What is topical this month?

This week’s Jobs and Skills Summit is the talk of the business world at the moment. There is strong hope among all sectors of the economy that some real, immediate actions can be taken to help fill some of the 480,000 jobs that are currently available in Australia. Led by the Prime Minister and Treasurer, and supported by other key ministers, the Summit will recommend immediate actions and opportunities for medium and long-term reform. This summit will be critical for Australia’s future economic outcomes, as the lack of workers is impacting many businesses – particularly small businesses – ability to operate at full capacity.

Labour Force

Seasonally adjusted unemployment rate is at the lowest it has been since 1974, at 3.4 per cent. There are now fewer unemployed people than there are jobs available in Australia.

However, looking beyond the raw unemployment rate, we may be seeing early signs that some heat is coming out of the labour market, as the total number of people employed dropped for the first time since October 2021. The reason the unemployment rate also dropped, was that the participation rate (the proportion of Australians currently in the job market) also declined. Participation has been at record high levels, so some levelling off is not surprising. Still a drop in employment could mean that businesses are starting to prepare their workforce make up in anticipation for leaner times ahead.

Source: ABS Labour Force July 2022

Inflation and wages

We are finally starting to see easing of inflation in some parts of the world, most notably, the USA. However, this is not a uniform trend, and inflation continues to be a serious problem in the UK and Europe. The UK inflation rate is currently 10.1 per cent, and investment bank, Citi, has made headlines by predicting that UK inflation will reach a staggering 18 per cent in 2023. The UK and Europe are impacted to a far greater degree by inflation due to their reliance on Russian gas. The upcoming winter will see continued soaring demand for energy, even after much of the continent has spent the summer stockpiling as much natural gas as it can.

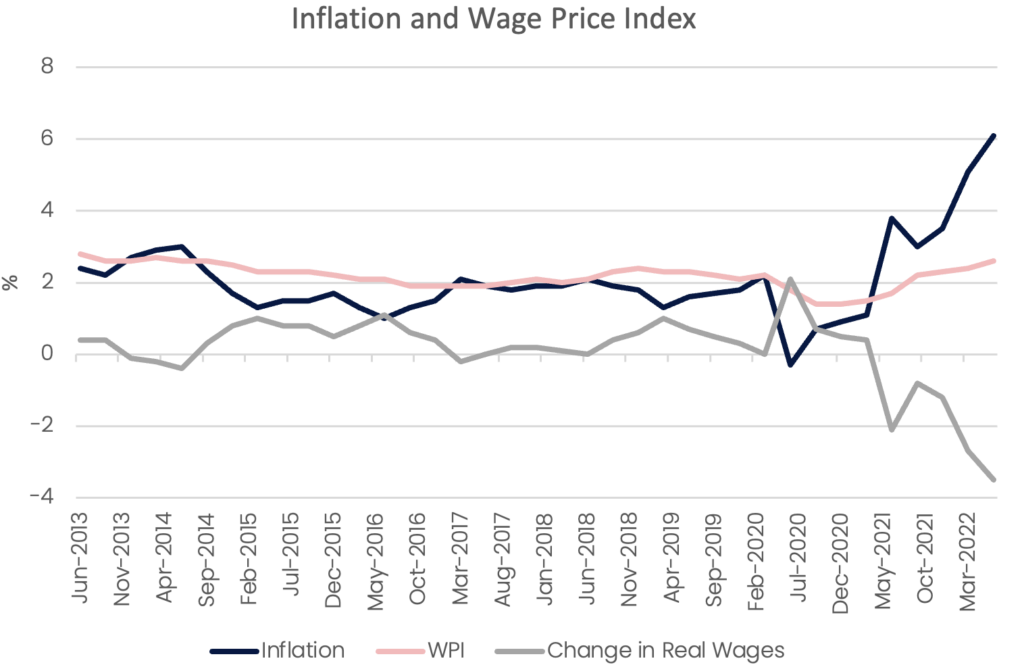

Inflation continues to impact the real wages of Australian employees. Based on ABS Wage Price Index Data, real wages have been in decline since June 2021. The high savings rate has meant many Australians have not felt the impact of this drop immediately, however, the total savings rates of Australians is now also starting to drop. This means that many people are now using their savings pool to meet higher interest repayments and the general higher cost of living.

source: ABS CPI and WPI

Interest Rates

Responding to the June 2022 inflation figures, the Reserve Bank of Australia (RBA) once again decided to raise the target cash rate. This is the fourth month in a row that the RBA has chosen to increase, indicating the level of concern that inflation is causing. Contributing to the decision was the June unemployment data, which recorded a drop in unemployment to 3.5 per cent. There are now 600,000 more Australians employed than there was in March 2020, and extraordinary increase.

