Analysing the ebb and flow of our economic recovery

Stats that matter – comparing June’s Business Risk Review 2021 to May 2021

- External administrations down 22.6%

- Court actions down 9%

- Payment defaults up 14.95%

- Credit enquiries down 2.3%

The June 2021 CreditorWatch Business Risk Review is a reflection of the ups and downs playing out in the economy through the COVID period. While a number of measures have deteriorated in June, the credit landscape is in an infinitely better position than the outlook this time last year.

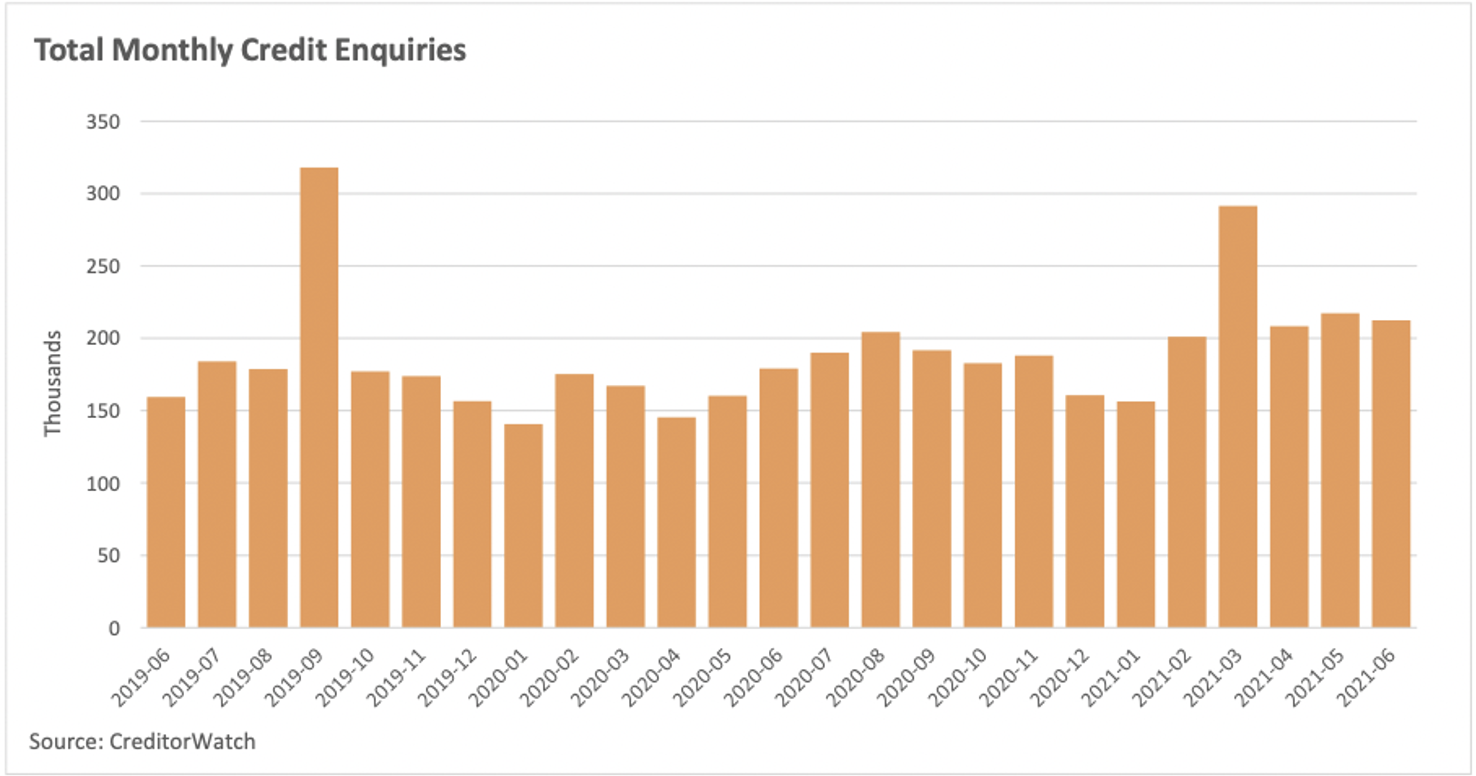

Credit enquiries a good news story

Credit enquiries have risen for the ninth consecutive month, and are also 32% higher in June 2021 than June 2020.

