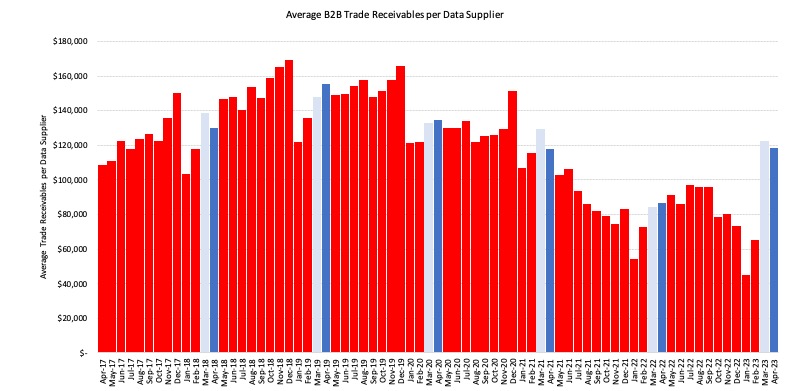

The April 2023 CreditorWatch Business Risk Index (BRI) has revealed that the average value of invoices (trade receivables) remained elevated in April despite other leading indicators showing that businesses are coming under increased pressure.

The index also highlighted that businesses in South-East Queensland are coming under increased pressure, with four of the 10 worst performing regions in that area and Brisbane ranking as the worst performing capital city.

Key Business Risk Index insights for April:

- B2B trade receivables are up 36% year-on-year due to rising inflation but also a resumption of ‘normal’ trading activity post-COVID.

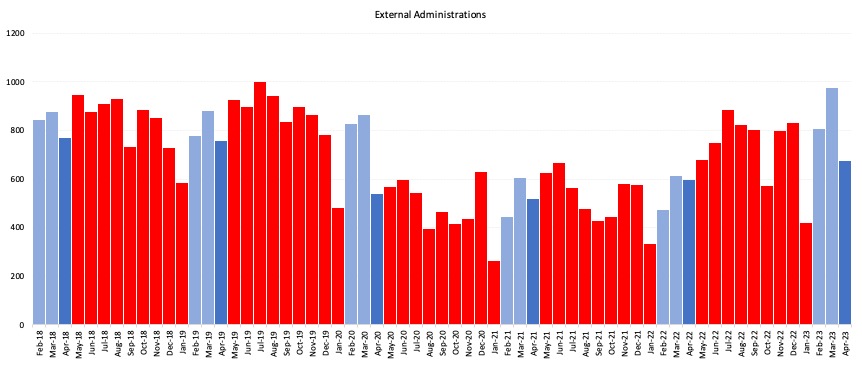

- External administrations dipped from March to April due to seasonality but were still up 13% YoY.

- Court actions also dropped in April due to seasonality but were up 26% YoY.

- Credit enquiries were up a massive 139% year-on-year.

- B2B trade payment defaults are down from March to April but up 35% YoY.

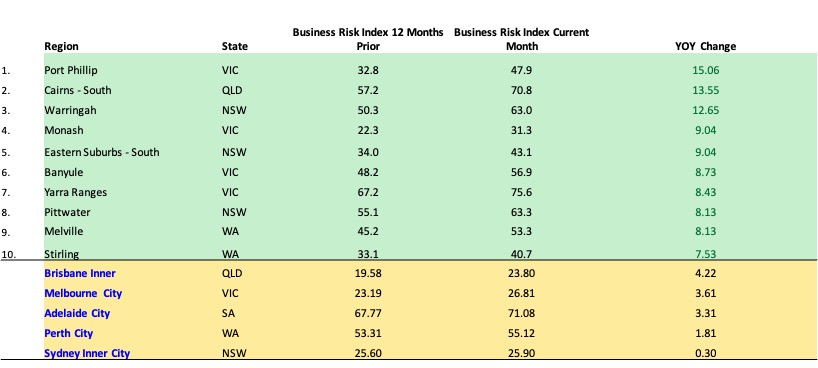

- The regions showing the biggest improvements in the rate of business failures are Port Phillip (VIC), Cairns – South (QLD) and Warringah (NSW).

- The regions showing the biggest increases in the rate of business failures are Chatswood-Lane Cove (NSW), Wyong (NSW) and Gosford (NSW).