The economic update provided by the Treasurer pointed to inflation peaking toward the end of the year, at near eight per cent, before starting to fall in 2023. While this is clearly of concern, the RBA will no doubt be focused on trying to break out supply side inflation, versus demand side, and tailoring its monetary policy response as close as possible to this. Much of the inflation recorded over the June 2022 quarter was caused by supply side issues – war in Ukraine (fuel), and weather events (fruit and veg). Construction of new dwellings was another big contributor to inflation, driven by both demand and supply issues. It could be argued that the forward demand issue here has already been resolved through falling house values and dramatically increased construction costs. Further, whilst Australia’s inflation number is double the upper range of the RBA’s target, it is far below that of other western nations, suggesting that maybe the RBA caught the cycle earlier than other countries’ central banks. Quarterly inflation was also lower than the March quarter (1.8 per cent vs 2.1 per cent in March), which means price rises aren’t gaining momentum.

While it is highly likely that the cash rate will rise further, the medium to longer term outlook is moderating. This assumes however, that supply side issues can begin to resolve themselves. Unfortunately, luck and other factors outside the control of the RBA will tell the story there.

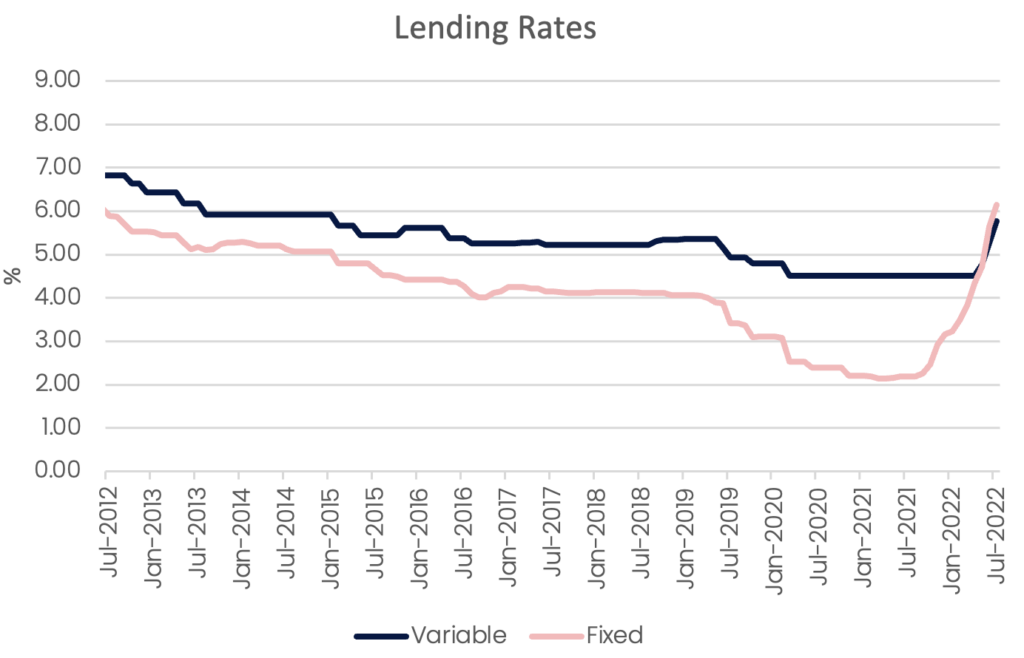

source: RBA

NOTE: data is for owner occupier standard loan, fixed term is 3 years

Consumer Sentiment

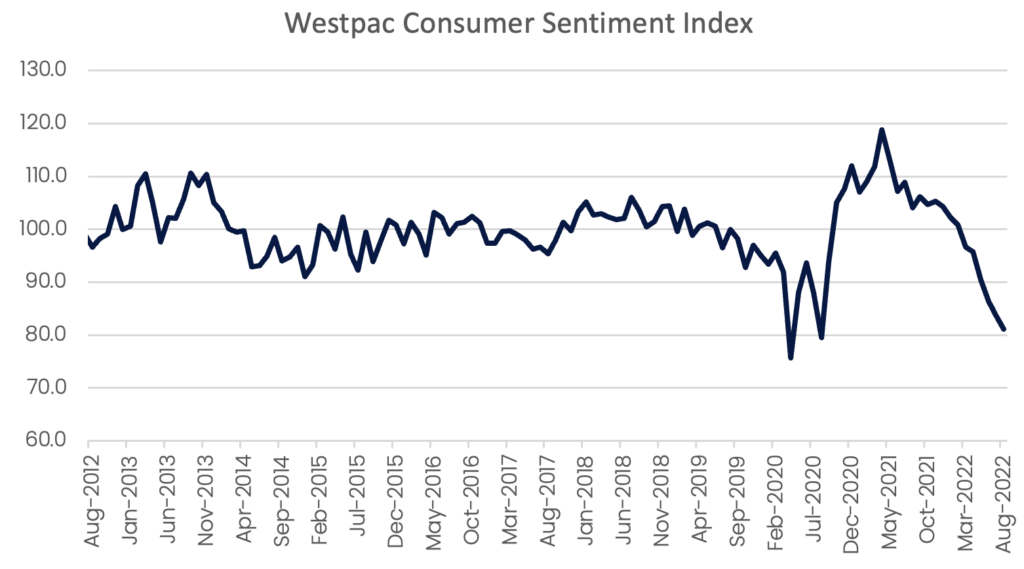

Consumer sentiment continues its downward trend, with the Westpac Consumer Sentiment Index now falling by 22 per cent since November 2021. Notably, the fall in consumer sentiment happened around five months after real wages turned negative, highlighting the delayed nature of consumers’ reactions to inflation. Understandably, respondents with a home loan recorded the biggest drop in sentiment. Their confidence fell by 8.9 per cent compared to modest moves from tenants (0.2 per cent) and those owners who do not have a mortgage (-2.1 per cent).

source: Westpac Melbourne Institute Consumer Sentiment Index

Business Conditions