“This is the part in the economic cycle when you would expect trade credit numbers to rise and fall before they are likely to normalise in the third quarter of calendar 2021,” says Patrick Coghlan, CEO, CreditorWatch.

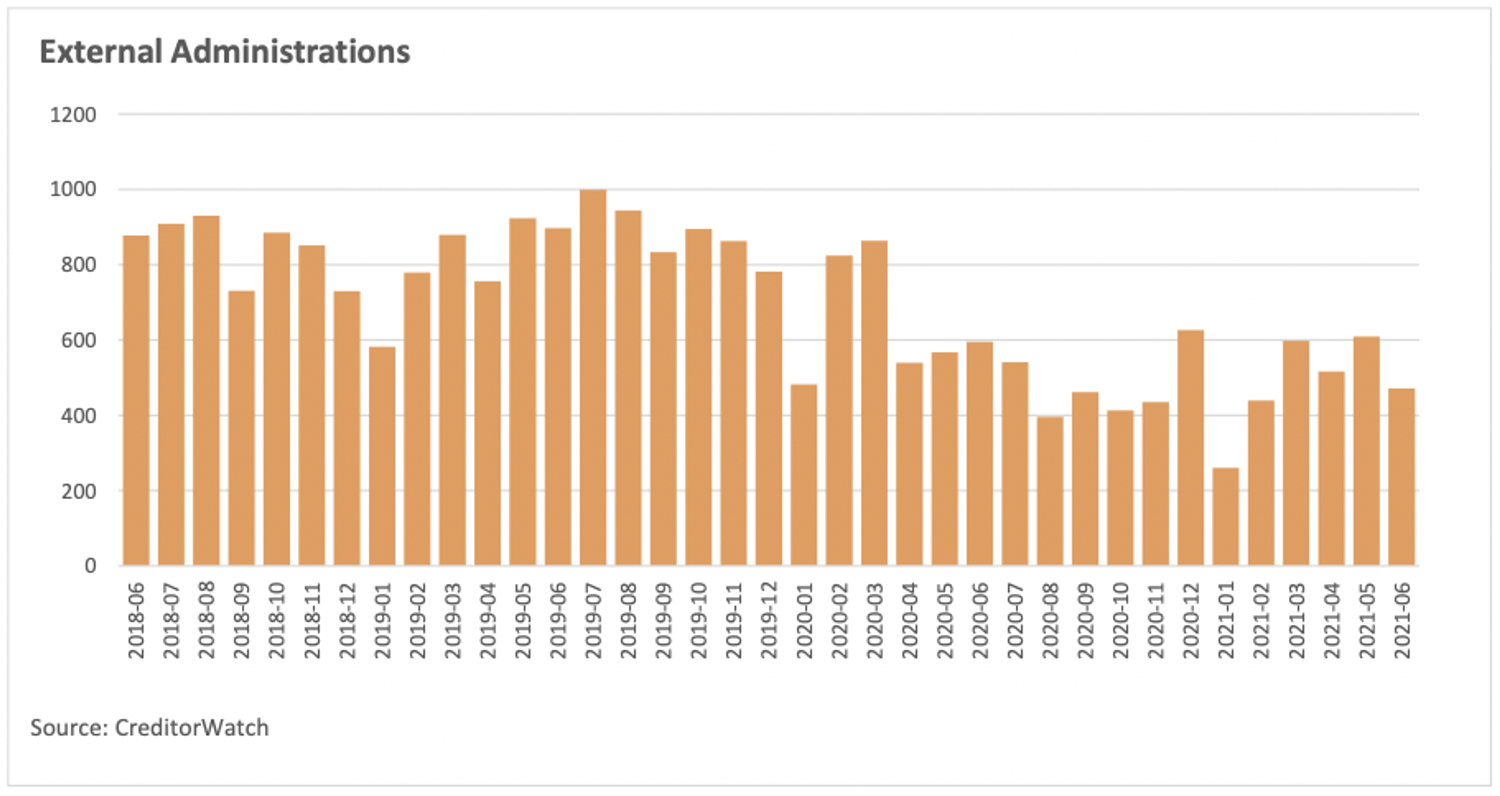

External administrations hint at a positive economic recovery

External administrations are 21% lower in June 2021 than June 2020. CreditorWatch Chief Economist Harley Dale says, “CreditorWatch data on the number of external administrations reveals Australian businesses were not in great shape before COVID-19. That backs up a range of economic indicators which emerged over 2018/19.”

Monthly economic perceptions with Harley Dale

The Board of the Reserve Bank of Australia (RBA) made its monthly interest rate decision on Tuesday 6th July.

Everybody expected the key announcement – no change to the Official Cash Rate (OCR)! Significantly, the statement accompanying the decision reinforced that the RBA still does not expect to raise the OCR until 2024.

Since the last CreditorWatch update there has been considerable speculation that because of growing evidence of a strengthening economy, the RBA may lift rates earlier than that. Some are speculating as early as the end of 2022.

That may well turn out to be the case, but the RBA is providing no indication of that at this stage. That is because they do not expect to see sufficient upward pressure on prices and wages until 2024. We’ll talk more about that dynamic next month.

Analysing industry performance

The good news for businesses across all industries is that super low interest rates will remain available for some time yet. This outlook is augmented by the Bank purchasing weekly bonds (albeit at slightly reduced rate) out to April 2024. This is a fancy way of saying there will be downward pressure maintained on business and household borrowing costs in coming years.

That is mighty good news because there continues to be widespread differences in business conditions across industries. In a net sense it is still accurate to say there are more industries we need to see considerable improvement in than those that are starting to fire.

Commercial Construction, Healthcare and Social Assistance, and Wholesale Trade represent three examples of industries who have some way to climb back to what participants would consider to be acceptable performance.

