In the latest Business Risk Index, the bounce back in trade receivables data that we recorded in March was broadly consistent in April. This is an element of positive news to come through in our data and does reflect the continuing strength in business focused surveys, such as the NAB Business Sentiment Index.

While NAB indicated that business conditions fell two points in March to +16 index points, the index itself remains well above the long run average. Importantly, Capacity Utilisation remains at near record levels, at 85.1, and has barely moved in the last six months of the survey.

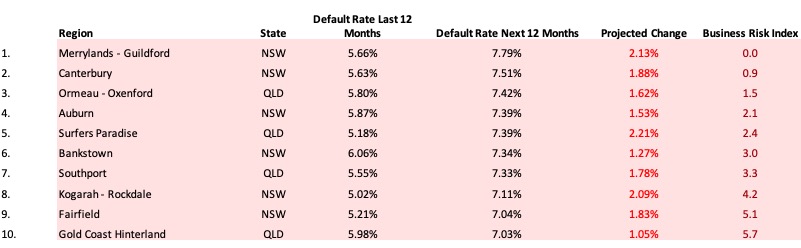

One noticeable trend that stands out in both our BRI data and other trade and survey data, is the worsening conditions in SE Queensland. According to NAB’s March Business Sentiment Survey, Queensland is the only state where Business Confidence is reading at a negative figure. This reflects our BRI SA3 data, which shows that four of the 10 regions at most risk of business insolvencies are concentrated around South-East Queensland.

Source: CreditorWatch Business Risk Index, April 2023

South-East Queensland’s higher risk may be to do with the concentration of food and beverage, tourism and construction type businesses in the area. We also know that higher commercial property rents increase the risk of insolvency. Many businesses in SE Queensland that are reliant on strong foot traffic will be paying higher rents for the best locations, with this only adding to the cost strain.

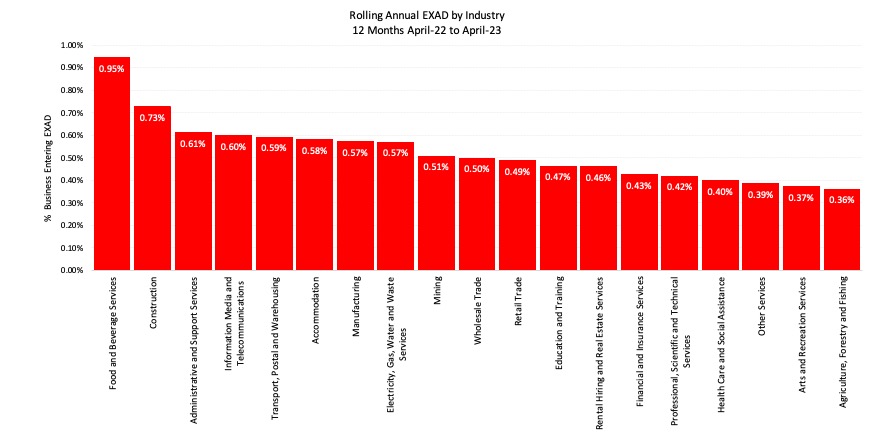

One of the sectors bearing the brunt of services-based inflation is the Food and Beverage sector. Inflation in services continues to rise, even as goods inflation is reducing. Restaurants and cafes are still bearing the brunt of cost increases, as they are such labour-intensive businesses, with the costs of the goods they buy able to fluctuate daily based on supply and demand. Unfortunately, cafes and restaurants are unable to change the prices they charge customers with as much regularity as their suppliers can change prices on them, and as a result, margins are very thin, and insolvencies higher than all of the industries we monitor.

Source: CreditorWatch Business Risk Index, April 2023

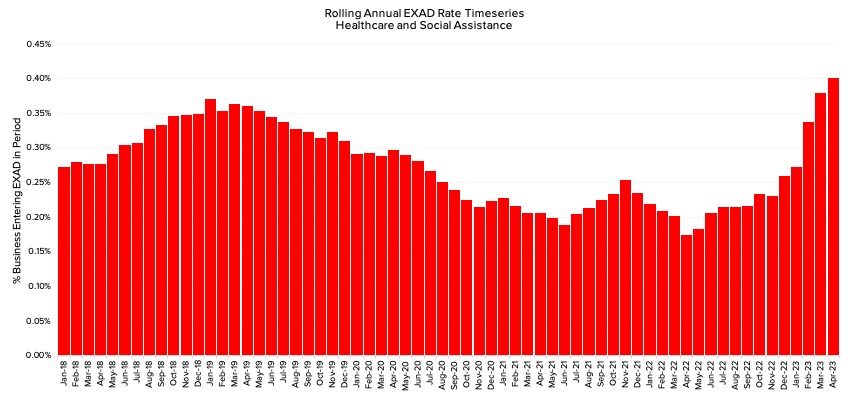

While coming off an extremely low base (in fact, the lowest of all industries we report on) the Health Care and Social Assistance sector has seen a steep increase in External Administrations in the last six months. This is likely impacting the smaller ancillary healthcare businesses such as physios, osteopaths, remedial massage etc. This is a trend worth watching however, as the Federal Government’s efforts to reign in spending on the NDIS will most acutely affect this industry and many smaller operators within this sector.

Source: CreditorWatch Business Risk Index, April 2023

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.