All groups monthly CPI rose 5.2% over the year to August, up from 4.9% the month prior. While a higher figure is not welcome news for borrowers, the figure is heavily impacted by the higher cost of fuel this month. Excluding volatile items like fuel, holiday travel and fruit and vegetable items, monthly CPI increased 5.5%, down from 5.8% the month prior.

Residential rents, fuel and insurance pricing continue to gain momentum. For the business community, rising insurance will have a big impact, and add to already significant cost pressures many businesses are facing. The construction sector, in particular, is very reliant on insurance, and while price growth momentum in building materials is slowing, rising insurance premiums will be the next headache the industry will face.

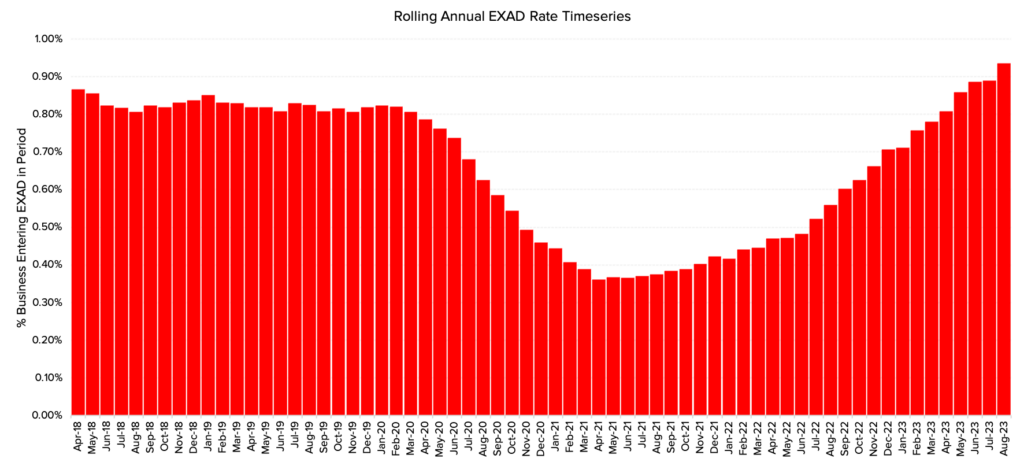

This is on top of rising external administrations. CreditorWatch’s Business Risk results for August show that external administrations for the construction industry are now above pre-COVID levels.

Source: CreditorWatch Business Risk Index

The cafe and restaurant sector currently experiences the highest rate of insolvencies according to our Business Risk Index data, and the news that fruit and vegetable prices continue to fall will be welcome relief.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.