Economic Update – October 2022

Economic news this month was dominated by the release of the Federal Budget 2022/23 and September quarter inflation. Unfortunately, both releases point to far more difficult economic conditions for Australian businesses in 2023.

The Treasurer noted that energy prices will continue to rise dramatically over the next year, and that the budget can do little to relieve the financial pressure this puts on households without further fuelling inflation. The October Budget 2022/23 included forecasts showing GDP growth to slump and the unemployment to rise in 2023/24, and the Wage Price Index is not expected to catch up to inflation until 2023/24.

The next day’s inflation release by the ABS effectively guarantees more cash rate rises for the remainder of the year, with the CPI rising by 7.3 per cent year on year. This is the largest increase since 1990. Non-discretionary inflation is proving to be the biggest headache for the RBA, as these are goods people can’t do without, and inflation in this sector is rising much faster than inflation for discretionary goods, at 8.4 per cent versus 5.5 per cent year-on-year.

Interest rate rises tend to hit the price of discretionary items first, as this is where consumers can change their spending habits. Unfortunately, interest rate rises have a smaller impact on the big problem area of non-discretionary inflation, meaning the RBA has a tough job on its hands as it fights inflation.

Selected economic forecasts – October Federal Budget 2022/23

% change p.a. except Net Overseas Migration

The biggest contributors to inflation were construction of new dwellings, where prices increased a massive 20.7 per cent year on year, fruit, and vegetables (16.2 per cent), dairy and related products (12.1 per cent), non-durable household products (11.9 per cent), automotive fuel (18 per cent) – which is decline from June quarter increase of 35.1 per cent, but still incredibly high – and furniture (6.6 per cent). Rents are also rising strongly, particularly in the 6 capital cities outside of Sydney and Melbourne. These six capitals saw rental growth of 5.6 per cent, versus 1.6 per cent in Sydney and 1.2 per cent in Melbourne.

While the inflation figure is backward looking, and the RBA is well aware that their slew of cash rate rises will really start to bite mortgage-holders in December, they will need to respond to the higher than expected inflation figure and are highly likely to increase the cash rate by at least 25 basis points after the Melbourne Cup Day board meeting.

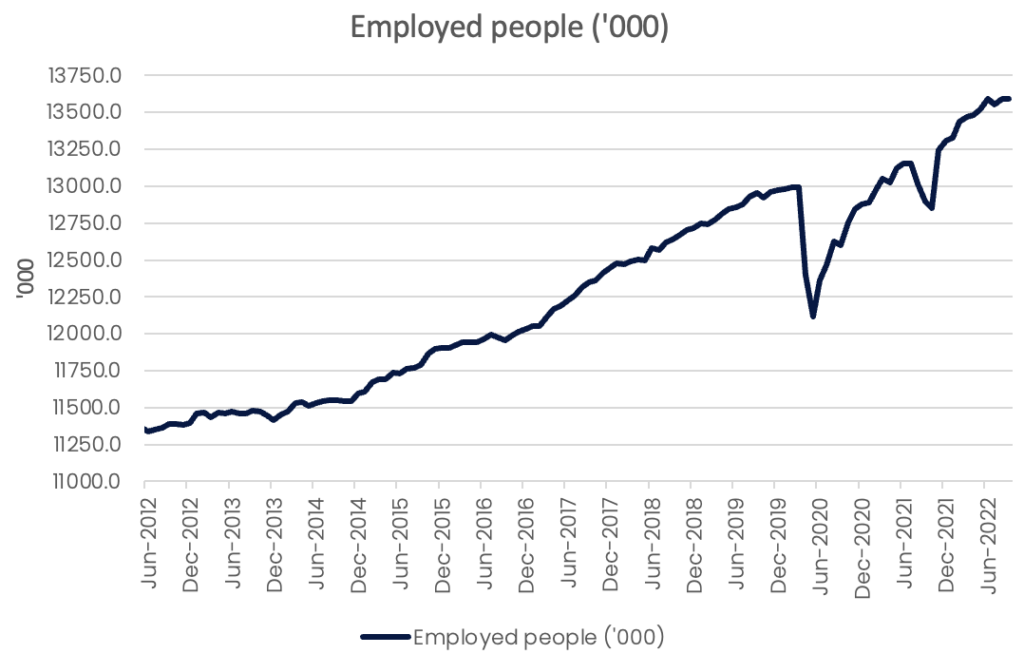

Where the RBA will find some comfort is in the labour force and jobs vacancy data, which showed that the growth in jobs has slowed down dramatically, and the unemployment rate has stopped falling. An easing labour market will help the RBA to fight inflation, as consumers are likely to tighten their spending when they feel less confident about employment and wages growth prospects.

Overall, both the Australian and global economies appear to be teetering at an inflection point, where all signs are pointing to a significant slow down in economic growth in 2023 and continued higher prices will make life very tough for businesses and consumers.

source: ABS

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.

Subscribe to our newsletter

You’ll never miss our lat news, webinars, podcasts etc. Our newsletter is sent our regularly so don’t miss out.