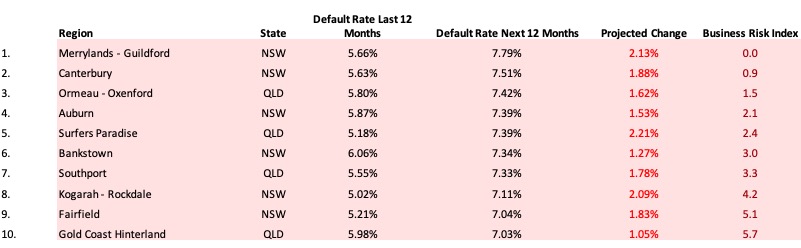

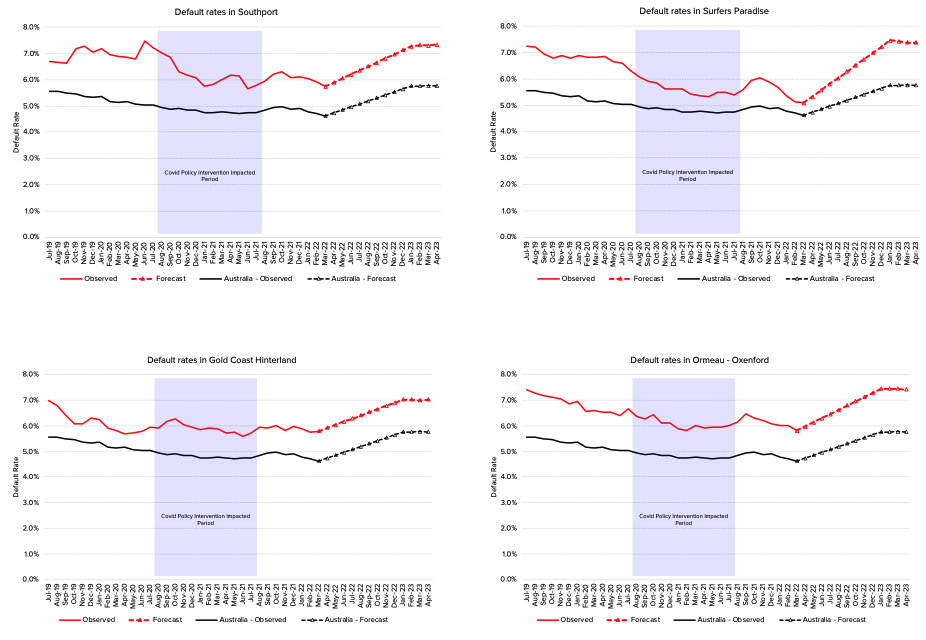

- Four of the 10 highest ranking regions in Australia for probability of default are located in South-East Queensland; all regions feature higher than average commercial rents, high rates of personal insolvency and lower median incomes.

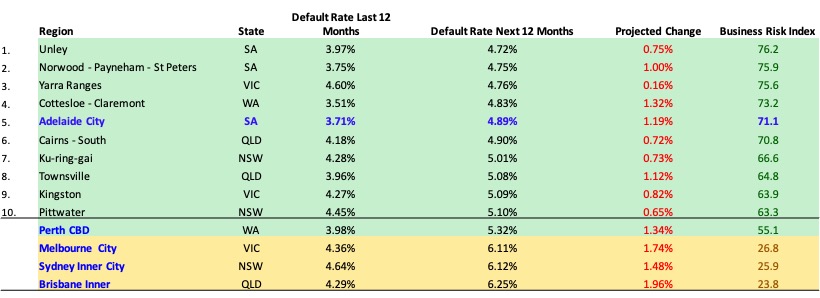

- Unley in South Australia is the region with the lowest insolvency risk (across regions with more than 5,000 businesses), followed by Norwood-Payneham-St Peters, also in SA.

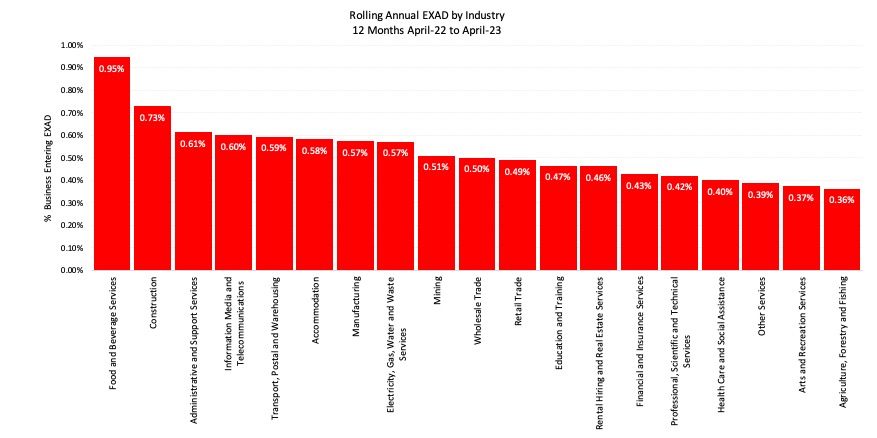

- Food and Beverage Services remains the industry at highest risk of default, due to its reliance on discretionary spending, which is in decline, as well as ongoing challenges such as labour shortages.

- The rate of external administrations in the construction industry continue to trend upward – sitting at a their highest point since June 2020.

- External adminstrations in the Healthcare and Social Assistance sector, while still low, are at their highest rate since CreditorWatch began reporting this data in January 2015.

The increase in receivables was consistent with the Australian Bureau of Statistics’ (ABS) Monthly Business Turnover Indicator for March, which showed year-on-year increases in turnover across 11 of 13 industries. Arts and Recreation Services recorded the highest month-on-month increase in business turnover at 9.7%, while the largest fall was in retail trade (-2.0%).

CreditorWatch CEO, Patrick Coghlan, says that the increase in trade receivables is encouraging, but other leading indicators are of concern.