There have been recent reports of considerable COVID related insolvencies in Sydney and Melbourne.

CreditorWatch expects most businesses to push through, although the latest lockdown in Sydney is a stark reminder of the economic vulnerability of some industries – hospitality and accommodation in the Sydney CBD and beyond being a prime example.

The uncertainty created by recent lockdowns and Australia’s low vaccination rate are two key uncertainties confronting all businesses. We need to be cognisant of that situation and the fact that some industries are still facing considerable economic challenges in mid-2021.

What we do also find is that in the middle of this year the overall Australian economy is in far better shape than was feared would be the case through the majority of 2020. The RBA recognised this in its latest statement and used the labour market as a prominent example.

There are now more Australians employed than there was before the pandemic and the unemployment rate is falling faster than initially expected.

A shortage of skilled labour is having an adverse impact on some relatively strongly performing industries, such as Agriculture, Forestry and Fishing. Lockdown impacts notwithstanding, Retail, and Accommodation and Food Services are examples of industries doing relatively well but is hard to get staff in the hospitality sector, for example.

So where to from here?

The first half of this fresh financial year will be critical, a point CreditorWatch has been making for some time. We still had JobKeeper in the March 2021 quarter, naturally followed by the first quarter without it. Now we are into the main game.

We believe most businesses, across industries, will survive. Some will be scarred, others will have found a way to thrive in the uncertain and volatile economic environment that the pandemic brought, and that will be here for a substantial time yet.

Yes, there will be ongoing insolvencies and there will volatility to that situation, which is never good for any industry. We didn’t fall off a cliff, though, we just need to scrutinise the first half of 2021/22 to ensure no cracks or fragility appear that would risk derailing the overall economic recovery.

We don’t know just yet, but if industry performance can become broader-based and most companies from here push on through, that will be huge for the Australian economy.