Consumer sentiment took another dive this month, following another interest rate rise after the June RBA board meeting. Westpac reported that responses during its monthly survey in June (taken over a few days before, during and after the board meeting) deteriorated dramatically following the RBA’s decision. This month, business sentiment and business conditions also moved down, in a sign that the strong business operating environment we have been experiencing since lockdowns ended might not be over.

Early trading update reports from major retailers indicate that mid-year sales activity is well below the same time last year at many stores, particularly those in the household goods sector. Baby Bunting, Adairs, JB HiFi, Treasury Wine Estates, Michael Hill Jeweller, Dominoes and (unofficially) David Jones have all reported that sales have slowed dramatically since around May. Clearly, consumers are now starting to feel the pinch from higher interest rates, rents and costs of everyday items. In addition, many fixed-rate loans are still to convert to variable rates, and households will also be dealt a further financial blow with rising energy bills over the winter months.

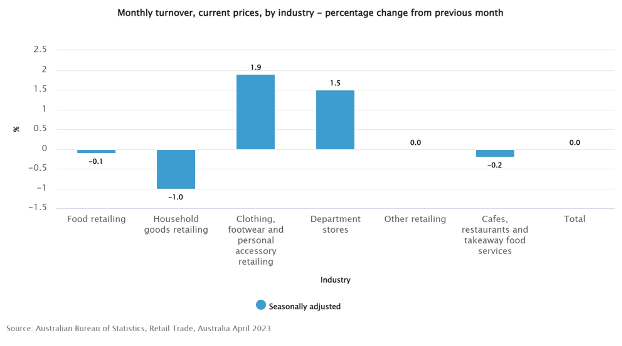

Sales in the household goods sector had been negative for some time, however spending in cafes and restaurants and food retailing turned negative in April, while ‘other’ retailing was flat. Department stores (which includes discount department stores) and clothing and footwear were the only bright spots for retailers, although this may reflect sales of items to consumers as they prepare for the winter months.

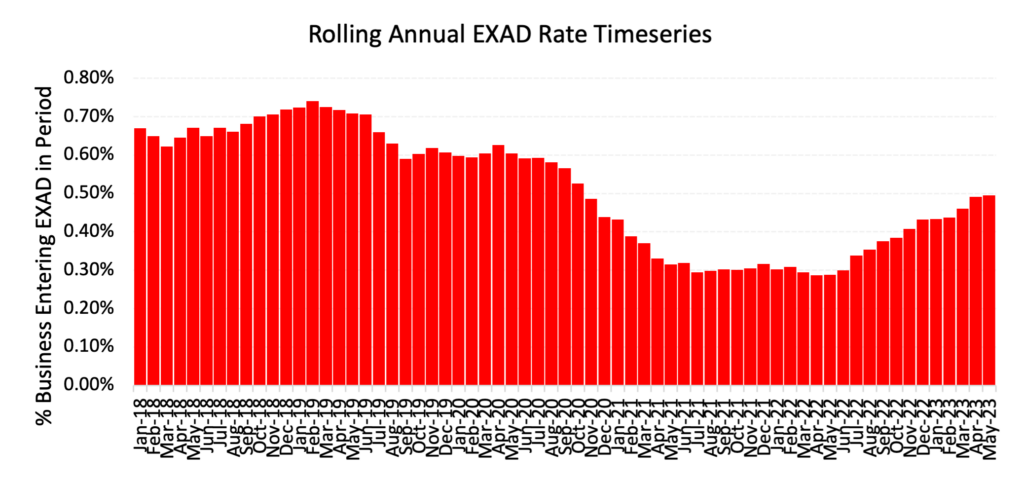

External administrations in the retail sector are currently well below their pre-COVID levels, although on a rising trend. Given the current trading conditions, it is expected that further administrations in the retail trade sector will be recorded, particularly amongst retailers who can’t clear overhanging stock levels.

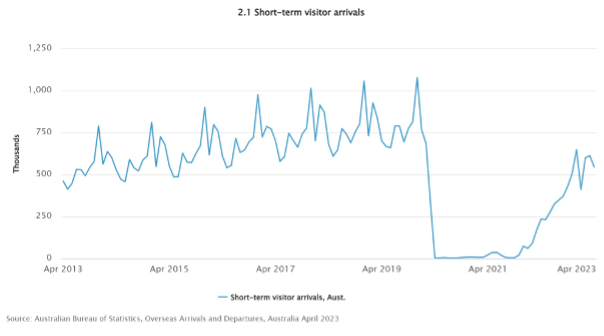

In addition, to the Australian consumer being far more cautious, short term visitors to Australia have not recovered following the re-opening of international travel. This will weigh heavily on areas particularly around South East Queensland, that rely heavily on both local and international tourism.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.