers had not had a lot to spend their money on for two years.

Christmas 2022 follows a period of very high inflation, the ATO normalising their collection patterns, and of course higher interest rates. Therefore, we expect the risk of default for retail businesses to rise, even if slightly, as they enter some of the most difficult trading conditions experienced for some time.

Source: CreditorWatch risk score credit rating average probability of default by industry

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.