Perhaps reflecting the relative robustness of economic conditions in Australia versus other developed nations, the NAB Business Conditions Index strengthened in July. Trading conditions, profitability and employment conditions were all higher than the previous month. Capacity utilisation – a leading indicator of changes in unemployment – rose to a record high 86.7 per cent. Not surprisingly, labour costs have increased as a result, increasing by 4.6 per cent and purchase costs grew by 5.4 per cent.

Businesses can pass these cost increases on to consumers at this stage, with overall product prices increasing by 2.7 per cent and retail prices by 3.3 per cent. Taken as a standalone, this data suggests we have some way to go before we can break the back of inflation. However, supply side inflation does appear to be waning, and assuming we can get some immediate outcomes from the Jobs and Skills Summit, businesses may start to get some labour price relief.

source: NAB Business Conditions Survey, July 2022

Retail Sales

Retail sales in July increased by 1.3 per cent month on month, the largest increase since March 2022. The monthly change in retail sales has settled down in the post-lockdown era, when wild shopping trends turned the data on its head. While smoother, monthly changes in 2022 are so far well above the pre-COVID era. In the years prior to COVID, the monthly change in retail trade averaged around 0.2 per cent. In the year to July 2022, the monthly change has averaged 1.28 per cent. A portion of this will be attributable to rising prices, but still, there appears to be a lot of ‘catch up’ spending underway by consumers.

Consumers spent 3.3 per cent more on clothing, footwear and personal accessories in July versus June, and 3.8 per cent more at department stores. Household goods retailing did see a decline in spending, at 1.1 per cent. This sector does have a correlation to housing turnover, as people tend to refresh furniture and appliances as they move house.

Overall, the news is still positive for businesses, as consumers have yet to shut their wallets. The retail trade data also reflects the relative confidence of business in NAB’s latest Business Conditions Survey, which strengthened in July. It does, however, strengthen the likelihood of a further increase in the cash rate after the RBA’s meeting next week, as they continue to work on cooling red hot demand.

source: ABS

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.