“The pick up in trading activity is great to see but my excitement is tempered by our data on external administrations, in particular, which are rising across almost every industry,” he says.

“While this is a return to pre-COVID levels in most instances, the rate of external administrations in industries such as healthcare and media/telecommunications is beginning to exceed that.”

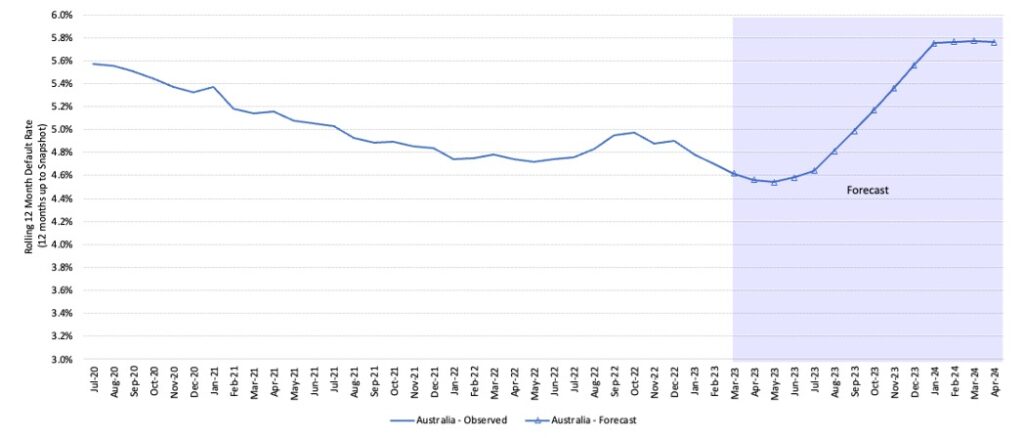

CreditorWatch Chief Economist, Anneke Thompson, says we are at an unsustainable stage in the economic cycle where business conditions are generally good but consumer demand is plummeting.

“Given all the incoming data, there is little doubt that default rates and external administrations are going to increase,” she says. “The areas that are going to be particularly impacted are those that are most reliant on labour, as labour supply still appears to be in strong demand, despite high overseas migration.”

Sources: CreditorWatch Business Risk Index and ABS

Sources: CreditorWatch Business Risk Index and ABS

Sources: CreditorWatch Business Risk Index and ABS

Sources: CreditorWatch Business Risk Index and ABS

The worst regions in our bottom 10 index have now consolidated exclusively around SE Queensland and Western Sydney. This is partly due to the added burden of additional interest rate rises on households with home loans, which are typically in areas with a large number of new housing estates. For South East Queensland, particularly the Surfers Paradise region, there is the added burden of higher commercial rents and low international tourism numbers that are adding to financial difficulty of businesses in the area.

Sources: CreditorWatch trade receivables data (accounting software integration)

Sources: CreditorWatch trade receivables data (accounting software integration)

External administrations appear to be broadly following trend, and a noticeable increase is yet to be recorded in our data. Consumer confidence has now plummeted to record lows and has been sustainably low for some time.

While the roughly 30% of households who have neither a home loan nor are renters are, by and large, insulated from this extreme monetary policy tightening, but the flow on impacts will soon be hitting the broader sector. It is almost without doubt, however, that in an environment of still rising costs for many industries, particularly those reliant on labour, and falling demand, that external administrations will rise.

Source: CreditorWatch Business Risk Index 2023

The industries with the highest probability of default over the next 12 months are:

- Food and Beverage Services: 7.18%

- Transport, Postal and Warehousing: 4.66%

- Arts and Recreation Services: 4.62%

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.26%

- Agriculture, Forestry and Fishing: 3.53%

- Wholesale Trade: 3.58%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

Source: CreditorWatch Business Risk Index 2023

Services inflation remains the greatest concern for the RBA, and is indeed impacting Australian businesses. Whilst it is fairly clear that goods inflation is receding, there is no noticeable downward trends for services inflation. High overseas migration is both a solution and a problem for services inflation, as it adds to both labour supply and demand.

Default rates for businesses in South-East Queensland are considerably higher than the national average. This is a function of factors such as high rental and property costs, high personal insolvency rates, low median income and high population density (Surfers Paradise and Southport in particular).

These areas are also very reliant on discretionary spending, and for Surfers Paradise in particular, spending from overseas. Queensland also appears to be suffering from higher than average labour costs. Even though the state has recorded a large influx of migrants, the outlook for construction costs and labour, as an example, is higher than other areas. This is because mayny migrants to Queensland are of retirement age, so actually add to the demand for labour, and don’t contribute to the supply of labour.

Source: CreditorWatch Business Risk Index 2023

The outlook for the Australian business community continues to be one of quite extreme pessimism. The great positive of the Australian economy is the strong labour market, and this is making many households feel reasonably comfortable with their financial position. Unfortunately, to get inflation under control, the unemployment rate will have to rise, and that will shake the foundations of many Australians who either directly lose their job, or are exposed to job losses in their firms.

There are no easy solutions to inflation. However, of all the ‘narrow paths’ to economic stability being trodden around the world, Australia’s economy has probably the best chance of actually executing. Global instability remains.

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.